Japan and Philippines Launch Historic Defense Pacts to Counter China's Maritime Influence

Japan and Philippines Forge Historic Defense Pacts, Reshaping Indo-Pacific Security Landscape

MANILA — Under the sweltering tropical heat of the Philippine capital, Japanese Prime Minister Shigeru Ishiba and President Ferdinand Marcos Jr. cemented what both leaders called a "golden age" in bilateral relations on Tuesday, agreeing to negotiate two landmark defense agreements that significantly alter the strategic calculus in one of the world's most contested maritime regions.

The two leaders, standing side by side at Malacañang Palace, announced plans to pursue an Acquisition and Cross-Servicing Agreement (ACSA) and a General Security of Military Information Agreement (GSOMIA). These pacts would build upon last year's Reciprocal Access Agreement (RAA), creating what security analysts describe as a quasi-alliance that extends Japan's defense perimeter and bolsters Philippine capacity to defend its maritime claims.

The Acquisition and Cross-Servicing Agreement (ACSA) is a pact allowing allied militaries to exchange logistical support, supplies, and services. The General Security of Military Information Agreement (GSOMIA) establishes the framework and rules for securely sharing classified military intelligence between nations.

"This partnership is indispensable to maintaining a free and open Indo-Pacific," Prime Minister Ishiba declared, explicitly naming Chinese coercion in the East and South China Seas as the primary catalyst for the deepening partnership. President Marcos, nodding in agreement, characterized the moment as nothing less than a "golden age of relations" between Tokyo and Manila.

