GM Appoints Aurora Co-Founder Sterling Anderson as New Chief Product Officer to Lead Software-Hardware Integration

GM's Strategic Move: Silicon Valley's Autonomy Architect Takes the Wheel

Aurora Co-Founder Brings Software-First Mindset to Detroit's Manufacturing Giant

DETROIT — General Motors announced Monday the appointment of Sterling Anderson as its new executive vice president of global product and chief product officer, a newly created position that consolidates unprecedented power over both hardware and software development.

Anderson, who co-founded autonomous trucking company Aurora and previously directed Tesla's Autopilot program, will assume his duties on June 2, operating from GM's Mountain View Tech Center in California rather than the company's Detroit headquarters. The appointment comes just one week after Anderson announced his departure from Aurora, which recently launched America's first commercial fully driverless trucking service between Houston and Dallas.

"The scope of the opportunity to shape future mobility at a company with GM's rich heritage and bold vision is extraordinary," Anderson said in an interview following the announcement. "Mary Barra and Mark Reuss have built a solid foundation for change."

The timing of Anderson's arrival couldn't be more critical for GM. The automotive giant recently lowered its 2025 earnings guidance, projecting a $4-5 billion hit from President Trump's auto tariffs, revising its adjusted earnings downward to $10-12.5 billion from the previous $13.7-15.7 billion. The company has also faced software quality issues, including problems that temporarily halted sales of the Blazer EV.

GM's Adjusted Earnings Guidance Revision for 2025.

| Metric | Initial 2025 Guidance (Jan 2025) | Revised 2025 Guidance (May 1, 2025) | Notes |

|---|---|---|---|

| Adjusted EBIT | $13.7B - $15.7B | $10.0B - $12.5B | Revised guidance incorporates an estimated $4B - $5B tariff impact. |

| Net Income (Attributable) | $11.2B - $12.5B | $8.2B - $10.1B | Lowered due to updated outlook including tariff exposure. |

| Adjusted EPS (Diluted) | $11.00 - $12.00 | $8.25 - $10.00 | Reflects updated EBIT and Net Income forecasts. |

| Adjusted Auto Free Cash Flow | $11.0B - $13.0B | $7.5B - $10.0B | Reduced forecast following tariff impact assessment. |

|

A 'Full-Stack' Executive with Unprecedented Authority

In creating this new position, GM has given Anderson exceptional authority over product development. His expansive role includes oversight of the complete product lifecycle for GM's entire vehicle lineup, from traditional internal combustion engines to electric vehicles. His responsibilities will encompass hardware and software integration, services and user experience development, vehicle and manufacturing engineering, and battery and software product management.

"Our customers are expecting more from our vehicles than ever before," GM President Mark Reuss explained. "We have an opportunity to evolve the way we build from the ground up, with tighter integration between software and hardware, shorter development cycles, and an unwavering focus on a seamless customer experience."

