PassiveLogic Raises $74 Million to Make Buildings Run Themselves With AI Technology

The Rise of Robot Buildings: PassiveLogic's $74M Bet on Physical AI Revolution

Salt Lake City startup positions autonomous infrastructure as the next frontier in decarbonization and operational efficiency

PassiveLogic announced today it has secured $74 million in Series C funding to expand its vision of "physical AI"—bringing the autonomous decision-making capabilities of robotics to the built environment that surrounds us daily.

The funding round, led by noa, Europe's largest built-world venture capital firm, attracted a notable mix of strategic investors including Prologis Ventures, Johnson Controls, and PSP Growth. These new backers join existing investors Addition, NVentures (NVIDIA's venture arm), Keyframe, and Brookfield, bringing PassiveLogic's total funding to over $125 million.

When Buildings Think for Themselves

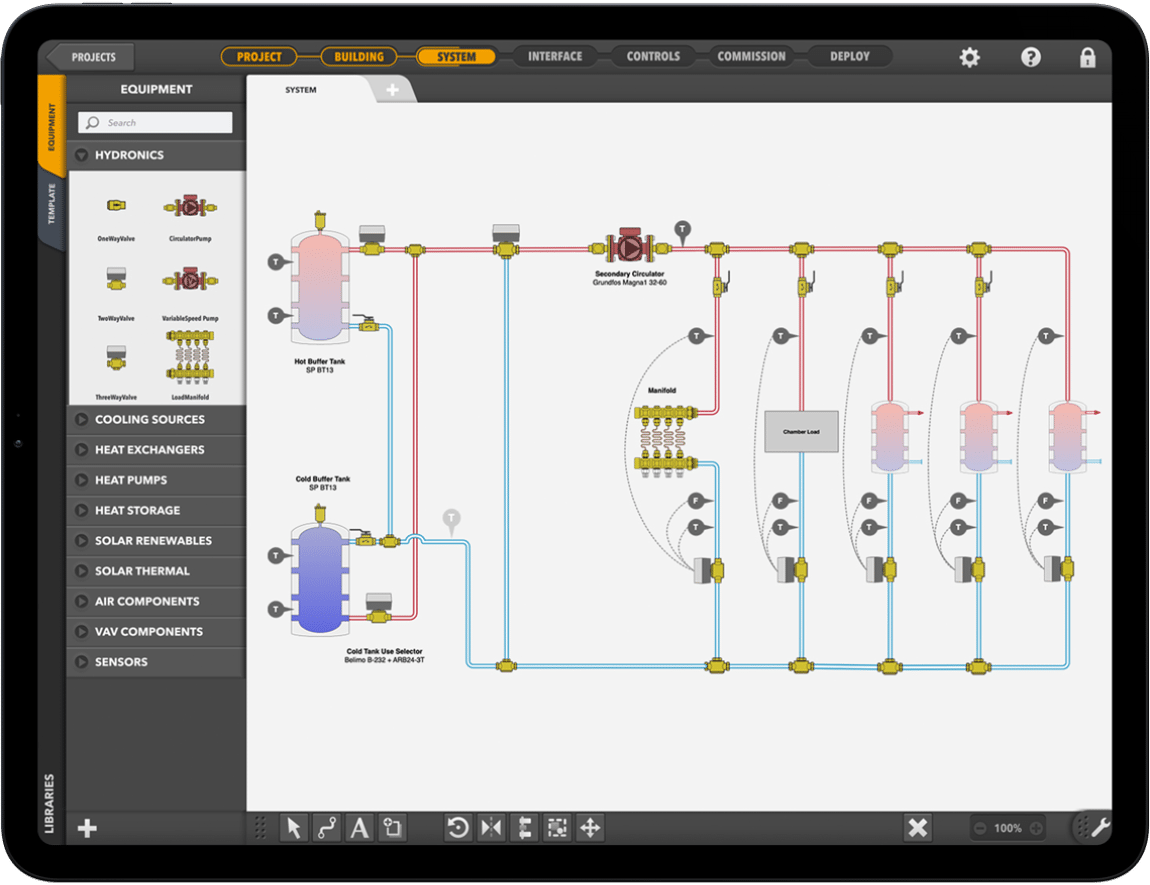

PassiveLogic's platform represents a departure from traditional building management systems that rely on rigid, rule-based programming unchanged since the 1990s. Instead, the company's Hive system uses on-site GPU clusters to power real-time decision engines that coordinate heating, cooling, lighting, and logistics systems as integrated networks rather than isolated components.

"We're seeing the emergence of buildings that can understand, predict, and adapt to changing conditions without human intervention," explains one industry analyst familiar with the company's technology. "This goes far beyond smart buildings—these are autonomous buildings that can optimize themselves continuously."

The platform consists of three core components: Hive, the GPU-powered decision engine that processes physics-based digital twins; Sense Nano, wireless sensors capturing occupancy and environmental data; and Quantum Lens, a mobile application that creates detailed digital building models using only smartphone cameras.

This technological stack addresses what many consider the most pressing challenge in commercial real estate: buildings account for approximately 37% of global energy consumption and carbon emissions, yet most remain controlled by outdated systems that treat each mechanical component in isolation.

Regulatory Pressure Meets Market Reality

The timing of PassiveLogic's funding aligns with mounting regulatory pressure across major markets. New York City's Local Law 97 began imposing fines of $268 per ton of CO2 equivalent above prescribed limits in 2024, while the European Union's revised Energy Performance of Buildings Directive introduces "smart readiness indicators" that reward automation and digitalization.

