Bristol Myers Squibb Commits $11.1 Billion to Partner with BioNTech on Dual-Target Cancer Drug

Bristol Myers Squibb and BioNTech Forge $11.1 Billion Cancer Drug Alliance

A strategic bet on next-generation bispecific antibody technology could reshape oncology treatment landscapes while transforming BioNTech beyond its mRNA roots

In the gleaming laboratories of BioNTech's Mainz headquarters, a molecule known only as BNT327 has been quietly rewriting the rules of cancer immunotherapy. Today, that potential was validated in spectacular fashion as Bristol Myers Squibb announced it would pay up to $11.1 billion to co-develop and commercialize what both companies believe could become a foundational treatment across multiple cancer types.

BioNTech's stock surged 10.95% in pre-market trading on news of the deal. Bristol Myers Squibb shares edged up slightly, gaining $0.43 to $48.28.

The Prize: A Two-Pronged Attack on Cancer's Defense Systems

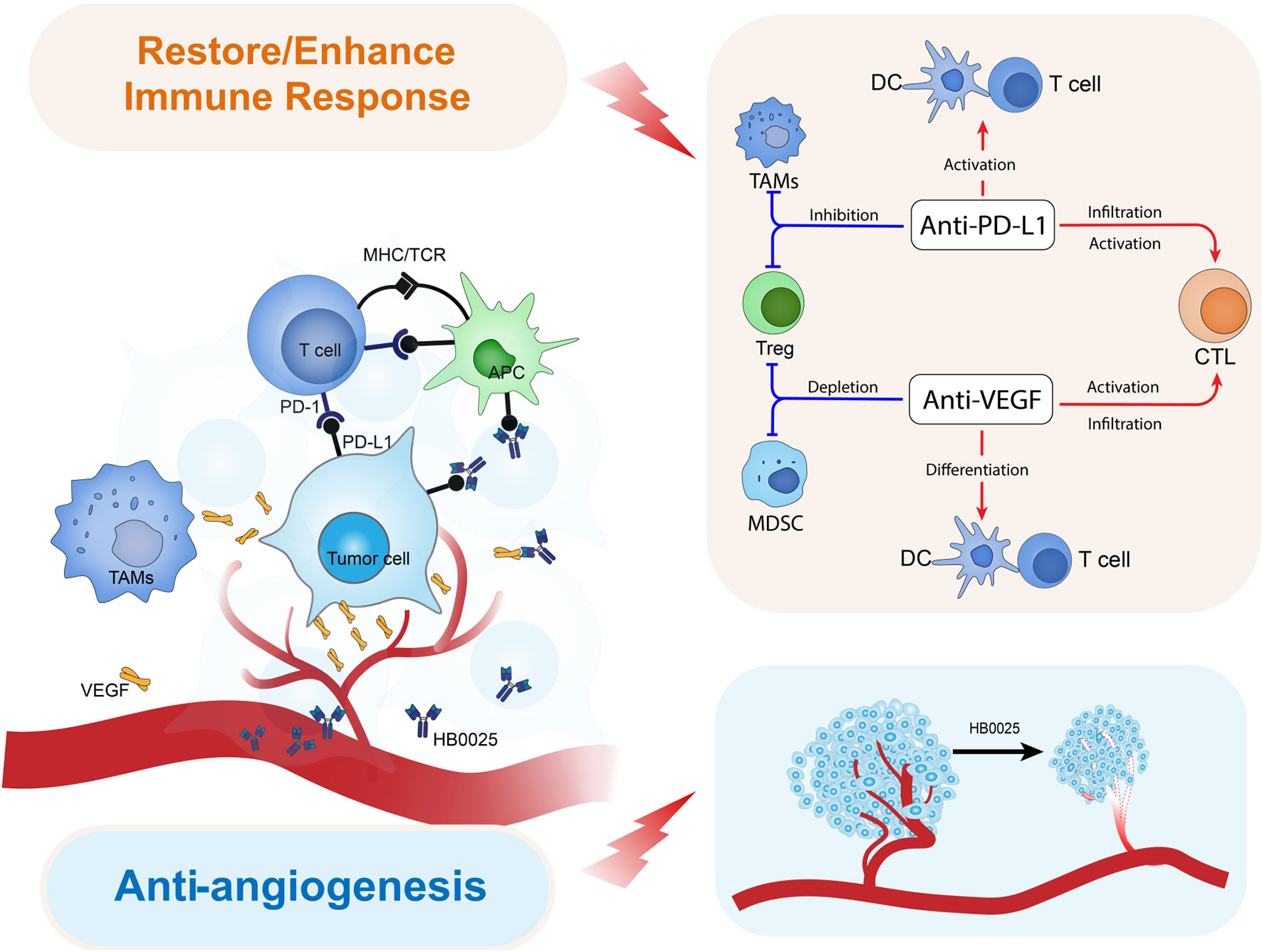

At the heart of the partnership lies BNT327, a bispecific antibody engineered to simultaneously target two critical cancer pathways: PD-L1, which helps tumors evade immune detection, and VEGF-A, which promotes the growth of blood vessels feeding malignancies.

