AI for Science Defies Bubble Claims as Investors Navigate Barbell Market of Proven Wins and Speculative Bets

The artificial intelligence for science sector is experiencing a fundamental question that extends far beyond typical market hype cycles: Is AI4S a speculative bubble destined for collapse, or a transformative field with sustainable economic foundations? The answer, according to comprehensive market analysis, reveals a more complex reality that challenges both bubble skeptics and breakthrough evangelists.

AI4S is not a traditional bubble, but rather operates as a barbell market with proven, revenue-generating applications on one end and high-risk, long-cycle investments on the other. This distinction has profound implications for how venture capitalists and institutional investors should approach the sector.

The Case Against Bubble Claims: Measurable Breakthroughs

Multiple AI4S applications have demonstrated clear superiority over established methods across measurable performance metrics. Google DeepMind's GraphCast weather forecasting model outperformed the European Centre for Medium-Range Weather Forecasts high-resolution system across most 10-day metrics, as documented in Science 2023. The validation was so compelling that ECMWF itself launched AI-powered forecasts through its AIFS system.

In materials discovery, DeepMind's GNoME expanded the landscape of stable crystalline materials by 2.2 million candidates, with approximately 381,000 predicted as stable. Berkeley Lab's A-Lab facility synthesized 41 of 58 target materials in just 17 days through end-to-end automation. These represent order-of-magnitude accelerations over traditional research timelines.

