UK Startup Isembard Raises $9 Million to Build Software-Driven Manufacturing Network Amid Western Production Crisis

Software-Powered Micro-Factories: Isembard's $9M Bet to Rescue Western Manufacturing

LONDON — A new manufacturing facility quietly opened in London in January 2025, representing the first deployment of Isembard's ambitious plan to revitalize Western precision manufacturing. Led by Alexander Fitzgerald, a former tech entrepreneur who previously exited his company Cuckoo, Isembard is pioneering a network of modular, highly automated manufacturing units that diverge significantly from traditional factory models.

The company's approach reflects Fitzgerald's vision of transforming manufacturing through software innovation. As a military reservist with a strong sense of patriotism, he has repeatedly emphasized the connection between manufacturing capacity and national security, viewing the current decline in Western production capabilities as an existential challenge requiring urgent solutions.

The company announced today it has secured $9 million in seed funding led by Notion Capital, with unprecedented joint backing from both the UK Government's National Security Strategic Investment Fund and the German Federal Government — a rare collaboration that underscores the strategic importance of the venture.

A Silent Manufacturing Crisis Looms

Behind Isembard's emergence lies a troubling reality largely invisible to the public: Western precision manufacturing capacity is quietly disappearing. Small businesses, which account for a staggering 95% of precision manufacturing output in Europe and North America, face a demographic cliff. The average owner exceeds 65 years of age, and 40% plan to retire within the next five years, according to industry surveys.

This demographic tsunami arrives precisely as Western economies scramble to reshore critical production. British companies alone plan to invest $650 billion over the next three years to bring manufacturing home — a figure that reflects similar trends across Europe and North America.

"We're racing toward a perfect storm," explains a senior analyst at a London-based industrial policy think tank who requested anonymity to speak candidly. "Just as geopolitical realities force us to secure our supply chains, the small workshops that form the backbone of precision manufacturing are vanishing. Without intervention, we'll have reshoring capital but nowhere to spend it."

A Software-First Revolution for Hardware Production

Isembard's solution diverges markedly from traditional approaches. Rather than building massive facilities requiring hundreds of millions in capital, the company deploys networks of smaller, standardized manufacturing units — each powered by its proprietary software platform called MasonOS.

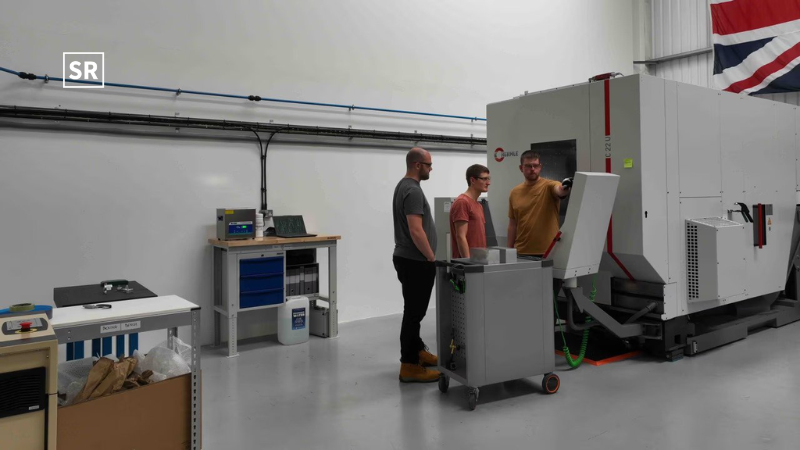

Inside the London facility, this approach becomes tangible. While conventional factories might span 100,000 square feet, Isembard's unit occupies roughly a tenth of that space. What it lacks in size it makes up for in digital sophistication.

"Traditional manufacturing still runs on paper travelers, fragmented software systems, and tribal knowledge," Fitzgerald says, showing a dashboard where AI algorithms optimize production schedules across multiple machines in real-time. "When the average shop owner retires, decades of expertise walk out the door. Our system captures that knowledge and improves upon it continuously."

The MasonOS platform integrates everything from initial customer quoting through supply chain management and production planning down to the machine code that drives fabrication equipment. Perhaps most significantly, the system is designed to operate identically across multiple locations — enabling rapid geographic expansion without the quality inconsistencies that typically plague distributed manufacturing.

