Arkansas Commits $105 Million to Israeli Bonds as Local Communities Demand Investment at Home

Arkansas Places $105 Million Wager on Israeli Bonds While Communities Seek Local Investment

LITTLE ROCK, Arkansas — In the marbled halls of the Arkansas State Capitol, a financial strategy is unfolding that has transformed the state into one of America's most significant subnational investors in Israeli sovereign debt—a $105 million commitment that illuminates the complex intersection of geopolitical alignment, economic development, and fiduciary responsibility.

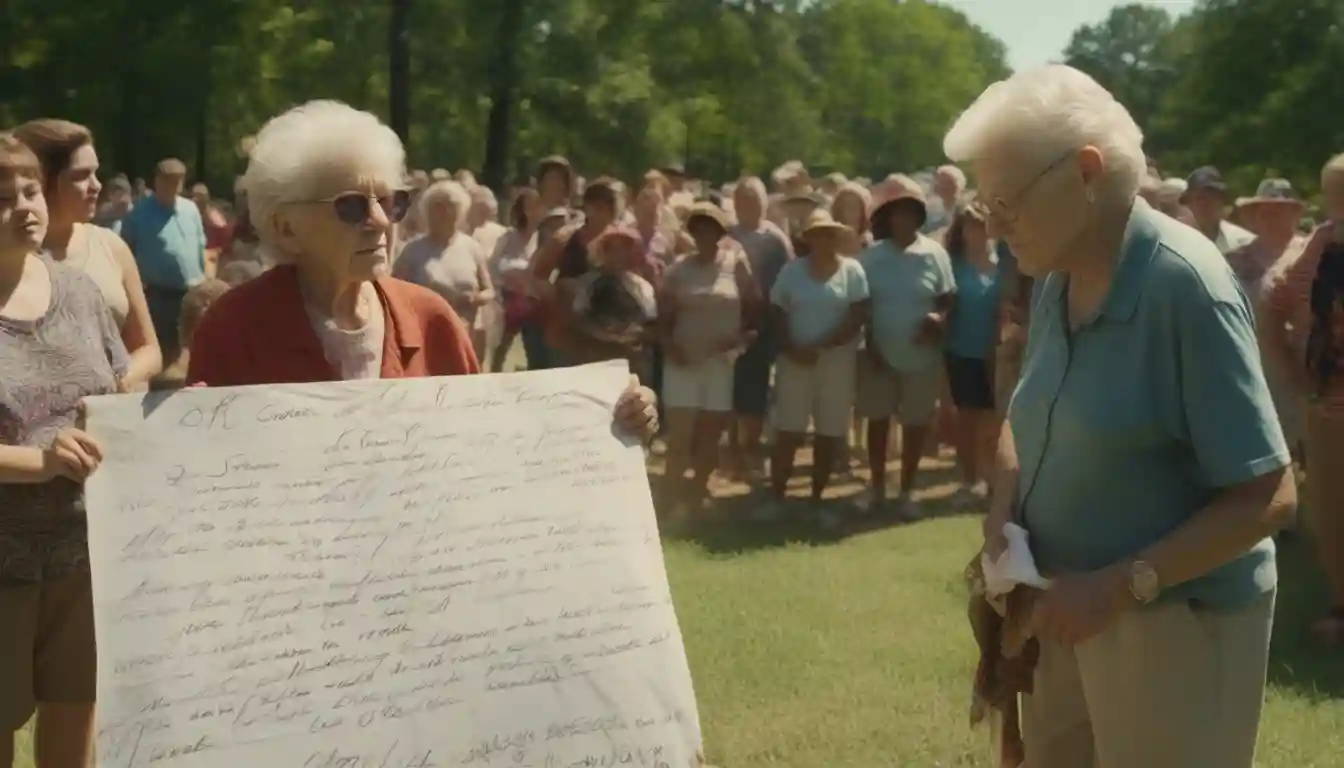

Governor Sarah Huckabee Sanders' administration has doubled down on Israeli bond investments, adding up to $50 million in new commitments to the $55 million already held by the Arkansas Treasury. This expansion comes as protesters gathered outside the capitol on August 9, welcoming Sanders back from her recent diplomatic mission to Israel and the UAE, their signs reading "Invest in Arkansas First."

