EU's Landmark €150 Billion Defense Fund Reshapes European Security Landscape

EU's Landmark €150 Billion Defense Fund Reshapes European Security Landscape

In a windowless conference room in Brussels, exhausted diplomats finally reached agreement on what may be the European Union's most consequential security initiative in decades: a €150 billion loans-for-arms scheme that fundamentally alters how the bloc approaches defense funding and procurement.

The landmark initiative, officially named Security Action for Europe , represents not merely a financial package but a profound strategic pivot for a continent grappling with Russia's ongoing war against Ukraine and increasing pressure from Washington to shoulder more of its security burden.

"We are entering an era of rearmament," a senior EU official involved in the negotiations. "This fund transforms how Europe finances its defense capabilities while simultaneously rebuilding our industrial base."

Breaking New Ground in European Defense Finance

The newly agreed fund operates through an innovative financial mechanism where the European Commission borrows money from capital markets using the EU's strong credit rating, then offers these funds as loans to member states at favorable rates – approximately 3%. This represents a particularly attractive proposition for countries with higher sovereign borrowing costs.

Did you know? The European Union borrows from capital markets by issuing EU bonds and bills, much like a country, to fund major initiatives like COVID-19 recovery and job protection programs. Managed by the European Commission and backed by the EU budget, this borrowing is highly secure and attracts global investors. The funds support grants and loans to member states, with repayments coming from future EU budgets or new revenue sources like environmental levies—all under strict transparency and governance rules.

For the first time, Brussels will directly finance weapons procurement on this scale, allowing member states to collaboratively purchase critical military hardware including artillery ammunition, missiles, drones, air defense systems, strategic aircraft, and advanced cyber capabilities.

"The financial engineering here is revolutionary," explained a Brussels-based defense analyst who has closely tracked the initiative's development. "By pooling borrowing power, the EU creates a force multiplier that individual states simply cannot match."

To qualify for funding, defense projects must involve at least two EU countries or one EU member plus Ukraine, and address specific capability gaps identified by European defense planners. The Commission has also proposed a VAT waiver for SAFE-funded projects, further enhancing their financial attractiveness.

Did you know? In the EU, large-scale projects funded by the EU budget can receive VAT waivers, allowing them to avoid paying value-added tax on goods and services. This helps reduce overall project costs, improves efficiency, and ensures more funding goes directly to achieving project goals. However, strict eligibility rules apply, and proper documentation is essential to avoid legal or financial issues.

The New European Preference

Perhaps the most contentious aspect of the agreement involved determining who could benefit from this massive infusion of capital. After months of tense negotiations, EU capitals settled on specific terms that heavily favor European manufacturers while allowing limited non-EU participation.

Under the final agreement, loans can be spent on products where at least 65% of component value comes from arms companies in the EU, Ukraine, Iceland, Liechtenstein, Norway, and Switzerland. Arms manufacturers from third countries can account for a maximum of 35% of purchase value, with any single non-EU subcontractor's contribution capped at 15%.

Table: Component Value Sourcing Requirements for SAFE-Funded Defense Projects (2025)

| Sourcing Category | Percentage | Eligible Countries/Regions | Additional Requirements |

|---|---|---|---|

| EU and Allied Sources | 65% minimum | - EU Member States- EEA EFTA States (Iceland, Liechtenstein, Norway)- Ukraine | For complex systems: Contractors must fully control the design to prevent new dependencies |

| Third-Country Sources | 35% maximum | - Acceding countries (Albania, Moldova, Montenegro, North Macedonia, Serbia, Türkiye)- Candidate countries (Bosnia and Herzegovina, Georgia)- Potential candidates (Kosovo)- Countries with EU Security and Defense Partnerships (Japan, South Korea) | Contractors must be established with executive management structures in EU/EEA/Ukraine- Infrastructure and facilities must be primarily located in these regions |

This restriction sparked immediate reaction from Washington. "The European Commission is creating a 'Fortress Europe' mentality at precisely the moment when transatlantic cooperation should be deepening," said a U.S. defense industry representative in Brussels who requested anonymity to speak candidly.

