Oura Doubles Valuation to $11 Billion After $900 Million Raise as It Bets on Health Data Over Hardware

The $11 Billion Question: Inside Oura’s Bold Gamble That Health Data Can Beat Hardware

Oura just pulled off one of the biggest moves in wearables history. On Tuesday, October 14, 2025, the Finnish smart ring maker raised more than $900 million from major investors including Fidelity Management & Research Company, ICONIQ Growth, Whale Rock Capital Management, and Atreides Management. That enormous check doubled the company’s valuation to $11 billion—up from $5.2 billion just ten months ago. With this Series E round, Oura has now raised roughly $1.5 billion in total.

The timing isn’t accidental. The smart ring category is entering a do-or-die moment. The big question: can recurring subscription revenue justify premium hardware pricing when Samsung is willing to sell its Galaxy Ring with no monthly fee?

Oura believes the answer is yes—and it has the numbers to back it up. The company has shipped more than 5.5 million rings since 2015. Over 3 million of those went out in the past sixteen months. Revenue more than doubled to $500 million in 2024, and leadership says they’ll cross $1 billion this year. CEO Tom Hale says the new capital will help Oura “accelerate innovation, expand our global reach, and set a new standard for what wearables can achieve in advancing preventive health.”

Turning Jewelry Into A Money Machine

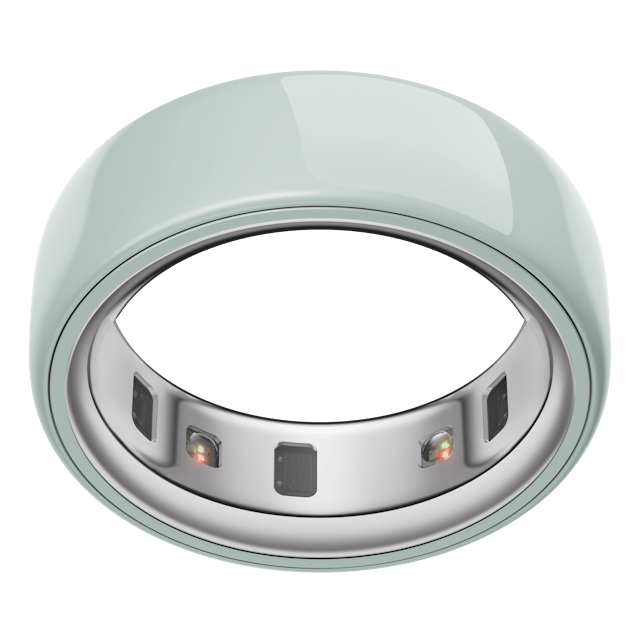

Most hardware startups barely survive. Oura survived by refusing to act like one. The $299-to-$349 titanium ring isn’t the product—it’s the doorway. The company’s real play is software. For $5.99 per month, users get advanced health insights, and 80% of them stick with it. That kind of retention turns a one-time sale into a recurring revenue stream.

As that base grows, Oura expects blended gross margins to rise toward 55–60 percent. That’s well above the 40–50 percent margins typical of hardware-only wearables and puts them closer to software economics.

Look deeper and the unit economics get even more compelling. Each ring costs an estimated $130–$160 to make, meaning Oura captures $70–$110 in gross profit per device. Add the net present value of a three-year subscription—roughly $60–$90—and the total lifetime value hits $130–$200. With customer acquisition costs in the $50–$80 range, the model still works even as competition heats up.

Samsung Enters the Ring

Then came the giant. Samsung launched its Galaxy Ring in 2024, priced at $399 but with no monthly fees. That move validated the category but also exposed Oura’s biggest weakness. Why pay for both hardware and a subscription when a big-name alternative offers similar sensor accuracy with zero recurring cost?

Analysts warn Samsung’s distribution power and integration with the broader Android ecosystem could pressure Oura, especially outside North America. Right now, 80 percent of Oura’s revenue comes from the U.S. and Canada. If that dominance slips, pricing power could erode quickly.

