Figure AI Raises $1 Billion to Build Humanoid Robots at Record $39 Billion Valuation

Silicon Valley's $39 Billion Bet: Figure AI's Mega-Round Signals Robot Revolution's Financial Turning Point

Humanoid robotics startup raises over $1 billion in Series C as investors pile into embodied AI race

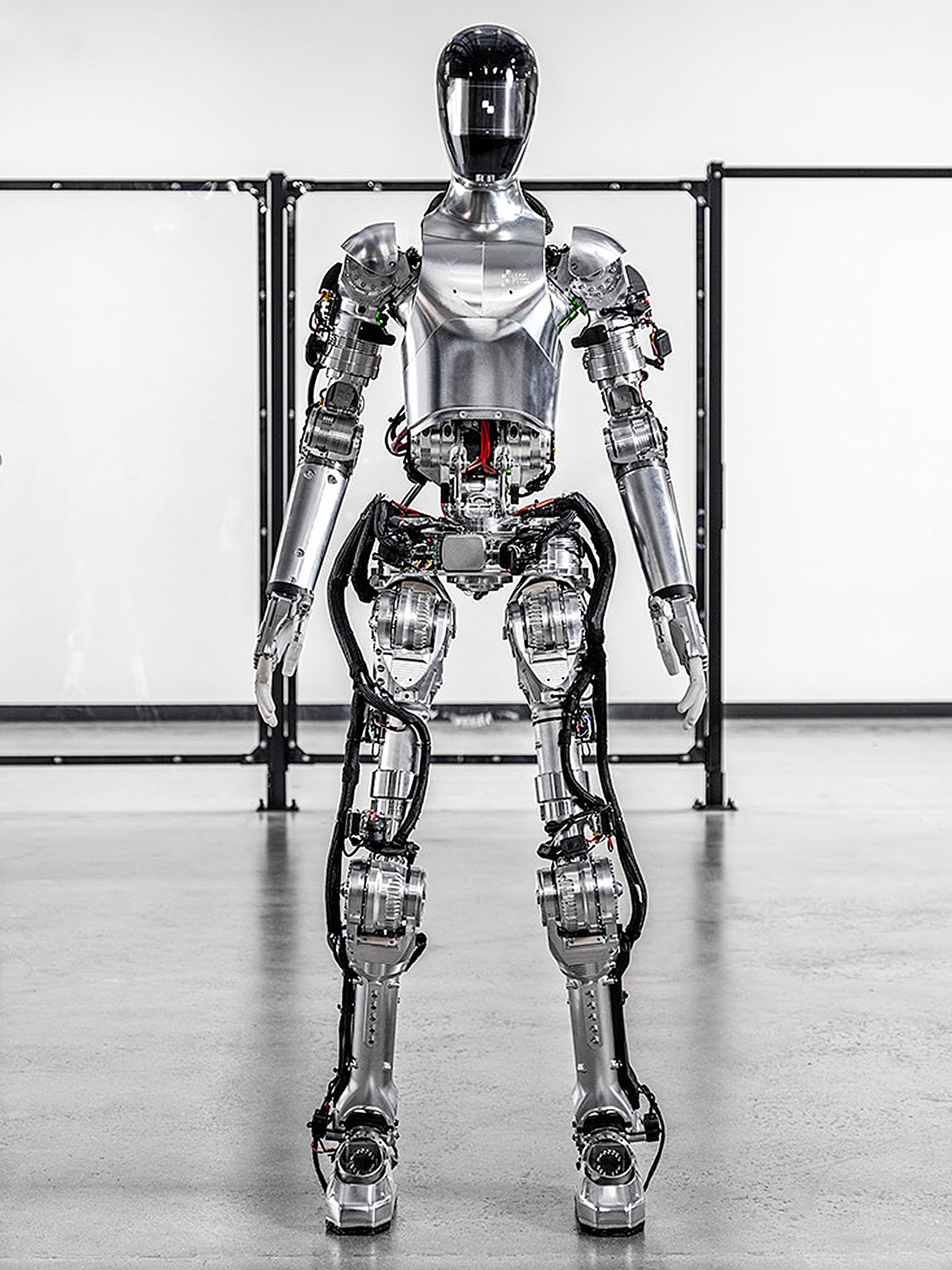

SAN JOSE, Calif. — In a funding round that would have seemed fantastical just three years ago, Figure AI announced today it has secured more than $1 billion in Series C financing at a staggering $39 billion post-money valuation, cementing the startup's position as the most valuable pure-play humanoid robotics company in the world.

The astronomical valuation—which exceeds that of established robotics companies with actual revenue streams—represents more than a 15-fold increase from Figure's $2.6 billion valuation in its previous round just last year. Led by Parkway Venture Capital, the syndicate reads like a who's who of technology infrastructure: NVIDIA, Brookfield Asset Management, Intel Capital, Qualcomm Ventures, and telecommunications giant T-Mobile Ventures, among others.

The round underscores a seismic shift in venture capital allocation, as investors rotate billions from saturated artificial intelligence software plays into what many view as the final frontier: robots that can work alongside humans in the physical world.

When Silicon Valley Dreams Meet Factory Floors

Brett Adcock, Figure's founder and CEO, frames the milestone as critical infrastructure for scaling the company's Helix AI platform and BotQ manufacturing operations. The funding will accelerate three core initiatives: expanding production of general-purpose humanoid robots, building next-generation NVIDIA GPU infrastructure for training and simulation, and launching comprehensive data collection efforts focused on human video and multimodal sensory inputs.

Yet the numbers reveal the breathtaking expectations embedded in this valuation. Industry analysts suggest that to justify a $39 billion equity value, Figure would need to deploy approximately 15,000 to 25,000 active robots generating around $144,000 in annual revenue per unit—assuming premium robotics-as-a-service pricing of roughly $30 per hour.