French officials, who pushed hardest for European preference rules, counter that the continent must rebuild its defense industrial base after decades of decline. "This is not protectionism – it's survival," insisted a senior advisor to the French defense ministry. "We have systematically dismantled our defense capabilities over thirty years. Now we are paying the price."

Eastern Europe's Frontline Focus

For eastern member states bordering Russia or close to Ukraine, SAFE represents more than industrial policy – it's an urgent security imperative.

In Warsaw, officials are already mapping out ambitious procurement plans that could absorb up to 40% of the entire fund. "For us, this is not theoretical. The threat is at our doorstep," said a Polish defense ministry representative who requested anonymity to discuss sensitive procurement strategies.

The Polish state-owned PGZ defense group stands to benefit significantly, as do Romanian defense manufacturers who will likely receive substantial offset arrangements from any major purchases funded through the mechanism.

A senior Baltic defense official put it bluntly: "We've been warning about the Russian threat for years. Finally, Brussels is taking concrete action with real money behind it."

UK-EU Defense Reset

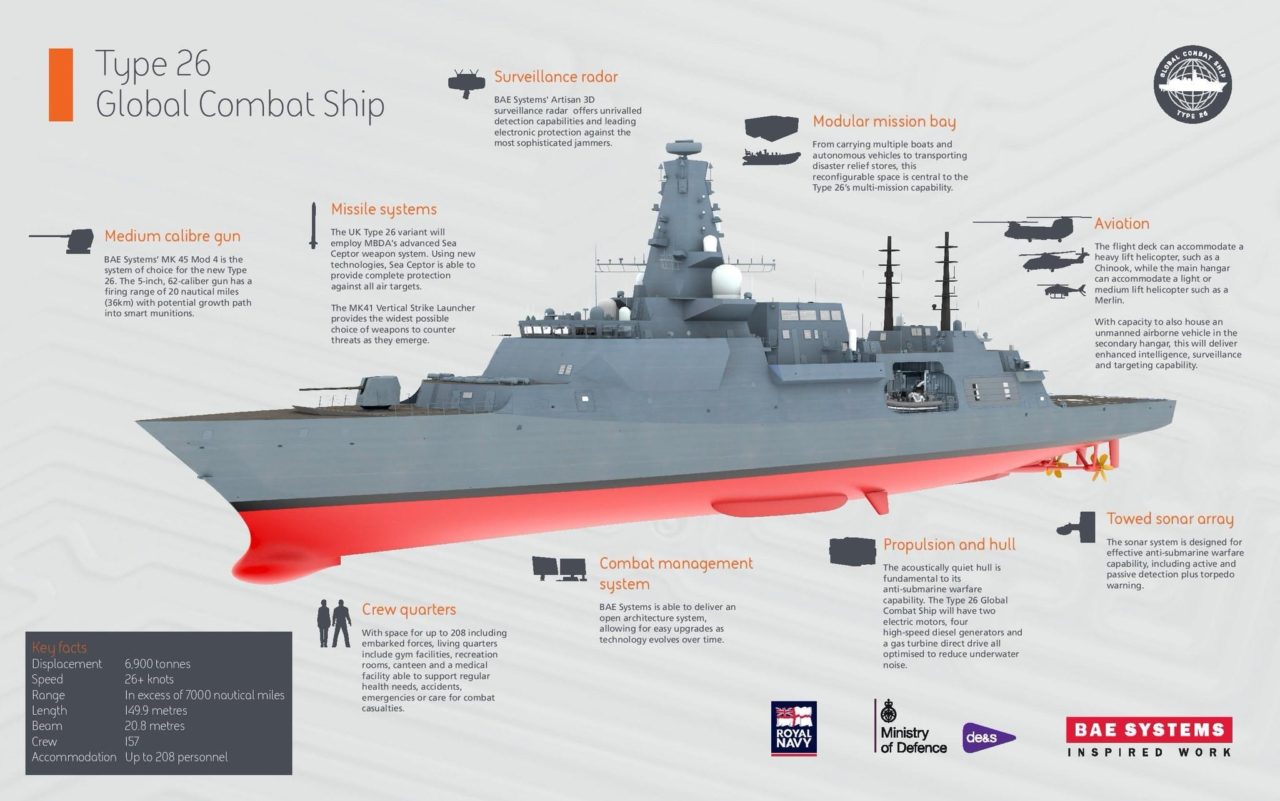

The SAFE initiative has also accelerated a broader reset in UK-EU defense relations. On May 19, 2025 – today – Prime Minister Keir Starmer is expected to sign an initial defense pact with the EU in London, potentially enabling British defense firms like BAE Systems to participate in projects funded by the new scheme.

Without such an agreement, British defense contractors would face severe limitations on their involvement in SAFE-funded projects, unable to contribute more than 15% to any individual procurement program.

"For the UK defense industry, access to this €150 billion pool of capital is existential," noted a London-based defense analyst. "Starmer recognizes that despite Brexit, Britain's security remains inextricably linked to European defense capabilities."

The diplomatic choreography around today's summit suggests both sides are eager to turn the page on years of post-Brexit tension. "We're witnessing the beginning of a more pragmatic phase in UK-EU relations, driven by harsh geopolitical realities," observed a former British diplomat familiar with the negotiations.

Markets React: Winners and Losers

Financial markets have already begun pricing in the implications of this massive defense stimulus. European defense stocks have rallied sharply, with Germany's Rheinmetall guiding for 25-30% top-line growth through 2025, sending the stock up 7.6% on March 12.

