China Plans September Military Parade to Debut New Hypersonic Weapons and Stealth Fighters

The Dragon's New Arsenal: How China's September Military Display Reshapes Global Power Dynamics

Beijing — China will stage its most ambitious military parade in decades on September 3rd, 2025, featuring 45 distinct formations designed to showcase what officials describe as "real-combat joint operations" rather than traditional service-branch displays.

The 70-minute event, commemorating the 80th anniversary of World War II's conclusion, represents a fundamental departure from previous military demonstrations. Chinese state media confirms the parade will debut multiple weapons systems making their first public appearance, including land, sea, and air-based strategic weapons, hypersonic strike systems, and next-generation unmanned combat platforms.

Recent weeks have witnessed unprecedented security measures surrounding parade preparations. Forums across Beijing and Hebei provinces report signal jamming in rehearsal zones, drone interceptions, and rapid removal of video uploads from Chinese social media platforms—indicators that suggest genuinely sensitive military capabilities will be revealed.

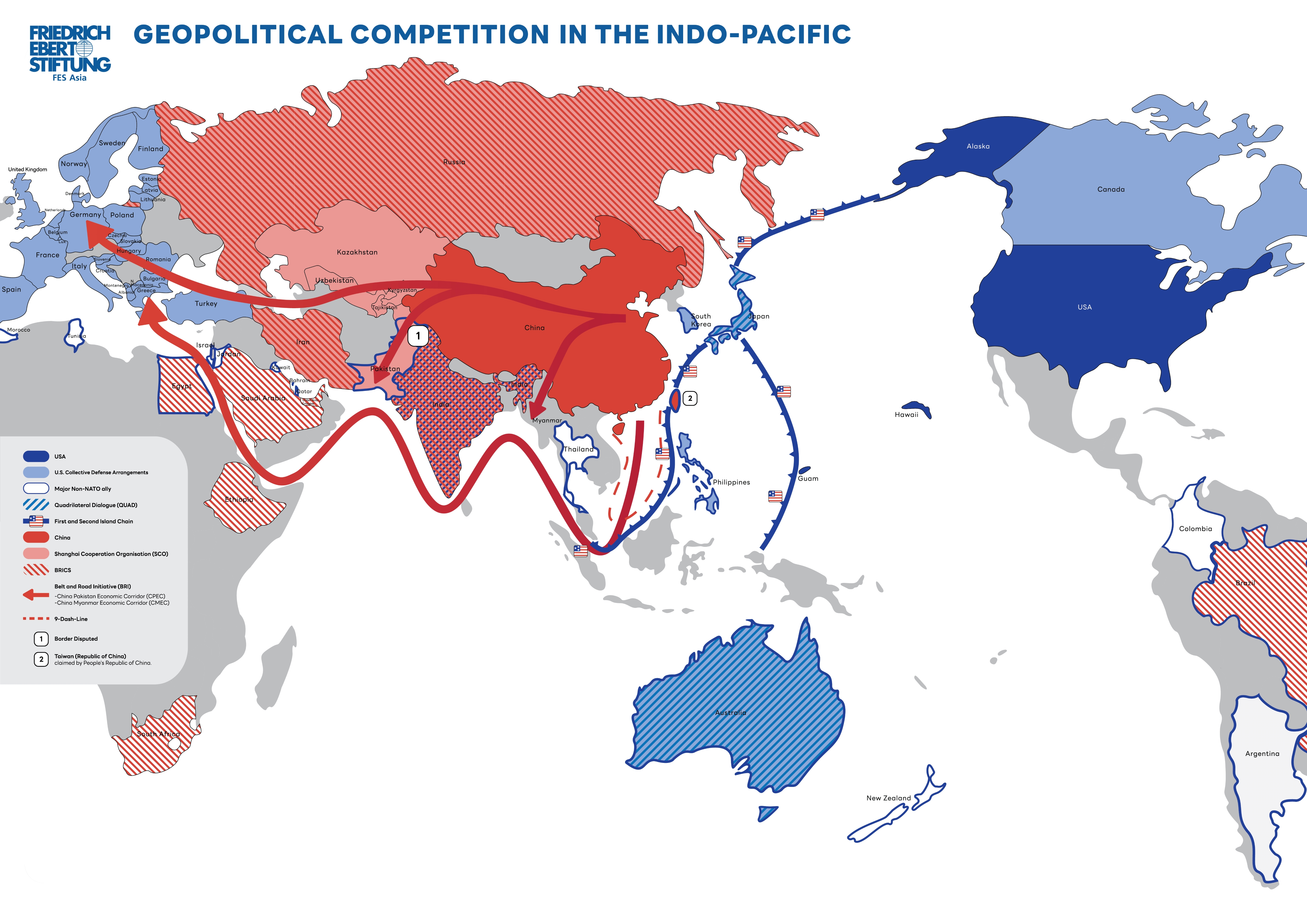

The parade's structure reflects China's evolving military doctrine. Equipment will be organized into operational groupings including land operations, maritime operations, air and missile defense, information warfare, unmanned operations, logistics, and strategic strike—demonstrating integrated warfare capabilities rather than individual platform showcases. This systematic approach signals Beijing's confidence in operational readiness across multiple domains simultaneously, a development that carries profound implications for regional strategic balance and global defense markets worth over $2.1 trillion annually.

When Deterrence Becomes Theater

Unlike previous parades that organized equipment by military service, this year's 45 formations will demonstrate "real-combat joint operations," according to official statements. The subtle but significant shift reflects Beijing's evolving doctrine—showcasing not individual weapons platforms, but integrated kill-chain capabilities designed to operate as unified systems.

A military kill chain is a structured process used to identify and destroy a target. Often described as the "sensor-to-shooter" loop, it outlines the sequence of steps required, such as the F2T2EA model: Find, Fix, Track, Target, Engage, and Assess.

