Nuclear-Armed India and Pakistan Exchange Fire as Airports Close and Markets React

Calculated Escalation: India-Pakistan Exchange Fire as Global Powers Urge Restraint

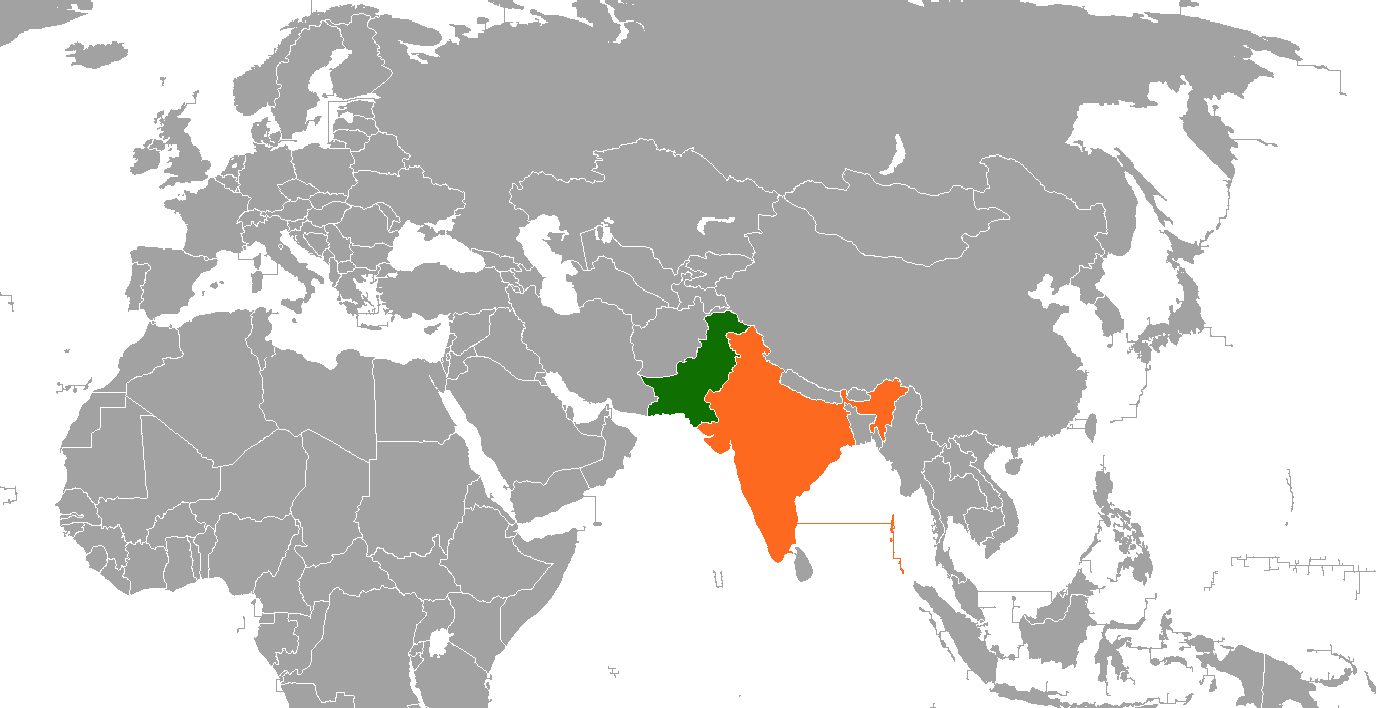

WASHINGTON — As dawn broke over the disputed Kashmir region on Tuesday, residents awoke to the sound of artillery fire and air raid sirens, marking the most significant military confrontation between nuclear-armed India and Pakistan in years. The exchange, which Pakistan claims has resulted in civilian casualties and downed aircraft, has sent tremors through diplomatic circles and financial markets alike, though analysts suggest the conflict remains contained for now.

Secretary of State Marco Rubio announced that the United States is actively engaged with both nations, maintaining "close contact with both Indian and Pakistani counterparts" while emphasizing Washington's commitment to promoting dialogue and de-escalation in the volatile region.

"We are maintaining direct communication channels with leadership in both New Delhi and Islamabad," a senior State Department official said. "There's significant concern, but also a measured confidence that cooler heads will prevail given the economic and geopolitical stakes."

Operation Sindhur: India's Calculated Response

The Indian government has framed its military actions as "Operation Sindhur," describing it to American officials as a precise operation targeting only known terrorist camps, deliberately avoiding civilian populations and economic infrastructure. During a call with Secretary Rubio, Indian National Security Advisor Ajit Doval emphasized the targeted nature of their strikes.

"This was not an escalation against Pakistan itself, but rather a necessary security action against specific threats," said a regional security expert affiliated with a Washington think tank. "The precision narrative is crucial for India's diplomatic positioning."

The careful framing reflects Prime Minister Modi's delicate balancing act as state elections approach. Military analysts note that this approach allows India to project strength domestically while maintaining a path toward de-escalation internationally.

Pakistan Claims Civilian Casualties and Military Victories

The Pakistani response has been multifaceted, combining claims of defensive victories with accusations of Indian aggression against civilian targets. The Inter-Services Public Relations, Pakistan's military media wing, released statements describing 24 Indian attacks across six locations that allegedly killed eight civilians, including a three-year-old girl at a religious site in Punjab province. The attacks reportedly injured 31 others and destroyed several buildings.

