Coinbase Makes History as First Crypto Company to Join S&P 500, Triggering $9 Billion Investment Wave

Coinbase Joins S&P 500: A Watershed Moment Reshaping Investment Landscapes

In a historic development that signals crypto's definitive arrival in mainstream finance, Coinbase Global Inc. will join the S&P 500 index on May 19, marking the first time a cryptocurrency-focused company has penetrated this bastion of traditional finance. The announcement, made Monday by S&P Dow Jones Indices, sent Coinbase shares surging 8-9% in after-hours trading, pushing toward $229.90 after closing the regular session at $207.22.

The inclusion represents more than just symbolic victory for the crypto industry. It triggers a mechanical transformation in global investment flows, as index funds controlling approximately $7.8 trillion in S&P 500-tracking assets must now allocate an estimated $9 billion to Coinbase shares—a seismic influx of capital into a stock with fewer than 300 million shares in its free float.

"This is about to force Coinbase into every portfolio in America," said Juan Leon, senior investment strategist at Bitwise, who estimates the inclusion "is going to force seven times the daily trading volume into the stock."

The Ripple Effect: From Index Technicality to Market Transformation

The mechanics of Coinbase's inclusion create a perfect storm for the company's valuation. As the cryptocurrency exchange replaces Discover Financial Services—which is being acquired by Capital One Financial in a $35.3 billion transaction expected to close May 18—a wave of forced buying will collide with relatively limited supply.

The structural dynamics could trigger what market technicians describe as a "positive reflexive loop," where forced capital inflows lead to higher liquidity, improved credit terms, and more robust derivative trading infrastructure—all feeding back into higher volumes and valuation multiples.

Did you know? George Soros's theory of reflexivity challenges the idea that markets always reflect fundamental realities. Instead, Soros argues that investors' perceptions and actions can actually shape market outcomes. In this feedback loop, market participants form biased views of reality, act on them, and in doing so, influence the fundamentals they were trying to assess. This can lead to booms, busts, and mispricings—helping explain why markets often behave irrationally. Reflexivity played a key role in Soros’s legendary success as a hedge fund manager, especially during major financial events like the 1992 British pound crisis.

Historical data suggests significant upside potential. The median one-month excess return for companies added to the S&P 500 since 2015 stands at +5.6%, but crypto-adjacent financial technology firms have typically seen stronger gains approaching 12%. With Coinbase's daily turnover before the announcement averaging approximately $800 million, the influx of index-driven capital could dramatically transform price discovery mechanics.

Table: Performance Comparison Between General S&P 500 New Entrants and Crypto-Adjacent Financial Firms (Post-2015)

| Metric | General S&P 500 Additions | Crypto-Adjacent Financial Firms |

|---|---|---|

| Announcement to Effective Date Returns | Declining: -1.26% to -4.25% for upward additions (2016-2020) | Limited direct data available |

| Post-Addition Excess Returns | +0.96% for upward additions (ED to ED+5 days)-1.74% for pure additions | Not specifically measured for S&P 500 additions |

| Medium-Term Performance | Traditional index effect weakening or reversing | Crypto funds outperformed traditional investments (600% vs 40-70% cumulative log-returns, 2015-2021) |

| Risk-Adjusted Returns | Not specifically highlighted | Strong Sharpe ratios (1.56-2.14) across crypto fund types |

| Market Correlation | Higher market integration | Mild correlation with traditional assets (0.05-0.30) |

| Recent Trends | Index addition effect diminished from 7.12% (1995-1999) to -1.66% (2011-2021) for inter-index additions | Potential regulatory tailwinds for crypto-exposed companies in changing political environment |

A veteran institutional trader who requested anonymity noted: "The market hasn't fully processed what this means. We're talking about institutional investors who've spent years avoiding crypto exposure suddenly becoming forced owners through their index holdings. That's a paradigm shift."

Strategic Positioning: The Deribit Deal Changes Everything

The S&P 500 announcement arrives just days after Coinbase unveiled its most ambitious strategic move to date—a $2.9 billion acquisition of Dubai-based Deribit, the world's leading cryptocurrency derivatives exchange. The transaction, structured as $700 million in cash plus 11 million shares of Coinbase stock, represents the largest acquisition in cryptocurrency industry history

.

