Meta Found Liable for Illegally Harvesting Menstrual Health Data from Flo App Users in Landmark Privacy Case

A Digital Reckoning: Meta’s Privacy Verdict Shakes the Foundations of Femtech and Ad-Tech

In a San Francisco courtroom, the gavel fell on August 1, 2025, delivering a seismic verdict that reverberated far beyond Silicon Valley’s glass towers. A California jury found Meta, the tech behemoth behind Facebook, liable for violating the state’s Invasion of Privacy Act, holding the company accountable for harvesting intimate menstrual health data from millions of Flo Health app users without their consent. The decision, rooted in actions between 2016 and 2019, marks a watershed moment for digital health privacy, exposing the fragility of Big Tech’s data-driven empires and igniting a fierce debate over innovation, accountability, and the future of personal data.

The case, involving the popular period-tracking app Flo Health, underscores a broader reckoning: how far can tech giants stretch outdated privacy laws before they snap? For professional investors, the verdict is a flashing red signal—heralding heightened legal risks, shifting market dynamics, and a burgeoning demand for privacy-first solutions in a world where data is both currency and liability.

A Breach of Trust in the Digital Age

The Heart of the Case

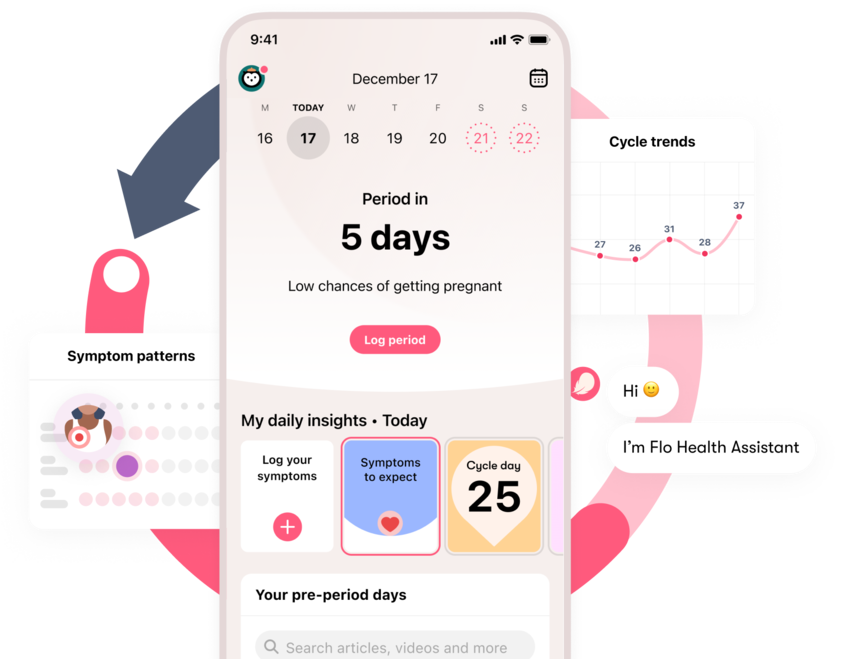

Between November 2016 and February 2019, millions of women across the U.S. logged their menstrual cycles, fertility goals, and pregnancy details into Flo Health, a femtech app marketed as a trusted companion. Unbeknownst to them, Meta’s software development kits , embedded in the app, quietly funneled this sensitive data into the company’s vast advertising machine. The plaintiffs, representing potentially millions of users, argued that Meta exploited this information to fuel targeted ads, violating California’s Invasion of Privacy Act, which carries penalties of up to $5,000 per violation.

The lawsuit, filed in 2021, initially targeted Flo Health, Meta, Google, and analytics firms AppFlyers and Flurry. By the trial’s start on July 21, 2025, Google and Flurry had settled, and Flo Health followed suit on July 31, leaving Meta as the sole defendant facing the jury’s scrutiny. The verdict was unequivocal: Meta’s data practices crossed a legal and ethical line.

A Climate of Distrust

The timing of the ruling amplifies its weight. Following the U.S. Supreme Court’s 2022 overturning of Roe v. Wade, women’s health data has become a lightning rod for privacy concerns. “The idea that a period-tracking app could expose such intimate details to advertisers feels like a betrayal,” said one privacy advocate, speaking anonymously due to ongoing legal sensitivities. The case taps into a broader anxiety: in an era of heightened reproductive rights scrutiny, can digital platforms be trusted with life’s most personal data?

The Legal Quagmire: Old Laws, New Realities

Resurrecting a Cold War Statute

At the core of the verdict lies the California Invasion of Privacy Act, a 1960s-era law designed to combat wiretapping, now repurposed as a cudgel against digital data harvesting. The statute’s application to modern app telemetry—where data flows seamlessly across SDKs—marks a bold reinterpretation. “This ruling shows that old laws can still bite,” noted a legal analyst familiar with the case. “It’s a wake-up call for tech companies that thought vague privacy policies were enough.”

