The Bureaucracy Behind the Blockbuster: A Senior Director's Warning from Inside Novo Nordisk

COPENHAGEN, Denmark — The email arrived to us around six months ago with the stark subject line that would prove prophetic: a senior director's unfiltered assessment of Novo Nordisk's internal dysfunction, written with the raw frustration of someone watching a pharmaceutical empire crumble from within.

"A blockbuster product that could sell out in pharmacies even with a robot managing it is now lagging behind in R&D, with production capacity held back by a bunch of bureaucratic and incompetent fellow middle managers," the director wrote, his identity concealed but his anguish unmistakable.

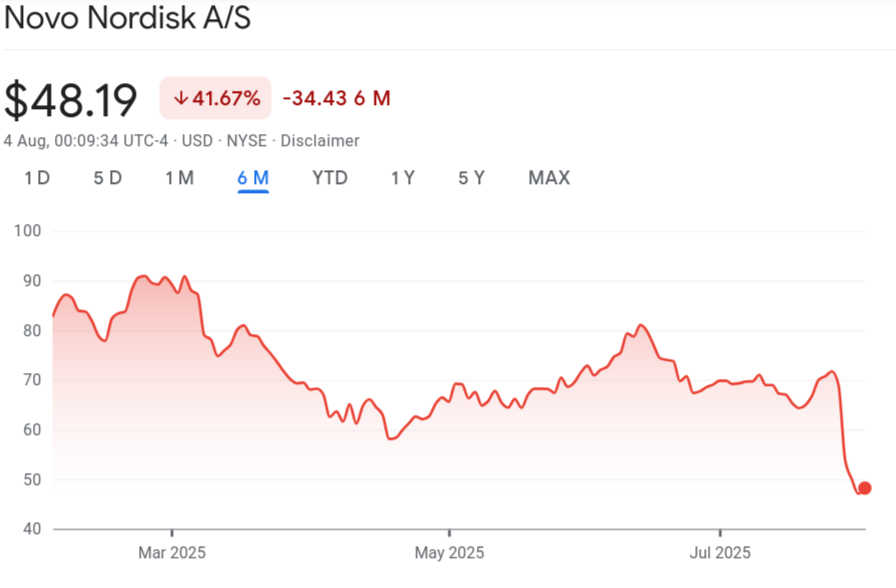

Now, six months later, as Novo Nordisk's American depositary receipts languished at $48.19—down 70% from their June 2024 peak—that internal cry of alarm reads less like corporate dissent and more like a roadmap to organizational failure.

The Danish pharmaceutical giant, architect of the obesity revolution with blockbuster GLP-1 drugs Ozempic and Wegovy, now finds itself trapped in the paradox that the senior director so presciently identified: unprecedented demand for products crippled by the very management structure meant to deliver them.

"What's the Legacy Lars Left for Novo?"

The director's critique strikes at the heart of Novo's cultural identity—the vaunted "Novo Nordisk Way" that has guided the company for decades. "What's the legacy Lars left for Novo? The 'Novo Nordisk Way'?" he wrote, referring to the management philosophy established under former leadership.

This wasn't mere corporate venting. The email detailed specific organizational pathologies that external data now confirms with uncomfortable precision. "The company is full of 'people managers' who don't actually work but just manage people for management purpose," the director observed, describing what internal organizational charts reveal as a management-to-scientist ratio that approaches one manager for every frontline researcher.

The numbers validate the director's frustration: over 300 VP and SVP titles scattered across the organization, compared to fewer than 140 active laboratory principal investigators. In pharmaceutical terms, this represents an inversion of traditional research priorities—more energy spent managing the discovery process than conducting it.

"One frontline worker supporting seven or eight middle managers who don't even know how to relay a message properly," the director continued. "Getting any information up to 'heaven' (senior execs) is a long and error-prone process."

Market Reality Meets Management Fiction

The director's internal observations gained external validation on July 29, when Novo slashed its 2025 sales growth guidance to 8-14%, down from an ambitious 13-21% projection. The market's response was immediate and brutal: a 23% single-day plunge that erased $100 billion in market capitalization.

"The CFO keeps bragging about a U-shaped recovery in growth, but as sales continue to be revised downward, they're not even trying to figure out why," the senior director had written months earlier, anticipating the guidance catastrophe with remarkable accuracy.

The email revealed an organization where internal metrics diverged dangerously from market realities. While leadership celebrated process improvements and organizational restructuring, the fundamental challenge of matching supply to demand for Wegovy remained unsolved—a disconnect the director attributed to bureaucratic layers that obscured rather than illuminated operational problems.

"Besides the bloated management, I seriously think Novo's pipeline is eventually going to blow up," they predicted, not from scientific failure but from organizational inability to execute on scientific success.

The Team-Building Revelation

Perhaps the most revealing passage in the email described a recent company team-building event, where anonymous employee questions exposed the depth of organizational dysfunction. "Someone even anonymously asked why there are so many VPs and SVPs managing people, but a serious lack of real scientific talent (and this wasn't even R&D-related departments)," the director recounted.

The response from leadership—"The SVP on stage just danced around the issue"—crystallized the director's broader critique of an organization more skilled at managing perceptions than addressing realities.