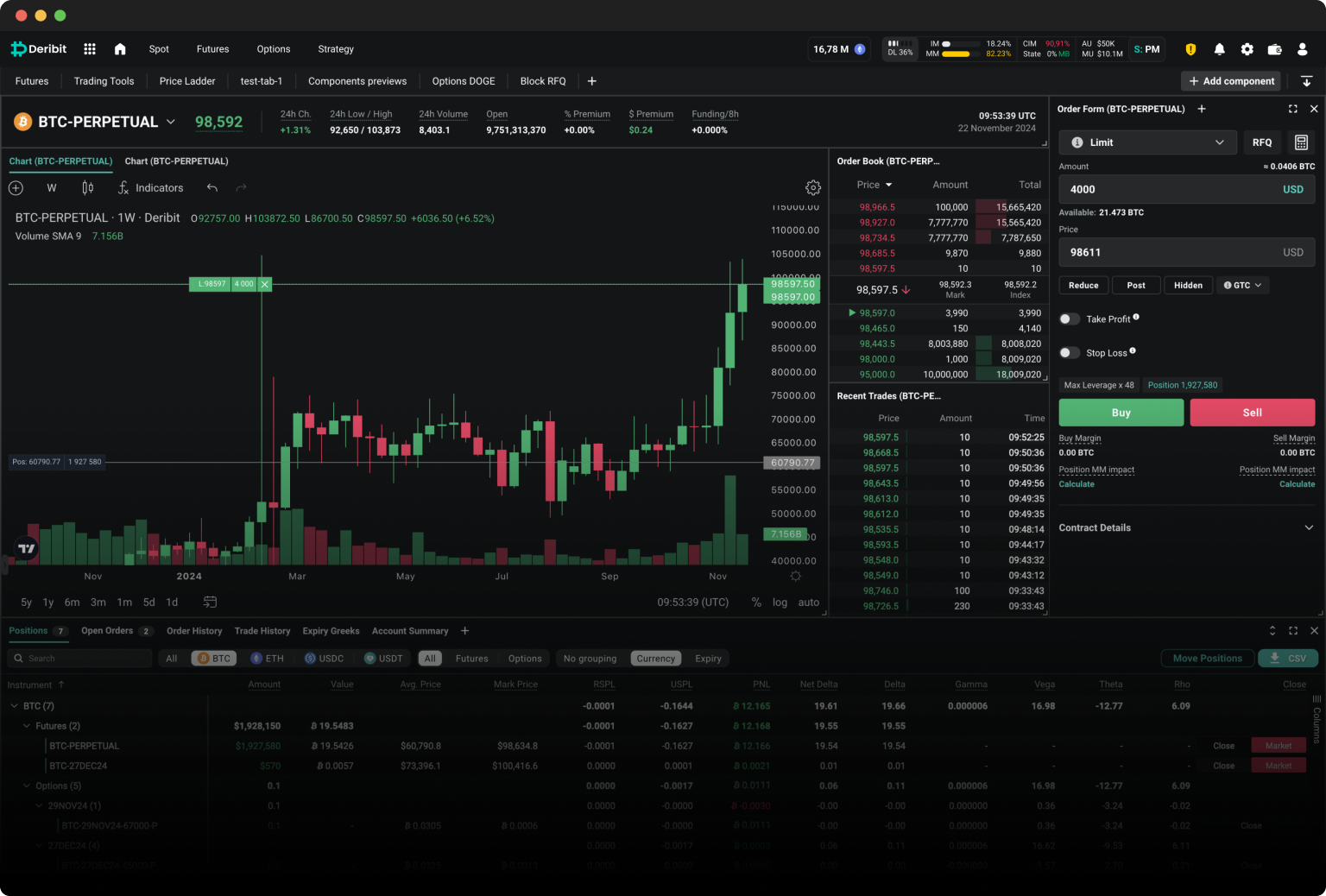

The timing appears far from coincidental. By securing Deribit's derivatives infrastructure—which facilitated over $1 trillion in trading volume last year and maintains approximately $30 billion in open interest—Coinbase positions itself to capture high-margin revenue streams less vulnerable to cryptocurrency price volatility.

