The Forgotten Lung Disease Finally Finds Its Voice

After decades of medical neglect, FDA approval of BRINSUPRI transforms the landscape for half-million Americans while creating a new investment frontier in respiratory therapeutics

BRIDGEWATER, N.J. — In medical centers across America, respiratory specialists have watched helplessly for decades as patients with non-cystic fibrosis bronchiectasis cycled through emergency rooms, their airways progressively scarred by a disease that medicine could only chase, never catch.

Today, that vigil ended.

The Food and Drug Administration's approval of BRINSUPRI marks more than a regulatory milestone—it represents the conclusion of medicine's longest therapeutic drought in respiratory disease. For approximately 500,000 diagnosed Americans whose damaged airways trap infections in a vicious cycle of inflammation and decline, the approval signals the arrival of the first weapon specifically designed for their battle.

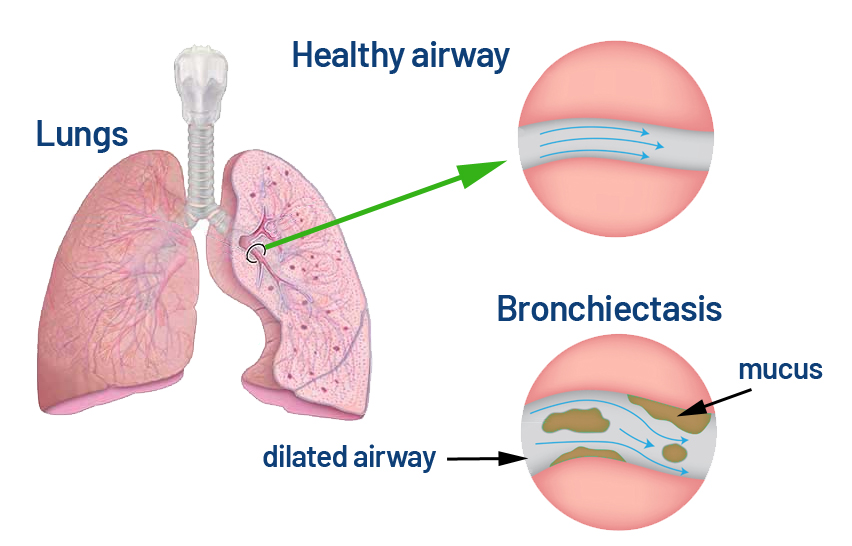

Did you know that Non-Cystic Fibrosis Bronchiectasis (NCFB) is a long-term lung condition where the airways become permanently widened and damaged, causing mucus build-up that’s hard to clear? This creates a perfect environment for infections and ongoing inflammation, often leading to chronic cough, frequent chest infections, and breathing difficulties. NCFB can stem from past lung infections, autoimmune diseases, or genetic disorders unrelated to cystic fibrosis, and while it can’t be cured, treatments like antibiotics, mucus-clearing techniques, and lifestyle changes can help control symptoms and slow its progression.

The transformation extends beyond hospital corridors into investment boardrooms, where Insmed Incorporated's brensocatib has created what analysts characterize as a "category-defining moment" in pharmaceutical markets—a rare phenomenon where scientific breakthrough meets commercial opportunity in a previously untapped therapeutic space.

The Architecture of Neglect

Non-cystic fibrosis bronchiectasis operates through a biological paradox that has confounded medical intervention for over a century. While most respiratory diseases narrow airways, bronchiectasis irreversibly widens them—creating pockets where mucus and bacteria accumulate like standing water in damaged pipes.

This counterintuitive pathology has relegated patients to a therapeutic wilderness of borrowed treatments. Antibiotics combat infections without addressing underlying inflammation. Airway clearance techniques help mobilize secretions but cannot reverse structural damage. Anti-inflammatory drugs developed for other conditions provide modest symptomatic relief.

The clinical data underlying today's approval, published in the New England Journal of Medicine through the pivotal ASPEN trial, represents the first evidence that bronchiectasis pathophysiology can be meaningfully interrupted. Patients receiving BRINSUPRI experienced approximately 20% fewer annual exacerbations compared to placebo—a statistically significant reduction that, while modest, establishes proof of concept for targeted intervention.

