Infineon Completes $2.5 Billion Purchase of Marvell's Car Networking Technology Business

The $2.5 Billion Handshake That Rewires Tomorrow's Machines

MUNICH — In the boardrooms of Germany's semiconductor capital, regulatory documents bearing today's date confirmed what industry insiders have been anticipating since April: Infineon Technologies has successfully completed its $2.5 billion acquisition of Marvell Technology's Automotive Ethernet business.

The transaction represents more than corporate consolidation—it signals the emergence of an infrastructure revolution that extends far beyond transportation. As machines across industries demand increasingly sophisticated communication capabilities, the technologies enabling split-second coordination between sensors, processors, and actuators are becoming the nervous system of an automated economy.

"This transaction significantly reinforces our number one position in automotive semiconductors and strengthens our strategy of profitable growth," said Jochen Hanebeck, CEO of Infineon, as the deal officially closed following months of regulatory review.

The acquisition brings several hundred engineers and a design-win pipeline valued at approximately $4 billion through 2030 into Infineon's portfolio—commitments that reflect automotive development's unique characteristic where today's supplier relationships determine revenue streams extending well into the next decade.

The Architecture of Autonomous Intelligence

At its essence, this acquisition addresses a fundamental challenge facing every industry embracing automation: how do machines communicate with the speed and reliability that autonomous operation demands?

Automotive Ethernet is a high-speed physical network designed for in-vehicle communication, acting as a powerful upgrade to older standards like the CAN bus. It provides the high bandwidth required to support the massive data loads from modern features like advanced driver-assistance systems (ADAS), high-resolution displays, and infotainment.

Traditional automotive communication systems, designed for simpler times when vehicles primarily transported rather than computed, are proving inadequate for the new reality. Modern vehicles generate terabytes of data daily as sensors, cameras, and radar systems continuously map their environment—information that must be processed and acted upon in microseconds when software controls acceleration, braking, and steering decisions.

The Brightlane Automotive Ethernet portfolio now under Infineon's control represents sophisticated infrastructure supporting data transmission rates from 100 megabits per second to 10 gigabits per second. This bandwidth enables real-time coordination between dozens of sensors while maintaining the split-second timing necessary for safe autonomous operation.

Industry data underscores the market's trajectory: automotive Ethernet is experiencing compound annual growth rates exceeding 20 percent, driven not only by vehicle automation but by parallel demands in manufacturing facilities where robotic systems require similar precision timing and data processing capabilities.

Table: Comparison of CAGR for Automotive Ethernet and Overall In-Vehicle Networking Market

| Technology/Market Segment | Approximate CAGR Range | Forecast Period | Key Growth Drivers |

|---|---|---|---|

| Automotive Ethernet Market | 13.6% – 19.7% (up to 24.5%) | 2023–2030/2032/2035 | High-speed, low-latency communication for ADAS, infotainment, V2X, software-defined vehicles, zonal architectures |

| Overall In-Vehicle Networking Market | ~7.4% – 9.2% | 2024–2032/2033 | Gradual adoption of new protocols alongside CAN, LIN, FlexRay; increased connectivity features |

"The acquisition creates new opportunities in the field of physical AI, such as humanoid robots," Hanebeck noted, highlighting applications that extend far beyond traditional automotive boundaries into emerging sectors where similar communication challenges exist.

Did you know that Physical AI combines artificial intelligence with real-world hardware—like sensors, cameras, and robotic actuators—so machines can see, understand, and physically interact with their surroundings? Unlike traditional AI that works mainly in virtual environments, Physical AI empowers robots and autonomous systems to perceive changes in real time, make decisions on their own, and adapt their actions in dynamic, unpredictable settings. This emerging field draws on disciplines from computer science to materials engineering and is already powering innovations like autonomous vehicles, smart manufacturing machines, AI-driven healthcare robots, and agile robots such as Boston Dynamics’ Spot, capable of navigating and performing tasks in challenging environments.

Financial Architecture and Strategic Calculation

The deal's structure reveals sophisticated strategic thinking beneath what might initially appear an aggressive valuation. At approximately ten times the acquired business's projected 2025 revenue of $225-250 million, the multiple reflects premium positioning in a market where technical barriers to entry remain formidable.

