Genomic Surgery Goes Global - Abu Dhabi-UCSF Alliance Signals New Era in CRISPR Commercialization

Genomic Surgery Goes Global: Abu Dhabi-UCSF Alliance Signals New Era in CRISPR Commercialization

The gleaming medical campus rising from Abu Dhabi's desert landscape may soon house something unprecedented: surgeons who operate not with traditional scalpels, but with molecular tools that cut and repair DNA itself. In what industry experts are calling a pivotal moment for genomic medicine, the Department of Health – Abu Dhabi has partnered with the University of California, San Francisco and the Innovative Genomics Institute to establish the world's first dedicated genome surgery centers on two continents.

The initiative, announced today at a closed-door summit in the UAE capital, aims to transform CRISPR gene editing from an experimental approach into a standard clinical treatment for severe genetic conditions. While the financial terms remain undisclosed, sources familiar with the agreement describe it as a "multi-billion dollar commitment" spanning a decade of development.

From Lab Breakthrough to Global Treatment Centers

The Abu Dhabi-UCSF-IGI partnership represents more than scientific collaboration—it's an industrial-scale bet on genomic medicine's future. Each partner brings distinct advantages: Abu Dhabi contributes its massive Emirati Genome Programme dataset of over 800,000 sequenced genomes, UCSF brings world-leading expertise in pediatric and fetal therapy, and IGI—co-founded by Nobel laureate Jennifer Doudna—supplies cutting-edge gene-editing research and a crucial 2023 scale-up agreement with Danaher Corporation.

"This is an extraordinary time to be in medicine, when we have the opportunity to develop life-saving therapies for patients with severe genetic conditions," said Dr. Tippi MacKenzie from UCSF in the announcement.

Dr. Fyodor Urnov of IGI emphasized both the humanitarian and industrial dimensions: "The mission is to make [CRISPR] the standard of medical care, no matter where such a child is born."

Beyond the Breakthrough: Manufacturing Becomes the Bottleneck

For investors and industry analysts, the significance of this development extends beyond scientific innovation. While CRISPR's potential has been heralded for years, the Abu Dhabi initiative highlights a critical shift in focus from discovery to delivery.

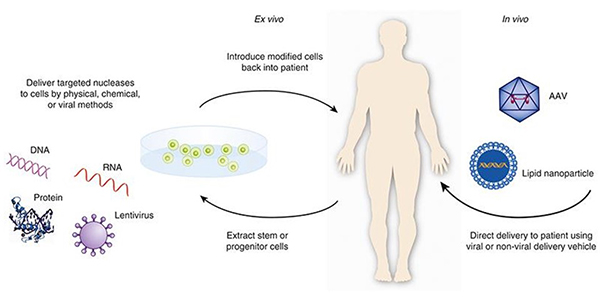

"We're entering genomic medicine's industrial phase," explains a senior healthcare analyst at a major investment bank who requested anonymity. "The question is no longer 'Can we edit genes safely?' but 'Who can edit cheaply and at scale?' The centers in Abu Dhabi and San Francisco will be proving grounds for industrial-scale bioprocessing and delivery."

This manufacturing challenge is reflected in current treatment economics. The first FDA-approved CRISPR therapy—Vertex and CRISPR Therapeutics' Casgevy for sickle cell disease—costs approximately $2 million per patient, with manufacturing costs alone estimated at $1.5-2 million. Such economics remain prohibitive for widespread adoption.

A Market Poised for Explosive Growth

The initiative comes amid projections of extraordinary growth across genomic medicine. Market analysts estimate the global genomics market will surge from approximately $33 billion today to over $400 billion by 2030—a nearly 20% compound annual growth rate. The gene therapy segment alone is projected to reach $55 billion by 2034.

Financial data reveals a market still grappling with how to value this potential. Despite the December 2023 approval of the first CRISPR therapy and over 90 ongoing clinical trials, pure-play gene editing companies have experienced volatile valuations:

- CRISPR Therapeutics trades at just under $3 billion market capitalization despite its approved therapy

- Intellia Therapeutics has fallen below $1 billion valuation even as its lead candidate enters pivotal trials

- Beam Therapeutics , specializing in next-generation base editing, trades at a price that values its intellectual property and pipeline at less than half its cash reserves

A Strategic Gambit in the Geopolitics of Biotechnology

The partnership reveals Abu Dhabi's ambition to diversify beyond oil and establish itself as a biomedical powerhouse. The UAE's investment follows a pattern of Gulf sovereign wealth funds viewing population genomics as strategic assets comparable to natural resources.

"This is essentially industrial policy in action," notes a London-based biotechnology consultant. "Abu Dhabi supplies the capital, dataset, and regulatory flexibility; UCSF and IGI provide the intellectual property, talent pipeline, and FDA credibility. Each side gets something they couldn't easily build alone."

The centers will pursue what many consider medicine's highest-value frontier: fetal and early childhood intervention for severe genetic conditions. By treating these conditions before birth or shortly after, the partners aim to prevent lifelong disability and drastically reduce healthcare costs over patients' lifetimes.

The Investment Thesis: Infrastructure Before Therapies

For professional investors monitoring this development, the clearest implications may be for companies positioned along the supply chain rather than therapeutic developers themselves.

"Own the picks and shovels," advises a portfolio manager specializing in healthcare innovation. "The Abu Dhabi center represents an industrial build, not just a scientific experiment. Bioprocess hardware, single-use consumables, quality control analytics, and cold-chain logistics will scale before patient volumes justify big biotech P&Ls."

Companies like Danaher Corporation, which has partnered with IGI through its Cytiva and Pall subsidiaries to provide manufacturing capability, may benefit disproportionately as the infrastructure for genome surgery expands globally.

Risk Factors and Forward Outlook

Despite the initiative's promise, significant challenges remain. Regulatory frameworks for genetic therapies vary widely internationally, manufacturing complexity creates quality control hurdles, and ethical concerns about genetic intervention—especially in fetal applications—persist.

The next 18 months will prove critical, with key milestones including:

- Potential FDA approval pathway decisions for next-generation editing approaches

- EMEA review of pediatric applications for existing CRISPR therapies

- Binding construction contracts for the Abu Dhabi facility

Industry experts predict the partnership will accelerate investment in manufacturing capacity, potentially compress development timelines for clinical-stage assets, and increase competition among countries seeking to establish leadership in genomic medicine.

For patients with severe genetic conditions and their families, the initiative represents something more fundamental: hope that cutting-edge science might soon translate into accessible treatments, regardless of geography or economics.

"The genome surgery centers represent a fundamental shift," says a patient advocate who has worked with both UCSF and Abu Dhabi. "We're moving from asking 'What's theoretically possible?' to 'How quickly can we get this to every child who needs it?'"

Disclaimer: This article contains market analysis and forward-looking perspectives based on current data and trends. Past performance does not guarantee future results. Readers should consult financial advisors before making investment decisions.