The New Security Architecture: Beyond Paper Promises

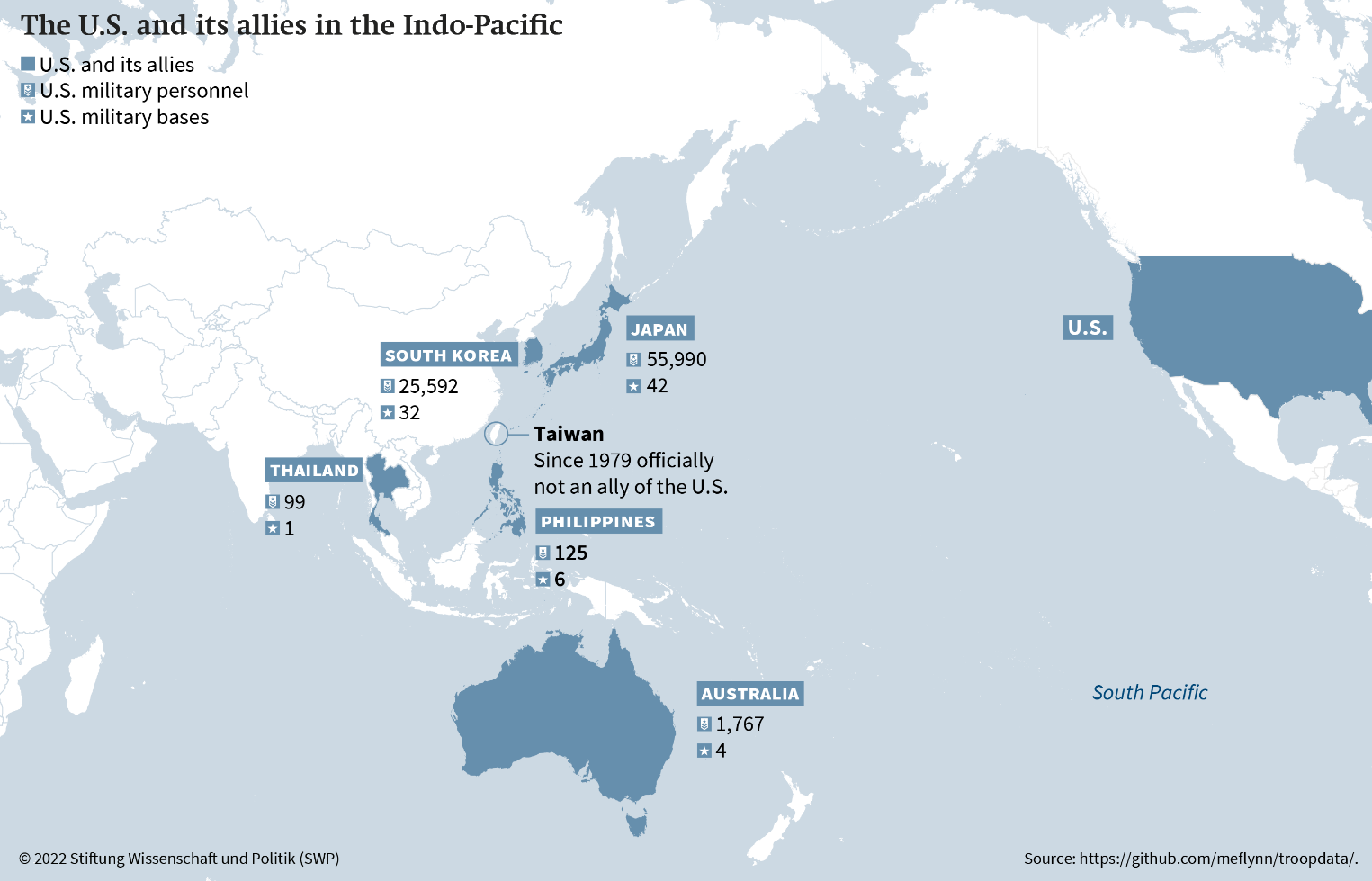

The agreements mark a dramatic evolution in Japan's regional security posture and represent the most consequential defense relationship Manila has developed outside its traditional alliance with the United States.

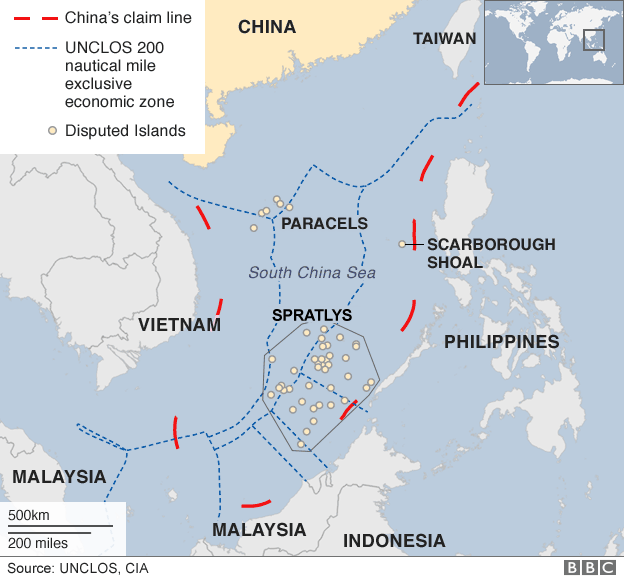

The ACSA will enable Japan's Self-Defense Forces and the Philippine military to share food, fuel, ammunition, and other logistical support during joint exercises and humanitarian operations. More significantly, it would allow Japanese naval tankers to refuel Philippine coast guard vessels within Manila's territorial waters, effectively shrinking response times around flashpoints like the Second Thomas Shoal, where Chinese and Philippine vessels have repeatedly clashed.

"This isn't merely about signing documents," said a senior Philippine defense official who requested anonymity due to the sensitivity of ongoing negotiations. "These agreements create tangible operational advantages in scenarios where minutes matter and presence equals power."

The GSOMIA, meanwhile, establishes protocols for sharing classified military intelligence, particularly critical for monitoring Chinese naval and coast guard movements. Security experts note that this arrangement would give Tokyo direct access to Philippine radar feeds monitoring the strategically vital Bashi Channel — a key transit route for China's navy in any Taiwan contingency.

The Quiet Transformation of Japan's Defense Posture

For Japan, these agreements represent another step in Prime Minister Ishiba's quiet transformation of the country's defense policy. Since taking office, Ishiba has accelerated the normalization of Japan's security role while carefully navigating the constraints of its pacifist constitution.

Article 9 of the Japanese Constitution is known as the "pacifist clause," where Japan renounces war as a sovereign right and the threat or use of force to settle international disputes. This article places constitutional limits on Japan's Self-Defense Forces, prohibiting the maintenance of traditional land, sea, and air forces with war potential.