Table summarizing the key aspects of bispecific antibodies (BsAbs) in cancer treatment

| Aspect | Description | Examples |

|---|---|---|

| Mechanism | BsAbs bind two different targets simultaneously—typically a tumor antigen and an immune cell receptor—to bring immune cells into contact with cancer cells. | CD19 (tumor) + CD3 (T-cell); EGFR + MET |

| Enhanced Precision | Dual targeting enhances specificity and reduces off-target effects, lowering damage to healthy tissues. | CD19/CD3 binding in B-cell leukemia |

| Immune Evasion Counteraction | BsAbs overcome tumor evasion by recruiting immune cells to the tumor and targeting multiple pathways. | Blinatumomab links T-cells to cancer cells to bypass immune evasion |

| Versatility in Cancer Types | Customizable for both hematologic and solid tumors by targeting specific antigens. | Blinatumomab (ALL); Amivantamab (NSCLC); Tebentafusp (uveal melanoma) |

| Combination Therapies | BsAbs are used with checkpoint inhibitors, chemotherapy, and targeted therapies to improve efficacy. | BsAbs + PD-1 inhibitors in melanoma and lymphoma |

| Clinical Efficacy | Show superior efficacy in relapsed/refractory cancers, with several approved and over 100 in clinical trials. | FDA-approved: Blinatumomab, Amivantamab, Tebentafusp |

| Recent Industry Activity | Major investments indicate strong market interest; deals such as Bristol Myers Squibb’s $11.1B partnership with BioNTech reflect the field’s momentum. | BMS–BioNTech BsAb development deal (2025) |

| Challenges | Includes potential toxicity (e.g., cytokine release syndrome), high manufacturing complexity, and resistance development. | CRS management; research into BiTEs and novel delivery methods |

| Future Directions | Innovations include BiTEs, dual checkpoint inhibitors, and subcutaneous delivery for better safety, efficacy, and accessibility. | Next-gen BsAbs in development to improve durability and ease of use |

"What makes this approach so compelling is that it combines two established cancer-fighting mechanisms in a single molecule," explains an oncology researcher familiar with the technology but not affiliated with either company. "It's like deploying two proven weapons simultaneously without the logistical challenges of administering separate drugs."

The scientific approach builds upon the success of blockbuster treatments like Tecentriq (targeting PD-L1) and Avastin (targeting VEGF), but with potentially improved efficacy and convenience. Initial clinical data appears to support this thesis – in extensive stage small cell lung cancer trials, BNT327 combined with chemotherapy has shown an 85% objective response rate and median progression-free survival of 10.6 months, significantly outperforming historical benchmarks for existing treatments.

"The early signals are genuinely impressive," notes a senior pharmaceutical analyst who requested anonymity due to investment banking relationships. "We're seeing nearly double the progression-free survival compared to standard Opdivo-chemotherapy combinations in similar patient populations."

A Marriage of Scientific Innovation and Commercial Muscle

For BioNTech, the deal represents a strategic pivot beyond the mRNA technology that propelled the company to global prominence. Having acquired BNT327 through its purchase of Biotheus for approximately $800 million to $1 billion, the company has now engineered a remarkable return on investment while still maintaining half the drug's future economics.

BioNTech’s strategic expansion beyond mRNA technology across therapeutic diversification, AI integration, manufacturing innovation, and global partnerships.

| Strategic Area | Key Initiatives & Highlights | Examples/Details |

|---|---|---|

| Therapeutic Portfolio Diversification | Expanded from mRNA to four drug classes, with emphasis on oncology modalities. | mRNA cancer immunotherapies, next-gen immunomodulators, targeted therapies |

| Next-Gen Immunomodulators | Focus on bispecific antibody development, particularly BNT327, for broad cancer treatment potential. | BNT327 positioned as immuno-oncology backbone |

| Targeted Therapies | Integrated into combination treatment strategies to support curative approaches. | Combines synergistic modalities beyond mRNA |

| Artificial Intelligence Integration | Core innovation driver via subsidiary InstaDeep; supports protein design and drug discovery. | Bayesian Flow Network, DeepChain™, RiboMab™ |