These regulations transform energy inefficiency from an operational concern into a direct financial liability, creating urgent demand for systems capable of continuous optimization rather than periodic adjustments.

"Building owners can no longer treat energy management as a set-and-forget operation," notes a facilities management executive who requested anonymity. "The compliance costs alone justify significant investments in automated control systems."

The economic imperative extends beyond regulatory compliance. With buildings representing roughly 80% of the structures that will exist in 2050, the decarbonization challenge requires retrofitting existing infrastructure rather than waiting for new construction.

Strategic Capital Signals Market Maturation

The investor composition of PassiveLogic's Series C reveals the strategic importance various industries place on autonomous building technology. Prologis Ventures brings immediate access to massive logistics and data center portfolios where thermal management and energy costs directly impact operational margins.

Johnson Controls' participation carries particular significance, representing both validation from a building systems incumbent and potential channel access to global installation networks. However, this relationship introduces complexity, as Johnson Controls competes in many of the same markets PassiveLogic aims to transform.

"The presence of strategic investors from different parts of the value chain suggests we're moving beyond the proof-of-concept phase," observes one venture capital professional tracking the building technology sector. "When operators like Prologis and systems providers like Johnson Controls invest together, it signals confidence in commercial viability."

PSP Growth's involvement adds another dimension, representing pension fund capital seeking stable, long-term returns from infrastructure improvements—a validation of the sector's investment thesis.

Technology Claims Meet Market Skepticism

PassiveLogic's technical approach centers on physics-informed artificial intelligence models that simulate building behavior in real-time, enabling predictive rather than reactive control. The company claims its proprietary Swift-based compiler delivers significant training and inference speed advantages over conventional frameworks, though independent verification of these performance metrics remains limited.

The on-premises GPU deployment model distinguishes PassiveLogic from cloud-based building analytics platforms, prioritizing low-latency control and data sovereignty over centralized processing. This architecture alignment with edge computing trends, particularly relevant for mission-critical facilities like hospitals and data centers where millisecond response times can impact safety and operational continuity.

Critics point to integration challenges with existing building systems, noting that most commercial buildings rely on established protocols like BACnet that require certification through lengthy testing processes. Success in this market often depends as much on standards compliance and installer relationships as technological innovation.

"The technology sounds compelling, but buildings are conservative environments," explains one mechanical engineering consultant. "Owners need to see proven interoperability and documented savings before they'll trust autonomous systems with life-safety functions."

Market Sizing and Investment Opportunity

PassiveLogic frames its addressable market as expanding from traditional building automation, projected to reach $191 billion by 2030, to a broader "autonomous buildings" category the company estimates at $1.3 trillion globally. While this larger figure represents aspirational market creation rather than established demand, the underlying drivers appear substantial.

The investment thesis rests on several converging trends: regulatory mandates creating compliance costs, rising energy prices increasing operational pressure, and technological maturation enabling more sophisticated automation. Additionally, utility programs increasingly reward buildings that can provide grid flexibility through automated demand response—potentially creating new revenue streams for building owners.

For institutional investors, autonomous building technology offers exposure to both climate technology trends and the massive real estate sector, with the potential for predictable returns through energy savings and operational efficiency improvements.

Deployment Challenges and Competitive Response

PassiveLogic's success will ultimately depend on execution across several critical dimensions. The company must demonstrate that its phone-based digital twin creation process can reliably capture the complexity of diverse building types, reducing the commissioning time that often makes building system upgrades economically prohibitive.

Cybersecurity represents another crucial consideration, as automated building systems create new attack vectors that could compromise both operational safety and occupant privacy. The industry's history includes cautionary tales like the 2013 Target data breach, which originated through compromised HVAC systems.

Incumbent building system providers are unlikely to cede market share without response. Johnson Controls' dual role as investor and potential competitor creates an interesting dynamic, possibly signaling industry recognition that autonomous control capabilities will become competitive necessities rather than optional features.

Looking Forward: The Autonomous Infrastructure Thesis

The implications of successful autonomous building deployment extend beyond individual facility optimization. At scale, buildings that can respond instantly to grid signals could serve as distributed energy resources, providing flexibility that supports renewable energy integration and grid stability.

Near-term opportunities appear strongest in facilities with acute thermal management challenges—data centers experiencing explosive growth, hospitals with stringent environmental requirements, and logistics centers operating on thin margins where energy costs significantly impact profitability.

Market analysts suggest the next 18 months will prove critical for establishing autonomous building technology as a legitimate category rather than experimental innovation. Success metrics will include demonstrated energy savings validated through independent measurement protocols, seamless integration with existing building systems, and deployment scalability that proves economic viability across diverse facility types.

For investors, PassiveLogic's funding round represents a significant bet that physical AI will follow the trajectory of its digital counterparts—moving from specialized applications to mainstream adoption as costs decline and capabilities expand. The confluence of regulatory pressure, technological maturation, and strategic investor validation suggests this transformation may accelerate faster than traditional building industry adoption cycles would predict.

The ultimate test will be whether autonomous buildings deliver the promised combination of operational efficiency, environmental impact reduction, and financial returns that can justify the complexity of implementation. If successful, PassiveLogic and its competitors could reshape how society thinks about the buildings that house our economic activity—transforming them from passive infrastructure into active participants in energy and operational optimization.

Investment Disclaimer: This analysis is for informational purposes only and should not be considered investment advice. Past performance does not guarantee future results. Readers should consult with financial advisors before making investment decisions.