The smart ring market itself is booming, expected to jump from $1.2 billion in 2024 to $5.7 billion by 2030. Oura currently owns about 5 percent of that pie. Keeping it will depend on whether users believe paid data insights are truly better than “free.”

Betting on Regulation and Insurance

Oura is playing a longer game than most consumer hardware brands. Its plan? Become a health platform, not just a gadget. The company is pursuing FDA clearances for features like atrial fibrillation detection and fertility tracking. Those approvals aren’t just for show. They create regulatory walls that casual competitors can’t easily scale.

With FDA backing, Oura could partner with insurance companies and employers—huge channels where per-member-per-month subsidies change the math entirely.

Early signs look promising. Corporate wellness interest is rising, and insurers want access to continuous temperature data, heart rate variability, and sleep insights. One health tech analyst said Oura’s dataset could transform women’s health research and early illness detection, as long as the company protects user privacy and maintains trust.

The strategy aligns with a broader shift in healthcare: from reacting to problems to preventing them. As medical costs soar, tools that reduce hospital visits or improve outcomes are incredibly valuable. To win, Oura must prove its insights don’t just correlate with health—they change it.

Valuation: Software Dream or Hardware Reality?

With investors valuing the company at about 11 times projected 2025 revenue, Oura sits between two worlds. Hardware companies usually trade at mid-single-digit multiples. High-growth software companies land in the mid-teens. Oura’s valuation signals that investors believe in the subscription engine and the potential of its data, not the ring itself.

That leaves almost no room for failure. Base case forecasts call for $1.3–$1.5 billion in revenue and roughly 58 percent gross margins by late 2026. At 9–10 times sales, the company would be worth $12.6–$14 billion—just slightly above today’s round.

In the best-case scenario, Oura hits $1.7 billion in revenue, 60 percent margins, and low-teens EBITDA margins. With regulatory wins and insurer deals, that could support a valuation between $20–$24 billion.

In a darker scenario, Samsung’s free model eats into demand. If Oura’s revenue growth drops below 50 percent and margins fall under 52 percent, revenue multiples could compress to 5–6 times sales. That would slash the company’s value to $5–$7 billion—painful for recent investors.

How Oura Plans to Spend the Money

Fidelity leading the round shows serious institutional confidence. It also signals a broader shift in venture capital—away from pure AI hype and toward businesses that blend software, hardware, and recurring revenue. ICONIQ Growth, which backed Facebook and Stripe, joining in hints that Oura may pursue enterprise channels beyond direct-to-consumer.

With burn rates near $300 million per year, the new $900 million gives Oura two to three years of runway. The company plans to expand in Europe and Asia, build more AI-based predictive health features, and recruit top talent from major tech firms.

Early investors are already celebrating. Some professional athletes who backed Oura when it was worth only $35 million have seen returns north of 300x. Huge wins like that attract big money—but they also raise expectations.

What Investors Should Watch

Growth-focused investors are tracking a few key signals. Oura must keep subscription attach rates above 60 percent on new customers and churn below 30 percent—even with Samsung pushing hard on promotions. Regulatory wins and insurer partnerships within the next year would justify the premium valuation. But if Oura starts offering “free for life” subscriptions or deep discounts, it could indicate real pricing stress.

Smaller smart-ring makers may not survive the coming battle. Many lack capital, brand power, or distribution. The wearables market may consolidate, with only a handful of serious players left. Garmin and Whoop will stick to performance-focused niches. Apple remains the wildcard—if it enters the ring space, it could either expand the market or crush margins for everyone.

Disclaimer: The analysis reflects current market conditions and publicly available data. Past performance doesn’t guarantee future results. Wearables face regulatory, technological, and competitive risks. Investors should do their own research and consult advisors. Forward-looking statements involve uncertainty and may not materialize.

For professional traders, Oura’s $11 billion valuation assumes strong execution. The upside is real, especially if regulatory approvals and insurer deals land. But the model must be watched closely for signs of competitive pressure or cracks in the subscription engine.

In short: Oura is no longer just selling rings. It’s betting that health data—not hardware—will define the future of wearables. The market is watching to see if that bet pays off.