Barrick Gold Launches CEO Search as Mark Bristow Plans Exit Amid Record Profits and Mali Crisis

Mining Giant Barrick Accelerates CEO Succession as Geopolitical Tensions Mount

Gold's Steward Prepares to Pass the Torch Amid Record Earnings and Strategic Crossroads

TORONTO — In the understated boardroom at Barrick Gold's headquarters, where decisions affecting billions in global mining assets are routinely made, a significant transition is quietly taking shape.

The world's third-largest gold producer is accelerating its search for a successor to its formidable CEO Mark Bristow, signaling a pivotal shift in leadership amidst both unprecedented prosperity and mounting challenges.

Bristow acknowledged that succession planning has intensified, with the board taking a more active role in determining the leadership that will guide the company's future direction.

The timing is particularly noteworthy: Barrick just reported a staggering 60% year-on-year increase in first-quarter net earnings for 2025, reaching $474 million on the back of gold prices that have soared to historic highs, briefly touching $3,500 per ounce—a 29% increase this year alone.

Gold price trend over the past year, showing recent surge to historic highs.

| Date | Price per Ounce (USD) | Notes |

|---|---|---|

| May 7, 2025 | $3,385.32 - $3,397.00 | Price reflects intra-day trading and various sources. |

| May 6, 2025 | $3,401.00 - $3,414.22 | |

| April 24, 2025 | ~$3,337.99 | |

| April 22, 2025 | $3,499.88 - $3,500.05 | All-time high reached. |

| April 21, 2025 | $3,395.84 | |

| May 31, 2024 | $2,326.97 | Closing price for May 2024. |

| May 15, 2024 | ~$2,357.58 | Spot gold price. |

| The company's share price has followed suit, climbing 20% since January. |

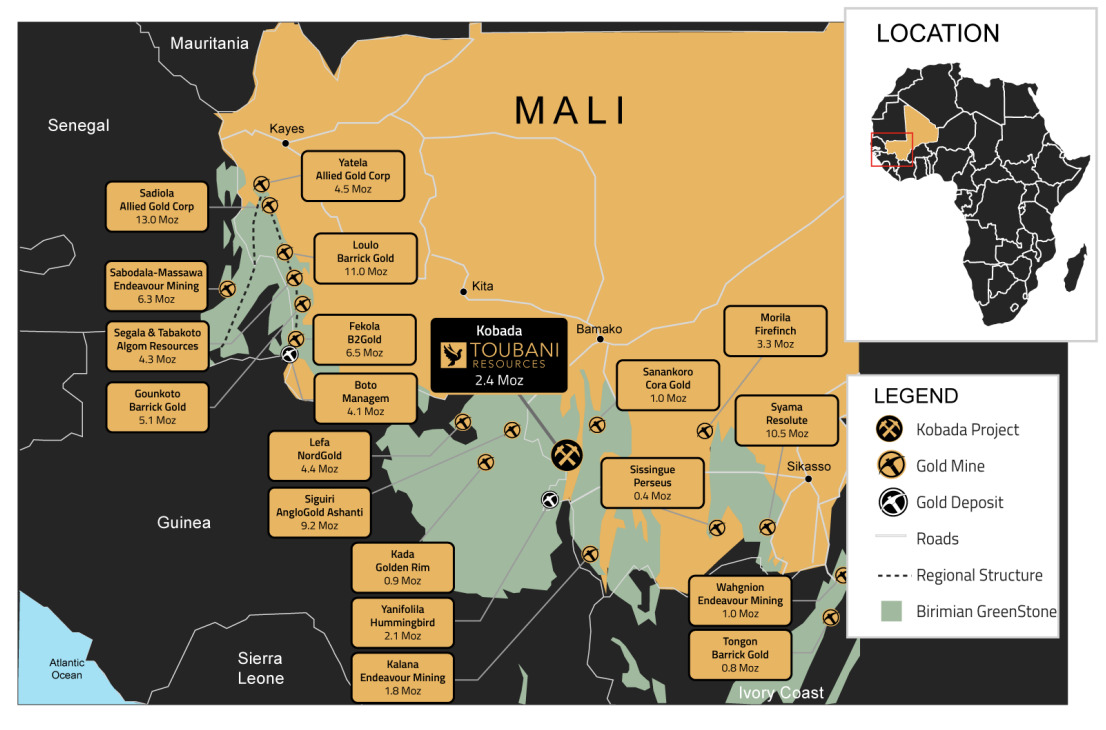

Yet this financial windfall comes as Barrick navigates treacherous geopolitical waters. In Mali, four company employees have been detained for nearly six months in what Bristow describes as a "violation of human rights."

