Inspiren Raises $100M Series B to Transform Senior Living with AI-Powered Safety and Care Platform

Senior Living’s AI Revolution Speeds Up as Inspiren Lands $100M in Fresh Funding

A bold bet on technology aims to ease staff shortages and meet rising demand for care as America ages

NEW YORK — Senior living has long lagged behind in tech adoption, but that may be changing fast. Inspiren just secured a $100 million Series B funding round, a move that puts artificial intelligence squarely at the heart of an industry bracing for massive demographic shifts. The round, led by Insight Partners with backing from Avenir and Scale Venture Partners, lifts Inspiren’s total haul to $155 million and underscores a growing belief that AI isn’t just helpful—it’s inevitable.

The timing isn’t accidental. By 2030, every Baby Boomer will be over 65. That means more residents entering care facilities, more medical complexity, and greater pressure on already stretched staff. Instead of offering piecemeal fixes, Inspiren bundles resident safety monitoring, staffing optimization, care planning, and emergency response into one AI-powered platform. Think of it as a digital nerve center for senior living.

The U.S. population aged 65 and older is projected to nearly double by 2060, increasing the demand for senior care services.

| Year | Population Aged 65+ (Millions) | Percentage of Total U.S. Population |

|---|---|---|

| 2020 | 55.8 | 16.8% |

| 2022 | 57.8 | 17% |

| 2040 | 78.3 | 22% |

| 2050 | 82 | 23% |

| 2060 | 88.8 | n/a |

Technology Meets an Industry in Crisis

Senior care providers face a perfect storm. Occupancy in major markets reached about 88.1% in the second quarter of 2025, yet new construction has stalled at multi-year lows. At the same time, today’s residents are older and sicker than those a decade ago, needing care closer to hospital-level support than hospitality.