The potential financial fallout is staggering. With an estimated 100 million U.S. Flo users during the relevant period, Meta’s exposure could theoretically reach hundreds of billions if each data point is deemed a separate violation. While legal experts doubt the full penalty will be imposed, the sheer scale underscores the verdict’s gravity.

A Patchwork of Accountability

The case also highlights the fragmented nature of U.S. privacy law. Unlike the EU’s cohesive General Data Protection Regulation, America relies on a patchwork of state statutes, leaving companies like Meta navigating a minefield of compliance risks. “The absence of a federal privacy framework creates chaos,” said a regulatory expert. “This verdict will push lawmakers to act, but it’s a slow grind.”

Industry Ripples: Femtech and Beyond

A Chill on Innovation?

The ruling casts a long shadow over the femtech sector, where apps like Flo, valued at over $1 billion after a $200 million raise last year, have thrived on user trust. Developers now face a stark choice: overhaul data practices or risk crippling lawsuits. “The fear of $5,000-per-violation penalties could freeze innovation,” cautioned a venture capitalist specializing in health tech. “Small startups might avoid analytics tools altogether, even ones that could improve user experience.”

Yet, some see opportunity in the chaos. “This is a chance for femtech to lead with transparency,” said a health-tech consultant. Apps that prioritize on-device analytics or partner with HIPAA-compliant cloud providers could gain a competitive edge, attracting privacy-conscious users and investors alike.

Big Tech’s Recalibration

For Meta, the verdict threatens a cornerstone of its business model: third-party SDKs that feed its advertising juggernaut, which generated $47.52 billion in Q2 2025 revenue. Developers may now hesitate to integrate Meta’s tools, fearing liability or user backlash. In response, Meta is likely to accelerate its pivot to AI-driven ad optimization, squeezing more value from less data. “They’ll lean harder on automation to offset the loss,” predicted a digital advertising strategist. “But regulators are watching those algorithms closely, too.”

Investment Horizons: Navigating the New Privacy Landscape

A Golden Age for Privacy Tech

The verdict opens a window for privacy-enhancing technologies . Companies offering on-device analytics, differential privacy, or secure data clean rooms—such as Habu or Privitar—could see a surge in demand as app developers scramble to comply. “Investors should look at Series B and C startups in this space,” advised a tech-focused fund manager. “They’re poised for 20x ARR multiples as compliance becomes non-negotiable.”

Regulatory tech also stands to gain. Platforms like OneTrust, which automate consent tracking and data mapping, are well-positioned to capture enterprise budgets. “The compliance market is about to explode,” said an industry observer. “This verdict is a catalyst.”

Femtech’s Make-or-Break Moment

The femtech sector, while bruised, offers selective opportunities. Investors should prioritize companies with robust privacy frameworks, such as Ovia Health or Wellpepper, which could command premiums in a consolidating market. “Expect Big Pharma and digital health platforms to snap up privacy-compliant startups by Q4 2026,” noted a healthcare VC. “Deals in the $100–200 million range are likely.”

Alternative Ad Channels

As third-party data tracking falters, ad budgets may shift to less invasive channels like audio streaming, in-game sponsorships, or live commerce. Platforms like Spotify, with its podcast ad network, or gaming companies leveraging engagement metrics, could siphon billions from traditional social media ads. Investors should monitor these sectors for growth potential.

Risks to Watch

Portfolios heavily weighted toward ad-tech giants like Meta, Snap, or Pinterest face near-term volatility. A 10–15% pullback in Meta’s stock is plausible as markets digest litigation risks, though conservative reserves in Q3 guidance could spark a rebound. Hedging via diversified tech indices or short-duration corporate credit in SDK vendors like AppFlyer is prudent. “Litigation funding vehicles are another space to watch,” said a fixed-income analyst. “They’re fueling these class actions.”

Disclaimer: Past performance does not guarantee future results. Investors should consult financial advisors for personalized guidance.

The Road Ahead: Appeals and Adaptation

Meta is expected to appeal, potentially dragging the case into 2026. If the Ninth Circuit upholds the verdict, damages could reshape Meta’s financial outlook, forcing a rethink of its SDK strategy. Meanwhile, the ruling may galvanize Congress to craft a federal privacy law with explicit health data protections, streamlining compliance but raising the bar for all players.

The verdict also signals a cultural shift. “Privacy by design isn’t just a buzzword anymore,” said a cybersecurity expert. “It’s a survival strategy.” Companies that embed privacy engineers and transparent consent flows will emerge as safe havens, while those clinging to opaque data practices risk obsolescence.

A New Compact for the Digital Age

The Meta-Flo verdict is more than a legal milestone; it’s a clarion call for a digital ecosystem where user trust is paramount. For investors, the path forward lies in betting on privacy innovators and resilient femtech players while bracing for volatility in ad-tech stalwarts. As the lines between technology, law, and ethics blur, one truth stands clear: the age of unchecked data collection is over, and the race to redefine digital trust has just begun.