"The government must come to the table," Bristow insisted, as negotiations continue alongside formal arbitration proceedings at the World Bank's International Centre for Settlement of Investment Disputes (ICSID).

Did you know? The International Centre for Settlement of Investment Disputes (ICSID), part of the World Bank Group, helps resolve legal disputes between foreign investors and states through arbitration and conciliation. Established in 1966 by the Washington Convention, ICSID provides a neutral forum where investment-related disagreements can be settled fairly, and its rulings are enforceable in over 150 member countries, making it a key player in global investment protection.

The Bristow Legacy: Triumph and Controversy

At 66, Bristow represents a rare breed of mining executive—equal parts geologist, diplomat, and financial strategist.

Did you know? The 2019 merger between Barrick Gold and Randgold Resources created the world’s largest gold mining company in an $18.3 billion all-stock deal. Randgold’s CEO, Mark Bristow, took the helm of the combined entity, bringing his expertise in African operations, while Barrick’s John L. Thornton remained Executive Chairman. With 78 million ounces in gold reserves and a global footprint, the merger reshaped the mining industry, though it also sparked legal disputes, including a $2 million award to dealmaker Ian Hannam.

"Under any conventional metric—earnings, cash flow, share price, safety improvements—Bristow has delivered exceptional value," noted a mining analyst. "The company achieved a fifth consecutive year of safety gains, including a 47% drop in Lost Time Injury Frequency Rate and went months without a single lost-time injury in 2024. That's remarkable in an industry where safety metrics are closely scrutinized."

The Lost Time Injury Frequency Rate (LTIFR) is a crucial safety metric, particularly in industries like mining, used to measure the number of lost-time injuries occurring per a standard number of hours worked (often one million). It essentially indicates how frequently employees are injured severely enough to miss work.

Yet Bristow's tenure has not been without controversy. Trophy-hunting photographs published by British media showed him posing with dead elephants, antelopes, hippos, and lions, prompting his resignation from conservation organization Panthera. A lawsuit over merger advisory fees created public friction, though it was ultimately settled for $2 million—far less than the $18 million originally sought.

Most pressing, however, is the deteriorating situation in Mali, where the military government's arrest warrant hangs over Bristow like a sword of Damocles, despite reports of a draft $438 million settlement that remains unfinalized.

"The geopolitical drag from Mali has created a significant discount in how investors value those assets," explained a portfolio manager specializing in precious metals. "Even with gold at record prices, the market is applying an uncertainty premium to Barrick that's becoming impossible to ignore."

The Copper Pivot and Capital Transformation

While navigating these challenges, Bristow has committed to staying until 2028 to oversee what may be his most ambitious legacy project: the $9 billion Reko Diq copper-gold development in Pakistan's Balochistan province.

The project represents more than just expansion—it signals Barrick's strategic repositioning toward copper, widely viewed as critical to the global energy transition.

Projected Copper Demand Growth from Global Energy Transition

| Category | Current | Projected | Growth | Timeframe |

|---|---|---|---|---|

| Overall Demand | - | 50 million tonnes | +70% | By 2050 |

| Energy Transition Share | 7% of demand | 23% of demand | +16 pts | By 2050 |

| Clean Energy Technologies | 6.4 million tonnes | 11.5 million tonnes | +81% | By 2035 |

| Sector Growth Rates | ||||

| - Grid Battery Storage | - | - | +557% | By 2035 |

| - Electric Vehicles | 396,000 tonnes | 2.6 million tonnes | +555% | By 2035 |

| - Solar Power | - | - | +43% | By 2035 |

| - Wind Power | - | - | +38% | By 2035 |

| Supply Gap | - | 70% of demand unmet | - | By 2035 |

| Required Investment | - | $2.1 trillion | - | Over 25 years |

Did you know? Copper is a cornerstone of the global energy transition, used extensively in renewable energy systems, electric vehicles, and power grids due to its unmatched electrical conductivity. As the world moves toward cleaner energy, demand for copper is soaring—EVs alone require up to four times more copper than traditional cars. From solar panels to battery storage and grid upgrades, copper enables the shift to low-carbon technologies, though its supply challenges and rising costs could become key bottlenecks in the race to decarbonize.

Despite a setback when Saudi Arabia's Manara fund failed to deliver expected funding, Barrick is pressing ahead with development plans.

"Reko Diq transforms Barrick from primarily a cash-return champion to a mega-project operator," observed an industry consultant who has worked with multiple mining majors. "That's a fundamental shift in capital allocation strategy that requires different leadership skills and risk management approaches."

The timing of the succession formalization aligns with this transition. Major lenders like the IFC and ADB will require governance clarity before funds are fully drawn, and investors accustomed to steady dividends are growing wary about potential payout reductions once Reko Diq's capital expenditures accelerate.