"You could think of each unit as a highly intelligent, self-optimizing node in a broader manufacturing network," notes a robotics engineer who has consulted for both legacy manufacturers and startups like Isembard. "The software layer is what makes this distributed approach viable — it ensures that parts produced in London will be identical to those made in Munich or Boston."

Defense and Aerospace: Early Adopters in a Conservative Industry

The company's initial focus targets aerospace, defense, and energy sectors — industries where precision requirements are extraordinarily demanding and supply chain resilience carries national security implications.

"These are not sectors that embrace change quickly," admits Jos White, General Partner at Notion Capital, which led the funding round. "But what makes Isembard compelling is that they're addressing an existential problem. The defense industrial base needs new manufacturing capacity desperately, and traditional approaches simply aren't scaling fast enough."

Early traction has come primarily from defense contractors and fast-growing autonomy startups, though specific customer names remain undisclosed due to security considerations. Industry insiders suggest the involvement of both the UK and German governments signals confidence in Isembard's potential to address critical supply chain vulnerabilities.

"Having both the UK's National Security Strategic Investment Fund and German Federal Government as backers is exceptionally rare for a seed-stage company," observes a venture capitalist specializing in defense technology. "It reflects the geopolitical urgency behind reshoring and securing manufacturing capacity."

Battling Established Giants with a New Model

Isembard enters a competitive landscape dominated by established players. Digital marketplaces like Xometry reported $486 million in 2024 revenue, while traditional on-demand manufacturers like Protolabs generated over $500 million. Both operate at scales orders of magnitude larger than Isembard's current footprint.

The closest analogue might be Hadrian, which has raised over $216 million to build automated factories serving U.S. defense and aerospace needs. But whereas Hadrian pursues centralized facilities, Isembard's distributed approach represents a fundamentally different bet on manufacturing's future.

"The centralized model makes sense if you believe manufacturing should consolidate around massive hubs," says Fitzgerald. "We're betting on a more resilient, distributed future where production happens closer to demand, with software ensuring consistency across the network."

Industry observers note significant challenges ahead. Manufacturing remains inherently capital-intensive, and scaling physical facilities requires substantial funding beyond the initial $9 million seed round. Aerospace and defense customers demand rigorous certifications that typically take 6-12 months to secure, potentially delaying revenue.

"The playbook for scaling software is well-established, but scaling software-driven hardware businesses requires exceptional discipline," says a manufacturing investor not involved with Isembard. "They'll need to prove their model works repeatedly before larger rounds will materialize."

Named for a Visionary Engineer

The company draws its name from Isambard Kingdom Brunel, the legendary 19th-century British engineer whose innovations in railways, bridges, and shipbuilding helped define the first industrial revolution. This historical connection feels deliberate — a nod to ambitions that extend beyond incremental improvement.

"Western manufacturing led the world for generations before declining in recent decades," says Fitzgerald. "We're not just building a company; we're trying to preserve a capability that underpins economic sovereignty and national security."

The startup's $9 million in funding will be used to expand the London facility, grow the engineering team developing MasonOS, and prepare for deployment of additional manufacturing units. While skeptics question whether software alone can overcome the industry's inherent capital requirements and regulatory hurdles, supporters see a necessary evolution of manufacturing for an increasingly uncertain world.

"Whether this specific approach succeeds or not, the problem Isembard addresses is undeniable," notes an aerospace supply chain consultant. "Someone needs to build new manufacturing capacity in the West, and they need to do it quickly. The question is whether this distributed, software-first model can scale fast enough to meet the moment."

As global supply chains continue fracturing along geopolitical lines and reshoring accelerates, Isembard's experiment in reinventing manufacturing will likely attract continued attention from both industry and government leaders. For Fitzgerald, the stakes could hardly be higher.

"We've grown accustomed to outsourcing our industrial capacity," he says, watching as a robotic arm precisely mills an aerospace component. "But you can't outsource the foundation of your economy and expect to maintain sovereignty. Manufacturing isn't just another sector — it's the sector that makes all other sectors possible."