Apple Reports Record $94 Billion Q3 While Reshaping Global Manufacturing Under Tariff Pressure

Apple's Tightrope Walk: Record Earnings Mask Deeper Tensions in Global Tech Giant

Apple delivered record third-quarter earnings yesterday, showcasing impressive resilience with $94 billion in revenue, up 10% from last year, and profits climbing even faster. But beneath these polished financial figures lies a company actively recalibrating its global operations while facing unprecedented geopolitical pressures that threaten to unravel decades of carefully orchestrated supply chain mastery.

"The disconnect between the headline numbers and the underlying business reality has never been starker," said one veteran technology analyst who requested anonymity due to client relationships. "Apple is posting record profits while simultaneously dismantling and rebuilding its entire manufacturing strategy in real time."

The Tariff-Fueled Buying Spree That Supercharged Sales

Apple's impressive $44 billion in iPhone revenue—a 13% year-over-year surge—comes with a significant asterisk. Company officials acknowledged that approximately one percentage point of that growth came from American consumers rushing to purchase devices before potential tariff-related price increases take effect.

This "panic buying" phenomenon delivered a welcome but potentially unsustainable boost to the quarter's results. The company is now confronting what one analyst described as a "pull-forward hangover" that could dampen sales in coming periods.

Meanwhile, the tariff situation itself continues to worsen. Apple disclosed that trade barriers cost the company $800 million in the just-completed quarter, with projections of $1.1 billion in the current period. Beyond that horizon, executives admitted they cannot confidently forecast the impact—an unusual acknowledgment of uncertainty from a company renowned for its meticulous planning.

