Breaking the Cycle: First Treatment for Rare Throat Disease Ends Decades of Surgical Dependency

FORT WORTH, Texas — On Friday, the Food and Drug Administration granted full approval to Precigen's Papzimeos (zopapogene imadenovec-drba) under Priority Review, marking the first pharmaceutical treatment ever approved for adults with recurrent respiratory papillomatosis.

The regulatory milestone ends a three-decade medical void for patients suffering from RRP, a rare condition caused by human papillomavirus types 6 and 11 that triggers benign growths throughout the respiratory tract. Until this approval, surgical removal represented the only therapeutic option—procedures that patients often endure multiple times annually as growths inevitably return.

The clinical significance extends beyond regulatory achievement. In pivotal trials involving 35 patients treated at the recommended dose, 51% achieved complete response at 12 months, defined as requiring no surgical interventions. Remarkably, 43% maintained surgery-free status at 24 months, representing unprecedented durability for a patient population accustomed to quarterly or more frequent procedures.

Percentage of RRP patients remaining surgery-free after Papzimeos treatment in clinical trials.

| Time Point | Percentage of Patients Remaining Surgery-Free |

|---|---|

| After 12 months | 51.4% of all study patients. |

| After 24 months | 83.3% of the patients who were surgery-free at 12 months continued to be surgery-free. |

"For decades, our community has persevered through an isolating journey of countless surgeries, silence, and uncertainty," said Kim McClellan, President of the Recurrent Respiratory Papillomatosis Foundation. "Today, our hope is realized. Today, with the approval of Papzimeos our hope is no longer a dream, it's a reality."

Markets responded decisively to the breakthrough. Precigen's stock surged 58.92% in after-hours trading, closing at $2.94 from a previous close of $1.86, as investors absorbed the commercial implications of addressing an estimated 20,000 to 27,000 adult patients nationwide who have lacked pharmaceutical alternatives for managing their condition.

Precigen (PGEN) stock performance following the FDA approval announcement of Papzimeos.