"We're witnessing Japan add another spoke to what has historically been Washington's hub-and-spoke alliance system," explained a Tokyo-based security consultant with close ties to Japan's Defense Ministry. "While not a formal mutual defense pact, these agreements effectively create a security relationship that functions like a quasi-alliance in practical terms."

Before the summit, Ishiba visited a memorial dedicated to José Rizal, the Philippine national hero who once lived in Japan — a symbolic gesture highlighting the countries' historical connections beyond security cooperation. He also met with stateless Japanese-Filipino descendants of World War II soldiers, promising citizenship pathways in what observers viewed as addressing historical reconciliation alongside strategic partnership.

Economic Dimensions and Market Implications

The burgeoning security partnership carries significant economic implications, extending well beyond defense contractors and into shipping, insurance, mining, and infrastructure development.

Japan's fiscal year 2025 defense budget already exceeds 2% of GDP, and Diet ratification of the RAA is expected to unleash substantial grant aid plus export orders worth approximately ¥240 billion (US$1.6 billion), including eight 97-meter offshore patrol vessels and three advanced radar systems.

Japan's Defense Spending as a Percentage of GDP (Trend Toward 2%)

| Fiscal Year | Spending (% of GDP) | Key Points |

|---|---|---|

| 2022 | 1.08% | Spending historically capped at ~1%; ¥5.1 trillion budget (TheGlobalEconomy.com). |

| 2023 | 1.20% | Increased to ¥6.6 trillion (World Bank: 1.1961%). |

| 2024 | 1.4–1.6% | ¥8.9 trillion including related ministries (SIPRI estimate: 1.4%). |

| 2027 (Goal) | 2.0% | Target set for 2% of GDP by FY2027. |

"The regional security environment is fundamentally changing the economics of shipping and insurance in Southeast Asian waters," noted a risk analyst at a major maritime insurance firm. "War-risk premiums for hull coverage in the Spratlys jumped 25% in the first quarter of 2025 alone, and could climb further if tensions escalate."

Trend of Maritime War Risk Insurance Premiums – South China Sea

| Date/Period | Premium Trend | Key Drivers / Context |

|---|---|---|

| 2016 (Historical) | Stable; no major premium hikes | Hague tribunal ruling had limited impact; JWC did not list as high-risk. |

| September 2024 | Rising premiums | Geopolitical instability, piracy, and insurer policy reviews. |

| Early 2025 | Significant premium increases | Rising China-Taiwan tensions; insurers tightening terms. |

| March 2025 | Heightened insurer caution, no JWC hotspot listing | Shipowners seeking more coverage; potential future cost modeling. |

| General Trend | Ongoing premium pressure | Naval buildup, territorial disputes (Spratly, Paracels, Scarborough Shoal); risk compared to Red Sea tensions. |

For the Philippines, which supplies roughly 22% of China's nickel ore, any disruption to shipping routes could tighten global markets for Class 1 nickel, with downstream effects for electric vehicle battery manufacturers worldwide.

"These agreements exist within a complex economic ecosystem," observed a Manila-based investment strategist. "Japanese infrastructure financing for dual-use port facilities creates immediate construction opportunities while positioning the Philippines as a more resilient link in regional supply chains."

Beijing's Calculus: The Prospect of Escalation

The defense pacts present Beijing with difficult choices. China has historically responded to new alliance formations with what security analysts call "facts on the water" — intensified land reclamation, concentrated coast guard deployments, or other displays of maritime presence.

"China faces the prospect of Japan effectively becoming a stakeholder in South China Sea disputes," explained an international relations professor at the University of the Philippines. "This complicates Beijing's ability to isolate claimants and changes the escalation ladder in ways that Chinese strategists must now recalibrate."

During a regular press briefing in Beijing yesterday, a Chinese Foreign Ministry spokesperson characterized the agreements as "Cold War thinking" that would "inject destabilizing factors into regional security." The spokesperson urged Japan to "respect China's territorial sovereignty and maritime rights" and called on the Philippines to "honor its commitments" under previous bilateral understandings.