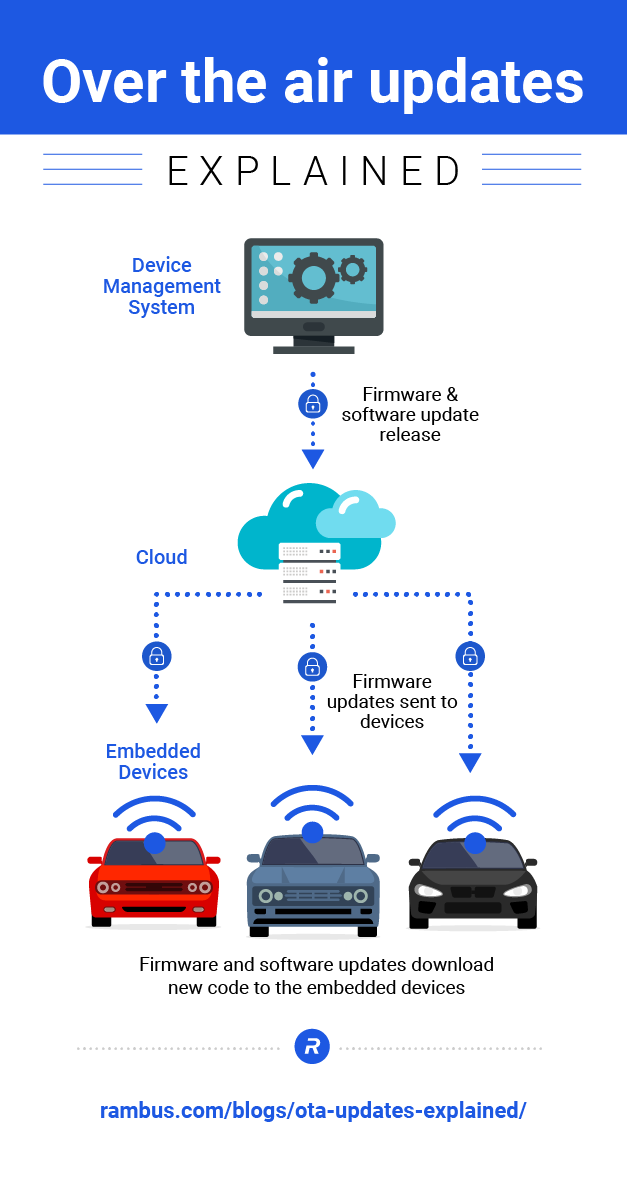

A Software-Defined Vehicle (SDV) represents an automotive concept where features and functions are primarily enabled and controlled through software, rather than being solely dependent on hardware. This highlights the growing importance of software in modern cars, allowing for updates, upgrades, and new functionalities to be delivered over the vehicle's lifetime.

Several key GM executives will report directly to Anderson, including Kurt Kelty, who heads battery propulsion and sustainability and also came from Tesla, as well as the heads of global manufacturing, product engineering, software and services, and vehicle product programs, safety and integration.

"This isn't just another executive appointment," noted an industry analyst who requested anonymity. "GM is effectively rewiring its entire product development process around a software-first methodology at precisely the moment when the industry is transforming. Anderson's authority spans areas that traditionally operated in silos."

From MIT to Tesla to Aurora to GM: A Career Built on Automation

Anderson's career trajectory has prepared him uniquely for this role. He holds master's and Ph.D. degrees in robotics from the Massachusetts Institute of Technology, where he developed advanced human-machine interface systems. At Tesla, he led the Model X program and directed the Autopilot team during its critical evolution from Level 1 to Level 2 automation capabilities.

The SAE J3016 standard outlines six levels of driving automation, ranging from Level 0 (no automation) to Level 5 (full self-driving). These levels primarily differentiate Advanced Driver-Assistance Systems (ADAS) and autonomous capabilities based on whether the human driver or the automated system is responsible for monitoring the driving environment and performing driving tasks.

In 2017, Anderson co-founded Aurora with Chris Urmson, the former head of Google's self-driving project, and Drew Bagnell, who previously led Uber's autonomy team. Aurora achieved a significant milestone just before Anderson's departure, launching the first commercial fully driverless Class 8 freight service in Texas.

"Leaving Aurora is one of the most difficult decisions I've ever made, especially given the exciting stage Aurora is at," Anderson told Aurora investors. His board position at Aurora will end on August 31, 2025.

Strategic Inflection Point: From Robotaxis to Personal Vehicles

Anderson's appointment aligns with GM's recent strategic pivot away from the Cruise robotaxi model, which the company effectively abandoned in December 2024. Instead, GM has refocused on enhancing autonomy in personal vehicles and accelerating adoption of its Super Cruise hands-free driving technology, which it plans to implement across more than 20 models and 750,000 miles of mapped roads.

"The hiring of Anderson the very next quarter after this strategic shift makes the company's intentions crystal clear," said a veteran automotive analyst who spoke on condition of anonymity. "They're doubling down on making advanced driver assistance systems a core consumer product rather than pursuing the fleet robotaxi model that has proven challenging for the entire industry."

This strategic reorientation comes as GM has cut approximately 1,000 software jobs to refocus on "high-priority" initiatives, raising questions about potential cultural clashes between Silicon Valley's software-first approach and Detroit's manufacturing traditions.

Potential Financial Transformation Through Software

The financial implications of Anderson's appointment could be substantial. Industry experts suggest that under Anderson's leadership, GM could transform Super Cruise into a subscription-based service similar to Ford's BlueCruise but at a much larger scale, potentially generating $4 billion in high-margin annual revenue.

Projected Annual Revenue Potential for Automotive ADAS Subscription Services.

| Service/Company | Projected Annual Revenue / Target Earnings | Timeframe / Target Year |

|---|---|---|

| GM Super Cruise | ~$2 Billion USD. | Annually within 5 years (from early 2025). |

| Mercedes-Benz Software Subscriptions | Target of $1.06 Billion USD, planning to double revenue by 2030. | By 2025. |

| Stellantis Software Subscriptions | Plans for $22.5 Billion USD in earnings through value-added services. | By 2030. |

"If GM can successfully execute a software subscription model for its autonomy features, we could see an addition of 200-300 basis points to EBIT margin by 2028," suggested a market strategist who specializes in the automotive sector. "The current share price around $45 reflects tariff concerns but fails to account for this potential transformation."