The acquired business operates with gross margins approaching 60 percent—profitability levels associated with highly specialized technologies requiring years of development and extensive intellectual property portfolios. Unlike commodity semiconductor markets, automotive Ethernet demands compliance with stringent safety standards and long-term supply commitments that create natural competitive barriers.

Infineon financed the acquisition through existing liquid funds supplemented by additional debt capital, indicating confidence in both the technology trajectory and the company's ability to service increased leverage through improved operational performance. The creation of a dedicated "Ethernet Solutions" business line within Infineon's Automotive division signals intentions for focused expansion rather than integration dilution.

Table: Infineon’s Q3 FY2025 Revenue Breakdown by Business Segment and Strategic Highlights

| Business Segment | Revenue (€ million) | % of Total Revenue | QoQ Change | YoY Change | Segment Result (€ million) | Segment Result Margin | Strategic Notes |

|---|---|---|---|---|---|---|---|

| Automotive | 1,870 | 50.5% | +1% | -3% | 371 | 19.8% | Largest division; growth driven by software-defined vehicles; boosted by Marvell Automotive Ethernet acquisition |

| Green Industrial Power | 431 | 11.6% | +9% | — | — | — | Demand in industrial applications and renewable energy |

| Power & Sensor Systems | 1,053 | 28.4% | +8% | — | — | — | Growth from power supply and sensor technology markets |

| Connected Secure Systems | 349 | 9.4% | -2% | — | — | — | Slight decline; focuses on IoT, security, and connectivity solutions |

| Total | 3,704 | 100% | +3% | ~0% | — | — | Company expects FY2025 revenue ≈ €14.6B; Automotive remains core pillar |

The financial architecture reflects recognition that in automotive development, visibility into future revenue streams comes through established design-win commitments. Supplier relationships and technical specifications established today typically determine revenue flows for five-to-seven-year platform lifecycles, creating unusual predictability in an otherwise cyclical industry.

When Industries Converge

Perhaps most significantly, this acquisition positions Infineon at the intersection of multiple rapidly growing markets experiencing similar technological demands. The same communication challenges emerging in autonomous vehicles—low-latency coordination between sensors, robust security protocols, and real-time processing—increasingly characterize advanced manufacturing, where Industry 4.0 initiatives demand comparable infrastructure capabilities.

Recent analysis suggests solutions developed for automotive safety applications often translate directly to industrial automation, creating opportunities for companies positioned across both domains. The timing appears particularly favorable as multiple industries simultaneously embrace software-defined operations requiring similar underlying communication technologies.

"We're incredibly proud of what our team has achieved in building a world-class Automotive Ethernet business," said Matt Murphy, Chairman and CEO of Marvell. "Infineon is the right company to take this business to the next level—with the scale, portfolio breadth, and customer reach to unlock its full potential."

The statement reflects broader industry recognition that competitive advantage increasingly resides with companies capable of providing comprehensive technology ecosystems rather than individual components. This shift toward integrated solutions accelerates as customers seek to reduce complexity in increasingly sophisticated system architectures.

Manufacturing specialists describe similar challenges in modern automated facilities, where robotic systems must coordinate movements with microsecond precision while processing continuous streams of sensor data—requirements mirroring those in autonomous vehicles with comparable safety and reliability standards.

Competitive Landscape Transformation

This transaction fundamentally alters competitive positioning within the automotive semiconductor ecosystem. By combining Marvell's Ethernet expertise with Infineon's dominant market position in automotive microcontrollers, the company creates integrated solution offerings that competitors may find difficult to match through organic development alone.