Robotics-as-a-Service (RaaS) is a business model where companies offer robotic capabilities, infrastructure, and support as a subscription-based service. Instead of purchasing expensive robots, businesses can access and utilize automation by paying a recurring fee, shifting from a capital expenditure to an operational expenditure model. This makes robotics more accessible and reduces upfront investment for users.

This implies Figure must transition from demonstration phase to industrial-scale deployments within the next three to four years, a timeline that would represent one of the most aggressive scaling trajectories in robotics history.

The Embodied AI Gold Rush Accelerates

Figure's mega-round sits at the apex of a broader capital migration into humanoid robotics. Apptronik secured $350 million in February with Google's participation. 1X raised $100 million for its NEO androids. Chinese robotics firm Fourier Intelligence completed an $800 million Series E. The pattern is unmistakable: venture capital is flooding into companies promising to bridge the gap between AI's digital intelligence and physical-world utility.

Venture capital funding for humanoid robotics startups has seen exponential growth in recent years.

| Year | Total Funding (USD) |

|---|---|

| 2023 | $380 million |

| 2024 | $999 million+ |

| 2025 (YTD) | $2.0 billion+ |

Several factors are driving this investment surge. The maturation of foundation models has made general-purpose robotic control theoretically viable, moving beyond narrow, rule-based automation. Simultaneously, labor shortages in logistics and manufacturing have created genuine enterprise demand for 24/7 automated workers. Aging demographics in developed economies only amplify this trend.

Embodied AI refers to artificial intelligence systems that possess a physical body, allowing them to perceive, interact with, and learn from the real world. Unlike traditional AI that primarily operates in digital environments, embodied AI develops intelligence through physical experiences and actions, leading to more robust and context-aware understanding.

The geopolitical dimension adds urgency. China's explicit state backing of embodied AI development has created a technology race dynamic, with both nations viewing humanoid robotics as strategically critical infrastructure. Export controls and supply chain bifurcation are already emerging as industry considerations.