Board Reinforcements Signal Strategic Direction

Barrick has provided few clues about potential successors, declining to name internal or external candidates. However, the recent addition of two heavyweight directors offers insights into the board's thinking about future leadership priorities.

Ben van Beurden, former CEO of Shell, brings unparalleled experience in managing complex multinational operations and energy transition strategies.

Equally significant is the arrival of Pekka Vauramo, who previously led both Metso (mining equipment and services) and Finnair.

"These aren't just typical director appointments—they're strategic chess pieces," said a corporate governance expert familiar with mining board dynamics. "Both bring complementary skills that could either support an internal candidate's development or potentially place one of them in an executive role themselves."

A Succession Race with Global Implications

Industry observers point to several potential candidates, each offering distinct advantages and limitations. Graham Shuttleworth, Barrick's current CFO and a Randgold veteran, would provide continuity and capital markets credibility but may lack the diplomatic gravitas required for dealing with increasingly assertive host governments.

Greg Walker, who successfully led the Pueblo Viejo expansion, has operational credibility that could help unblock the Mali situation but less experience with multi-metal mega-projects of Reko Diq's scale.

The board might even consider van Beurden himself for an executive chairman role paired with an internal CEO promotion—a dual-leadership model that proved successful at Rio Tinto following its Juukan Gorge crisis in 2021.

Did you know? In 2020, mining giant Rio Tinto legally destroyed the 46,000-year-old Juukan Gorge caves in Western Australia—sacred to the Puutu Kunti Kurrama and Pinikura peoples—triggering global outrage and the resignation of top executives. Although the blast complied with outdated heritage laws, it sparked a major governance reckoning, leading to parliamentary inquiries and calls for stronger Indigenous consultation. Despite new legislation introduced in 2021, it was repealed in 2023 due to practical challenges, leaving heritage protection still under scrutiny as Indigenous groups continue pressing for meaningful reforms.

"My analysis suggests the board favors complementary leadership—perhaps promoting Shuttleworth to CEO while embedding van Beurden as executive chair to mentor him and handle high-stakes diplomacy," speculated a mining sector recruiter who has placed C-suite executives at multiple resource companies.

Market Impact and Investment Implications

For investors and traders, Barrick's leadership transition creates both uncertainty and opportunity. The succession process will likely create an overhang on the stock, causing it to lag gold's price momentum by approximately 0.2-0.3 times until a credible successor is identified.

However, the longer-term outlook could be considerably more positive. A new CEO with copper expertise could potentially re-rate Barrick's EV/EBITDA multiple by a full turn if they successfully de-risk Mali operations or monetize a minority stake in Reko Diq.

The EV/EBITDA multiple is a popular company valuation metric that compares a company's Enterprise Value (EV) to its Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA). This ratio helps investors assess how a company is valued relative to its operational earnings power, often used to compare valuations across similar companies.

The succession also has implications for gold prices broadly. With Barrick potentially less positioned to pursue major acquisitions during a leadership transition, bid pressure for tier-one gold assets may decrease, providing modest support for bullion prices.

Did you know? A Tier-One gold asset is a top-tier mine that produces over 500,000 ounces of gold annually, has a mine life of at least 10 years, and operates at low costs—typically in the lowest industry quartile. Located in geopolitically stable regions and often boasting high-grade reserves, these assets are the crown jewels of the gold mining world. Increasingly, strong environmental, social, and governance (ESG) performance is also a key factor in defining a Tier-One gold mine.

If Barrick delays growth capital expenditures, physical supply growth could slow into 2027, potentially supporting a structurally higher floor above $3,000 per ounce.

For copper markets, Barrick's commitment to Reko Diq amid leadership changes signals confidence in long-term demand fundamentals. Global copper demand is projected to outstrip supply by approximately 6 million tons by 2030, with Reko Diq's eventual 200,000 tons per annum positioned to capture significant scarcity premiums.