Did you know? Derivatives like futures, options, and perpetual swaps play a crucial role in driving institutional adoption and maturity in the crypto market. These financial instruments allow institutions to hedge risk, manage exposure, and implement sophisticated trading strategies—tools essential for operating in volatile markets. The growth of regulated crypto derivatives also brings greater liquidity, price discovery, and market stability, signaling a shift from speculative hype to a more mature, finance-integrated ecosystem.

"The Deribit acquisition fundamentally transforms Coinbase's business model," explained a cryptocurrency market structure specialist familiar with both platforms. "They're moving from a primarily retail-focused spot exchange to becoming the premier regulated derivatives powerhouse in digital assets—exactly where institutional money wants to play."

The strategic implications extend beyond revenue diversification. Derivatives trading typically generates steadier income flows through a market cycle compared to spot trading, and institutional investors value consistent earnings trajectories when assigning valuation multiples.

Financial Evolution: Beyond Transaction Revenue

While Coinbase reported mixed first-quarter results—with $2.03 billion in revenue slightly missing analyst expectations of $2.1-2.2 billion—the composition of those earnings reveals a company in transition.

Transaction revenue fell 19% quarter-over-quarter to $1.26 billion, but subscription and services revenue grew 36.3% year-over-year to $698.1 million. This shift toward recurring revenue streams carries significant valuation implications, as subscription services typically command higher multiples than transaction-based income.

Table: Coinbase Q1 2025 Revenue Diversification and Market Metrics

| Category | Amount (in billion USD) | Notes |

|---|---|---|

| Transaction Revenue | 1.26 | Q1 2025 |

| Subscription & Services Revenue | 0.6981 | Q1 2025, approx. 35% of total revenue |

| Total Revenue | 2 | Q1 2025, below forecasted $2.2 billion |

| Stablecoin Revenue | 0.298 | Q1 2025, up 32% quarter-over-quarter |

| Consumer Trading Volume | 78.1 | Q1 2025, decreased 17% quarter-over-quarter |

| Institutional Trading Volume | 315 | Q1 2025, decreased 9% quarter-over-quarter |

The platform's engagement metrics tell a compelling story beneath the headline figures. USDC balances on Coinbase increased 49% quarter-over-quarter to $12.3 billion, indicating strong user retention despite market volatility. This growing stable-asset footprint provides multiple monetization vectors through yield-generating activities.

Did you know? USDC (USD Coin) is a regulated stablecoin that maintains a 1:1 peg to the U.S. dollar, backed by fully reserved assets and issued by Circle in partnership with Coinbase. Unlike volatile cryptocurrencies, USDC offers price stability, making it a trusted tool for digital payments, trading, and DeFi applications. Its regulatory compliance and transparency—through regular attestations—make it especially attractive to institutions and governments seeking a secure bridge between traditional finance and the blockchain economy.

"What's underappreciated is how Coinbase has evolved from pure exchange to financial infrastructure provider," observed a financial technology analyst at a major investment bank. "The market still values them primarily on trading volumes, but their services revenue—staking, custody, USDC yield—is growing twice as fast and carries margins approaching software companies rather than exchanges."

The Market Mechanics: Volatility Transfer and Cross-Asset Correlation

Coinbase's inclusion creates fascinating market structure implications extending far beyond its own share price. Academic research on index inclusions consistently shows short-term spikes in both beta (market correlation) and idiosyncratic volatility for newly added companies.

Did you know? In investment analysis, beta measures how much a stock moves relative to the overall market—indicating its sensitivity to market-wide risks. A beta above 1 means the stock is more volatile than the market, while below 1 means it's less volatile. In contrast, idiosyncratic volatility refers to the portion of a stock's risk that comes from company-specific factors, like earnings surprises or leadership changes. While beta reflects systematic risk that can't be diversified away, idiosyncratic risk can often be reduced through diversification—making it a key concept for building balanced portfolios.

For Coinbase, these effects may prove particularly pronounced due to cryptocurrency's 24/7 trading cycle. Bitcoin price movements during weekend hours—when equity markets remain closed—often create significant Monday opening gaps in crypto-exposed stocks. This phenomenon could introduce new volatility patterns into the broader S&P 500 index.

