Beyond Niche - The $200 Billion Opportunity Transforming Women's Health Investment

Beyond Niche: The $200 Billion Opportunity Transforming Women's Health Investment

In a San Francisco venture capital boardroom, a female founder pitches her menopause management platform to a panel of predominantly male investors. Five years ago, she might have faced blank stares or uncomfortable shifts in seats. Today, she walks out with a $60 million check. This scene, once rare, is becoming increasingly common as investors awaken to FemTech's massive market potential-estimated to grow to over $200 billion by 2033-representing one of the most significant yet historically overlooked opportunities in healthcare investment.

Projected growth of the global FemTech market, reaching over $200 billion by 2033.

| Base Year | Market Size (USD) | Projected Year | Projected Market Size (USD) | CAGR (%) | Source |

|---|---|---|---|---|---|

| 2023 | $50.97 Billion | 2032 | $177.05 Billion | 15.38% (2024-2032) | BioSpace |

| 2024 | $56.50 Billion | 2033 | $206.84 Billion | 15.51% (2025-2033) | Astute Analytica |

| 2023 | $6.9 Billion | 2033 | $26.1 Billion | 15.2% (2024-2033) | femtechmarket.com |

| 2024 | $60.2 Billion | 2034 | Not Specified, CAGR only | 16% (2025-2034) | Global Market Insights |

| 2025 | $60.89 Billion | 2034 | $130.80 Billion | 8.88% (2025-2034) | Precedence Research |

| 2024 | $41.07 Billion | 2029 | $100.04 Billion | 21.0% (forcast period until 2029) | The Business Research Company |

| 2023 | $59.4 Billion | 2033 | $127.1 Billion | 7.9% (2024-2033) | Market.us |

The Emergence of a Healthcare Revolution

FemTech-technology-driven solutions addressing women's health needs-was once relegated to the periphery of venture capital interest. Despite women comprising half the global population and spending twice as much on healthcare as men, FemTech investments have represented a mere 2% of the health tech sector.

Historically, women's health was often dismissed as a "niche" market rather than a mainstream concern. This perception contributed to systemic underinvestment, and understanding the reasons behind this historical marginalization is key to addressing current disparities.

This startling disparity stems from the longstanding, erroneous perception that women's health is a "niche" market, despite overwhelming evidence to the contrary.

The term "FemTech" itself is relatively new, coined in 2016 by Ida Tin, the founder of the German period-tracking app Clue.

Yet in the past five years, the market has undergone a remarkable transformation. In 2023, the global FemTech industry was valued at between $50-56 billion, and projections suggest explosive growth to $206.84 billion by 2033, representing a compound annual growth rate of 15.51%. This momentum signals a tectonic shift in investor perspectives, as capital flows increasingly toward addressing the vast unmet needs in women's healthcare.

Breaking the Investment Barrier

The investment landscape has evolved dramatically from hesitant, conservative funding rounds to major capital influxes that rival mainstream healthcare investments. Fertility platform Maven Clinic exemplifies this evolution, securing a $90 million Series E funding round in late 2022, bringing its total capital raised to $300 million and elevating its valuation to $1.35 billion.

In venture capital, a "unicorn" refers to a privately held startup company valued at over $1 billion. The term, coined by Aileen Lee in 2013, highlights the statistical rarity of such successful ventures. Similarly, Flo Health, a reproductive and menstrual health app, achieved unicorn status with a $200 million Series C funding round that pushed its valuation beyond $1 billion.

"We started Flo with the identification of a huge gap in women's health services," noted Dmitry Gurski, co-founder and CEO of Flo Health. "Now, we're a leader in a global movement to make women's health a priority everywhere."

This surge in investment reflects a growing recognition that women's health technologies can deliver substantial returns. Venture funding in fertility-focused technology alone reached $854.5 million in 2022, compared to just $134 million a decade earlier.