General Motors (GM) Stock Price Performance (Past Year).

| Date | Open | High | Low | Close/Last | Volume |

|---|---|---|---|---|---|

| May 9, 2025 | $47.56 | $47.97 | $47.25 | $47.50 | 8,582,913 |

| May 8, 2025 | $46.10 | $47.72 | $46.09 | $47.35 | 14,499,470 |

| May 7, 2025 | $45.71 | $45.94 | $44.97 | $45.47 | 8,711,862 |

| May 6, 2025 | $45.01 | $45.97 | $44.84 | $45.46 | 9,638,215 |

| May 5, 2025 | $45.28 | $45.75 | $45.15 | $45.38 | 8,084,268 |

| May 2024 | $44.06 | $45.64 | $41.85 | $44.55 | 257,872,500 |

| Apr 2024 | $44.68 | $45.71 | $41.60 | $44.09 | 311,653,100 |

| Mar 2024 | $40.41 | $45.09 | $38.57 | $44.90 | 382,667,100 |

| Feb 2024 | $38.68 | $40.93 | $37.12 | $40.58 | 325,071,300 |

| Jan 2024 | $38.30 | --- | --- | $38.80 | --- |

Anderson's experience could also streamline GM's vehicle platform architecture, potentially reducing costs of goods sold by up to 100 basis points through fewer electronic control units and over-the-air-driven variants. His unified approach to battery and software roadmaps might accelerate GM's electric vehicle programs, potentially reducing the typical 40-month development cycle by up to six months.

An Electronic Control Unit (ECU) serves as the embedded 'brain' for specific systems within a vehicle, managing functions like the engine, transmission, or brakes. While modern cars traditionally utilize numerous ECUs, there is an increasing trend towards consolidating these into fewer, more powerful domain controllers.

"Advanced technologies have opened opportunities to revolutionize not just how we create products, but what those products can be and do," Anderson said, hinting at his transformative vision for GM's future offerings.

Challenges Ahead: Culture, Execution, and Tariffs

Despite the strategic potential, Anderson and GM face significant challenges. Previous Silicon Valley executives have struggled to adapt to Detroit's corporate culture; former Apple executive Mike Abbott's brief tenure at GM highlights this risk. Additionally, Anderson must address existing software quality issues while simultaneously developing new autonomy capabilities.

The macroeconomic environment adds further complexity. President Trump's 25% auto tariffs are projected to reduce GM's 2025 EBITDA by $4-5 billion, with vehicles imported from South Korea particularly affected. These tariffs could constrain capital available for the research and development necessary to execute Anderson's vision.

Industry-Wide Implications

Anderson's move to GM has sent ripples through the automotive industry. Aurora now faces questions about its future direction without one of its visionary founders, with some analysts suggesting it could become an acquisition target for companies seeking to internalize AI freight capabilities.

For GM's competitors like Tesla, Ford, and Stellantis, Anderson's appointment signals a need to accelerate their own Level 3 automation ambitions. Tier-1 suppliers may need to recalibrate their strategies if GM pursues greater vertical integration under Anderson's leadership.

"This is a watershed moment for the industry," remarked an investment banker specializing in automotive technology. "GM has effectively declared that the future will be defined by software-defined vehicles, and they've hired one of the industry's most accomplished practitioners to lead that transformation."

Key Milestones to Watch

As Anderson prepares to assume his new role, investors and industry observers will be watching several key indicators of his impact. His day-one strategy memo in June could provide early insights into his approach. GM's Q3 2025 Investor Day will likely feature the first unified product roadmap under his leadership. By late 2025, any pilot subscription revenue from Super Cruise would signal progress toward the software-driven business model.

Longer term, the implementation of zonal electrical architecture in 2027 model-year Cadillacs would demonstrate Anderson's ability to fundamentally reshape GM's engineering approach. Any regulatory movement toward "eyes-off" Level 3 automation rules would potentially widen GM's first-mover advantage under Anderson's guidance. With Anderson's appointment, GM has placed a decisive bet on software-defined vehicles as the future of transportation. For a company founded in 1908 on the principles of mass manufacturing, this represents nothing less than a fundamental reimagining of what an automobile company can be in the 21st century.

"The Street sees tariff potholes," concluded one portfolio manager who specializes in mobility investments. "I see a chance to buy a 20th-century titan that just installed a 21st-century operating system."