| Computational Infrastructure | Investing in near exascale computing to handle complex biological data and AI scale-up. | Enables broad AI application in drug development |

| Manufacturing Innovation | Introduction of BioNTainers—mobile mRNA manufacturing units—to decentralize production. | Deployed to improve vaccine access globally, particularly in Africa |

| African Manufacturing Expansion | Partnered with CEPI to build mRNA R&D and manufacturing hub in Kigali. | $145M deal with CEPI; aims to scale vaccine production in low-resource settings |

| Expanded Therapeutic Focus | Targeting diseases beyond oncology and COVID-19, including neglected and chronic conditions. | Allergies, inflammatory diseases, regenerative medicine, TB, malaria, HIV, Mpox |

| Strategic Partnerships | Collaborates with global pharma leaders for R&D, manufacturing, and market access across modalities. | Pfizer, Genmab, Sanofi, Genentech (Roche), Regeneron, Genevant, Fosun Pharma |

"This is financial alchemy at its finest," observes a veteran biotech investor. "BioNTech effectively turns an asset they acquired for under $1 billion into an $11 billion valuation while still keeping substantial upside exposure."

The transaction's structure reveals careful balancing of risk and reward. Bristol Myers Squibb will pay $1.5 billion upfront, followed by $2 billion in guaranteed anniversary payments through 2028, and up to $7.6 billion in milestone payments tied to development, regulatory approval, and commercial success. Both companies will split costs and profits equally.

For Bristol Myers Squibb, the partnership addresses a looming revenue gap. The company faces patent expirations on two blockbuster drugs – Opdivo and Eliquis – in 2028, creating urgency to replenish its pipeline with high-potential candidates.

Did you know that Bristol Myers Squibb faces one of the pharmaceutical industry's most dramatic "patent cliffs," with its two blockbuster drugs Eliquis and Opdivo—which together generated nearly $26 billion in revenue—set to lose patent protection between 2026 and 2028? Eliquis alone accounts for 24% of the company's total revenue at $12 billion annually, with EU generic competition beginning in late 2026 and U.S. exclusivity ending in April 2028, while the $9 billion cancer drug Opdivo will face biosimilar competition starting in 2028. This impending revenue loss is so significant that BMS has implemented an aggressive $2 billion cost-cutting program and is banking on its "growth portfolio" of newer medicines to exceed 50% of total sales by 2025, projecting over $25 billion from new products by 2030 to offset what could be billions in lost annual revenue by 2029.

"This is classic big pharma strategy – using today's cash flows to secure tomorrow's growth," explains a pharmaceutical industry consultant. "What's notable is the scale of the bet and the fact that they're willing to share economics rather than acquiring the asset outright."

The Scientific Battleground: Racing to Redefine Standard of Care

BNT327 enters a competitive landscape where several companies are pursuing similar approaches. Most notably, a partnership between Summit Therapeutics and Akeso is developing ivonescimab, another bispecific antibody targeting the same pathways.

That program recently generated both excitement and confusion among investors. While ivonescimab outperformed Merck's industry-leading Keytruda in one non-small cell lung cancer study, subsequent mixed results triggered a 30% plunge in Summit's stock value just days ago.

"The bispecific antibody field is rapidly evolving, with stunning successes and perplexing setbacks sometimes occurring in the same development program," notes a clinical oncologist who serves on advisory boards for several pharmaceutical companies. "What distinguishes BNT327 is the breadth and scale of its clinical program – with over 1,000 patients treated and multiple Phase 3 trials already running."

BioNTech and Bristol Myers Squibb appear positioned to capitalize on any stumbles by competitors. Two global Phase 3 studies for BNT327 in extensive stage small cell lung cancer and non-small cell lung cancer are fully enrolled, with a third pivotal trial in triple negative breast cancer scheduled to begin by year-end.

"The development timeline suggests potential regulatory submissions as early as late 2025 if the data is compelling," suggests a regulatory affairs specialist. "Given the unmet need in these indications, there could be pathways for accelerated approval."

From Molecule to Market: Threading the Needle

Despite the considerable optimism surrounding the partnership, significant challenges remain. Regulatory hurdles have intensified in recent years, with the FDA increasingly demanding overall survival data rather than surrogate endpoints like progression-free survival.