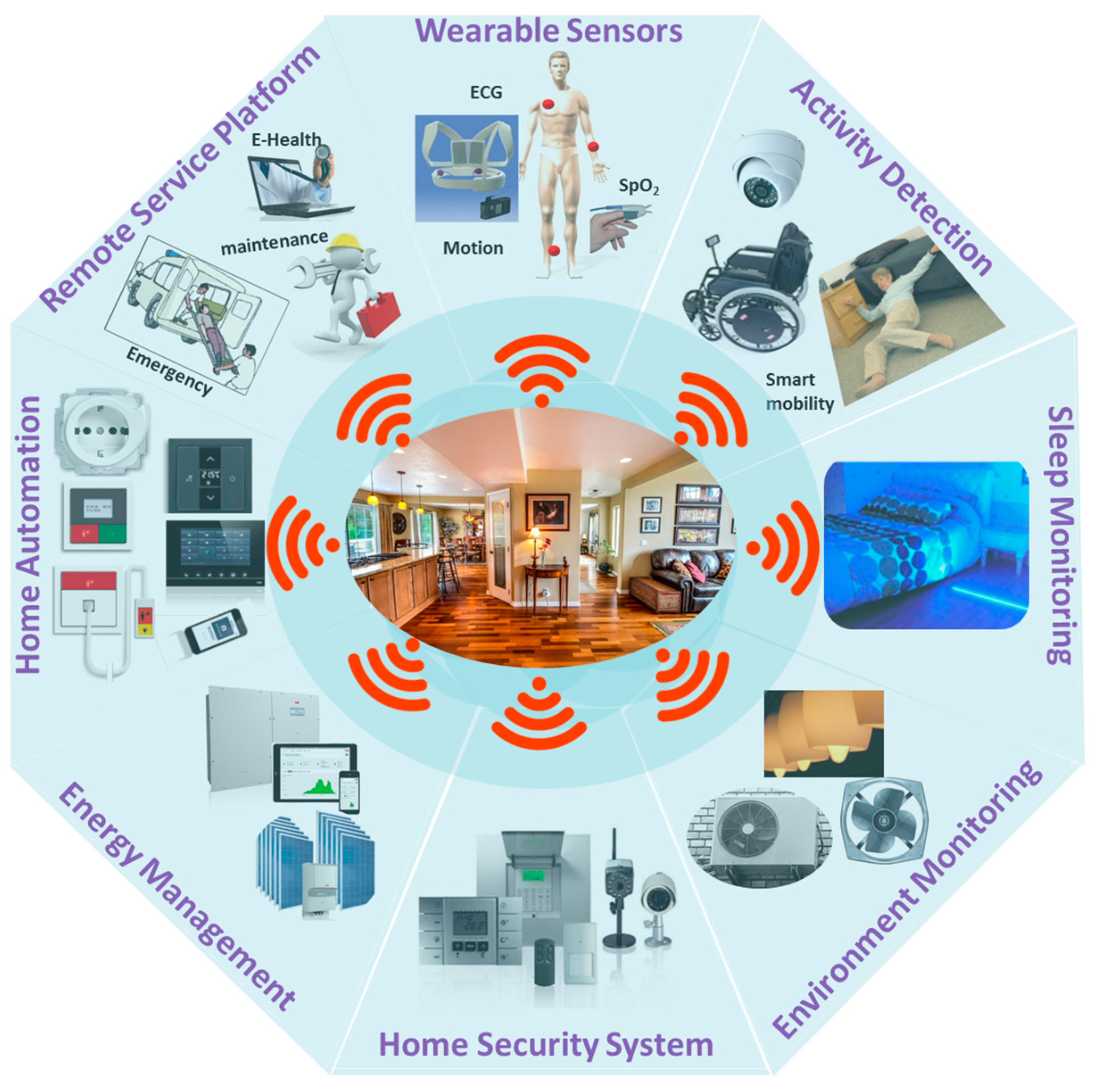

For years, facilities relied on a patchwork of nurse call systems, electronic medical records, staffing software, and emergency alerts—all disconnected. “The industry has been operating with fragmented systems for too long,” a healthcare analyst explained. “Integration isn’t just convenient anymore. It’s survival.”

Healthcare data interoperability is the seamless exchange and use of patient information across disparate IT systems and devices. This is crucial for overcoming fragmented healthcare data systems, enabling comprehensive patient records, and improving care coordination and outcomes.

The labor shortage makes integration even more urgent. Nursing homes remain among the hardest hit by pandemic-era job losses. Projections show a deficit of 200,000 to 450,000 registered nurses by 2025, with full recovery unlikely before 2026. Without new tools, facilities risk being unable to meet basic care standards.

Projections show a significant and ongoing shortage of registered nurses in the U.S., a key driver for technology adoption in healthcare.

| Year | Projected RN Shortage (National) | Source/Notes |

|---|---|---|

| 2025 | 78,610 Full-Time Equivalent (FTE) RNs. (Other projections indicate a deficit of approximately 295,800 RNs nationwide) | Health Resources and Services Administration (HRSA), McKinsey & Company/HRSA |

| 2027 | 10% shortage of Registered Nurses | HRSA, National Center for Health Workforce Analysis (NCHWA) |

| 2037 | 6% shortage, equivalent to 207,980 FTE RNs | HRSA, National Center for Health Workforce Analysis (NCHWA) |

Real-World Results

Early adopters are already reporting dramatic improvements. Heritage Communities, for example, cut bedroom-related falls with injury by 86% after installing Inspiren’s system. At Ascent Living, the platform flagged a fall a resident initially denied, leading to a stroke diagnosis and rapid treatment that might otherwise have been delayed.

These aren’t isolated wins. Arrow Senior Living rolled the system out across 27 communities in six states, a scale large enough to earn recognition at the 2024 McKnight’s Technology Awards and again as a finalist in 2025. As one operations consultant put it, “This isn’t just automation. It’s a force multiplier in a place where every pair of hands counts.”

Why Investors Are Piling In

Inspiren’s big raise mirrors a broader surge of capital flowing into healthcare AI. In fact, most digital health funding in early 2025 went to AI-driven startups. Consolidation is also heating up, as buyers hunt for platforms that can handle multiple problems at once.