Growth in venture funding for fertility-focused technology over the last decade.

| Year | Global VC Investment in Fertility Tech | Key Developments & Insights |

|---|---|---|

| 2019 | $133 million (US startups) | Funding for fertility support startups in the U.S. more than doubled from 2019 to 2021. |

| 2020 | $254 million (US startups) | U.S. fertility support startups saw a 35% increase in VC funding from 2020. |

| 2021 | $823.1 million (Global) | A significant peak in investment, with $823.1 million invested across 90 deals globally. Early-stage femtech startups raised $284 million. |

| 2022 | Over $1 billion (Global Femtech) | Investment levels in the broader femtech category (which includes fertility tech) began to decelerate but remained higher than in 2020. Early-stage femtech startups raised $267 million. Fertility tech companies raised over $1.5B in equity funding since 2019, though funding slowed in the past couple of years it remains elevated. |

| 2023 | $1.14 billion (US Women's Health Startups) | North American femtech funding saw a decline from 2021 to 2023. However, early-stage femtech investment was projected to be 13% higher than in 2022. US women's health startups (a related category) raised $1.14 billion across 120 deals. The global fertility market was valued at $33.92 billion. |

| 2024 | $28 billion (Combined Enterprise Value of Femtech Companies) | Femtech companies are now worth $28 billion. European femtech startups raised a record €339.4 million. The global fertility market is calculated at $36.57 billion. |

| These figures demonstrate that investors are finally understanding the economic imperative of addressing women's health needs comprehensively. |

Beyond Reproduction: The Expanding FemTech Landscape

While reproductive health and pregnancy care initially dominated the FemTech landscape, investors are increasingly diversifying their portfolios to encompass the full spectrum of women's health needs. About 37% of the global FemTech market relates to pregnancy, nursing, and reproductive health, but the sector has rapidly expanded to include menstrual health, pelvic and uterine healthcare, sexual wellness, menopause management, and general healthcare solutions specifically designed for women's needs.

Global FemTech Market by Segment

| Segment | Focus Area | Key Insight |

|---|---|---|

| Reproductive Health | Fertility tracking, contraception, reproductive condition management | Held 43.9% of market in 2024; growth driven by increased use of tracking apps. |

| Pregnancy & Nursing | Support during pregnancy, childbirth, postpartum, and breastfeeding | Led market in 2022–2023 (49.5% share); boosted by wearable tech and R&D. |

| Menstrual Health | Menstrual tracking and symptom management | Used by 50M+ women; growing investor interest. |

| General Wellness | Mental health, fitness, chronic disease management | Growth tied to women’s role in healthcare decisions and demand for tailored digital tools. |

| Pelvic/Uterine Health | Pelvic floor and uterine condition support | Gaining attention with innovations in pelvic health tech. |

| Menopausal Health | Perimenopause and menopause solutions | Emerging focus for investors; apps used for symptom management. |

| Sexual Wellness | Sexual health education and digital tools | FemTech expanding with platforms and gadgets for sexual wellness. |

Menopause care, once virtually ignored by the healthcare industry despite affecting all women, has emerged as a particularly promising investment category. Midi Health secured $60 million in funding in early 2024, bringing its total funding to $100 million. The company's CEO, Joanna Strober, explains their approach: "We started Midi with just one specific focus: helping women access world-class, expert perimenopause and menopause care, covered by insurance. But what we have also learned is that addressing the health concerns of women in midlife is more complex than simply treating hot flashes."

Menopause significantly impacts women's health, often creating challenges in the workplace and contributing to broader economic effects. Despite these consequences, many aspects of menopause's influence, including how symptoms affect work, remain under-researched, highlighting a need for greater attention.

