Nvidia Invests $5 Billion in Intel as Tech Giants Form Partnership to Develop AI Chips

Silicon Giants Unite: Nvidia's $5 Billion Intel Bet Signals New AI Architecture Era

Nvidia announced Thursday it will invest $5 billion in struggling rival Intel, forging an unprecedented alliance that could fundamentally reshape how artificial intelligence systems are built. The partnership, which combines the world's most valuable AI chipmaker with America's traditional processor champion, represents the latest tectonic shift in an industry being revolutionized by artificial intelligence demand.

Intel's stock surged 26.81% in intraday trading to $31.61—its highest level since July 2024—while Nvidia shares climbed 3.12% as investors digested the implications of what Jensen Huang, Nvidia's chief executive, called a "historic collaboration." The announcement comes just one month after the U.S. government agreed to take a 10% stake in Intel, underscoring the strategic importance of American semiconductor manufacturing in an increasingly competitive global landscape.

The $23 Bet That Changes Everything

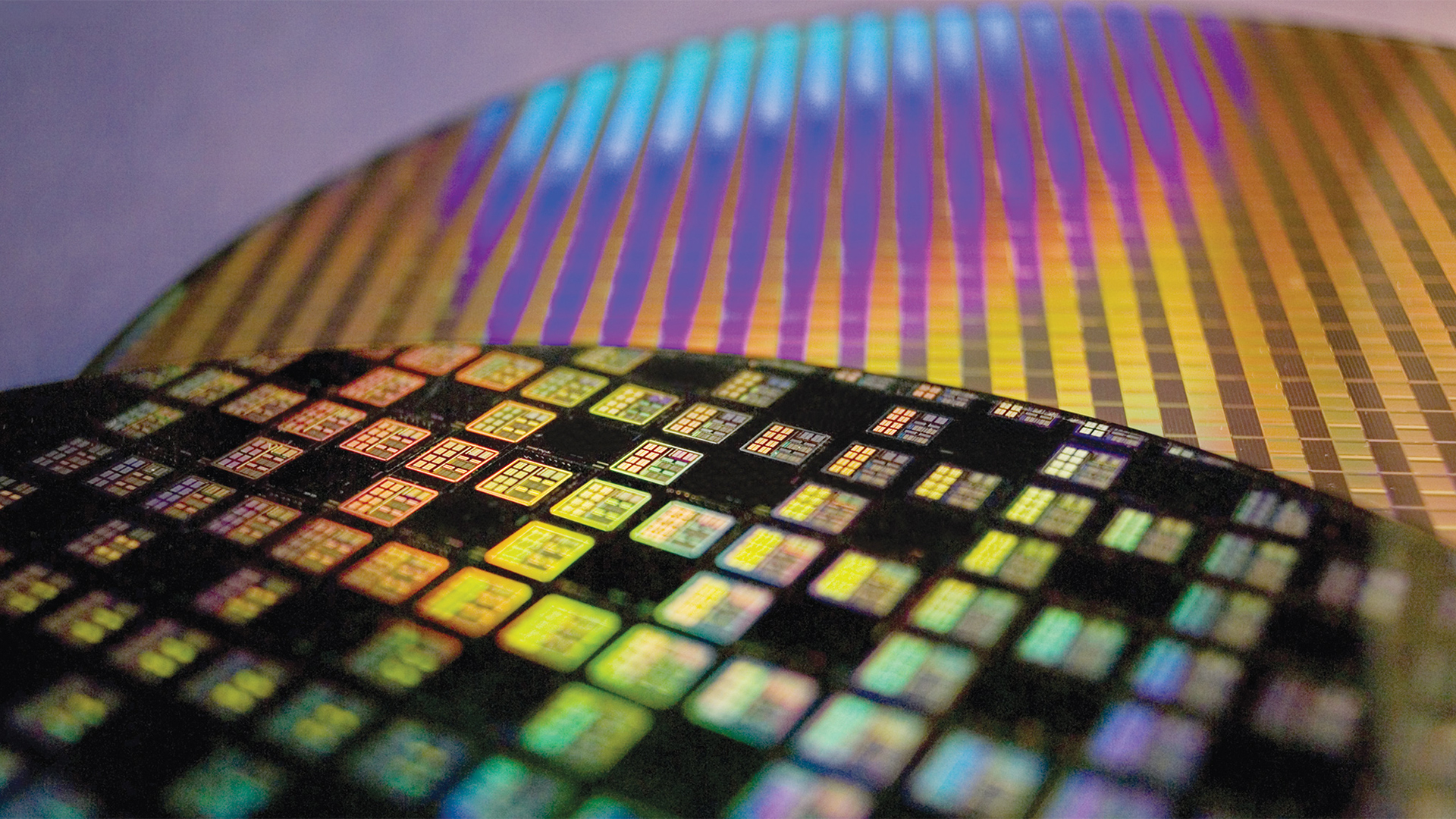

Nvidia will purchase $5 billion worth of Intel stock at $23.28 per share, acquiring approximately 4% ownership in the company that once dominated global chip manufacturing. But the financial investment, while substantial, represents only part of a broader strategic realignment that industry analysts suggest could redefine competitive dynamics across datacenter and personal computing markets.

The partnership centers on two critical initiatives: Intel will develop custom central processing units optimized for Nvidia's AI platforms, while the companies will collaborate on next-generation PC processors that integrate Nvidia's RTX graphics capabilities directly into Intel's x86 architecture. This marks a dramatic departure from traditional industry relationships, where chip companies typically compete rather than collaborate on core product development.