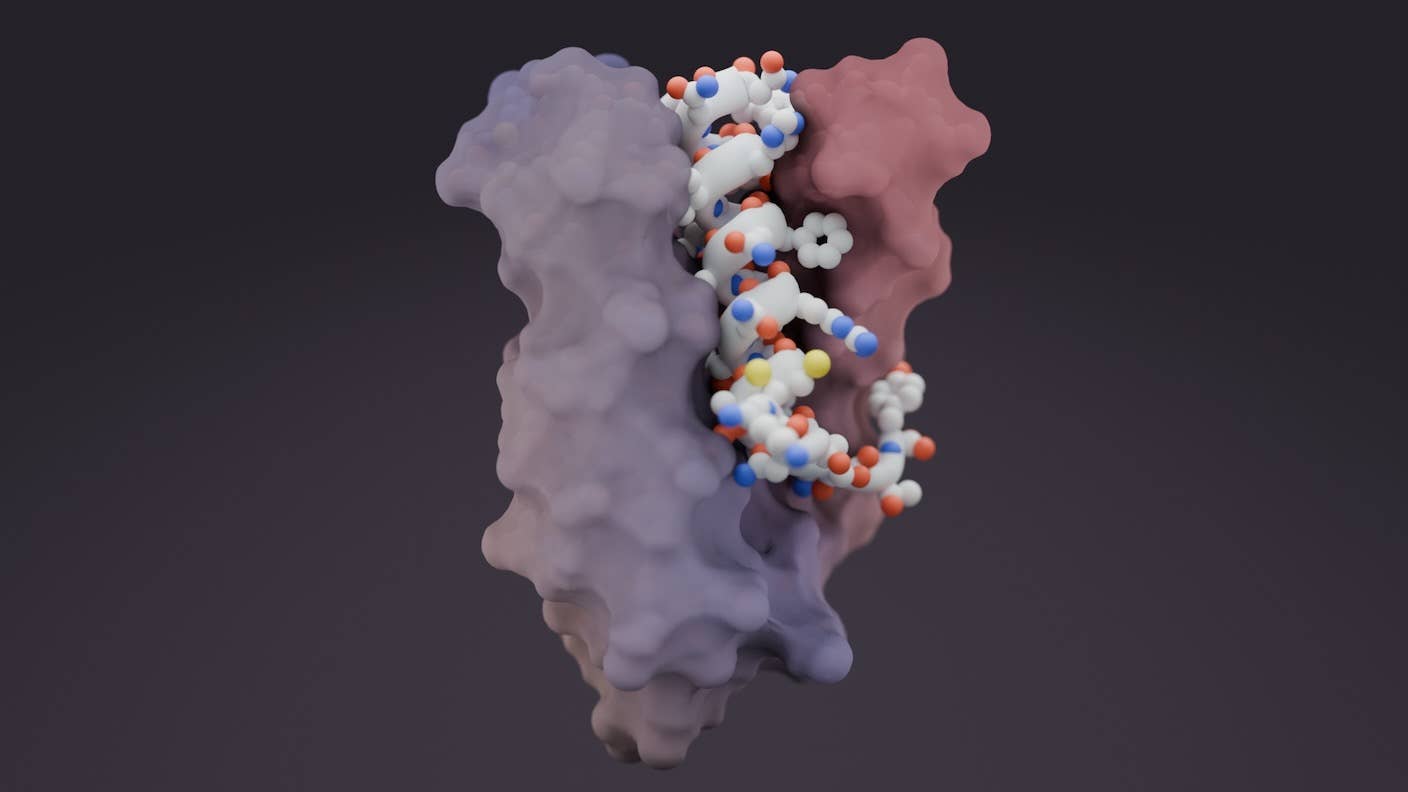

AlphaFold's evolution from solving protein folding challenges to providing infrastructure for over 200 million protein structures has created measurable value in pharmaceutical research workflows. AlphaFold 3's extension to protein-DNA, RNA, and ligand complexes strengthens early discovery processes by reliably pruning wet-lab search spaces.

The Investment Reality: Barbell Distribution of Risk and Return

Venture capital analysis reveals AI4S operates as a barbell market rather than a uniform investment category. Near-term, cash-flow-positive applications include weather forecasting, energy optimization, and materials research platforms that demonstrate immediate revenue potential through API monetization and enterprise software sales.

( Summary table of the AI4S barbell market structure, contrasting revenue-positive applications with frontier high-risk R&D, and noting the thin middle zone. )

| Market Segment | Example Applications | ROI Profile | Adoption Level | Time Horizon |

|---|---|---|---|---|

| Revenue-Positive / Commercial | Weather forecasting, supply chain optimization, predictive maintenance, healthcare diagnostics | Short-term, high certainty | High | Near-term |

| Middle Zone / Moderate Risk | Niche optimization tools, specialized AI models with limited domain adoption | Medium-term, moderate certainty | Medium | Mid-term |

| High-Risk / Frontier R&D | AI-driven drug discovery & design, advanced materials simulation, fundamental physics, space research, cell therapies | Long-term, speculative | Low | Long-term |

Weather and Earth systems modeling represents the most immediately investable segment. Machine learning models now match or surpass numerical weather prediction systems at fractions of computational costs, creating clear value propositions for energy trading, aviation, logistics, and agricultural applications.

Materials research platforms coupled with autonomous laboratory capabilities offer software-as-a-service pathways and co-development partnerships with chemical, battery, and semiconductor manufacturers. These applications show measurable cycle-time reductions and hit-rate improvements in production environments.

The Pharmaceutical Paradox: Billion-Dollar Bets Meet Clinical Reality

The pharmaceutical sector presents AI4S investment complexities that exemplify broader market tensions. Major collaborations between AI platforms and pharmaceutical companies have reached deal values approaching $3 billion, including partnerships between Isomorphic Labs and both Eli Lilly and Novartis.

Value of major AI-pharma collaboration deals announced in recent years, highlighting multi-billion dollar partnerships.

| Partner 1 | Partner 2 | Deal Value (USD) | Upfront Payment (USD) | Date Announced |

|---|---|---|---|---|

| Isomorphic Labs | Eli Lilly | Up to $1.7 billion | $45 million | January 2024 |

| Isomorphic Labs | Novartis | Up to $1.2 billion | $37.5 million | January 2024 |

| Sanofi | Formation Bio | Up to €545 million | Not specified | June 2025 |

| AstraZeneca | Absci | $247 million | Not specified | December 2023 |

| Insilico Medicine | Sanofi | Up to $1.2 billion | Not specified | November 2022 |

| Sanofi | BioMap | Over $1 billion | Not specified | October 2023 |

However, platform biotechnology companies have simultaneously experienced pipeline cuts and workforce reductions despite substantial computational partnerships. The translation from computational predictions to clinical outcomes remains a fundamental bottleneck that has not been solved by increased computing power or algorithmic sophistication.

This disconnect between partnership announcements and operational reality suggests that pharmaceutical AI4S investments require different evaluation criteria than other sector applications. Success depends on prospective validation in target domains rather than retrospective benchmark performance.

Technical Limitations Behind the Marketing

Beneath surface-level breakthrough claims lie significant technical challenges that sophisticated investors must understand. Physics-informed neural networks, frequently cited as revolutionary tools for solving complex equations, suffer from training ill-conditioning problems that limit practical applications.

Did you know that Physics-Informed Neural Networks (PINNs) are a type of AI that blends deep learning with the laws of physics to solve scientific and engineering problems? Instead of relying solely on large datasets, PINNs build physical equations—like differential equations—into their training process, ensuring predictions obey known scientific rules. This makes them more data-efficient, better at handling noisy measurements, and capable of producing physically consistent solutions for complex problems like fluid flow, heat transfer, and wave propagation, all without needing traditional computational grids.