The investment strategy represents more than financial positioning—it signals Arkansas's deeper integration into Middle Eastern defense supply chains while testing the boundaries between political solidarity and portfolio management.

The Camden Connection: Where Geopolitics Meets Manufacturing

The financial commitment cannot be understood without examining the industrial foundation it supports. In East Camden, a former lumber town of 11,000 residents, RTX Corporation and Israel's Rafael Advanced Defense Systems are constructing a facility to manufacture Tamir interceptors—the projectiles that power Israel's Iron Dome missile defense system.

The plant, scheduled to reach full production in 2025, represents a tangible economic anchor for Sanders' broader Israeli partnership strategy. Components manufactured in Arkansas will soon protect Israeli cities, creating a supply chain relationship that extends far beyond bond purchases.

Did you know that Israel’s Iron Dome is a mobile missile defense system capable of detecting, tracking, and intercepting incoming short-range rockets and artillery shells before they hit populated areas? Using advanced radar, it calculates whether a projectile poses a real threat and launches a Tamir interceptor only when necessary, detonating it mid-air to neutralize the danger. Each battery can protect up to 150 square kilometers with a reported interception success rate of around 90%, making it a highly effective, cost-efficient shield against rocket attacks.

Economic development officials frame this as strategic positioning within the global defense economy. Arkansas has cultivated relationships with Israeli defense contractors for over a decade, with the 2022 Memorandum of Understanding with Israel's National Technological Innovation Authority laying the groundwork for Sanders' more aggressive approach.

Financial Architecture of a Controversial Strategy

The numbers reveal a sophisticated, if politically charged, investment approach. Israeli bonds currently offer yields that compete favorably with comparable corporate debt—recent 10-year Maccabee bonds yielding 5.27% and Jubilee bonds at 5.42%, rates that reflect both Israel's sovereign backing and elevated geopolitical risk premiums.

However, credit rating agencies have collectively downgraded Israeli debt since October 2023. Moody's moved Israel to Baa1, while both S&P and Fitch assigned A ratings with negative outlooks—a deterioration that complicates the state's investment thesis.

Table: Israel’s Sovereign Credit Rating History and Recent Changes (2023–2025)

| Rating Agency | Date of Latest Action | Current Rating | Previous Rating | Outlook | Key Reasons for Downgrade/Outlook |

|---|---|---|---|---|---|

| Moody’s | July 2025 (affirmed) | Baa1 | A2 (Sept 2024) | Negative | Heightened risks from ongoing conflict, fiscal pressures, despite economic resilience and growth prospects. |

| S&P | Oct 1, 2024 | A | A+ (Oct 2023) / AA- (pre-2023) | Negative | Security risks from conflicts in Gaza and with Iran, potential escalation, fiscal constraints. |

| Fitch | March 2025 (affirmed) | A | A (Aug 2024 downgrade) | Negative | Elevated debt levels, fiscal strain from increased defense spending, security challenges. |

Portfolio managers familiar with the Arkansas strategy note the liquidity constraints inherent in Israeli bonds. Unlike U.S. Treasuries, these instruments trade in limited secondary markets, effectively locking purchasers into buy-and-hold positions. This illiquidity becomes problematic during market stress periods when portfolio rebalancing becomes necessary.

Did you know that sovereign credit ratings are like a country’s financial report card, issued by agencies such as Standard & Poor’s, Moody’s, and Fitch? These ratings assess how likely a nation is to repay its debts, influencing its ability to borrow money and the interest rates it pays. High ratings (like AAA) signal low risk and cheaper borrowing, while low ratings (“junk” status) mean higher risk and costs. Factors such as political stability, economic growth, debt levels, and trade performance all play a role in determining the rating, making it a crucial indicator for investors worldwide.

"The yield pickup is real, but you're accepting significant liquidity constraints and concentration risk," said one pension fund consultant familiar with the Arkansas allocations, speaking on condition of anonymity. "The question becomes whether that spread compensates for the operational limitations."