Table: Market Share and Competitive Position of Leading Automotive Semiconductor Suppliers (Latest Available Data, 2024–2025)

| Company | Latest Reported Global Market Share | Key Strengths & Segments | Regional Leadership Highlights |

|---|---|---|---|

| Infineon Technologies | 13.5% (Global, 2024) | Global leader; 32% market share in automotive microcontrollers; strong in ADAS, electrification | #1 in Europe (14.1%), China (13.9%), South Korea (17.7%); #2 in North America (10.4%) & Japan (13.2%) |

| NXP Semiconductors | Not specified (Top global player) | Strong in automotive microcontrollers, in-vehicle networking, and connectivity solutions | Consistently competitive across all major regions |

| Renesas Electronics | ~6.8% (Global, 2023) | Focus on SoCs for autonomous driving & electrification; strong operational margins | Expanding in software-defined vehicles and AI-powered ADAS |

| Broadcom | Not specified (adjacent influence) | Leading in high-performance computing & networking chips used in automotive systems | Indirect influence via advanced chip technologies in vehicles |

The strategic implications extend beyond immediate market share considerations. As automotive manufacturers increasingly evolve into technology companies competing on software capabilities rather than purely mechanical engineering excellence, they seek comprehensive technology partners capable of enabling rather than merely supplying their transformation.

Competitors including Broadcom, NXP, and Renesas now face pressure to assemble comparable capabilities through acquisition or partnership arrangements, potentially accelerating broader consolidation within the automotive semiconductor sector. Market observers suggest this dynamic favors companies with strong intellectual property positions and established customer relationships over those competing primarily on manufacturing scale or pricing.

The shift reflects automotive manufacturers' recognition that their competitive differentiation increasingly comes through software capabilities and user experience rather than traditional engineering metrics—a transformation requiring robust, secure communication infrastructure capable of supporting continuous software evolution throughout vehicle lifecycles.

A Software-Defined Vehicle (SDV) is a vehicle where features and functions are primarily controlled by software rather than being dependent on the underlying hardware. This architecture allows automakers to add new capabilities, fix issues, and upgrade the vehicle's performance and user experience through over-the-air (OTA) updates, similar to a smartphone.

Investment Implications and Market Evolution

For institutional investors, this acquisition illuminates compelling themes extending beyond the immediate transaction participants. The automotive Ethernet market could reach $10 billion by 2030, representing growth rates that reflect fundamental shifts in how machines communicate and coordinate across multiple industries.

Global automotive Ethernet market size forecast, projecting growth to $10 billion by 2030.

| Research Firm | 2023 Market Size (USD) | 2030 Forecast (USD) | CAGR (2024-2030) |

|---|---|---|---|

| Mordor Intelligence | $3.5 Billion (2025 est.) | $9.97 Billion | 23.30% (2025-2030) |

| P&S Intelligence | $2.61 Billion | $9.39 Billion | 20.2% |

| Grand View Research | $2.52 Billion | $7.04 Billion | 15.9% |

| KBV Research | $2.10 Billion (2022) | $6.4 Billion | 14.2% |

Companies controlling essential enabling technologies for software-defined operations may command sustained premium valuations as digital transformation accelerates beyond transportation into manufacturing, logistics, and emerging automation sectors. The convergence suggests investors may benefit from focusing on organizations positioned at technology intersections rather than those serving single-market applications.

However, execution risks remain substantial. The $4 billion design-win pipeline represents potential rather than guaranteed revenue, subject to automotive industry cycles, evolving customer requirements, and competitive responses. Successfully integrating acquired engineering teams, harmonizing product development roadmaps, and maintaining customer relationships requires careful management in industries where technical precision allows minimal tolerance for error.