Between Alliance and Autonomy: The Balancing Act

For the Philippines, the agreements represent a delicate balancing act. The Marcos administration seeks enhanced security cooperation with Japan and the United States while avoiding total alienation from China, its largest trading partner.

"President Marcos is playing a sophisticated game," remarked a former Philippine diplomat who served in both Tokyo and Beijing. "These security arrangements with Japan provide a critical hedge against Chinese maritime expansionism while carrying fewer domestic political complications than expanded U.S. military presence might entail."

The agreements also institutionalize a trilateral U.S.-Japan-Philippines security framework that creates a second northern anchor (complementing Okinawa) for potential contingencies involving Taiwan.

"What we're witnessing is not just bilateral cooperation but the crystallization of a networked security architecture that spans the First Island Chain," noted a defense analyst with expertise in Indo-Pacific maritime security. "This fundamentally changes the strategic geography for all regional actors."

Investment Implications: Winners and Losers

Financial markets have yet to fully price in the geopolitical shift these agreements represent, creating opportunities and risks across multiple sectors:

Japanese defense manufacturers like Mitsubishi Heavy Industries, NEC, and IHI Corporation stand to benefit significantly from the opening of new export markets following Tokyo's 2024 defense export reforms.

Philippine construction and port operators, particularly industry leaders like EEI Corporation and International Container Terminal Services Inc., are positioned to receive Japanese-financed upgrades to dual-use port facilities.

Conversely, Chinese state-owned enterprises involved in Philippine infrastructure projects face heightened scrutiny and potential cancellations, while regional tourism operators may confront reduced demand for destinations perceived as within potential conflict zones.

Currency markets also reflect these security dynamics, with the yen historically appreciating approximately 2% following significant East Asian security incidents. Analysts suggest a serious confrontation could push the USD/JPY exchange rate toward 142, complicating the Bank of Japan's monetary policy trajectory.

USD/JPY Exchange Rate Drivers During April 2025 East Asian Tensions

| Date Range | Event | Impact on USD/JPY |

|---|---|---|

| Early-Mid Apr 2025 | Renewed U.S.-China trade tensions | Yen strength pressured USD/JPY toward 140 |

| Mid-Apr 2025 | Tokyo core inflation surge (3.4%) | Initial yen weakness, later growth concerns |

| Late Apr 2025 | Easing U.S.-China tensions | USD/JPY rebounded above 142.00 |

| Apr 2025 (Ongoing) | BoJ’s cautious policy stance | Limited yen gains despite high inflation |

| Apr 2025 (Ongoing) | Technical resistance/support levels | Resistance at 144; bears target 140 |

Risk Scenarios and Forward Outlook

Security experts outline several potential scenarios for the coming year. The most likely outcome (55% probability) involves continued "gray-zone" confrontations — water-cannon incidents and close-quarter maneuvers without fatalities — which would exert modest upward pressure on energy prices while boosting defense and insurance equities.

Gray zone tactics in international relations refer to coercive actions by state or non-state actors that deliberately remain below the threshold of conventional armed conflict. Often considered a component of hybrid warfare, these activities aim to achieve political or security objectives while avoiding a direct military response from adversaries.

More concerning scenarios include Chinese remilitarization of features like Mischief Reef (30% probability), which could reduce ASEAN GDP growth by up to two percentage points, or a "hot incident" involving fatalities and U.S. military response (10% probability), which would significantly widen Asian high-yield credit spreads.

Only a small probability (5%) exists for meaningful de-escalation through an ASEAN-brokered Code of Conduct, which would likely trigger a relief rally in regional transportation stocks and commodity price moderation.

"The Ishiba-Marcos summit represents more than diplomatic symbolism," concluded a senior investment strategist at a global asset management firm. "It fundamentally reconfigures regional capital flows, insurance markets, and supply chains in ways that markets have not yet fully digested."

As Japan awaits Diet ratification of the cornerstone RAA agreement and negotiations proceed on ACSA and GSOMIA, the Indo-Pacific's most consequential bilateral security relationship outside of U.S. alliances continues to evolve, reshaping both geopolitical calculations and investment landscapes across multiple asset classes.