Table: Global Copper Market Projections Showing Near-Term Surplus vs. Long-Term Deficit Forecasts (2025-2031)

| Time Frame | Source | Projection | Key Figures |

|---|---|---|---|

| Near-Term Forecasts | |||

| 2025 | ICSG (April 2025) | Surplus | +289,000 tonnes |

| 2026 | ICSG (April 2025) | Surplus | +209,000 tonnes |

| Long-Term Deficit Projections | |||

| 2030 | JPMorgan | Deficit | -4,000,000 tonnes |

| 2030 | RFC Ambrian | Deficit | -1,900,000 tonnes |

| 2030 | Trafigura | Additional AI/Data Center Demand | +1,000,000 tonnes |

| 2030 | GlobalData | Supply Estimate | 29,300,000 tonnes (with demand substantially higher) |

| 2031 | McKinsey | Deficit | -6,500,000 tonnes (Supply: 30.1M vs. Demand: 36.6M) |

| Key Deficit Drivers | Factor | Impact | |

| Energy Transition | 2× copper usage in EVs vs. conventional vehicles | ||

| Renewable Energy | Green uses rising from 4% (2020) to 17% (2030) of consumption | ||

| AI/Data Centers | Significant new demand not in earlier forecasts | ||

| Mining Investment | 10-20 year development timelines in North America | ||

| Discovery Rates | Only 4 major discoveries in past five years |

Stakeholder Chess Game Intensifies

The leadership transition has already triggered strategic positioning among key stakeholders. Income-oriented investment funds are pressing the board to outline dividend policies before appointing a new CEO, while thematic copper and electric vehicle funds are considering entering Barrick's shareholder register if the successor demonstrates strong base metals credentials.

Host governments are equally attentive to the power shift. Mali's military leadership likely views the transition as leverage to extract more favorable fiscal terms or local ownership stakes. Pakistan's government gains negotiating power on infrastructure concessions, knowing that Barrick cannot afford delays that would erode Reko Diq's net present value while a new CEO gets up to speed.

Net Present Value (NPV) is a calculation used to determine the current worth of future cash flows from an investment or project, after accounting for the initial cost. It's a crucial tool in project valuation and investment analysis, helping to assess profitability by considering the time value of money.

Meanwhile, original equipment manufacturers focused on the energy transition are exploring early copper offtake agreements that could effectively pre-fund portions of Reko Diq's development, potentially shifting Barrick's capital structure away from traditional project finance models.

Offtake agreements in mining are contracts where a producer agrees to sell, and a buyer agrees to purchase, a specified quantity of future mineral production, like copper. Their primary purpose is to secure a market for the mine's output, which is often crucial for obtaining project financing, while guaranteeing supply for the buyer.

Environmental, social, and governance advocates are also watching closely. Bristow's trophy-hunting controversy has kept non-governmental organizations alert to Barrick's practices, and a successor with stronger environmental credentials could potentially reduce the company's social risk discount.

Industry-Wide Implications

Barrick's succession planning reflects broader trends reshaping the mining sector. An aging leadership cohort across major mining companies—including Newmont, Freeport, and Harmony—suggests an industry-wide knowledge transfer challenge that could accelerate cultural and technological transformation.

The Mali situation has heightened awareness of resource nationalism risks, potentially expanding equity discount rates for Africa-based gold miners by 100-150 basis points.

Resource nationalism describes a country's efforts to assert greater control over its natural resources, often to ensure more of the economic benefits accrue domestically. This can significantly impact industries like mining through policies such as increased taxation, local ownership requirements, or even nationalization.

Simultaneously, gold producers with credible copper development options will likely command scarcity premiums as electric vehicle supply chains seek to reduce raw material risks.

Most significantly, investor appetite is shifting toward capital discipline over growth at any cost. Companies that carefully sequence mega-projects rather than overlapping them will be rewarded with premium valuations—a reality that may ultimately slow Reko Diq's development timeline but potentially enhance its internal rate of return.

Investment Outlook

For traders and investors, Barrick presents a nuanced opportunity. The base case suggests the stock will trade sideways relative to gold for 6-12 months, creating potential buying opportunities on dips below 11 times forward EV/EBITDA. The target multiple could reach 15 times once CEO clarity emerges and Mali tensions ease, implying a share price of approximately $29.

Downside risks include a protracted leadership search combined with renewed asset seizures in Mali, which could reduce fiscal year 2025 production by 8% and compress valuation multiples to 9 times. However, upside potential exists if the new leadership team executes an early joint venture sell-down at Reko Diq or secures copper marketing memorandums of understanding, potentially unlocking $1.5 billion in net present value and justifying a 20% share price rerating.

Share price rerating signifies a fundamental change in how the market values a company's stock, often reflected in an expansion or contraction of its valuation multiples like the P/E ratio. This reassessment is typically driven by new information or factors that alter investor perception of the company's future earnings potential, growth prospects, or risk profile.

As Bristow himself reflects on the transition he initiated by merging Randgold with Barrick in 2018, he remains characteristically focused on the long game: "You have to build a business that's designed to survive."

Now, as the board intensifies its search for his successor, Barrick's resilience faces perhaps its most significant test yet—navigating leadership succession amid geopolitical tensions, strategic repositioning, and volatile commodity markets that have pushed gold to unprecedented heights.