| Date | Event | Stock Price (USD) | Change (%) |

|---|---|---|---|

| August 14, 2025 | Closing Price Before FDA Approval | $1.85 | N/A |

| August 15, 2025 | Intraday High After FDA Approval | $3.25 | +71.81% |

| August 15, 2025 | Intraday Price Fluctuation | $3.1786 | +48.84% |

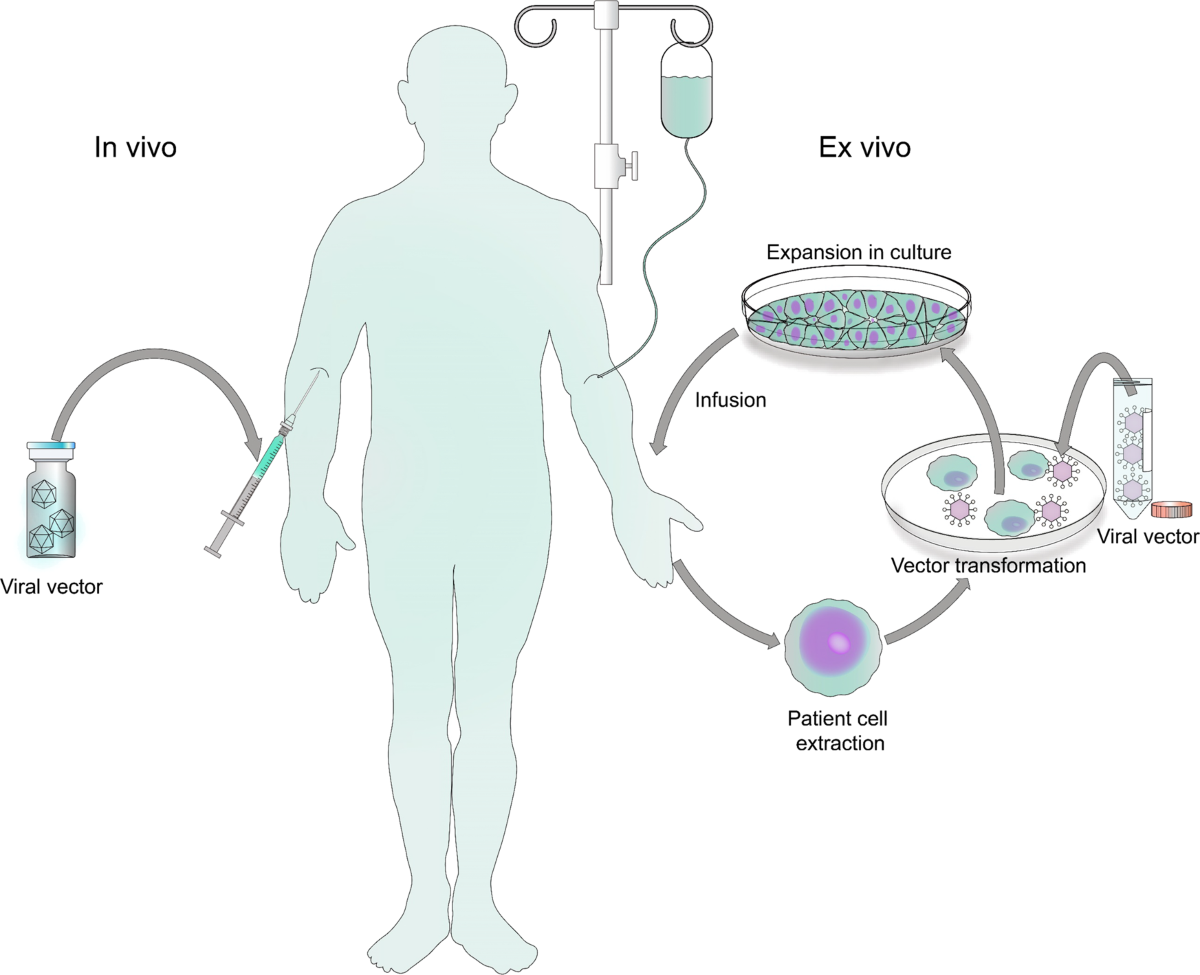

The treatment represents a fundamental departure from surgical management. Papzimeos is a non-replicating adenoviral vector-based immunotherapy designed to generate immune responses specifically targeting papilloma cells expressing HPV 6/11. Rather than removing symptomatic growths, the therapy attacks the underlying viral cause through four subcutaneous injections delivered over a 12-week interval.

An adenoviral vector is a modified version of a common adenovirus, engineered to deliver genetic material into human cells. Key viral genes are removed, making the vector non-replicating, so it can safely deliver its genetic payload for applications like vaccines or gene therapy without causing disease.

When Breathing Becomes a Medical Emergency

Recurrent respiratory papillomatosis transforms the airways into battlegrounds. Benign growths, triggered by human papillomavirus types 6 and 11, proliferate throughout the respiratory tract with devastating regularity. For the estimated 20,000 to 27,000 adults living with RRP nationwide, surgical removal becomes a recurring necessity—often quarterly, sometimes monthly.

The disease's unpredictable nature creates profound uncertainty. Patients navigate not just physical challenges of airway obstruction, but existential questions about voice preservation and breathing autonomy. Children face particularly aggressive disease progression, though pediatric treatment options remain absent from today's approval.

Clinical trial data reveals the treatment's transformative potential: beyond the 51% achieving 12-month surgery-free status, 43% maintained that benefit at 24 months. For a patient population accustomed to quarterly surgical interventions, these outcomes represent fundamental shifts in disease trajectory.

The therapeutic mechanism involves four subcutaneous injections delivered over 12 weeks, designed to trigger immune responses against HPV-infected cells. Each injection targets the root viral cause rather than merely managing symptomatic growth—a distinction that medical professionals describe as paradigmatic.

The Economics of Rare Disease Breakthrough

Behind the clinical triumph lies complex commercial reality. Industry analysts project peak U.S. revenues approaching $250 million, though achieving these figures requires navigating operational complexities that could moderate adoption timelines.

The economic framework supporting these projections reflects both clinical value and substantial costs associated with current surgical management. Historical estimates place annual RRP treatment costs at approximately $60,000 per patient, with total U.S. healthcare burden exceeding $100 million annually. A therapy reducing surgical frequency could justify premium pricing through cost-offset mechanisms.

However, the addressable market presents nuanced dynamics. While total adult RRP population spans tens of thousands, clinical practice suggests adjuvant therapies typically target the 20% experiencing frequent surgeries—translating to an initial treatment-eligible population of approximately 4,000 to 6,000 patients.

Breakdown of the estimated U.S. adult RRP patient population, highlighting the target segment for adjuvant therapies.

| Category | Estimated Patient Population | Key Characteristics |

|---|---|---|

| Total Estimated Adult RRP Patients in the U.S. | Approximately 27,000 | Adults diagnosed with Recurrent Respiratory Papillomatosis. |

| Patients Requiring Adjuvant Therapy | Approximately 5,400 | Constitutes about 20% of the total adult RRP patient population who require treatments in addition to surgery to control the disease. |

| Patients with Frequent Surgeries | Subset of the 5,400 | Patients who require four or more surgical interventions per year to manage their condition. |

| Patients with Aggressive Disease | Subset of the 5,400 | Individuals experiencing rapid regrowth of papillomas leading to potential airway compromise, or the spread of the disease to the lower airway. |

"The challenge lies not in proving clinical value, but in executing the operational complexity required to deliver specialized therapy," observed a pharmaceutical industry consultant familiar with rare disease commercialization.