"What we're witnessing represents a fundamental departure from traditional military demonstrations," observed a senior defense analyst who requested anonymity due to the sensitivity of ongoing assessments. "This isn't about showing off new toys. It's about advertising systematic overmatch."

The parade preparations, shrouded in unprecedented secrecy, have featured comprehensive electronic countermeasures and rapid content removal from Chinese social media platforms. Such measures typically accompany the debut of genuinely sensitive capabilities—suggesting Beijing plans to reveal systems that have remained classified until now.

Multiple intelligence sources indicate the display will feature first public appearances of hypersonic anti-ship missiles, advanced ballistic missile interceptors, and what appears to be China's carrier-based stealth fighter, the J-35. More significantly, the weapons will be presented within formations emphasizing artificial intelligence integration, unmanned systems coordination, and cross-domain warfare capabilities.

The Hypersonic Revolution Arrives

Perhaps no development carries greater strategic weight than China's apparent readiness to showcase operational hypersonic weapons systems. Rehearsal imagery analyzed by defense specialists suggests the debut of the YJ-17, YJ-19, and YJ-20 anti-ship missiles—each representing different approaches to defeating current American naval defenses.

The implications for global maritime operations are profound. These systems, if operational as advertised, compress engagement timelines from minutes to seconds while following unpredictable flight paths that challenge existing interceptor technologies. For naval forces operating within 1,000 nautical miles of Chinese territory—encompassing virtually all critical Pacific shipping lanes—the strategic environment has fundamentally changed.

"The physics are unforgiving," noted a former Pentagon official now working in defense consulting. "When you're dealing with hypersonic speeds and maneuvering warheads, traditional point-defense systems face mathematical impossibilities."

Hypersonic weapons are a game-changer because they combine immense speed—traveling at over five times the speed of sound—with the ability to maneuver in flight. This combination, achieved through technologies like boost-glide vehicles or scramjets, allows them to fly on unpredictable trajectories, making them extremely difficult for current missile defense systems to track and intercept.