Did you know that amid rising European defense spending, industry giants Rheinmetall and Thales have shown remarkable financial strength since early 2024, with Rheinmetall achieving a stunning 39% revenue increase to €9.98 billion, a record €55 billion order backlog, and hitting all-time stock highs in 2025, while Thales posted 11.7% revenue growth to €20.577 billion with a €51 billion order book, though facing contrasting market reactions as its shares dropped 4% in April 2025 despite strong quarterly revenue due to concerns about a 27% year-on-year decline in new orders?

Second-tier suppliers like sensor specialist Hensoldt, propulsion maker MTU Aero, and Italian electronics group Elettronica may gain disproportionately because the 65% EU-content rule rewards deeper European supply chains rather than final-assembly operations.

Debt markets are preparing to price approximately €30 billion per year of new AAA-rated EU paper – essentially a "NextGenerationEU-for-weapons" sequel. Bond specialists anticipate a bull-flattening bias in the long end of the euro-sovereign curve as core investors switch from German Bunds to Brussels-backed bonds.

Summary of AAA-Rated EU Bonds and Their Significance.

| Aspect | Description |

|---|---|

| Credit Rating | AAA – Highest rating by agencies like S&P, Moody’s, and Fitch |

| Issuer | European Union (via the European Commission) |

| Purpose | Fund major EU initiatives (e.g., NextGenerationEU, green transition) |

| Investor Appeal | Considered ultra-safe; attractive to global institutional investors |

| Borrowing Costs | Low interest rates due to minimal perceived credit risk |

| Market Role | Serves as a benchmark for EU capital markets and promotes euro liquidity |

| Global Impact | Acts as a stable alternative to U.S. Treasuries; enhances the euro's reputation |

"The spreads on peripherals like Italy and Greece should compress 8-15 basis points as those treasuries arbitrage SAFE's cheaper funding," predicted a fixed-income strategist at a major European bank.

Economic Ripple Effects

The macroeconomic implications extend beyond defense contractors. Goldman Sachs estimates that additional defense spending will have a fiscal multiplier of 0.5 over two years, meaning every €100 spent would boost GDP by approximately €50.

Did you know? Fiscal multipliers reveal how much economic activity is generated by government spending or tax changes. For example, a multiplier of 1.5 means that every €1 the government spends boosts GDP by €1.50. These multipliers tend to be larger during recessions and smaller during economic booms, making them crucial tools for designing effective fiscal policies—whether stimulating growth or managing debt.

