Autonomous Revolution - The Seismic Shift Reshaping Auto Insurance

Autonomous Revolution: The Seismic Shift Reshaping Auto Insurance

In the gleaming headquarters of Progressive Corp., executives are facing an uncomfortable reality. The insurance giant's stock plunged over 10 dollars today, continuing a troubling pattern that has left investors increasingly wary of companies whose fortunes are tied to traditional auto insurance models.

The culprit? The accelerating adoption of autonomous vehicles is fundamentally reshaping the insurance landscape faster than many industry veterans anticipated—threatening to shrink the personal auto insurance market by up to 60% in real terms by 2040, beyond even Goldman Sachs' recent projection of a 50% decline.

"We're witnessing the most profound restructuring of risk in the automotive sector since the invention of the automobile itself," said an insurance industry analyst who requested anonymity. "This isn't just evolution—it's revolution."

Table: Leading Companies in US Autonomous Driving Car Insurance and Their Key Initiatives

| Insurer/Entity | Focus Area | Notable Initiatives |

|---|---|---|

| State Farm | Personal auto insurance | Digital transformation, large market share |

| GEICO (Berkshire Hathaway) | Personal/commercial auto insurance | Adapting products for AVs, broad reach |

| Progressive | Personal auto insurance, telematics | Usage-based insurance, digital tools |

| Allstate | Usage-based, connected vehicle insurance | "Miles-wise" program, Ford partnership |

| Marsh | AV testing, commercial fleets | Autonomous Mobility Insurance Facility |

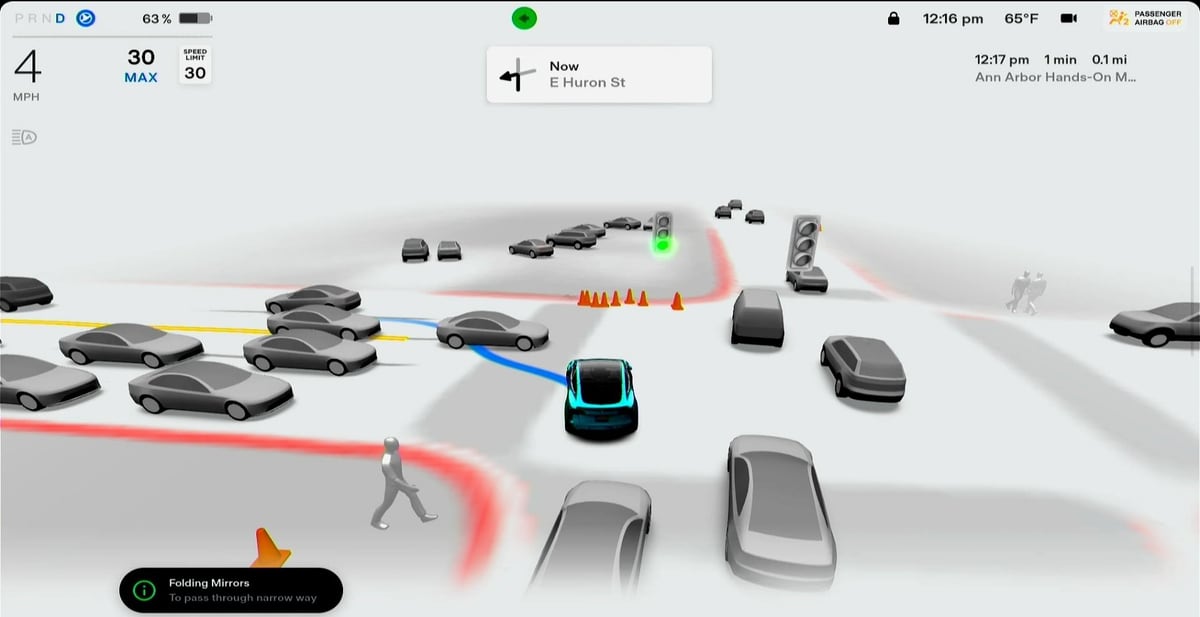

| Tesla | Embedded AV insurance for Tesla vehicles | Real-time data-driven pricing |

| Ford, GM, etc. | Embedded insurance, manufacturer programs | Partnerships with insurers, in-house offers |

When Cars Drive Themselves, Who Pays for Crashes?

The central disruption is straightforward yet far-reaching: as vehicles increasingly drive themselves, responsibility for accidents is shifting from human drivers to the manufacturers and software developers who create the autonomous systems.

This transformation is particularly evident in higher levels of automation (Levels 4 and 5), where vehicles operate independently. According to recent empirical data from a Swiss Re–Waymo study, autonomous vehicles demonstrate dramatically better safety performance, with 88% fewer property damage claims and 92% fewer bodily injury claims across 25 million driver-out miles.

These compelling safety improvements are already justifying rate cuts for autonomous vehicle fleets—and accelerating the obsolescence of traditional driver-based insurance models.