The weapons represent more than technological achievement; they embody China's broader strategy of creating "systems disruption" rather than simply matching American capabilities. By forcing opponents to defend against multiple simultaneous threats across domains—from cyber and electronic warfare to hypersonic missiles and drone swarms—Beijing aims to overwhelm decision-making processes rather than simply outgun opposing forces.

The Invisible Revolution: AI and Autonomous Systems

While hypersonic missiles capture headlines, the parade's emphasis on unmanned and AI-integrated systems may prove equally transformative. Sources familiar with the preparations describe formations featuring loyal wingman drones, swarming unmanned aerial vehicles, and what appears to be comprehensive counter-drone systems—all linked through AI-driven battle networks.

This technological integration reflects China's recognition that future conflicts will be determined not by individual platform performance, but by the speed and accuracy of sensor-to-shooter networks. The ability to identify, prioritize, and engage targets across multiple domains simultaneously represents a form of "algorithmic warfare" that could render traditional military hierarchies obsolete.

"We're looking at a military force designed around machine-speed decision making," explained a technology analyst tracking Chinese defense developments. "Human commanders become orchestrators rather than operators."

The implications extend beyond battlefield effectiveness. China's integration of artificial intelligence into military systems creates new dependencies—and vulnerabilities—while accelerating the timeline for engagement decisions in ways that could destabilize crisis management.

Nuclear Shadows and Strategic Messaging

The parade's timing and content carry unmistakable strategic messaging. By showcasing advanced intercontinental ballistic missiles alongside submarine-launched ballistic missile systems, Beijing seeks to demonstrate credible second-strike capabilities that could complicate American intervention scenarios.

Intelligence assessments suggest possible displays of the JL-3 submarine-launched ballistic missile and advanced silo-loading systems—capabilities that would extend China's nuclear reach while improving survivability. The message is carefully calibrated: China possesses both the will and capability to escalate beyond conventional conflict if pressed.

Yet the nuclear element serves primarily as backdrop for conventional capabilities designed to achieve political objectives without requiring escalation. By creating credible conventional overmatch within the First Island Chain, China aims to make American intervention appear prohibitively costly—achieving strategic goals through deterrence rather than combat.

Market Implications and Investment Realities

The parade's revelations carry immediate implications for defense markets and broader economic sectors. Companies specializing in missile defense, electronic warfare, and counter-drone technologies face surging demand as military planners confront new threat environments. Global military expenditure by country, showing the rapid growth of China's defense budget compared to other major powers.

| Country | 2023 Military Expenditure (Billions USD) | 2024 Military Expenditure (Billions USD) |

|---|---|---|

| United States | $916 | $997 |

| China | $296 | $314 |

| Germany | Not specified | $88.5 |

| India | Not specified | $86.1 |

Specifically, investors may wish to monitor developments in hypersonic detection and tracking systems, where space-based sensors represent critical capabilities. The integration of artificial intelligence into military systems also creates opportunities for companies providing secure computing platforms and specialized semiconductors designed for defense applications.

However, the broader implications extend well beyond defense contractors. China's apparent technological leaps in critical military domains could accelerate supply chain diversification efforts, particularly in semiconductors and advanced materials. Insurance markets may need to reassess maritime risk premiums for Pacific shipping routes, while cybersecurity investments could see increased priority as military AI systems create new attack surfaces.

"The traditional assumption that American technological superiority provides a permanent strategic advantage is becoming questionable," observed an investment analyst specializing in aerospace and defense sectors. "Markets are beginning to price in a more competitive strategic environment."

The New Strategic Equilibrium

As Beijing prepares to showcase its military modernization achievements, the international community confronts a transformed strategic landscape. China's apparent success in developing operational hypersonic weapons, AI-integrated military systems, and advanced nuclear capabilities represents more than military advancement—it signals the emergence of genuine strategic competition between major powers.