A System-on-Chip (SoC) is an integrated circuit that combines multiple electronic components, such as a CPU, GPU, memory, and I/O controllers, onto a single chip. This contrasts with discrete architectures where these functions are separate, offering a compact and efficient "system" on one piece of silicon.

"We appreciate the confidence Jensen and the Nvidia team have placed in us with their investment and look forward to the work ahead as we innovate for customers and grow our business," said Intel chief executive Lip-Bu Tan, who assumed leadership in March 2025.

Beyond GPUs: The Platform Control Strategy

Industry experts suggest Nvidia's move reflects a sophisticated understanding that future AI system performance will be limited not just by graphics processing power, but by the entire computing platform. By partnering with Intel on custom processors, Nvidia gains influence over CPU design, memory architecture, and system interconnects—areas where bottlenecks increasingly constrain AI workload performance.

"This signals that GPU dominance alone isn't sufficient for next-generation AI systems," noted one semiconductor analyst who requested anonymity. "Nvidia recognizes it needs to shape the CPU layer to maximize platform throughput."

The partnership addresses a key vulnerability in Nvidia's current market position. While the company's graphics processors dominate AI training and inference markets, rival Advanced Micro Devices has gained traction by combining its own AI chips with high-performance EPYC processors, creating integrated solutions that some customers prefer over multi-vendor configurations.

Market Turbulence Reveals Competitive Realignments

Thursday's market action provided a real-time glimpse into how investors view the partnership's competitive implications. Beyond Intel's dramatic surge and Nvidia's modest gains, other semiconductor stocks experienced significant pressure. ARM Holdings dropped 5% to $145.82, while AMD declined 3.4% to $153.71, suggesting investors believe the alliance threatens both companies' growth prospects.

The ARM decline appears particularly significant, as the partnership undermines narratives around ARM-based processors gaining share in AI-optimized personal computers. By developing x86 processors with integrated RTX capabilities, Intel and Nvidia offer PC manufacturers a compelling alternative that maintains compatibility with existing Windows software while delivering enhanced AI performance.

AMD's stock weakness reflects concerns that the partnership could reduce demand for its EPYC processors in AI-focused datacenter configurations, particularly where customers currently pair AMD CPUs with Nvidia GPUs.

Geopolitical Chess Moves in Silicon Valley

The timing and structure of the partnership carries unmistakable geopolitical undertones. The U.S. government's recent decision to acquire a 10% Intel stake through the CHIPS Act reflects broader national security concerns about semiconductor manufacturing and supply chain resilience. Nvidia's investment reinforces this dynamic, creating a formidable alliance of American chip companies with explicit government backing.

Some industry observers suggest the partnership positions both companies favorably for future government contracts and regulatory decisions. As policymakers increasingly view semiconductor capabilities as critical national infrastructure, companies demonstrating commitment to domestic manufacturing and innovation may gain competitive advantages beyond pure technical merit.

Technical Innovation or Strategic Necessity?

The partnership's technical objectives span two distinct but interconnected markets. In datacenters, Intel will develop custom x86 processors optimized for Nvidia's NVLink interconnect technology and specialized for AI workloads. These processors could deliver superior performance compared to general-purpose alternatives while maintaining the x86 software compatibility that enterprises demand.

Did you know? 🤔 NVIDIA’s NVLink is a high-speed interconnect that lets GPUs (and sometimes CPUs) share data far faster than traditional PCIe, delivering up to 900 GB/s of bandwidth in its latest generation. Paired with NVSwitch, it allows multiple GPUs to be linked in a high-speed network, enabling seamless memory sharing. This technology powers AI training, scientific simulations, and HPC workloads, where massive data exchange between GPUs is essential.

For personal computers, the collaboration envisions system-on-chip designs that integrate Intel's processing cores with Nvidia's RTX graphics capabilities. This approach could deliver better performance per watt than current discrete graphics solutions while enabling new AI-powered applications that require tight integration between processing and graphics functions.

However, the partnership announcement notably omits any commitment for Intel's foundry services to manufacture Nvidia's graphics processors. This absence suggests the collaboration remains primarily focused on product architecture rather than manufacturing, leaving Nvidia's dependence on Taiwan Semiconductor Manufacturing Company unchanged.

Investment Implications for a Shifting Landscape

The partnership creates both opportunities and risks across the semiconductor ecosystem. For Intel, the deal provides validation of its technical roadmap and guaranteed demand from the industry's most influential AI company. Success could help Intel regain relevance in high-growth markets after years of struggling to compete effectively against both AMD and various ARM-based alternatives.

Nvidia's investment may prove prescient if custom processor designs deliver meaningful performance improvements for AI applications. The company gains influence over critical system components without the capital intensity and execution risk of building its own CPU business.

Market analysts suggest several investment themes may emerge from the partnership. Companies focused on AI infrastructure could benefit if integrated Intel-Nvidia systems drive broader adoption. Conversely, traditional server and PC component suppliers might face pressure if tighter integration reduces demand for separate components.

The partnership also highlights growing importance of end-to-end system optimization in AI applications. Companies that can deliver integrated solutions spanning processors, accelerators, memory, and networking may gain advantages over those competing with point solutions.

Looking ahead, the success of this unprecedented collaboration will likely depend on execution across multiple technical and business challenges. Intel must deliver competitive custom processors while continuing its broader turnaround efforts. Nvidia must navigate potential conflicts with existing partners while integrating new capabilities into its platform strategy.

The semiconductor industry's evolution continues accelerating, driven by AI applications that demand ever-greater performance and efficiency. Whether this partnership represents a sustainable competitive advantage or merely a transitional arrangement remains to be seen, but its immediate market impact suggests investors believe the stakes for both companies—and their competitors—have fundamentally changed.

NOT INVESTMENT ADVICE