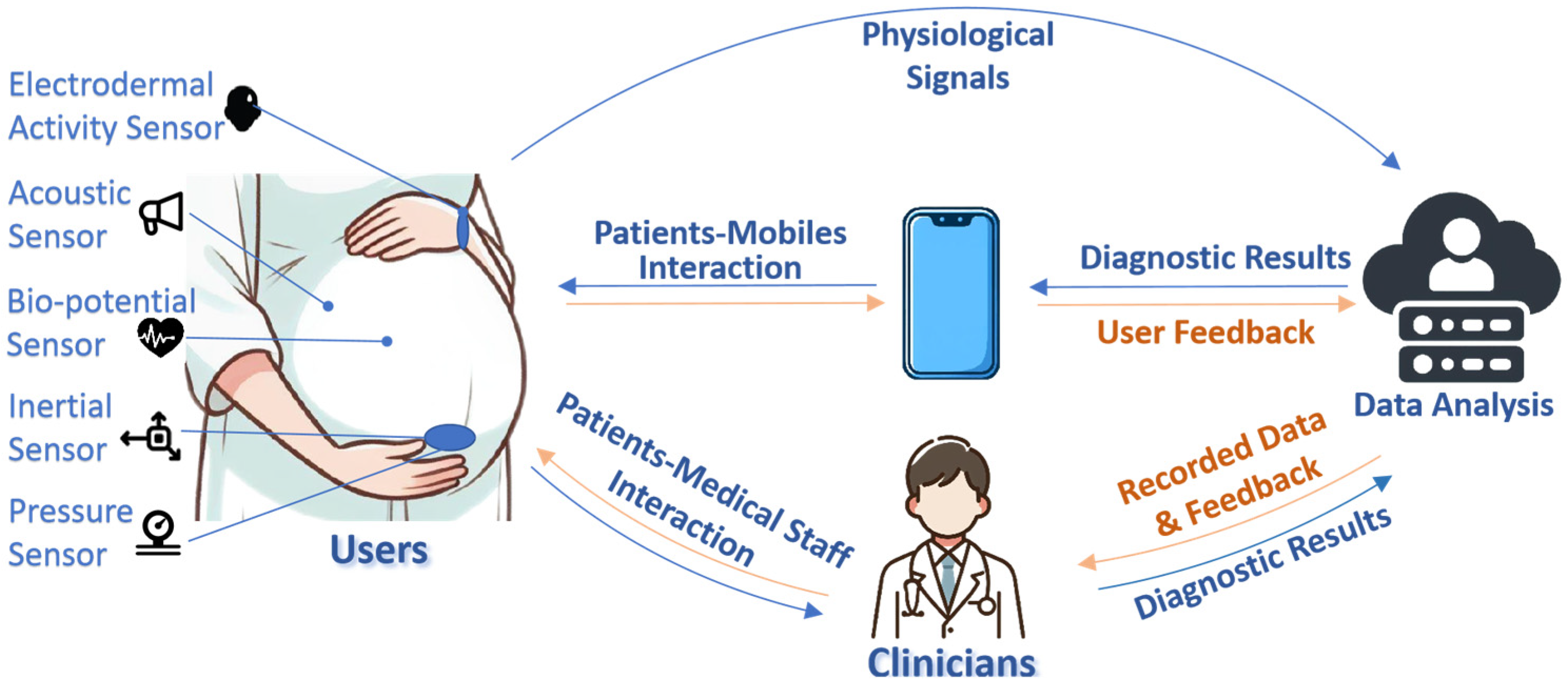

The Technology Driving FemTech Innovation

The technological innovations propelling FemTech forward are sophisticated and diverse. Artificial intelligence has become a cornerstone of the industry, with algorithms analyzing medical images to detect irregularities in ultrasound scans and Pap smears that might indicate cancer. AI-powered fertility-tracking applications analyze hormonal levels, basal body temperature, and menstrual cycles to predict ovulation with unprecedented accuracy.

AI algorithms are enhancing diagnostic accuracy within gynecology. This includes applications such as improving gynecological image analysis, aiding in cervical cancer detection, and increasing the accuracy of ovulation prediction.

Precision diagnostics and decentralized care models are reshaping FemTech delivery. Startups like Gynetech and Juniper Bio are deploying AI-powered tools to address diagnostic gaps in conditions such as adenomyosis and bacterial vaginosis, with Juniper's metagenomic swab kits reducing misdiagnosis rates by 51% in low-resource clinics.

Decentralized care refers to a healthcare model where services are delivered closer to the patient, moving away from reliance on large, central facilities. This approach aims to enhance accessibility and convenience, often utilizing local clinics, home-based care, and digital health technologies to improve patient outcomes.

However, challenges persist in ensuring these technologies benefit all women equally. Approximately 78% of AI training datasets for gynecological tools lack racial diversity, highlighting the critical need for inclusive data collection and algorithm development to avoid perpetuating healthcare disparities.

AI bias in healthcare is a significant concern, largely stemming from a lack of diversity in the data used to train these systems. This non-diverse training data, particularly regarding racial and other demographic factors, can lead to AI models performing inequitably and perpetuating existing health disparities.

Corporate America's Stake in Women's Health

The business case for FemTech has strengthened as corporations recognize the economic benefits of supporting women's health. JPMorgan reported a 23% reduction in maternity absenteeism after integrating Maven Clinic's fertility programs, demonstrating tangible return on investment for employer-funded solutions.

ROI of Women's Health Benefits

| Organization / Study | Focus Area | Key ROI Impact |

|---|---|---|

| JPMorgan Chase + Maven | Maternity & fertility programs | 23% less maternity-related absenteeism; 4:1 ROI. |

| IBI | Mental & reproductive health | Strongest link to reduced absenteeism; boosts retention. |

| UNFPA (ROI Tool) | SRH training & sanitary pads | Up to 62% drop in absenteeism; 9.5% productivity gain. |

| RAND Study (Fortune 100) | Lifestyle wellness programs | Slight reduction in absenteeism. |

| HBA + FemTechnology Global | General women’s health | 61% reported time off due to health issues. |

| Maven (EAP data) | Mental health via EAP | 52% fewer absences; higher loyalty & mental wellness. |

This corporate buy-in has created a virtuous cycle, where employer demand drives further innovation and investment in the space.