The Great Migration of Premium Dollars

The $200-250 billion in U.S. personal auto premiums won't simply evaporate. Instead, this massive pool of capital is migrating to new risk categories:

- Product liability and recall coverage for autonomous vehicle manufacturers

- Cyber and data-breach protection for connected vehicle systems

- Commercial motor policies for robotaxi and autonomous delivery fleets

- Usage-based parametric micro-coverage for riders and cargo

This shift is forcing insurers to fundamentally rethink their business models. By 2032, analysts project the U.S. personal auto insurance line will transition from being a profit center to a run-off business, with surviving carriers either pivoting to become embedded white-label capacity providers or exiting the market entirely.

The New Power Players: Data-Rich Automakers

Perhaps most telling is the aggressive move by automakers to capture insurance market share. Tesla, which now offers insurance in 30 states, along with GM (operating in 11 states) and Rivian, are leveraging their proprietary vehicle data to create more precise risk profiles than traditional insurers could ever hope to achieve.

"The entity that controls high-resolution driving data owns the underwriting edge and distribution leverage," explained a veteran insurance industry consultant. "This creates a flywheel effect where OEM captive insurers can achieve combined ratios below 70% while adding $500-800 in net present value per vehicle."

Tesla's stock rose modestly today, gaining $1.16 to reach $296.30, reflecting investor confidence in the company's growing insurance business. This stands in stark contrast to the fortunes of pure-play auto insurers like Progressive and Allstate, which fell 3.8% and 4.3% respectively.

A New Insurance Architecture Emerges

The liability framework for autonomous vehicles is evolving through distinct phases. Between 2025-2028, with autonomous vehicle penetration (Level 4+) at just 1-3% of new U.S. sales, drivers and vehicle owners will still bear primary responsibility for about 60% of accidents, with OEM captive insurers covering 25%.

But this balance will shift dramatically. By 2035-2040, when autonomous vehicles are projected to represent 45-55% of new sales, OEM captives will handle 70% of claims, reinsurers will cover 25%, and traditional driver-based policies will account for 5% or less.

The policy structures are evolving as well. Today's split driver/OEM policies with $1-5 million per occurrence limits will give way to single-policy OEM coverage with reinsurer quota shares by the late 2020s. By the mid-2030s, the market will be dominated by product and cyber towers, along with per-mile micro-coverage for riders.

Regulatory Landscape: A Patchwork Evolving Toward Uniformity

The regulatory environment remains fragmented but is showing signs of convergence. California currently requires $5 million in coverage for autonomous vehicle testing companies, while Florida mandates a $1 million minimum for fully autonomous vehicles. Texas has no explicit autonomous vehicle insurance limits but operates under a negligence statute, with insurers typically requiring at least $1 million in coverage.

Internationally, the UK has pioneered a single-policy model with insurer subrogation to OEMs under the Automated and Electric Vehicles Act of 2018—a framework likely to be adopted by Australia and Singapore by 2027.

One of the most significant open questions is whether the U.S. Congress will pass a federal autonomous vehicle liability statute. Such legislation could accelerate OEM assumption of risk by eliminating the friction of navigating 50 different state regulatory regimes. Industry watchers are closely monitoring committee mark-ups of a bipartisan draft expected in Q4 2025.

Investment Implications: Winners and Losers in the New Landscape

For investors, the strategy is clear: position portfolios away from legacy personal auto insurers and toward three key segments that stand to benefit from the transformation:

- Data-rich OEM insurers with captive insurance operations

- Global reinsurers writing excess product/cyber layers, such as Swiss Re and Munich Re

- AI-native insurtech platforms providing real-time risk scoring APIs

"The play is not about whether autonomy happens, but who owns the data and balance sheet when it does," noted a portfolio manager at a major asset management firm. "Expect significant multiple expansion for companies on the right side of this transition—and compression for those tied to the old model."

Some tactical investors are already expressing this view through pair trades, such as going long Tesla while shorting Progressive—a strategy that capitalizes on the market's current underpricing of OEM-controlled underwriting profit relative to eroding personal auto insurance volumes.

Managing Transition Risks

The road to a fully autonomous insurance landscape is not without potholes. Adoption could stall due to technological limitations or public trust issues. Litigation explosions could undermine profitability. Regulatory whiplash remains a persistent threat.

To navigate these uncertainties, savvy investors are maintaining delta-neutral positions between OEM captives and reinsurers, focusing on carriers with geographic diversification, and prioritizing insurers with real-time underwriting capabilities tied directly to vehicle operating system logs rather than proxy variables.

"We're entering a decade where the winners and losers in auto insurance will be determined by their ability to adapt to this new reality," said a senior analyst at a major investment bank. "For insurers clinging to traditional models, the clock is ticking."

Disclaimer: This analysis is based on current market data and established economic indicators. Past performance does not guarantee future results. Readers should consult financial advisors for personalized investment guidance.