Market Dynamics Reveal Both Promise and Peril

NVIDIA's presence across multiple humanoid robotics cap tables signals a crucial platform play. The chip giant's GR00T foundation model and Isaac simulation platform are becoming the de facto infrastructure for training robotic intelligence, creating a symbiotic relationship where successful robotics deployments drive GPU demand while advanced compute capabilities unlock robotic capabilities.

However, the valuation landscape reveals striking disparities with revenue reality. Boston Dynamics, acquired for less than $2 billion despite decades of development and actual commercial deployments, pales in comparison to Figure's paper valuation. This disparity suggests investors are pricing in not just future revenue but platform dominance and data network effects.

The competitive landscape remains fluid. Tesla's Optimus program, while generating significant publicity, has shown limited verifiable external deployment. Agility Robotics demonstrates the most credible evidence of paid commercial work through partnerships with Amazon and GXO Logistics. Meanwhile, Chinese competitors benefit from state support and domestic market access that could enable rapid scaling regardless of technological parity.

Investment Calculus Points to Infrastructure Play

The investor syndicate composition reveals strategic positioning beyond pure financial returns. NVIDIA's participation ensures compute infrastructure alignment. Telecommunications providers like T-Mobile suggest humanoids as edge computing nodes. Industrial partners like Brookfield Asset Management could provide deployment venues across their vast real estate portfolios.

This positions Figure less as a traditional robotics manufacturer and more as an integrated platform play—controlling the AI stack, a manufacturing process, and deployment infrastructure. The Apple-like vertical integration model could generate sustainable competitive advantages if execution succeeds, but also concentrates risk if key components underperform.

Manufacturing capabilities represent the most immediate execution challenge. Scaling actuator production, achieving automotive-grade reliability, and maintaining first-pass manufacturing yields above 90% will determine whether Figure can translate capital into actual deployed units. The BotQ manufacturing initiative faces the graveyard of previous robotics companies that struggled with hardware complexity and cost control.

Forward-Looking Investment Implications

Market analysts suggest several investment themes emerging from Figure's funding success. First, the robotics supply chain is poised for significant expansion, creating opportunities for component suppliers, sensor manufacturers, and specialized software providers. Companies enabling robotics deployment—from safety certification to field service infrastructure—may see accelerated demand.

Second, the labor economics implications could reshape multiple sectors. Logistics real estate investment trusts may benefit from facilities optimized for human-robot collaboration. Conversely, labor-intensive industries face potential margin compression as automation becomes more accessible.

Third, the international competitive dynamics suggest regional technology clusters will emerge. European companies may find acquisition opportunities as U.S. and Chinese ecosystems scale independently. Defense and aerospace applications, while not explicitly mentioned in current deployments, represent longer-term adjacencies with significant strategic value.

Navigating the Reality Gap

Industry observers note the substantial execution risk embedded in Figure's valuation. The transition from controlled demonstrations to high-utilization commercial deployments requires solving reliability, safety, and insurance challenges that have historically constrained robotics adoption. Mean time between failures must reach thousands of hours while maintaining sub-hour response times for service issues.

The regulatory landscape remains uncertain. As humanoid robots move beyond factory cages into collaborative environments, safety standards, liability frameworks, and insurance requirements will evolve rapidly. Companies that productize compliance capabilities may gain significant competitive advantages in enterprise sales cycles.

Customer economics present another critical factor. While early adopters may pay premium pricing around $30 per hour for robotic labor, long-term viability requires costs approaching $10-15 per hour to compete with human wages including benefits and overhead. This compression timeline will test gross margin sustainability during scaling phases.

Figure's success in attracting this unprecedented capital commitment reflects both the genuine technological progress in AI-enabled robotics and the venture capital community's recognition that embodied intelligence represents the next major platform shift. Whether the company can translate this financial foundation into the scaled commercial deployments required to justify its valuation will serve as a bellwether for the entire humanoid robotics sector.