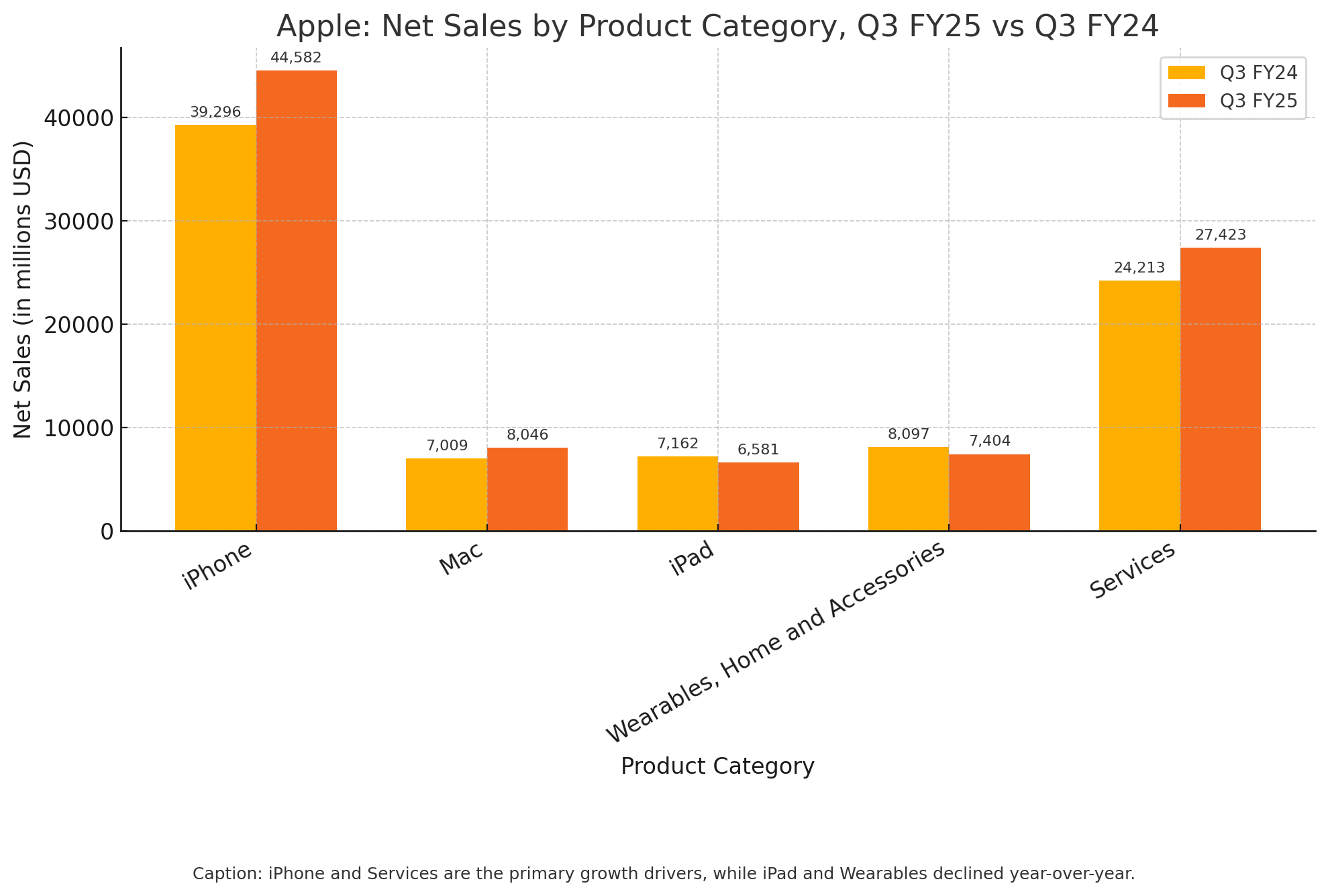

A Tale of Two Product Portfolios

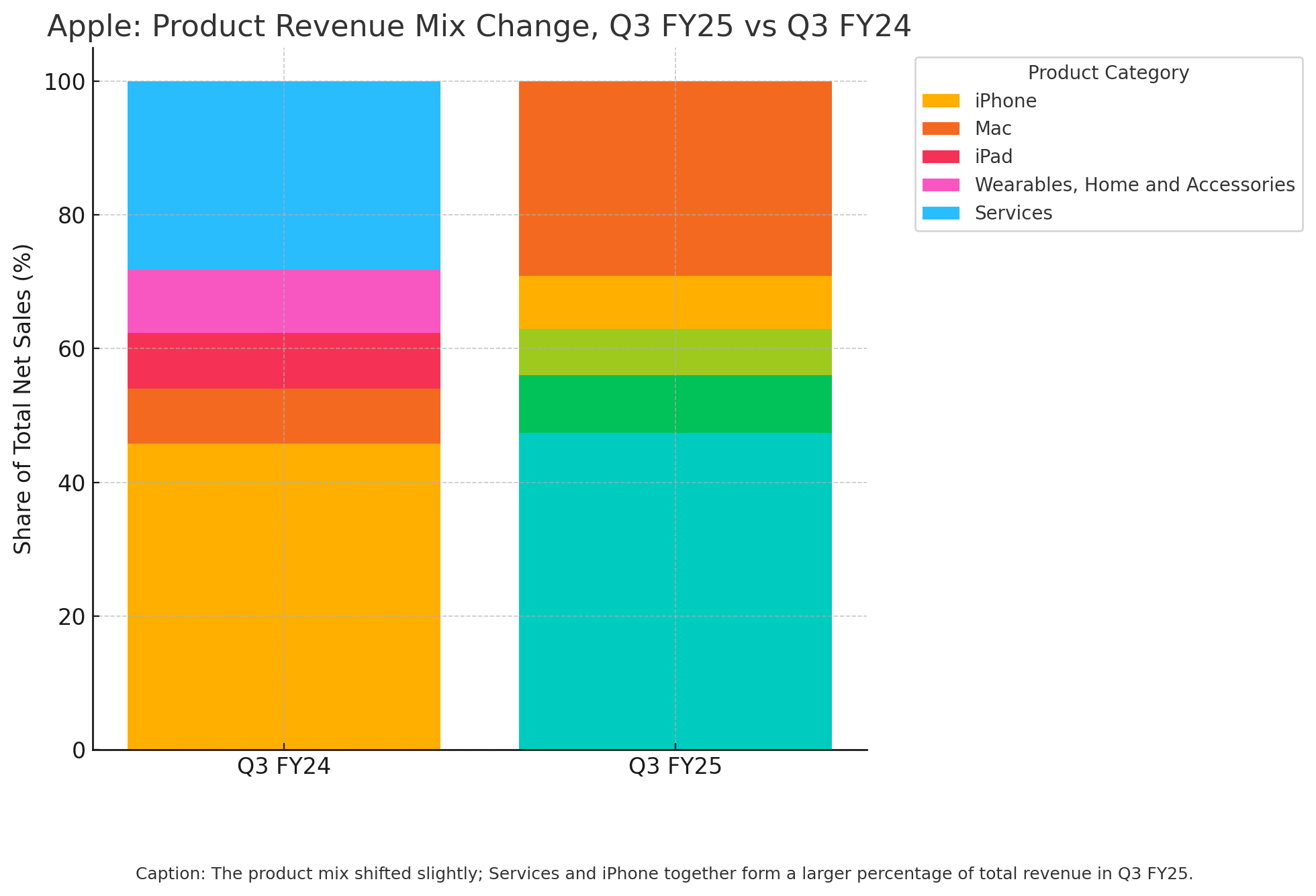

While iPhone and Services divisions dazzled with double-digit growth—Services hit a new peak at $27.4 billion—other segments showed concerning weakness. iPad revenue declined 8%, and the once-booming Wearables category dropped nearly 9% year-over-year, marking their first simultaneous contraction since 2020.

"Apple is becoming increasingly dependent on just two cylinders of its engine," noted a portfolio manager at a major technology investment fund. "When two of your five product categories are shrinking at once, that's not a balanced portfolio—that's a vulnerability."

The Mac division provided a bright spot with an unexpected 15% growth surge, contributing $8 billion to the quarter's revenue. This renaissance in Apple's oldest product line offered valuable diversification as the company navigates turbulent waters.

The Hidden Cash Flow Warning Sign

Perhaps most concerning to seasoned investors was a significant divergence that received little attention on the earnings call: while net income for the nine-month period increased by $5.5 billion, cash generated from operations fell by $9.7 billion—from $91.4 billion to $81.8 billion.

This 11% decline in operating cash flow stemmed from massive shifts in working capital, with accounts payable showing an $18.5 billion reduction as Apple apparently accelerated payments to suppliers. Additional working capital movements included a $15.2 billion reduction in other liabilities.

"When a company's accounting profits and cash generation move in opposite directions, that deserves scrutiny," said one investment banking analyst. "This could be a one-time balance sheet cleanup or a new, less cash-efficient operating model. Either way, it diminishes the quality of these otherwise impressive results."

The Global Chess Game: Manufacturing's New Map