Comparison of Key Clinical Trial Endpoints: Overall Survival (OS) vs. Progression-Free Survival (PFS)

| Endpoint | Definition | Clinical Significance | Advantages | Limitations |

|---|---|---|---|---|

| Overall Survival (OS) | Time from randomization or treatment start until death from any cause. | Gold standard for evaluating treatment efficacy. | - Clear, objective outcome - Direct measure of treatment benefit | - Requires longer follow-up - Influenced by subsequent therapies |

| Progression-Free Survival (PFS) | Time from randomization until disease progression or death, whichever comes first. | Indicates how long a treatment can delay tumor growth. | - Requires shorter follow-up - Useful in early-phase trials - Less affected by post-trial treatments | - Subjective (depends on imaging and criteria) - May not correlate with OS or quality of life |

| Use Cases | Most definitive endpoint in late-phase (Phase III) trials and regulatory approval. | Often used in early-phase or accelerated approval settings, especially in oncology. |

Manufacturing complexity represents another potential obstacle. Bispecific antibodies typically cost 30-50% more to produce than conventional monoclonal antibodies, potentially squeezing profit margins in an increasingly cost-conscious healthcare environment.

"Scale will be critical," observes a pharmaceutical manufacturing consultant. "The economics only work if they can achieve efficient production at commercial volumes, which requires significant technical expertise."

Intellectual property considerations add another layer of complexity. While not considered a high-probability risk, patent litigation from companies like Genentech, which holds extensive intellectual property related to VEGF inhibition through its Avastin franchise, could theoretically emerge.

Beyond the Balance Sheet: The Strategic Calculus

The partnership's significance extends beyond financial projections. For BioNTech, it represents diversification away from the inherent cyclicality of mRNA vaccines while showcasing the company's evolution into a more comprehensive oncology player.

"This transforms BioNTech's narrative from 'the COVID vaccine company' to a legitimate multi-platform oncology innovator," notes a healthcare investment banker. "That shift in perception could drive significant multiple expansion over time."

The company's substantial cash reserves – approximately $17.5 billion – enable it to fund its share of development costs without diluting shareholders, a luxury many biotechnology companies lack when pursuing late-stage clinical programs.

For Bristol Myers Squibb, the deal represents a calculated response to the pharmaceutical industry's perpetual innovation imperative. With an upfront payment representing less than 3% of its annual sales, the company secures optionality on a potential multi-billion-dollar franchise.

The Investor's Playbook: Positioning for Upside

For investors attempting to capitalize on the partnership, analysts suggest a nuanced approach. BioNTech currently trades at approximately 2.3 times estimated 2026 sales – a notable discount to many oncology-focused peers – while Bristol Myers Squibb trades at about 3.6 times forward sales, in line with large pharmaceutical averages.

"The asymmetric opportunity clearly lies with BioNTech," suggests a portfolio manager specializing in healthcare investments. "If BNT327 replicates its early clinical success in Phase 3 studies, the potential upside could exceed 75%, whereas Bristol Myers Squibb offers more modest but stable returns undergirded by its diversified portfolio."

Critical milestones to monitor include early safety data from combination studies expected in Q4 2025, potential Biologics License Application submission by year-end if interim overall survival data is compelling, and comprehensive Phase 3 readouts anticipated in mid-2026.

The Long View: Reshaping Cancer Treatment Paradigms

Beyond immediate market reactions and financial projections, the BioNTech-Bristol Myers Squibb partnership symbolizes the pharmaceutical industry's continued evolution toward more complex therapeutic modalities and collaborative development models.

"What we're witnessing is the industrialization of precision medicine," reflects a veteran oncologist. "These bispecific platforms represent the next logical step in immunotherapy's evolution – maintaining the transformative potential while addressing limitations of first-generation approaches."

Did you know? Precision medicine is revolutionizing modern oncology by tailoring treatments to each patient’s unique genetic and molecular profile. This approach enables doctors to identify the most effective therapies with fewer side effects by using tools like genomic sequencing, biomarker testing, and liquid biopsies. It has led to breakthroughs such as targeted drugs for EGFR-mutated lung cancer, HER2-positive breast cancer, and personalized cancer vaccines. While challenges like cost and access remain, ongoing advances in AI and multi-omics are rapidly expanding the potential of precision oncology to improve outcomes across a wide range of cancers.

For patients facing devastating cancer diagnoses, the promise of more effective treatments without increased treatment burden offers genuine hope. Whether BNT327 fulfills that promise now rests on forthcoming clinical data and the execution capabilities of two companies with complementary strengths.

As one investment analyst concluded: "This deal isn't just about filling revenue gaps or diversifying pipelines – it's ultimately a $11.1 billion bet that simultaneously targeting cancer's immune evasion and blood supply mechanisms will unlock superior outcomes for patients. If they're right, the returns – both financial and human – could be extraordinary."

Disclaimer: This analysis represents the author's informed perspective based on current market data and historical patterns. All investments carry risk, and past performance does not guarantee future results. Readers should consult financial advisors for personalized investment guidance.