Cohere Gets $500 Million Boost, Canadian AI Company Now Worth $6.8 Billion

Canada's Cohere Stakes $6.8 Billion Claim on Enterprise AI's Sovereign Frontier

TORONTO — Cohere secured $500 million in funding this week, pushing the Canadian AI company's valuation to $6.8 billion in a round that underscores growing institutional appetite for enterprise-focused artificial intelligence alternatives.

The funding, led by Canadian pension fund PSP Investments alongside technology partners Cisco, Fujitsu, and AMD, marks Cohere's second $500 million raise in just over a year. The company's previous round in July 2024 valued it at $5.5 billion, representing a 24% valuation increase during a period when many technology startups have faced declining investor interest.

The timing reflects a broader shift in enterprise AI purchasing patterns, as organizations increasingly prioritize data sovereignty and regulatory compliance over raw computational power. Banking executives and healthcare administrators have begun questioning whether routing sensitive operational data through systems controlled by American technology giants aligns with institutional risk frameworks.

The Architecture of Digital Sovereignty

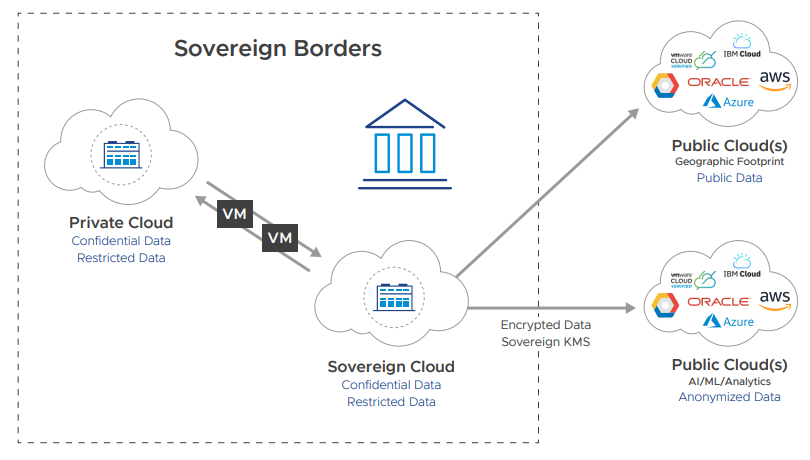

Unlike the headline-grabbing consumer AI race dominated by OpenAI's ChatGPT and Google's Gemini, Cohere has methodically constructed what market analysts describe as a "sovereign AI stack"—technology designed to operate within the controlled environments that regulated industries demand.

The company's annual recurring revenue has doubled to approximately $100 million, with an ambitious target of $200 million by year's end. More telling than raw growth figures is the composition: roughly 85% of Cohere's revenue now derives from private deployments, generating margins near 80%—a stark contrast to the commoditized API resale model that defines much of the consumer AI landscape.

Cohere's annual recurring revenue has doubled, with a significant portion coming from high-margin private deployments.

| Date / Period | Annual Recurring Revenue (ARR) | Revenue from Private Deployments |

|---|---|---|

| End of 2024 | $62 million | |

| February 2025 | $70 million | |

| May 2025 | $100 million | Approximately 85% |

| End of 2025 (Projection) | $200 million |

"Enterprise buyers increasingly recognize that the true value proposition extends far beyond model performance," observed one investment strategist familiar with the funding round. "Data locality, compliance frameworks, and deployment flexibility have become table stakes in regulated environments."

Sovereign AI refers to a nation's capability to independently develop, control, and deploy its own artificial intelligence technologies and data infrastructure. This strategic goal is driven by the pursuit of data sovereignty and has major geopolitical implications, as it aims to reduce technological dependence on other global powers and bolster national security.

This shift reflects broader institutional anxiety about technological dependence. Banking executives privately express concerns about routing sensitive financial data through systems controlled by American tech giants, while healthcare organizations navigate increasingly complex data residency requirements.

The Pineau Factor and Research Credibility

Cohere's strategic coup extends beyond capital to talent acquisition. The company has recruited Joelle Pineau, previously Meta's Vice President of AI Research and head of the influential FAIR laboratory, as Chief AI Officer. Pineau, who maintains concurrent roles at McGill University and Montreal's Mila Institute, brings both technical credibility and symbolic weight to Cohere's sovereignty narrative.

The hire represents a calculated response to persistent questions about whether independent AI companies can maintain research velocity against the resource advantages of Big Tech. Pineau's track record developing foundational AI research suggests Cohere's ambitions extend beyond enterprise service delivery to genuine technological leadership.

Industry observers note the appointment's timing coincides with Cohere's launch of "North," an agentic AI platform designed to operate within enterprise security frameworks. Early lighthouse deployments, including a collaboration with Royal Bank of Canada dubbed "North for Banking," suggest the platform addresses real workflow automation needs rather than experimental pilot programs.