"I was dying laughing," the director wrote, but the humor carried the bitter edge of someone watching institutional decay in real time. The anonymous questioning format itself suggested an organizational culture where direct challenges to management decisions required the protection of anonymity—hardly the hallmark of the collaborative, innovative environment necessary for pharmaceutical leadership.

The director also noted questions about "why the organizational restructuring has been so slow," indicating that even rank-and-file employees recognized the need for structural change that leadership seemed unwilling or unable to implement.

The Danish Disease

The senior director's critique extended beyond Novo to encompass broader patterns in Danish corporate culture. "There are a lot of bureaucratic companies like this in Denmark—hiring people to manage processes, with beautiful PowerPoints slides, and compliance officers managing people who do actually understand the business, know how to get clients, and can really bring in money."

This observation resonates with Novo's recent regulatory failures. The UK financial conduct authority identified 48 disclosure breaches, while questionable marketing practices drew media scrutiny—failures that cluster around controls and compliance, precisely the areas where process-heavy organizations should excel.

The director's comparison to other sectors proved particularly illuminating: "My friend works at Bitzer, a German family-owned precision machinery company. The biggest thing the top execs did last year was celebrate the 90th birthday of the family matriarch—literally spent the whole year kissing her ass!"

The contrast implicit in this comparison suggests the director's broader frustration with organizational priorities that emphasize ceremony over substance, process over performance.

The Acquisition Confession

The director's email anticipated Novo's eventual strategic response to its capacity constraints: "In the end, the company has to rely on acquisitions just to boost capacity." This prediction materialized with Novo Holdings' $16.5 billion acquisition of Catalent's three key manufacturing sites—a move that represents both crisis management and institutional admission of failure.

Rather than building internal capabilities organically, Novo chose the expensive path of external acquisition. The Catalent purchase, optimistically projected to deliver meaningful capacity by Q4 2026, reveals the depth of operational failures the senior director identified months earlier.

"Meanwhile, the company... still have the nerve to complain about the flood of generics," the director had written, highlighting management's tendency to blame external factors for problems rooted in internal dysfunction.

Cultural Consequences

The director's email illuminated the human cost of organizational dysfunction. "Some colleagues take it super seriously, like their work is their life, or they're just forced to tie themselves to the company," they observed, describing a workplace where dedication becomes indistinguishable from institutional capture.

This observation gains weight when examined alongside accelerating talent attrition. LinkedIn migration data suggests a net 8% attrition rate among senior scientists year-to-date, with many departing for nimbler biotechnology companies that promise clearer decision-making and more direct paths from scientific discovery to market impact.

The director's broader comparison to pharmaceutical competitors proved equally prescient: "Same over at Sanofi. My friend told me they have basically been left for over two years—still getting paid, but doing virtually nothing. Every day is just empty talk after empty talk!"

The Leadership Signal

Novo's subsequent choice of CEO Mike Doustdar—a 33-year company veteran—validated the director's skepticism about organizational change. "Now they've brought in someone who's been with Novo for 33 years to lead the team. Honestly, I have no confidence in a Novo Nordisk management team led by a conservative corporate culture."

The promotion reinforced the cultural insularity that the senior director identified as a core problem, signaling the board's preference for continuity over transformation. Doustdar joins a senior leadership team where virtually every key executive boasts decades of internal experience—precisely the institutional thinking the director suggested was constraining organizational performance.

Market Vindication

The financial markets have rendered their verdict on the organizational pathologies the senior director identified. Trading at 19 times EBITDA—still at a 25% premium to global pharmaceutical peers—Novo's valuation reflects lingering faith in scientific capabilities rather than confidence in execution.

Bear-case scenarios envision the trajectory the director anticipated: further operational deterioration, with biosimilar competition arriving by 2026 and persistent capacity constraints limiting growth potential. Under such conditions, fair value projections approach $32 per share—a 35% decline from current levels.

The director's email concludes with a reflection that now reads as both warning and prophecy: "Are all the major pharma companies' R&D operations like this now?" The question suggests broader industry trends toward bureaucratic capture of innovative processes—a pattern that Novo's experience may foreshadow rather than represent as an isolated case.

The Unheeded Warning

As Novo Nordisk confronts the market consequences of the organizational dysfunction the senior director so clearly articulated, their email stands as a testament to the power of internal perspective over external analysis. While Wall Street debated valuation metrics and growth projections, this insider identified the cultural and operational barriers that would ultimately constrain the company's ability to capitalize on scientific breakthrough.

The director's frustration—captured in raw, unfiltered language—reveals the human cost of organizational failure: talented professionals watching institutional decay undermine collective achievement. Their warning, delivered months before market recognition, demonstrates how internal dysfunction often becomes external crisis with predictable inevitability.

"The result? Layoffs and endless 'cost optimization,'" the director concluded, anticipating the strategic responses that would follow organizational failure to address fundamental structural problems.

In Novo Nordisk's case, the senior director's email serves as both diagnosis and prophecy—a roadmap to understanding how bureaucratic bloat can transform scientific triumph into strategic failure, one PowerPoint presentation at a time.

Disclaimer: The views and statements cited in this analysis—particularly those regarding internal culture—are drawn from a verified communication authored by a senior director-level employee at Novo Nordisk. These views do not represent the opinions, assessments, or endorsements of the publisher or its affiliates. All insights are provided for informational purposes only and should not be interpreted as financial advice or definitive commentary on corporate governance.