In response to mounting tariff pressure, Apple has embarked on an unprecedented geographic diversification of its manufacturing base. The company has accelerated iPhone production in India and shifted some Mac and Watch assembly to Vietnam.

However, this strategy faces its own uncertainties. The U.S. administration has signaled it may soon impose a 25% tariff on Indian-made iPhones as well, though temporary exemptions are currently in place.

"They're trying to stay one move ahead in a game where the rules keep changing," observed an industry consultant specializing in global supply chains. "The geopolitical environment is forcing Apple to build redundancies they never needed before, and that comes at a cost."

Capital expenditures have surged 45% year-over-year to $9.5 billion for the nine-month period, suggesting Apple is making substantial investments in new manufacturing capabilities and infrastructure across multiple countries.

The AI Race: Playing Catch-Up

Despite the strong quarter, Apple shares had fallen 16-17% in 2025 prior to the earnings report, reflecting not just tariff concerns but also investor anxiety about the company's position in the artificial intelligence race.

Apple's competitors—particularly Microsoft and Nvidia—have captured mind share and market value with their AI initiatives. Apple's recently announced "Apple Intelligence" features represent the company's attempt to close this perceived gap.

The significant increase in capital expenditures likely reflects not just manufacturing reshuffling but also investments in the specialized hardware infrastructure needed to power these AI capabilities.

Geographic Bright Spots Amid the Turmoil

While much attention focused on Apple's challenges in China, where growth was a modest 4.3%, two regions delivered standout performances: Japan saw 13.5% growth, while the Rest of Asia Pacific surged an impressive 20.1%.