A fully tapped SAFE facility could therefore lift EU-27 GDP by roughly 0.6 percentage points cumulatively. Front-loading during 2025-27 could offset cyclical weakness as ECB rates remain restrictive.

The initiative will also impact currency markets. "A structurally higher European defense capital expenditure path lifts the euro's terms of trade," explained a currency analyst at a major investment bank. "We project a 2-3% medium-term EUR-USD premium relative to pre-SAFE projections, though a second Trump administration could nullify this effect."

Implementation Challenges

Despite the ambitious timeline – with the fund expected to come into force before the end of May 2025 – significant implementation hurdles remain.

Past EU defense programs have typically taken approximately 12 months from initial call to contract execution. Unless the Commission establishes a fast-track procedure, cash may not reach manufacturer balance sheets before late 2026.

"The bureaucratic machinery in Brussels isn't designed for rapid deployment," cautioned a former EU defense procurement official. "There's a real risk that by the time the money flows, the strategic situation will have evolved significantly."

Supply-chain bottlenecks present another concern. Europe still imports more than 40% of solid-state chips for smart munitions, and delays in the EU's Chips Act fabs could blunt SAFE's impact.

Did you know? The EU Chips Act, launched in 2023 with over €43 billion in funding, aims to double Europe's share of the global semiconductor market to 20% by 2030. It supports advanced chip research, boosts production capacity, strengthens supply chains, and addresses skills shortages—all to reduce dependency on foreign technology and enhance the EU’s digital sovereignty. Despite some implementation challenges, it's a bold step toward securing Europe's role in the global tech race.

A Stealth Evolution in European Integration

Perhaps most significantly, SAFE represents another step in the EU's gradual evolution toward greater fiscal integration. Like the COVID-era recovery fund, this initiative is authorized under Article 122 TFEU emergency powers, bypassing the need for separate European Parliament approval.

Overview of Article 122 TFEU

| Aspect | Description |

|---|---|

| Legal Source | Article 122, Treaty on the Functioning of the European Union (TFEU) |

| Purpose | To enable EU-wide action during crises involving severe economic, natural, or energy disruptions |

| Key Clauses | - 122(1): Solidarity measures for exceptional circumstances or natural disasters - 122(2): Support for disruptions in essential supplies (e.g., energy, raw materials) |

| Decision-Making | EU Council can act by qualified majority, allowing rapid response |

| Notable Uses | - COVID-19 vaccine procurement - Energy price caps during 2022 energy crisis - Financial aid mechanisms like the EU Solidarity Fund and SURE program |

| Significance | Provides flexibility, accelerates action, and demonstrates EU solidarity in times of crisis |

"Once markets digest another round of Eurobonds, political resistance to permanent common debt diminishes," noted an EU integration expert. "We're likely to see calls for a grant window by 2027, transforming what began as an emergency measure into a permanent feature of EU fiscal architecture."

Summary of Eurobonds and Their Role in EU Fiscal Integration

| Aspect | Details |

|---|---|

| Definition | Jointly issued debt instruments by EU/eurozone countries |

| Key Features | - Joint liability - Single interest rate - Market stability |

| Risk Sharing | Lowers borrowing costs for weaker economies and spreads financial risk |

| Fiscal Solidarity | Promotes unity and shared responsibility across member states |

| Stabilization Tool | Enables collective response to crises and supports EU-wide investments |

| Capital Markets Union | Enhances liquidity and integration of EU bond markets |

| Challenges | - Moral hazard concerns - Political resistance - Legal treaty limits |

| Recent Example | NextGenerationEU fund as a step toward temporary debt mutualization |

For investors, defense analysts, and geopolitical observers, the message is clear: SAFE converts Europe's alarm over Ukraine into a semi-permanent defense-industrial stimulus and stealth fiscal union – unless political fragmentation or U.S. retaliation disrupts its trajectory.

As artillery shells begin flowing from new production lines and missile systems deploy along NATO's eastern flank in the coming years, the full implications of this watershed moment in European security will become increasingly apparent.

"This isn't just about weapons," concluded a veteran Brussels security correspondent. "It's about whether Europe can truly stand on its own in an increasingly dangerous world."