Kate Ryder, founder and CEO of Maven Clinic, notes the shift in awareness: "This is the first fundraise where I haven't felt the need to evangelize the problem we're solving. Gaps in access to global fertility and family building care are front and center for employers, payers, and even governments."

Geographic Distribution and Investment Patterns

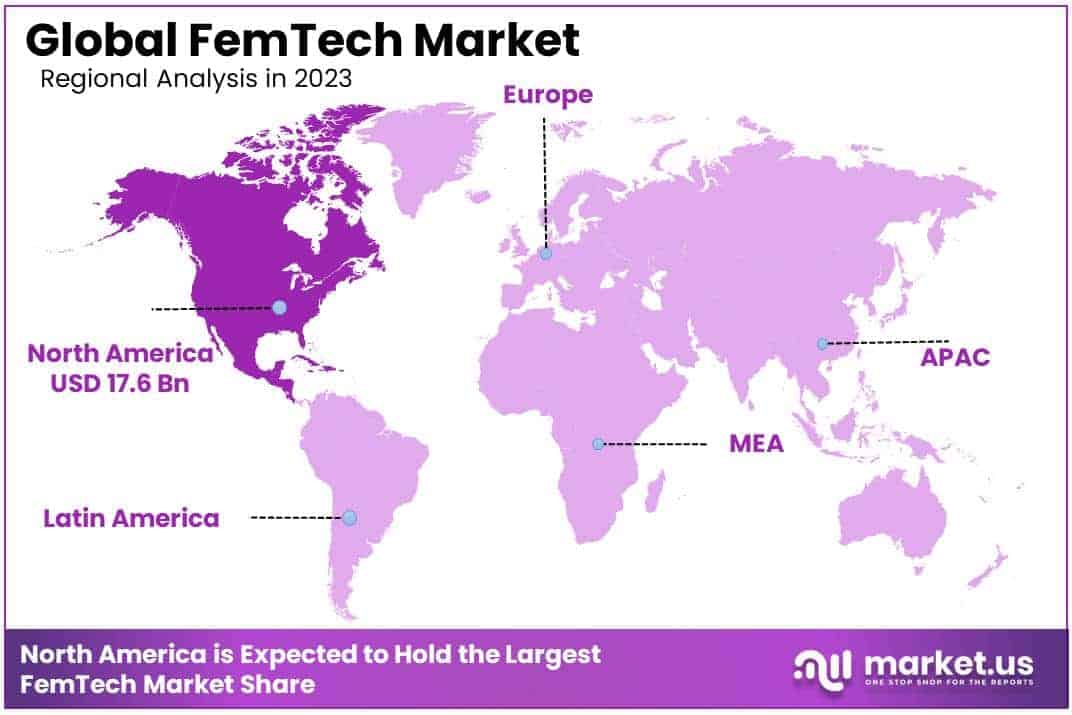

While North America has dominated the FemTech landscape, holding 38.64% of the global market share in 2023, Europe has emerged as another significant hub. The United Kingdom, Germany, and France lead European FemTech development, with Flo Health becoming Europe's first FemTech unicorn-though notably with an all-male founding team, sparking important discussions about gender representation in the sector. Global FemTech market share by region (North America, Europe, Asia, etc.) in 2023.

| Region | Market Share 2023 |

|---|---|

| North America | 52.91% |

| Europe | 25.2% |

| Asia-Pacific | - |

| LAMEA | - |

The investment ecosystem shows distinct regional patterns. European venture capital firms including Ascension VC, Calm/Storm Ventures, and Octopus Ventures have built substantial portfolios of FemTech companies. However, scaling challenges differ by region. When UK-based Elvie was acquired by US rival Willow in early 2025, one investor commented that the deal exemplified "the difficulties involved in scaling up a UK tech company," noting that "without serious and incentivised US backers you cannot win in their market."

UK tech companies encounter notable challenges when attempting to scale their operations into the US market. A significant factor contributing to these difficulties often involves navigating the distinct differences between the US and UK venture capital landscapes.

Shifts in Funding Priorities

The FemTech funding landscape has evolved significantly, particularly with the White House Initiative on Women's Health Research allocating $100 million in federal funding for women's health research in February 2024.