Market penetration depends significantly on logistical execution. The treatment requires storage at temperatures below -60°C, coordination with surgical procedures, and 30-minute post-injection observation periods. These requirements favor academic medical centers and large hospital systems over community practices, potentially extending adoption timelines beyond initial projections.

Competitive Dynamics in Uncharted Territory

Despite achieving first-mover advantage, Papzimeos enters terrain where off-label alternatives have established clinical comfort among practitioners. Bevacizumab, an angiogenesis inhibitor, has demonstrated efficacy in reducing surgical burden across multiple case series, creating entrenched treatment paradigms that new approvals must displace.

Off-label drug use occurs when a doctor prescribes a medication for a condition, dosage, or patient group for which it has not been officially approved by a regulatory agency. Physicians make this decision based on their professional judgment and emerging scientific evidence, believing it is the best course of treatment for a patient, particularly when approved options have failed or do not exist.

The competitive horizon includes Inovio's INO-3107, a DNA vaccine platform targeting similar viral mechanisms. Positive Phase 1/2 data positions this candidate for potential 2026 approval, creating defined timeline pressure for market position establishment. However, INO-3107's device-dependent delivery mechanism may limit community adoption compared to Papzimeos' simpler subcutaneous administration.

Checkpoint inhibitors represent additional competitive consideration, with small trials demonstrating partial response rates exceeding 50% for pembrolizumab. However, immune-related adverse events and absent formal approvals restrict these agents to off-label use in complex cases.

The regulatory pathway suggests a 12 to 18-month window of approved-therapy exclusivity, during which market position establishment becomes critical for sustained commercial success.

Investment Implications Beyond Market Excitement

For institutional investors, the approval removes binary regulatory risk while introducing execution-dependent variables that will determine commercial trajectory. The stock's immediate response reflects both relief over regulatory clearance and uncertainty about operational implementation across diverse healthcare settings.

Revenue scenarios spanning $108 million to $462 million in peak U.S. sales illustrate wide-ranging possible outcomes. Base-case projections assuming $120,000 net pricing, 45% market penetration, and 5,000 target patients yield approximately $270 million in annual revenues—aligning with current Street estimates.

Projected peak U.S. annual revenue scenarios for Papzimeos, illustrating low, base, and high-case outcomes.

| Scenario | Projected Peak U.S. Annual Revenue | Analyst/Source |

|---|---|---|

| High-Case | Over $1 billion | Seeking Alpha Analyst |

| Base-Case | $800 million | AInvest |

| Low-Case | $250 million | J.P. Morgan |

Several factors could compress these projections. Coverage policies may initially restrict treatment to patients documented with three or more annual surgeries, mirroring clinical trial inclusion criteria. Additionally, complex storage and administration requirements could extend adoption timelines beyond current modeling assumptions.

"The real test comes in translating clinical trial success into real-world implementation across hundreds of treatment centers with varying infrastructure capabilities," noted a healthcare equity analyst.

Key performance indicators over coming quarters will include pricing disclosure, payer policy development, J-code assignment timing, and center activation rates. These metrics will provide early signals about commercial trajectory and competitive positioning in an emerging therapeutic category.

The Unfinished Journey

The broader implications extend beyond immediate commercial opportunity. The approval validates gene therapy approaches for rare viral-mediated diseases, potentially accelerating investment in similar therapeutic platforms. For rare disease advocacy communities, it demonstrates that sustained research investment and patient advocacy can produce tangible therapeutic advances.

Yet significant challenges persist. Pediatric patients—often experiencing the most severe disease burden—continue without approved therapeutic options. International market access will require separate regulatory processes, potentially involving local clinical evidence generation and health economic assessments.

The treatment's success may accelerate competitive development, as pharmaceutical companies recognize commercial viability in targeting underserved rare disease populations. This dynamic could ultimately benefit patients through expanded therapeutic options while creating market share pressures for early entrants.

For the Recurrent Respiratory Papillomatosis Foundation and thousands of affected families, today's approval represents hope realized after decades of advocacy. The journey from surgical dependency to pharmaceutical intervention reflects not just scientific progress, but community resilience in pursuing alternatives to accepted medical limitations.

"This approval transforms our conversation from managing inevitable surgery to preventing it entirely," reflected a patient advocate familiar with the RRP community's multi-decade journey toward therapeutic alternatives.

The treatment may mark the beginning rather than culmination of therapeutic innovation for RRP patients worldwide—a reminder that rare disease breakthroughs often open doors to possibilities previously considered impossible.

Investment decisions should be made in consultation with qualified financial advisors. Past clinical trial performance does not guarantee future therapeutic or commercial outcomes.