These markets now represent over 14% of Apple's sales and are growing at twice the rate of core regions, potentially providing valuable diversification as U.S.-China tensions continue.

Investment Perspective: Navigating the Crosscurrents

For investors watching Apple's stock—which gained approximately 2-3% in after-hours trading following the report—the path forward contains both opportunity and peril.

The company maintains fortress-level profitability with gross margins holding steady at 46.5% despite tariff pressures. Services margins are particularly impressive at 75.6%, up from 74% last year, providing a high-profit engine that could further expand with AI-driven features.

Market analysts suggest three potential scenarios for the stock, which currently trades at approximately $207 per share:

- A base case scenario with continued EPS growth of around 8% annually could lead to a target price of $230 within 12-18 months.

- A more optimistic case, where Apple successfully monetizes AI features and boosts Services margins further, might push the stock toward $260.

- A pessimistic scenario featuring expanded tariffs and a reversal of the recent sales surge could send shares toward $175.

"The current valuation reflects investor faith in Apple's ability to navigate these challenges," noted one investment strategist. "But the multiple could compress quickly if gross margins deteriorate due to broader tariff implementation."

Investment Thesis

| Category | Details |

|---|---|

| Stock Info | Company: Apple Inc. (USA) Price: $207.57 (-$1.13) Open: $208.27 Volume: 80,641,776 High/Low: $215.0 / $207.285 Last Trade: Friday, August 1, 01:56:02 +0200 |

| Financial Performance | Revenue (YoY): +10% ($94B) EPS: $1.57 (+12%) iPhone Revenue: +13% Services Revenue: +13% iPad Revenue: -8% Wearables Revenue: -9% Gross Margin: 46.5% (June-quarter record) OCF: -11% YoY ($33B WC swing) |

| Tariff Risks | China Tariff Impact: $0.8B (current Q), $1.1B (next Q) India Tariff Risk: 25% duty if exemption revoked (400bps GM hit) Base Case EPS CAGR: ~8% Bear Case EPS Impact: -5% (if tariffs imposed) |

| AI & Capex | Capex (YTD): $9.5B (+45% YoY) AI Focus: Edge-cloud inference, custom silicon Potential Services GM Uplift: 78-80% (from 74%) AI Monetization Risk: Lagging behind MSFT/NVDA |

| Valuation | NTM P/E: ~30x (5-yr range: 19-34x) LTM FCF Yield: ~3% Buyback-adjusted EPS CAGR: 9.5% Organic EBIT CAGR: 6% |

| Market Opportunities | Japan & RoAPAC Growth: +14% & +20% YoY Vision Pro Localization Potential WC Reset: Potential FY-26 FCF rebound |

| Risks & Watchlist | Tariff Acceleration: USTR updates, India exemption status iPhone Demand Hangover: U.S. carrier activations AI Execution Gap: SDK adoption vs. Google Gemini Cash Flow Slippage: WC rebuild in Q4 10-K |

| Investment Stance | Base Case (Hold): $230 PT (8% EPS CAGR, 28-30x P/E) Bull Case (Overweight): $260 PT (11% EPS CAGR, 33x P/E) Bear Case (Underweight): $175 PT (flat EPS, 25x P/E) |

| Actionable Steps | 1. Model GM sensitivity (46%/45%/44%) 2. Track AI-enhanced App Store rankings 3. Monitor WC rebuild in Q4 10-K 4. Hedge with Jan-26 puts & covered calls |

Disclaimer: This analysis is based on current market data and established economic indicators. Past performance does not guarantee future results. Readers should consult financial advisors for personalized investment guidance.

As Apple looks toward the all-important holiday quarter, the company's legendary supply chain management faces its greatest test. With Chief Financial Officer Kevan Parekh projecting "mid to high single digits" revenue growth for the current quarter—higher than most analysts had anticipated—Apple continues to project confidence amid uncertainty.

The coming months will reveal whether the company can maintain its delicate balance: delivering the consistently strong financial results investors expect while simultaneously rewiring the global manufacturing network that has powered its success for decades.