Venture capital funding for AI-focused digital health companies has surged, reflecting investor confidence in technology's role in solving healthcare challenges.

| Period | AI-Focused Digital Health VC Funding (USD Billions) | % of Total Digital Health VC Funding (AI-focused) | Total Digital Health VC Funding (USD Billions) | Total Digital Health VC Deals |

|---|---|---|---|---|

| H1 2025 | $3.95 | 62% | $6.4 | 245 |

| Full Year 2024 | $3.74 (approx. 37% of $10.1B) | 37% | $10.1 | 497 |

| Full Year 2023 | $7.2 (U.S. healthcare AI companies) | 21% (of total VC healthcare investments) | $10.8 | 503 |

The underlying math looks unshakable. More than half of Medicare beneficiaries are now enrolled in Medicare Advantage, which rewards providers for preventing costly hospitalizations. Falls remain the leading cause of injury for older adults, and the medical bills alone are staggering. If AI can reduce those risks, the cost savings could be enormous.

Other startups are chasing the same opportunity. SafelyYou focuses on fall detection, care.ai builds ambient sensors for virtual monitoring, and August Health recently raised $29 million to expand its insights platform. The crowded field suggests investors see multiple paths to solving the same urgent problems.

Adoption Won’t Be Easy

But rolling out this technology across a fragmented industry isn’t simple. Many senior living operators are small, regional players. Installing hardware, training staff, and integrating new systems requires heavy upfront investment, which smaller facilities may struggle to afford.

Privacy concerns add another wrinkle. Families want reassurance their loved ones are safe, but constant monitoring can raise uncomfortable questions about dignity. To sidestep these issues, some companies are experimenting with radar and other camera-free solutions.

Camera-free monitoring leverages ambient sensing technologies, like radar-based systems, to passively track individuals without intrusive visuals. This approach offers enhanced privacy for patient and senior monitoring by detecting movement and activity through walls or spaces discreetly.

Regulations complicate things further. Because assisted living is governed at the state level, companies must tailor compliance strategies market by market. A string of high-profile incidents in recent years has also sparked greater scrutiny, which could accelerate adoption or pile on new barriers—depending on how regulators respond.

Building for Scale

Inspiren’s leadership team is clearly gearing up for growth. The company has brought in Mike Hsu, a veteran of Anduril and Peloton, as COO, and tapped Dominique Simoneau-Ritchie as CTO after her tenure at Shopify and other fintech firms. The hires hint at ambitions well beyond pilot programs.

The company recently upgraded its Inspiren HQ platform with a new analytics engine, Inspiren Intelligence, aiming to provide operators not just alerts but full-scale insights into staffing, safety, and care quality. As one former healthcare tech executive put it, “The winners will be those who can prove ROI fast and fit seamlessly into the workflows facilities already use.”

Looking Ahead

Analysts predict the AI market for aging and elderly care could balloon from $47.4 billion in 2024 to roughly $322 billion by 2034, a 21% compound annual growth rate. Still, such growth assumes companies can clear adoption hurdles and adapt to shifting regulations.

The global market for AI in aging and elderly care is forecasted to experience exponential growth over the next decade.

| Report Source | Base Year Market Size (USD Billion) | Forecast Year Market Size (USD Billion) | CAGR (%) | Forecast Period |

|---|---|---|---|---|

| InsightAce Analytic | 47.4 (2024) | 322.4 (2034) | 21.2 | 2025-2034 |

| DataM Intelligence | 34.42 (2024) | 208.59 (2032) | 25.26 | 2025-2032 |

| GMM Global Forecast | 31.74 (2025) | 74.15 (2029) | 23.6 | 2025-2029 |

| ResearchAndMarkets.com | 1.414 (2025) | 2.249 (2030) | 9.73 | 2025-2030 |

Investors are watching several trends:

- Larger platforms may swallow smaller startups through acquisition.

- Big operators will likely embrace comprehensive solutions, while smaller ones may stick with niche products.

- Medicare Advantage and value-based care contracts could start requiring or rewarding AI adoption.

- Partnerships with electronic health record providers and nurse call vendors could become critical for distribution.

Value-Based Care is a healthcare delivery model where providers are reimbursed based on patient health outcomes and quality of care, rather than the volume of services. This fundamentally shifts from the traditional fee-for-service model, impacting how healthcare businesses and providers operate and are compensated.

For now, the stars seem aligned. Aging demographics, AI capabilities, and deep-pocketed investors are all pushing in the same direction. The challenge will be execution. Companies that deliver real outcomes while navigating regulatory minefields could define the future of senior living. Those that stumble risk being left behind.

NOT INVESTMENT ADVICE