The White House has detailed its Initiative on Women's Health Research. This initiative includes a significant $100 million investment dedicated to advancing research in women's health. Major investment firms like Lux Capital and Google Ventures have increased their support for FemTech startups, signaling a mainstream acceptance of women's health as a viable investment category.

Deena Shakir, partner at Lux Capital, emphasizes the importance of innovation in this space: "Addressing infertility requires innovations that drive toward more inclusive-and ultimately more effective-family care."

As a proportion of total women's health venture capital investment, healthtech's dominance has declined from 54% in 2021 to 38% in 2024, while biopharma investments have surged to 35%. This shift indicates a maturing market with diversifying approaches to solving women's health challenges. Shift in women's health venture capital: Healthtech vs. Biopharma investment proportion (2021 vs. 2024).

| Year | Sector | Proportion of Total Women's Health VC Investment |

|---|---|---|

| 2021 | Healthtech | 54% |

| 2021 | Biopharma | 12% |

| 2024 | Healthtech | 38% |

| 2024 | Biopharma | 34%-35% |

The Impact of Trump’s Second Term on FemTech: Uncertainty, Restriction, and a Chilling Effect

A New Era of Uncertainty for FemTech

The return of Donald Trump to the White House has dramatically altered the landscape for FemTech, particularly for startups and investors focused on reproductive health, contraception, and digital health privacy. In his first 100 days, Trump’s administration has aggressively rolled back reproductive rights, pardoned anti-abortion activists, curtailed prosecutions protecting clinic access, and reinstated the Mexico City Policy, which restricts foreign aid to organizations involved in abortion services.

The Mexico City Policy, often referred to as the "Global Gag Rule," is a U.S. government policy that blocks federal funding for international non-governmental organizations that offer or promote abortion services. This policy has a significant impact on global health programs and has historically been instated or rescinded by different U.S. administrations. These moves, along with the rescinding of policies that facilitated reproductive care for service members, have sent shockwaves through the women’s health innovation sector.

Legal and Regulatory Risks for FemTech Startups

The Trump administration’s actions have created a climate of heightened legal risk and operational uncertainty for FemTech companies. Startups offering medication abortion, contraception, and even period-tracking apps are now confronting the possibility of increased scrutiny and potential restrictions. The administration’s fluctuating stance on issues like birth control and IVF-sometimes suggesting support, sometimes hinting at new restrictions-has left founders and investors on edge. For example, while Trump publicly stated he would veto a national abortion ban, he has also supported allowing states to impose their own bans, which could result in a fragmented and hostile regulatory environment for digital health platforms and clinics.

The existence of fragmented, or "patchwork," state-level regulations for digital health creates significant challenges. This variability makes it difficult for digital health services, particularly telehealth companies, to navigate and operate consistently across different US states, impacting their overall effectiveness.

Investment Headwinds and the “Stigma Premium”

Investor Risk Factors for Reproductive Health FemTech (2025)

| Risk Factor | Impact on FemTech | Key Insight (2025) |

|---|---|---|

| Restrictive Policies | Legal uncertainty, market access issues | Post-Roe interest faded; data misuse concerns rising. |

| Stigma & Censorship | Ad rejection, undervaluation of market | 84% of ads blocked on Meta; 64% products removed on Amazon. |

| Investor Bias | Funding gaps for female-led startups | Women-only teams get <3% of VC funding. |

| Data Privacy Risks | Trust and adoption issues | Data could be used in states with abortion bans. |

| Market Growth | Strong long-term potential | Market to grow from $28B (2024) to $60B (2027). |

The political climate has also affected FemTech’s access to capital. The stigma and politicization of abortion care have already posed significant fundraising challenges for startups in this space, and the new administration’s stance may further deter investors wary of regulatory risk. Even companies not directly involved in abortion care-such as those focused on fertility treatments, IVF, or general women’s health-are bracing for ripple effects, including increased compliance costs, legal ambiguity, and potential market contraction.

A stigma premium in investment refers to potentially higher returns investors may demand for investing in companies or sectors perceived negatively due to social, ethical, or environmental concerns. This premium compensates for the associated risks, such as reputational damage or a smaller investor pool, often found in controversial industries.

Broader Attacks on Gender Equity and Innovation

Beyond reproductive health, the Trump administration has targeted diversity, equity, and inclusion (DEI) initiatives, which has broader implications for the FemTech sector’s ability to address health disparities. The administration’s efforts to dismantle programs supporting women and marginalized groups, coupled with attacks on gender equity and trans health, threaten to undermine the very foundation of innovation and inclusivity that has powered FemTech’s recent growth.