Did you know that the ASPEN trial found BRINSUPRI (brensocatib) significantly reduced annual pulmonary exacerbations in patients with non-cystic fibrosis bronchiectasis? Over 52 weeks, the 10 mg dose cut exacerbations by 21.1% and the 25 mg dose by 19.4% compared to placebo, also delaying the time to first flare-up and keeping more patients exacerbation-free. The 25 mg dose even helped slow lung function decline, all with a safety profile similar to placebo. This makes BRINSUPRI the first approved treatment specifically targeting exacerbation reduction in this chronic lung condition.

Targeting the Inflammatory Engine

BRINSUPRI's mechanism reveals why previous therapeutic approaches have fallen short. As a first-in-class dipeptidyl peptidase 1 inhibitor, the drug targets neutrophilic inflammation—the cellular machinery that perpetuates bronchiectasis progression through unchecked protease activation.

Did you know that DPP1 inhibitors can help control harmful inflammation by blocking the enzyme dipeptidyl peptidase 1, which normally activates destructive neutrophil enzymes during immune cell development? By preventing these enzymes—like neutrophil elastase, proteinase 3, and cathepsin G—from becoming active, DPP1 inhibitors reduce tissue damage, mucus buildup, and inflammatory signaling, while still preserving overall immune defense. This targeted approach can calm chronic neutrophil-driven inflammation and protect tissues in conditions such as bronchiectasis, COPD, and cystic fibrosis.

Neutrophils, the immune system's rapid-response cavalry, become trapped in bronchiectatic airways where they release destructive enzymes intended to combat infection. Instead, these weapons turn against healthy tissue, creating a self-perpetuating cycle of damage that traditional anti-inflammatory approaches cannot effectively interrupt.

This mechanistic insight carries implications extending far beyond bronchiectasis. Industry observers note that neutrophilic inflammation drives pathology in chronic rhinosinusitis, certain dermatologic conditions, and other respiratory diseases—suggesting BRINSUPRI's approval may herald a broader platform opportunity for Insmed's therapeutic franchise.

Market Genesis and Investment Calculus

The approval creates unprecedented commercial dynamics in respiratory medicine. With no existing approved therapies, BRINSUPRI enters what industry analysts describe as a "blue ocean" market—a competitive environment defined by absence rather than saturation.

This therapeutic vacuum translates into immediate strategic advantages. Unlike typical pharmaceutical launches that require displacement of existing treatments, BRINSUPRI faces no entrenched prescribing patterns or formulary positioning challenges. Payer coverage decisions will focus on clinical criteria rather than comparative effectiveness, potentially simplifying market access negotiations.

Conservative market modeling focuses on patients experiencing frequent exacerbations—those suffering two or more episodes annually or requiring hospitalization. This subset, representing approximately 20-40% of diagnosed patients, forms the core addressable population most likely to demonstrate meaningful clinical benefit and justify coverage decisions.

Pricing speculation centers on the drug's unique market position within specialty respiratory therapeutics. Industry experts suggest annual wholesale acquisition costs may range from $36,000 to $90,000, positioning BRINSUPRI alongside chronic treatments like Ofev while accounting for its first-in-class status and the substantial unmet medical need it addresses.

The Commercial Infrastructure Advantage

Insmed's existing commercial architecture provides immediate operational synergies that could accelerate market penetration. The company's established presence in pulmonology practices through ARIKAYCE, its marketed therapy for mycobacterial lung disease, creates natural cross-selling opportunities and pre-existing relationships with key opinion leaders.

This infrastructure advantage extends beyond sales force efficiency into data analytics and market intelligence. Insmed's existing patient registries and clinical partnerships in respiratory medicine provide real-world evidence capabilities that could support expanded label claims and payer value propositions as BRINSUPRI usage accumulates.

Financial capacity presents no immediate constraints. With approximately $1.9 billion in cash as of June 2025 and established revenue streams from ARIKAYCE, Insmed possesses the resources necessary for a specialty pharmaceutical launch while maintaining investment in pipeline development.

Efficacy Reality and Adoption Headwinds

Despite its historic significance, BRINSUPRI's clinical profile reflects the persistent challenges of respiratory drug development. The 20% reduction in exacerbations, while statistically significant and clinically meaningful, represents a moderate effect size that may temper enthusiasm among physicians and patients expecting transformational outcomes.