The condition number from numerical analysis predicts convergence speed and accuracy in these systems. High condition numbers lead to unstable, slow training that can be addressed through preconditioning techniques like incomplete LU factorization. However, current preconditioners rely on explicit grids that perform poorly in high-dimensional problems.

Some AI4S applications represent rebranding of traditional research methods rather than genuine algorithmic innovation. Media coverage and startup marketing sometimes present conventional computational approaches as AI breakthroughs, creating valuation disconnects from underlying technical capabilities.

Investment Framework for AI4S Opportunities

Successful AI4S investment requires recognition that the field encompasses distinct sub-markets with different risk profiles and validation timelines. The venture capital approach should emphasize "model plus actuator" strategies where AI systems control physical processes like laboratory equipment, reactors, or robotic systems.

Earth systems applications with demonstrable profit-and-loss impact represent the most reliable near-term opportunities. These require quantified skill improvements versus customer baseline systems, backed by service-level agreements and live performance comparisons rather than academic benchmarks.

Biological platform investments should focus exclusively on companies maintaining captive wet laboratories and experimental capabilities. Pure computational approaches lack the data control and validation loops necessary for sustainable competitive advantages in therapeutic development.

Infrastructure investments in data operating systems, assay automation, and simulation acceleration tools offer attractive risk-adjusted returns across multiple vertical markets without the binary outcomes characteristic of drug discovery.

Diligence Standards for AI4S Investment

Effective AI4S investment evaluation requires specific diligence criteria that differ from traditional software or biotechnology assessments. Causality demonstration through prospective validations in target domains proves more valuable than correlation-based retrospective performance claims.

Delta-to-baseline analysis must quantify skill or accuracy improvements versus customers' current systems rather than cherry-picked academic benchmarks. Closed-loop data rights ensure startups own or perpetually license new data generated by their platforms, creating sustainable competitive moats.

Compute economics analysis should model total cost per decision for inference and training operations. Weather AI systems running on limited GPU resources while matching supercomputer performance represent compelling margin stories that justify premium valuations.

(Table comparing the computational cost, energy use, speed, and accuracy between AI-based weather models and traditional Numerical Weather Prediction (NWP) supercomputers, based on 2025 data and industry reports. AI models offer orders-of-magnitude lower energy and dollar costs while achieving comparable or superior accuracy in many scenarios.)

| Model Type | Energy Cost per Forecast | Dollar Cost per Forecast | Forecast Time | Reliability / Accuracy |

|---|---|---|---|---|

| Traditional NWP (Supercomputer) | Very high — hours on multi-million-dollar supercomputers; up to thousands of kWh | High — specialized hardware, costly maintenance/upgrades | Hours | Proven decades-long reliability, slower to update; physics-based interpretability |

| AI Weather Models (e.g., ECMWF AIFS, GraphCast, FourCastNet, Aurora) | Up to 12,000× less energy, often 1,000× less than NWP | ~1,000× cheaper — can run on consumer-grade/cloud hardware | Seconds to minutes | Comparable to or up to 20% better than NWP in many cases; excels in extreme weather but requires robust training data |

| Regulatory and timeline realism becomes critical in therapeutic applications. Financing structures should tie capital deployment to pre-agreed milestones like investigational new drug applications and Phase 1 safety signals rather than computational performance metrics. |

Market Maturation Signals to Monitor

The next 12 to 24 months will provide crucial validation signals for AI4S market maturity. Operational adoption by institutions like ECMWF and national electrical grids will demonstrate the transition from pilot programs to core infrastructure.

Materials applications will prove their value through measurable time-to-specification and cost reductions at named original equipment manufacturers in batteries, packaging, and coatings sectors. These outcomes must be directly attributable to AI-guided optimization loops rather than general process improvements.

Pharmaceutical proof points will emerge through AI-designed molecules achieving compelling Phase 2 clinical data with partner-led program expansions. The quality and cadence of these readouts will determine whether computational drug discovery delivers sustainable returns or requires fundamental strategy recalibration.

Beyond Bubble Narratives

AI4S resists simple bubble categorization because it encompasses multiple distinct markets with varying maturity levels and risk profiles. The sector combines proven applications generating immediate revenue with speculative long-term bets that may require years for validation.

Investment success requires sophisticated understanding of technical capabilities, domain-specific constraints, and the persistent divide between computational performance and real-world implementation. The most significant returns will likely accrue to investors who can distinguish between genuine breakthroughs and sophisticated rebranding while maintaining disciplined evaluation standards across rapidly evolving market conditions.

Investment advisory disclaimer: Past performance does not guarantee future results. Readers should consult qualified financial advisors for personalized investment guidance. Market analysis may change as new information becomes available.