The stakes extend beyond individual company performance to fundamental questions about the future of work, manufacturing competitiveness, and technological sovereignty in an increasingly automated world.

House Investment Thesis

| Aspect | Summary of Analysis & Key Data |

|---|---|

| Deal Headline | Figure's $1B+ Series C at a $39B post-money valuation. |

| Valuation Math | Implies industrial scale: Requires 15-25k active robots in 3-4 years. Assumptions: 4,800 hrs/yr @ $30/hr = $144k/robot/yr. Needs $2.2-3.3B revenue (12-18x forward multiple) to justify valuation. |

| Sector Context | Trend: Capital rotating from LLM-only to embodiment (Apptronik $350M, Agility $400M target, 1X $100M). NVIDIA seeding ecosystem. Outlier: Figure's $39B is an order of magnitude above peers, pricing in platform leadership, data rights, and manufacturing. |

| Root Causes for Shift | 1. Viable VLA Stack: GR00T-class models + sim (e.g., Figure's "Helix") enable cross-platform skill transfer. 2. Macro Labor Pressure: Enterprises (Amazon, GXO, auto OEMs) are now budgeting for humanoid trials. 3. Industrial Policy: China subsidizing embodied AI; US/Canada pushing strategic automation. |

| Bullish Thesis | • Warehouses/Brownfield Factories: Human form is a distribution hack for existing workcells. • Data Flywheel Moats: Large-scale, in-the-wild data capture compounds fastest. • Chip/Compute Symbiosis: Riding NVIDIA's GR00T roadmap reduces time-to-capability. |

| Skeptical Risks | • General-Autonomy Illusion: Deployments will be narrow task bundles for years. • Manufacturing Yield & MTBF: Scaling actuators/hands to automotive-grade reliability (90%+ yield, 1000+ hr MTBF) is critical. • GPU Dependency: Gross margin tied to NVIDIA's pricing/supply. • Safety/Insurance: A single high-profile injury could freeze the market. |

| Founder Playbook | 1. Pick a wedge tolerating 90-93% autonomy (e.g., pallet handling). 2. Design the entire workcell (fences, chargers), not just the robot. 3. Instrument data engine like SaaS (autonomy ratio, interventions). 4. Price for outcomes (~$30/hr anchor), not hardware. 5. Plan for spares & field service like an auto OEM. 6. Co-develop with one "design partner" per vertical. |

| VC Diligence Checklist | Product/Tech: Autonomy ratio, assist minutes, safety audits, MTBF/MTTR, sim2real gap. Manufacturing: First-pass yield, actuator BOM cost curve, monthly line rate. Commercial: Gross margin per robot-hour, pipeline quality (paid pilots), liability insurance terms. |

| Figure-Specific View | Strengths: Syndicate (NVIDIA, Brookfield) enables top-down channel; vertical integration (Helix + BotQ) could drive faster loops and lower COGS. Risk: Enormous step-up from $2.6B (2024); requires thousands of paid, high-uptime robots in 12-18 months or round looks premature. |

| Competitive Landscape | • Tesla Optimus: Strong ambition/PR; limited external proof. • Agility Robotics: Best evidence of real paid work (GXO/Amazon). • Apptronik: Strong manufacturing know-how (Jabil). • 1X: Service/Android orientation. • China Stack: Policy-backed volume; expect rapid domestic deployment. |

| Market Implications | • Pricing: Early buyers paying ~$30/hr; will compress to $12-15/hr by 2027. • Standards/Insurance: Will become kingmakers; require incident reporting and 3rd-party attestations. • Winner's Curse: Risk of winning pilots that can't be serviced, cratering reputation. |

| Bottom Line | A sector acceleration, not a one-off. The $39B valuation sets a bar for paid work at thousands-unit scale. Near-term winners will be boringly excellent at uptime, safety, and service in warehouses/factories first. |

NOT INVESTMENT ADVICE