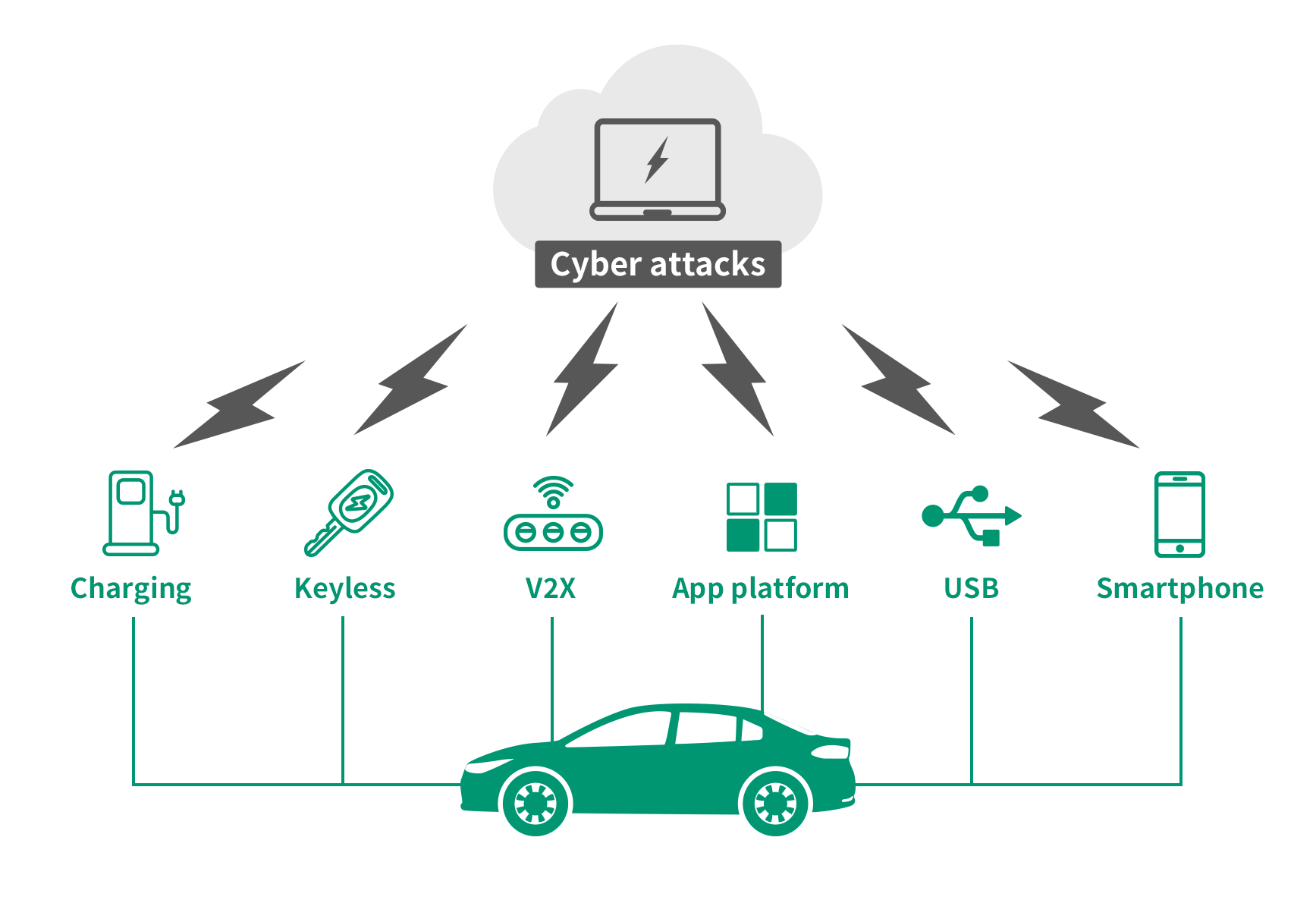

Forward-looking investment strategies might consider companies with capabilities spanning automotive and industrial automation, particularly those with strong intellectual property positions in communication protocols, cybersecurity, and real-time processing capabilities. Additionally, this transaction may create opportunities in complementary technologies, particularly cybersecurity solutions and validation systems, as increasing reliance on networked systems creates additional security and testing requirements.

Market projections suggest that by 2030, software-defined vehicle architectures will become standard across automotive platforms, creating sustained demand for the communication infrastructure enabling this transformation. Companies positioned to provide comprehensive solutions may command premium valuations as the industry prioritizes integration over component-level competition.

The acquisition ultimately represents strategic commitment to technological convergence—recognition that the boundaries between transportation, manufacturing, and automation continue blurring toward software-defined operations where communication infrastructure becomes a critical competitive advantage.

Analysis reflects current market conditions and established industry patterns. Investment decisions should consider individual risk tolerance and financial objectives. Professional consultation recommended for personalized investment strategies.