The Competitive Crucible

The enterprise AI landscape Cohere navigates grows increasingly treacherous. OpenAI commands a run-rate approaching $13 billion, while Anthropic targets a $170 billion valuation—scale advantages that dwarf Cohere's metrics. Yet market dynamics suggest scale alone may not determine enterprise winners.

A comparison of valuations for leading AI companies as of mid-2025, showing Cohere's position relative to giants like OpenAI and Anthropic.

| Company | Valuation (USD) | As of Date | Notable Investors |

|---|---|---|---|

| OpenAI | $300 billion | August 2025 | Dragoneer Investment Group, Blackstone, TPG, SoftBank |

| Anthropic | $170 billion (in talks) | August 2025 | Iconiq Capital, Qatar Investment Authority, GIC |

| Cohere | $6.8 billion | August 2025 | Radical Ventures, Inovia Capital, AMD Ventures, Nvidia, Salesforce Ventures |

"The hyperscalers excel at raw computational power and consumer engagement," noted one enterprise technology consultant who requested anonymity. "The question becomes whether that translates to regulated enterprise environments where control, auditability, and data residency often outweigh pure performance metrics."

Cohere faces additional pressure from data platform incumbents including Databricks and Snowflake, which leverage existing enterprise relationships to bundle AI capabilities directly into established workflows. These companies represent perhaps the most sophisticated competitive threat—not through superior models, but through superior distribution within existing enterprise data estates.

European competitor Mistral AI presents yet another challenge, particularly in regions where regulatory frameworks explicitly favor non-American AI providers. The emerging pattern suggests the enterprise AI market may fracture along geopolitical lines, with sovereignty concerns driving technology choices as much as technical capabilities.

The Margins of Transformation

Beneath the competitive dynamics lies a fundamental economic question: Can enterprise AI companies build sustainable margins in an increasingly commoditized market? Cohere's 80% margins on private deployments suggest one answer, contingent on maintaining differentiation as model capabilities converge.

The company's strategy centers on what executives internally describe as "retrieval-centric intelligence"—AI systems optimized for accessing and synthesizing enterprise data rather than generating original content. This focus aligns with practical enterprise needs: most organizations seek to automate existing workflows rather than replace human creativity.

Retrieval-Augmented Generation (RAG) is an AI framework that enhances large language models by first retrieving relevant, up-to-date information from a specific knowledge base before generating a response. This process grounds the model in factual data, making it a powerful alternative to fine-tuning for enterprise applications that require accuracy and context-specific answers.

Early metrics from North platform deployments indicate promising unit economics. Enterprise customers report measurable productivity gains in document processing, regulatory compliance, and customer service workflows—the kind of concrete ROI that justifies premium pricing in an era of tightening technology budgets.

Forward-Looking Investment Implications

The funding round occurs against a backdrop of consolidating enterprise AI buying patterns. Organizations increasingly favor comprehensive platforms over point solutions, creating winner-take-most dynamics within specific vertical markets.

Analysts suggest Cohere's pathway to sustainable scale requires capturing 20-40 marquee enterprise accounts deploying North across thousands of seats each. The company's cloud-agnostic approach—operating across AWS Bedrock, Microsoft Azure, and Oracle Cloud—provides optionality as enterprises negotiate with hyperscaler vendors.

"The investment thesis ultimately hinges on execution velocity," observed one institutional investor involved in the round. "Model quality continues advancing across all providers. The differentiator becomes deployment sophistication, integration depth, and the ability to prove measurable workflow transformation."

Market watchers identify several key catalysts that could accelerate Cohere's trajectory: expanded regulatory requirements for AI auditability, geopolitical tensions affecting technology vendor selection, and enterprise budget shifts from experimental AI projects to production deployments.

The Sovereign AI Thesis

Cohere's $6.8 billion valuation reflects more than financial engineering—it represents institutional confidence in a fundamentally different approach to enterprise AI. While Silicon Valley's giants pursue universal intelligence, Cohere constructs specialized sovereignty.

The coming quarters will test whether this approach can scale beyond early enterprise adopters to capture mainstream technology budgets. Success requires executing sophisticated technical capabilities while navigating complex enterprise sales cycles and evolving regulatory frameworks.

Yet the broader trend appears unmistakable: as AI capabilities become ubiquitous, differentiation increasingly derives from deployment models rather than raw intelligence. In this emerging landscape, sovereignty may prove as valuable as scale—transforming Cohere's Canadian approach from geographic accident into strategic advantage.

The $500 million funding round provides capital to test this thesis at scale. For institutional investors betting on enterprise AI's evolution, Cohere represents a calculated wager that the future belongs not to the fastest models, but to the most trusted ones.