Real-world adoption will depend critically on patient selection and clinical experience with the drug's safety profile. Clinical trials identified skin-related adverse events, including hyperkeratosis, while earlier studies revealed dental complications that require ongoing monitoring. These on-target effects, stemming from the drug's mechanism of action, necessitate patient education and clinical vigilance that could influence prescribing patterns.

Some respiratory specialists emphasize that modest improvements in exacerbation rates may translate into substantial clinical benefits for patients with frequent hospitalizations, where even marginal reductions in acute episodes can meaningfully improve quality of life and reduce healthcare utilization costs.

Competitive Landscape Evolution

While BRINSUPRI currently enjoys regulatory exclusivity through 2035, emerging competitive developments suggest the therapeutic landscape will evolve significantly over the coming decade. Zambon's investigational inhaled colistimethate, targeting patients colonized with Pseudomonas aeruginosa, has received breakthrough therapy designation and addresses overlapping patient populations through a complementary mechanism.

Biologic therapies under investigation for specific bronchiectasis phenotypes represent longer-term strategic considerations. Anti-IL-5 agents like benralizumab show promise in eosinophilic patient subsets, while other targeted therapies may emerge for genetically defined bronchiectasis variants.

Unlike traditional, chemically synthesized small-molecule drugs, biologic therapies are large, complex medicines derived from living organisms. These treatments, such as monoclonal antibodies, are highly specific and work by targeting particular proteins or cells in the immune system to interrupt the disease process.

However, industry analysts view these developments as potentially expanding rather than fragmenting the bronchiectasis market. The disease's heterogeneous pathophysiology suggests multiple therapeutic approaches may prove complementary, with BRINSUPRI serving as a foundational treatment for neutrophilic inflammation while other agents target specific disease phenotypes.

Global Expansion and Strategic Horizons

International regulatory pathways promise significant market expansion opportunities. European Medicines Agency and UK regulatory submissions are under active review, with commercial launches anticipated for 2026 pending approvals. Japan filings planned for 2025 could establish presence in a third major pharmaceutical market within two years of U.S. approval.

These international opportunities carry particular significance given bronchiectasis prevalence patterns. European registries suggest higher disease recognition and diagnosis rates compared to the United States, potentially expanding addressable patient populations. Asian markets, particularly those with high tuberculosis incidence and associated post-infectious bronchiectasis, may represent substantial long-term commercial opportunities.

Investment Implications and Forward Trajectory

Financial modeling suggests BRINSUPRI's commercial trajectory could exceed typical specialty pharmaceutical benchmarks despite moderate clinical effect sizes. The combination of large patient populations, chronic treatment requirements, and therapeutic exclusivity creates favorable dynamics that may persist for several years.

Analyst consensus on projected peak sales for BRINSUPRI, showing potential revenue growth over the next decade.

| Analyst/Firm | Projected Peak Sales (USD) | Indication |

|---|---|---|

| Stifel | Approximately $3.5 billion | Non-Cystic Fibrosis Bronchiectasis (NCFBE) |

| Stifel (Stephen Willey) | Over $5 billion | Not specified |

| Insmed Investor Presentation | Over $5 billion | Bronchiectasis |

| RBC Capital Markets | $6.5 billion | Bronchiectasis |

Conservative scenarios project U.S. net revenues reaching several hundred million dollars annually within three years, with potential for multi-billion dollar trajectories if international expansion succeeds and market penetration achieves upper-range estimates. Key variables include real-world effectiveness demonstrations, payer coverage breadth, and patient persistence rates in clinical practice.

Investors should consider that BRINSUPRI's success may signal broader investment themes in neglected disease markets where moderate clinical improvements can generate substantial commercial value. The drug's trajectory will serve as a crucial test case for whether first-in-class positioning and unmet medical need can overcome limited clinical differentiation in chronic respiratory conditions.

For Insmed, BRINSUPRI represents validation of its neutrophilic inflammation platform and provides a foundation for strategic expansion into adjacent therapeutic areas. The approval establishes the company as a credible player in respiratory medicine beyond its rare disease origins, potentially attracting partnership opportunities and expanding its strategic optionality.

As the first approved therapy for non-cystic fibrosis bronchiectasis, BRINSUPRI establishes both precedent and expectation for pharmaceutical innovation in historically neglected respiratory diseases. Its commercial performance will signal whether moderate therapeutic advances can justify significant investment in chronic conditions affecting substantial patient populations—a question with implications extending far beyond the confines of pulmonary medicine.