Legal Framework and Fiduciary Tensions

Arkansas's anti-BDS (Boycott, Divestment, Sanctions) legislation, upheld by the 8th Circuit Court of Appeals and left standing by the Supreme Court, provides legal cover for pro-Israel investments. Similarly, the state's anti-ESG statutes require fiduciaries to consider only "pecuniary factors" when making investment decisions.

BDS stands for Boycott, Divestment, and Sanctions, which are the tactics used by the movement. It is a Palestinian-led global campaign that applies non-violent economic and social pressure on Israel to advocate for Palestinian rights.

These legislative guardrails create a paradox: while the law demands purely financial considerations, public statements from Sanders' administration emphasize solidarity and strategic partnership with Israel. This rhetorical tension provides ammunition for critics who argue that political motivations are driving investment decisions.

The Arkansas Employees Pension System (APERS) and Arkansas Teacher Retirement System (ATRS) have authorized the additional Israeli bond purchases, but pension consultants privately express concern about the precedent of allowing political relationships to influence asset allocation decisions.

Community Resistance and Alternative Visions

The August 9 protest by Little Rock Peace for Palestine represents broader community frustration with Sanders' investment priorities. Local activists argue that $105 million could address pressing infrastructure needs, support community development financial institutions, or capitalize Arkansas-based venture funds.

The criticism extends beyond traditional progressive opposition. Rural communities struggling with broadband access, agricultural financing constraints, and manufacturing workforce development question whether foreign bond purchases serve Arkansas residents' immediate needs.

"Every dollar we send overseas is a dollar not invested in our communities," said one local economic development official, requesting anonymity due to the politically sensitive nature of the issue. "The governor talks about bringing Israeli companies here, but what about growing Arkansas companies first?"

Investment Outlook and Strategic Implications

Market analysts anticipate Arkansas will maintain its Israeli bond exposure while scaling future purchases based on credit rating stability. The state's commitment appears driven by three factors: competitive yields, geopolitical alignment, and industrial policy coordination.

The investment strategy carries asymmetric risk characteristics. If Israeli credit ratings stabilize and geopolitical tensions de-escalate, Arkansas captures attractive risk-adjusted returns. However, further rating downgrades or regional conflict escalation could generate mark-to-market losses that cannot be easily realized due to liquidity constraints.

Defense industry analysts suggest the Camden manufacturing facility provides a compelling economic justification for the broader Israeli partnership, independent of bond performance. The plant could attract additional defense contractors to Arkansas, creating a regional cluster around missile defense technology.

Forward-Looking Investment Considerations

Professional investors tracking Arkansas's strategy should monitor several key indicators. First, Israeli sovereign credit ratings will likely determine the pace of future bond purchases. Second, the success of the Camden facility in attracting ancillary defense investments will validate or challenge the broader economic development thesis.

Currency dynamics also merit attention. Israeli shekel volatility could impact bond returns for U.S. institutional investors, particularly if global conflict drives flight-to-quality flows toward traditional safe haven assets.

US Dollar to Israeli Shekel (USD/ILS) exchange rate volatility over the last several years.

| Date | Exchange Rate (1 USD to ILS) |

|---|---|

| April 8, 2025 | 3.7775 |

| July 11, 2025 | 3.3076 |

| August 11, 2025 | 3.413 |

For institutional investors considering similar strategies, Arkansas's experience offers both cautionary lessons and potential models. The combination of yield enhancement, geopolitical positioning, and industrial policy coordination represents a novel approach to public asset management—one that may be replicated by other states seeking to leverage investment decisions for economic development purposes.

The Arkansas experiment ultimately tests whether subnational governments can successfully integrate financial strategy with geopolitical alignment and local economic development. The answer will emerge through bond performance, manufacturing job creation, and political sustainability—metrics that extend far beyond traditional investment analysis.

As protesters continue planning additional demonstrations and Sanders prepares for more Israeli trade missions, Arkansas finds itself at the intersection of global finance and local politics, a position that will likely define the state's economic trajectory for years to come.

Investment analysis suggests monitoring Israeli credit ratings, regional conflict developments, and Arkansas defense manufacturing employment data as key indicators for the strategy's long-term viability. Past performance does not guarantee future results, and readers should consult financial advisors for personalized investment guidance.