Filevine’s $400M Raise Shakes Up Legal Tech

Filevine’s $400M Raise Shakes Up Legal Tech

Salt Lake City Startup Bets Big on AI as Industry Consolidates

The legal world is in the middle of a tech revolution, and Filevine just put itself squarely in the driver’s seat. The Salt Lake City startup has landed $400 million in equity funding over two rounds in the past 15 months, giving it one of the largest war chests in legal tech history. That kind of money doesn’t just keep the lights on—it signals a seismic shift in how lawyers will work as artificial intelligence becomes part of their everyday toolkit.

The round brought in heavyweight backers including Insight Partners, Accel, and Halo Fund, alongside longtime investors like Meritech and Stepstone. With this capital, Filevine isn’t just playing catch-up; it’s rewriting the playbook.

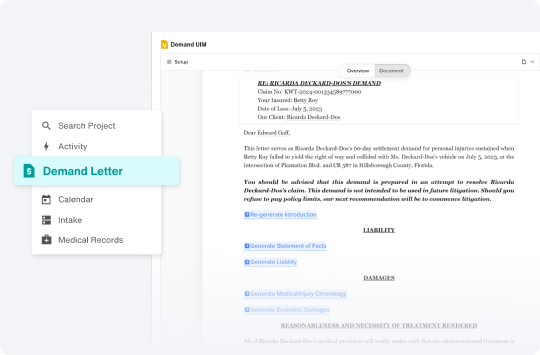

Unlike older, siloed systems that force firms to juggle a mess of disconnected apps, Filevine has built what it calls a “Legal Operating Intelligence System.” Think of it as an all-in-one cockpit for modern lawyers. The platform chews through more than 20 million pages of documents every single day, serving nearly 6,000 clients and 100,000 legal professionals ranging from small boutique firms to Fortune 500 giants and government agencies.

Goodbye Point Solutions, Hello Platforms

For decades, law firms have relied on a patchwork of tools: one system for case tracking, another for documents, a third for analytics. That model is collapsing fast. Firms now want everything under one roof, with AI seamlessly embedded instead of tacked on later.

As one industry analyst put it, “The market framework isn’t two systems anymore. Legal teams want AI woven into the fabric of their work, not bolted on.”

That demand explains Filevine’s stickiness. The company boasts a gross retention rate north of 96% and a net dollar retention rate topping 120%. When AI is baked into workflows that lawyers can’t live without, they tend to stay put.

Net Dollar Retention (NDR) measures the percentage of recurring revenue retained from existing customers over a period, factoring in upgrades, downgrades, and churn. It's a key metric for investors, particularly in SaaS, indicating customer health and growth potential, with rates often above 100% considered very strong.

AI Revenue Surpasses Traditional Software

Hidden in the funding news was an eye-catching detail: Filevine now makes more money from AI features than from its traditional software products. That’s a milestone few legal tech companies have reached, let alone revealed publicly.

And growth is nothing short of explosive. AI-driven tools like Filevine’s deposition workflows and medical chronology products are seeing weekly growth of more than 20%. These aren’t gimmicks; they’re tools that shave hours off legal tasks, the kind of time savings lawyers are willing to pay a premium for.

Illustrative chart showing rapid year-over-year growth in AI-based revenue for a SaaS company like Filevine.

| Year | Annual Revenue | Year-over-Year Growth |

|---|---|---|

| 2024 | $2,300,000 | 130% |

| 2025 | $5,290,000 | 130% |

| 2026 | $12,167,000 | 130% |

During due diligence, investors spotted what they called “heavy daily usage” of these AI features. No surprise then that Filevine reported about 130% year-over-year growth in AI revenue.

Fuel for a Consolidating Market

The timing of this raise couldn’t be more strategic. Legal tech is consolidating at breakneck speed. Old titans like Thomson Reuters and LexisNexis are packing AI into their sprawling ecosystems. Upstarts like Harvey AI and Clio are also raising massive rounds—Harvey at a $5 billion valuation, Clio with $900 million—proving that investors want to back platforms, not isolated tools.

Recent major funding rounds in the legal tech industry, comparing companies like Filevine, Harvey AI, and Clio.

| Company | Funding Round Type | Amount | Date (or Period) | Lead Investors |

|---|---|---|---|---|

| Filevine | Multiple Rounds | $400 Million | 2024-2025 | Insight Partners, Accel, Halo Fund |

| Harvey AI | Series E | $300 Million | June 2025 | Kleiner Perkins, Coatue |

| Clio | Unspecified | $900 Million | 2024 | Not specified |

| Legora | Series A | $25 Million | 2024 | Redpoint Ventures |

That leaves smaller, specialized AI firms in a tough spot. Without deep integration, many will either be acquired or disappear. Filevine’s fresh $400 million gives it ample firepower to scoop up niche players—think deposition analytics or evidence management startups—and fold them into its broader platform.

Big Firms, Big Expectations

Small and mid-sized firms may have embraced AI first, but the real prize lies with enterprise clients and government contracts. These buyers demand more than shiny features. They want airtight security, explainable AI, and compliance with strict regulations.

So far, Filevine seems up to the task. Its growing list of Fortune 500 clients and government agencies shows it’s winning trust at the highest levels. Government deals in particular come with steep hurdles like FedRAMP certification, but once those barriers are cleared, switching costs skyrocket. For Filevine, that means long-term contracts and deep customer lock-in.

FedRAMP Certification is a rigorous government standard for cloud security, designed to ensure that cloud products and services meet strict federal requirements. For businesses, achieving this certification is essential to provide cloud solutions to U.S. government agencies safely and securely.

What Investors See

For institutional investors, Filevine’s round highlights where the sector is headed. Companies that can:

- Show high adoption of AI features

- Build usage-based revenue models

- Consolidate fragmented tools

…are likely to draw the most capital over the next two years.

Yes, Filevine’s all-equity raise dilutes existing shareholders, but it gives the company maximum flexibility to plow resources into AI infrastructure—something that will only grow more expensive. Expect other growth-stage legal tech startups to follow the same playbook.

The Road Ahead

Next on Filevine’s agenda: expand its deposition product line, deepen enterprise relationships, and leverage its massive dataset—20 million pages processed daily—to sharpen its AI models. That dataset alone is a moat many competitors simply can’t replicate.

Legal tech as a whole is heading toward one outcome: consolidation around platforms that can do it all. The winners will be those who scale fast without sacrificing margins or user experience.

But this story isn’t just about legal tech. Filevine’s success shows a bigger truth: vertical software platforms with AI at their core—and real traction with enterprise buyers—can command sky-high valuations even in niche markets. It’s a recipe likely to ripple into accounting, consulting, and other professional services industries where AI adoption is still just beginning.

Lawyers everywhere face rising caseloads and relentless client demands. The firms that thrive will be the ones that don’t just work harder but work smarter—with AI quietly handling the grunt work in the background. Filevine, flush with $400 million, is betting it can be the platform to make that future happen.

NOT INVESTMENT ADVICE