The Bottom Line: A Chilling Effect on Innovation and Access

Trump’s second term has introduced a profound sense of uncertainty and risk for FemTech. The sector now faces:

- Increased regulatory and legal risks, particularly for companies operating in or serving restrictive states.

- Heightened privacy concerns for users of digital health platforms.

- Fundraising challenges and investor hesitancy due to political and legal unpredictability.

- Broader attacks on gender equity that threaten to stifle innovation and limit the impact of women’s health startups.

While the FemTech market remains vast and fundamentally underserved, the current political climate poses significant obstacles to realizing its full potential. The next chapter for FemTech will be defined not only by technological innovation but by the sector’s ability to navigate an increasingly hostile policy environment and defend the rights and privacy of the women it serves.

Persistent Challenges and Future Outlook

Despite remarkable progress, FemTech still faces significant challenges. Access to capital remains uneven, with women-led startups particularly disadvantaged. As noted in the context of Arion Long's company Femly, which provides innovative period care solutions, FemTech entrepreneurs often face funding hurdles despite addressing critical needs.

A significant funding gap persists for startups led by women and minorities, indicating a clear disparity in venture capital allocation. These entrepreneurs, including specific groups like Black women founders in sectors like FemTech, face distinct challenges in securing adequate funding.

Data equity represents another substantial challenge. The lack of diversity in research and development has led to technology that doesn't adequately serve all women, prompting initiatives like Kenya's Femtech Focus to prioritize inclusive data aggregation.

Data equity in medical research refers to the fair and inclusive representation of diverse populations within health datasets. This is crucial for preventing biased findings and "data deserts," particularly for underrepresented groups like women, ultimately leading to more equitable and effective healthcare for everyone.

Looking ahead, industry experts anticipate continued growth driven by several factors: increasing consumer demand for personalized health solutions, greater acceptance of telehealth following the pandemic, and a generational shift in openness about previously stigmatized health issues.

High-Growth FemTech Segments (2025)

| Segment | Growth Drivers | Key Data/Trends |

|---|---|---|

| Menopause | Awareness, destigmatization, personalized care tools | Stella: +106% growth; Peppy: +282% growth |

| Reproductive Health | Infertility rise, gov’t support, AI in fertility tech | Top VC-funded segment (2017–2024) |

| AI & Personalized Care | AI-driven insights, diagnostics, and tailored recommendations | Focus on PCOS, fertility, hormonal health |

| Apps & Wearables | Mobile health tracking, advanced wearables | Glow: 24M users; Clue: 11M users |

| General Wellness | Mental health, preventive care, digital health adoption | Top VC target in 2023–2024 |

Areas poised for particular growth include menopause care, personalized medicine based on female-specific data, and integrated mental and physical healthcare solutions.

The $200 Billion Imperative

The FemTech revolution represents more than just a financial opportunity-it's addressing decades of underinvestment in women's health with potentially transformative consequences for half the world's population. As Ida Tin, who coined the term "FemTech," observed, "Until recently, there has been a significant blind spot regarding female healthcare."

Historically, women's health research has suffered from significant underfunding, a problem often linked to systemic gender bias within the medical field. The funding history of major institutions, like the NIH, reflects these long-standing disparities in prioritizing women's health issues.

The stakes extend far beyond investor returns. Improved diagnostic tools, treatment options, and health management platforms for women translate to better health outcomes, reduced healthcare costs, and increased productivity. The ripple effects benefit families, communities, and economies worldwide.

For investors, the message is clear: FemTech is no longer a niche play but a mainstream opportunity with substantial growth potential. For entrepreneurs, particularly women, the expanding capital flows create unprecedented opportunities to develop solutions for long-neglected health needs. And for women everywhere, the FemTech revolution promises healthcare innovations specifically designed for their bodies and lives-a long-overdue correction to centuries of medical research and product development centered primarily on male physiology.

The "male default" in medical research signifies a historical gender bias where males were considered the standard, often leading to a narrow "bikini medicine" focus for women's health. This has resulted in significant negative consequences, particularly in clinical trials, impacting how diseases manifest and are treated in women.

The future appears to be female, or at least heavily influenced by FemTech. As the industry approaches the $200 billion milestone, it's clear that we're only at the beginning of a healthcare transformation that's simultaneously overdue and right on time.