More intriguingly, derivatives desks will likely establish new cross-asset arbitrage strategies linking S&P 500 futures to Bitcoin options as a hedging mechanism. This creates unprecedented interconnections between traditional equity volatility measures and cryptocurrency markets.

"Expect the VIX-Bitcoin correlation—already climbing in early 2025—to tighten further as equity investors inherit cryptocurrency's around-the-clock price discovery," noted a quantitative strategist at a global macro hedge fund. "We're essentially witnessing the beginning of volatility transfer between asset classes that historically operated in separate universes."

Stakeholder Impact: Winners and Losers

Coinbase's S&P 500 debut creates complex ripple effects across multiple stakeholder groups:

For index funds and ETFs tracking the S&P 500, the inclusion necessitates approximately $9 billion in Coinbase purchases, likely creating tracking error challenges due to liquidity constraints and potentially higher transaction costs that may be passed to investors.

Active large-cap fund managers face a new reality where underweighting Coinbase effectively creates an implicit short position relative to their benchmark. This could trigger additional buying pressure extending through June as managers adjust portfolios accordingly.

For retail investors, the inclusion means gaining passive exposure to cryptocurrency markets through 401(k) plans and robo-advisor portfolios without explicitly opting in—potentially accelerating mainstream adoption by making crypto exposure the default rather than an active choice.

The regulatory implications appear equally significant. As one policy analyst explained: "Coinbase joining the S&P 500 dramatically increases the political cost of an aggressively anti-crypto regulatory stance. When millions of American retirement accounts have indirect cryptocurrency exposure, the calculus for regulators shifts fundamentally."

Valuation Framework: Metrics That Matter

At approximately $225 per share following the announcement, Coinbase trades at roughly 12 times enterprise value to EBITDA based on 2026 analyst estimates—a 30% discount to traditional exchange CME Group despite projections for faster revenue growth.

The valuation discount appears particularly striking when considering Coinbase's strategic positioning at the intersection of multiple high-growth trends. With Bitcoin recently surpassing $100,000 and historically demonstrating an amplified effect on Coinbase's trading volumes (with a beta of approximately 1.8), further cryptocurrency price appreciation could significantly accelerate earnings growth.

The Deribit acquisition introduces additional valuation optionality. Even capturing just 1% in fees on Deribit's annual $1 trillion trading notional could theoretically add $10 billion to Coinbase's revenue pool—primarily in high-margin derivatives business.

An institutional investor focused on financial technology explained: "The market is still valuing Coinbase primarily as a retail crypto trading platform vulnerable to cyclicality. But the combination of S&P 500 inclusion, derivative market expansion through Deribit, and growing subscription revenue creates a fundamentally different business model deserving a significantly higher multiple."

Looking Forward: The Next Frontiers

As Coinbase cements its position in the financial establishment, several developments appear plausible in the coming 12-24 months:

The creation of a dedicated cryptocurrency and blockchain sub-industry within S&P indices seems increasingly likely, potentially bundling Coinbase with other crypto-adjacent companies like Block, MicroStrategy, and specialized semiconductor designers.

Traditional exchanges including CME Group, Intercontinental Exchange, and Cboe Global Markets may seek partnerships or margin offset arrangements with Coinbase to manage competitive threats posed by the Deribit acquisition—particularly in crypto derivatives.

The possibility of a settlement stablecoin pilot program with Federal Reserve banks appears increasingly viable as regulatory legitimacy grows, potentially front-running stalled legislative efforts.

"Coinbase's S&P 500 inclusion doesn't just validate cryptocurrency as an asset class—it institutionalizes it at the heart of global capital allocation," said the head of digital asset strategy at a prominent wealth management firm. "We've crossed a threshold where cryptocurrency exposure becomes obligatory rather than optional for mainstream portfolios."

For investors, the transformation creates both opportunity and complexity. The structural bid from index inclusion provides near-term support, while longer-term value depends on Coinbase's execution in integrating Deribit and continuing its evolution toward recurring revenue streams less sensitive to cryptocurrency price cycles.

What remains clear is that Coinbase's S&P 500 debut represents more than just another company joining the index—it fundamentally alters the relationship between cryptocurrency markets and traditional finance in ways that will reverberate through global capital markets for years to come.