"What we're seeing is classic information warfare on both sides," said a former U.S. defense attaché who served in South Asia. "Pakistan needs to demonstrate both victimhood to secure international sympathy and military competence to satisfy domestic audiences."

In a press conference that projected both defiance and openness to dialogue, Pakistani Defense Minister Khawaja Muhammad Asif characterized their military response as defensive rather than aggressive. "If these hostile acts cease, we are fully prepared to engage in dialogue with India," he stated. "We do not seek escalation, but we will respond if provoked."

Pakistani officials claim to have shot down five Indian fighter jets and captured Indian soldiers, assertions that India has not publicly addressed.

Economic Fallout: Air Travel Disruptions and Market Reactions

The conflict has already disrupted regional air travel and sent ripples through financial markets. Qatar Airways announced the suspension of all flights to Pakistan, citing airspace closure. Indian authorities temporarily shut down multiple airports in northern regions as a precautionary measure, while major Indian carriers issued travel advisories early Wednesday morning.

"This is the first concrete economic impact," noted a global transportation analyst. "Pakistan loses approximately $140,000 daily in overflight fees alone, a significant blow for a nation already facing acute foreign exchange reserve challenges."

Financial markets have responded with notable but measured movements. The Indian rupee experienced heightened volatility, with one-month implied volatility reaching two-year highs. Indian defense stocks surged 10-20% week-over-week, while Pakistan's Karachi KSE-100 index fell 4% across two trading sessions.

"Markets are signaling that this is a headline risk shock rather than a macro event with lasting economic consequences," explained a senior emerging markets strategist at a global investment bank. "Oil prices have barely budged, suggesting traders see little threat to global supply chains or energy infrastructure."

The China Factor: Beijing's Strategic Support for Pakistan

Complicating the regional dynamics is China's apparent support for Pakistan. Recent footage showing Pakistani Air Force JF-17 Block III fighters equipped with advanced Chinese PL-15 air-to-air missiles with a 200-kilometer range has raised concerns about Beijing's military backing.

"China is effectively using Pakistan as a testing ground for their advanced weapons systems against Western and Russian equipment in India's arsenal," suggested a military technology analyst who studies Sino-Pakistani defense cooperation. "This adds a layer of proxy competition beyond the bilateral India-Pakistan tensions."

With Chinese President Xi Jinping currently heading for Moscow, however, analysts believe Beijing will limit its involvement to avoid overshadowing its diplomatic initiatives with Russia.

Resource Limitations May Force Diplomatic Resolution

Despite the heated rhetoric, both nations face practical constraints that may ultimately force a diplomatic resolution. Multiple defense experts point to ammunition stockpiles as a critical factor, with one assessment suggesting India has only 10-12 days' worth of munitions for sustained conflict.

"Modern warfare burns through resources at an unprecedented rate," explained a former military logistics planner who has worked with South Asian armed forces. "Neither side can afford a prolonged engagement without significant external support."

Pakistan faces even more immediate economic pressures. With foreign exchange reserves reportedly below $10 billion and an IMF program review scheduled for June, Islamabad has strong financial incentives to seek rapid de-escalation.

Market Perspectives: Investment Implications

For investors navigating the geopolitical uncertainty, the current assessment suggests differentiated approaches across asset classes.

Global defense manufacturers like Lockheed Martin, RTX, and Rheinmetall have seen positive momentum, with Leidos shares climbing 4.6% on Monday. Industry observers suggest these tactical positions make sense in the short term but caution against chasing performance beyond 7-10% gains.

Currency markets present both risks and opportunities. Strategists anticipate potential rupee weakness to approximately 86.5 against the dollar if another strike occurs, though India's substantial $600 billion in reserves gives the Reserve Bank of India ample firepower to stabilize currency movements.

"The smart money is fading extreme moves in rupee volatility," said a currency derivatives strategist at an Asian investment bank. "History shows these geopolitical flare-ups typically create overreactions in implied volatility that subsequently normalize."

Probable Scenarios

Most analysts assign the highest probability—approximately 60%—to a "contained clash" scenario featuring 7-10 days of sporadic fire along the Line of Control without targeting major population centers. This base case would likely see the Indian rupee returning to around 84.5 against the dollar, with Indian equities potentially reaching new highs.

A more concerning "escalation" scenario, assigned roughly 25% probability, envisions India striking deeper into Pakistani territory with Pakistan retaliating against infrastructure targets. This would likely push oil prices up by approximately $5 per barrel and significantly pressure Pakistani financial assets.

The least likely but most catastrophic scenario—a "black swan" event involving misidentification leading to strikes on civilian centers—remains a tail risk that prudent investors are hedging against through positions in traditional safe havens.

Watching for Signals

For those monitoring developments, several key indicators may signal the conflict's trajectory. These include the ratio of rhetoric to confirmed damage in military briefings, the duration of Pakistan's airspace closures, and any shift in diplomatic language from Washington or Beijing from "urging restraint" to stronger condemnation.

As tensions simmer along one of the world's most militarized borders, the international community continues to press for dialogue while preparing for all contingencies in a region where miscalculation carries nuclear implications.