The parade serves multiple audiences simultaneously: reassuring domestic populations of China's defensive capabilities, signaling resolve to potential adversaries, and demonstrating to regional neighbors that alignment calculations may need updating. Most importantly, it marks China's transition from regional power to global military competitor capable of challenging American dominance in critical domains.

For investors and policymakers alike, the September display represents a watershed moment. The era of unchallenged American military supremacy, which has underwritten global economic stability since the Cold War's end, may be giving way to a more complex and potentially volatile strategic environment.

As one senior analyst concluded, "We're witnessing the emergence of genuine strategic parity in critical military domains. The implications for global stability, alliance structures, and economic relationships will unfold over decades, but the transformation begins now."

The dragon's new arsenal represents more than military modernization—it embodies China's broader challenge to the existing international order, one sophisticated weapons system at a time.

House Investment Thesis

| Topic / System | Parade Details & Likelihood | PLA Strategic Signal & Intent | U.S. Operational Impact | U.S. Recommended Actions (Military / Policy / Investor) |

|---|---|---|---|---|

| Overall Parade (Sept 3, 2025) | Confirmed: ~70 min, 45 formations reviewed by Xi, Putin attending. Combat-oriented groups (joint ops, unmanned, info/EW, etc.). | High Confidence: Showcase "system-of-systems" kill-chain integration, not just platforms. Signal A2/AD overmatch inside 1st Island Chain. | Acknowledges PLA doctrinal shift to integrated, networked warfare. | [Intel] Record order of march to map PLA's kill-web narrative. [Policy] Don't mirror parades; fund the kill-web (SDA, JADC2, munitions). |

| Hypersonic Anti-Ship Missiles | Probable: New YJ-series (YJ-17/19/20) with diverse features (glide, cruise, ballistic). | Complicate carrier & high-value unit defense with higher-speed, multi-axis attacks. | High Confidence: Shrinks engagement timelines; stresses U.S. missile defense mix (GPI, SM-6, PAC-3). | [Military] Accelerate GPI/SM-6 fielding; prioritize deception/decoys. [Investor] Beneficiaries: Hypersonic detection, missile defense producers. |

| Air & Missile Defense | Plausible: New exo-atmospheric interceptors (HQ-26/29 class) and smaller HQ-20 class. | Thicken mid-course & terminal defense layers for key coastal/inland assets. | Medium Confidence: A2/AD "bubble" becomes more resilient, able to withstand initial strikes. | [Military] Prioritize EW/cyber to disrupt PLA's kill-web over purely kinetic solutions. [Policy] Co-produce interceptors with Japan. |

| J-35 Stealth Carrier Fighter | Plausible: Public debut of the stealth fighter, indicating delivery to the PLAN. | CATOBAR carrier (Fujian) ecosystem is maturing, enabling longer-range stealth carrier aviation. | Medium Confidence: Narrows U.S. asymmetric ISR advantage around Chinese carrier groups. | [Military] Double down on MQ-25, NGAD family-of-systems, and counter-ISR. [Intel] Photograph J-35 serial numbers. |

| Unmanned Systems & Swarms | Highly Likely: Loyal wingmen, UUVs, UGVs, swarms, and counter-UAS systems. | The PLA plans to use networked, attritable mass ("trade steel for volume"). | Drone saturation tactics will be a standard, widespread threat. | [Military] Equip every ship/site with counter-UAS. [Policy] Co-produce C-UAS with allies. [Investor] Beneficiaries: Counter-UAS and undersea autonomy firms. |

| Strategic & Nuclear Forces | Possible: DF-41 ICBM, new silo-loader vehicle, hints of JL-3 SLBM maturity, H-6N with air-launched ballistic missile (ALBM). | Medium Confidence: Advertise triad depth and a credible second-strike sanctuary, not a war-fighting doctrine. | Intentional nuclear signaling to deter escalation and protect conventional forces. | [Military] Keep SDA hypersonic tracking & NC3 hardening on schedule. [Policy] Pair firmness with risk-reduction talks. |

NOT INVESTMENT THESIS