Poland Shuts Belarus Border as France and Germany Send Fighter Jets After Russian Drone Incursions

NATO's Eastern Fortress: Poland's Border Lockdown Signals New Defense Reality

Allied Air Power Surges as Warsaw Seals Belarus Crossing Amid Drone Incursions

Poland announced it will shut all road and rail border crossings with Belarus from midnight September 12 local time, citing security risks from ongoing Russia-Belarus "Zapad-2025" joint military exercises near its frontier. Prime Minister Donald Tusk characterized the drills as "very aggressive" in both doctrine and proximity to Polish territory.

The border closure coincides with reported Russian drone incursions into Polish airspace this week during attacks targeting western Ukraine. In response, France committed to deploying three Rafale fighter jets to help protect Polish airspace, while Germany indicated it would step up defense support measures. Poland has simultaneously imposed air traffic restrictions along its eastern borders that could extend until early December as authorities reassess security risks.

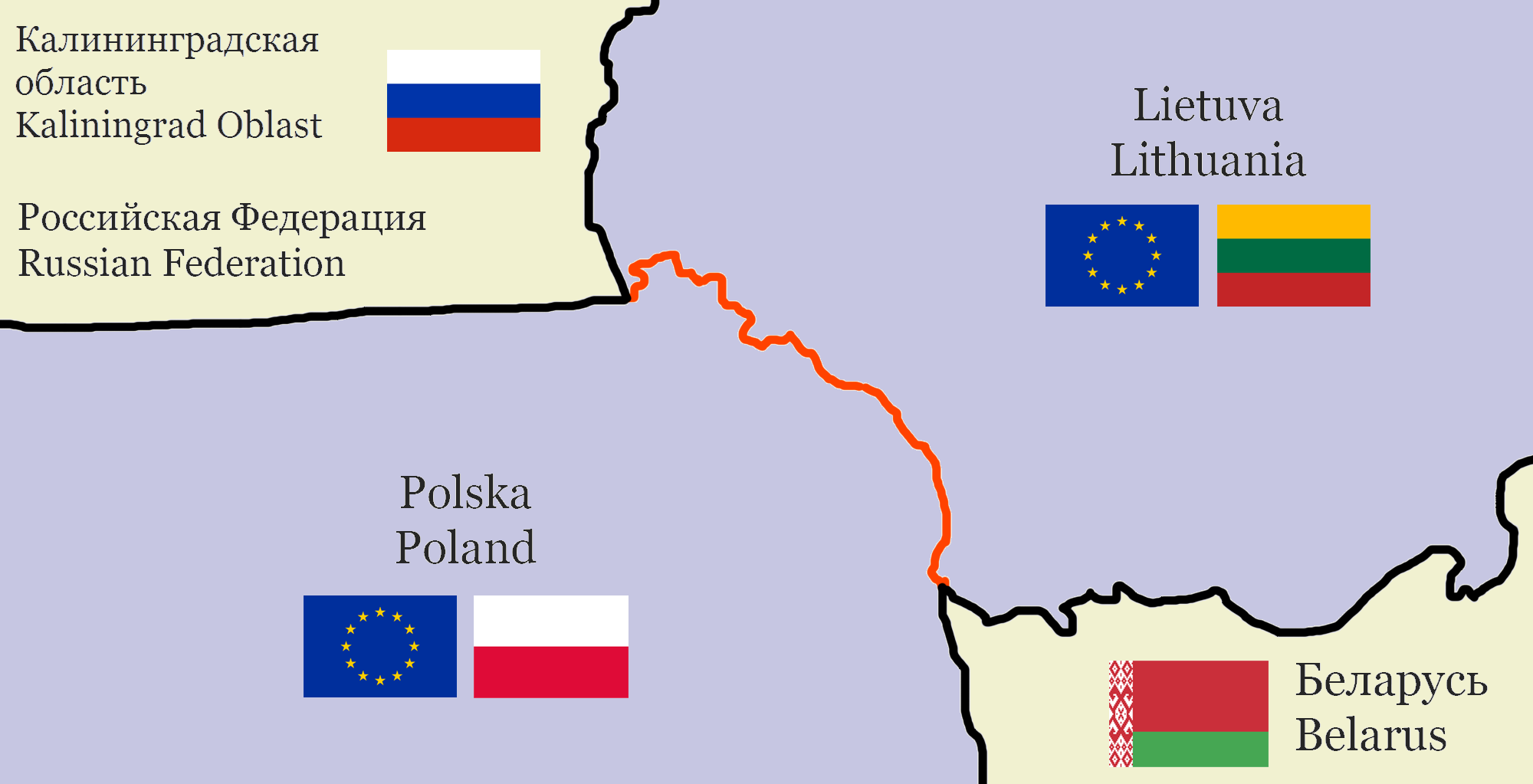

The Zapad-2025 exercises, scheduled to run through September 16, simulate military operations near the Suwałki Corridor—the strategic land bridge between Poland and Lithuania that connects NATO territory to the Baltic states. This convergence of cross-border incidents and large-scale military exercises has prompted the most coordinated allied response on NATO's eastern flank since the initial aftermath of Russia's invasion of Ukraine.

When Deterrence Meets Reality

The catalyst emerged this week as Russian drones repeatedly penetrated Polish airspace during attacks targeting western Ukrainian infrastructure. These incursions prompted emergency Article 4 consultations and an extraordinary UN Security Council session, transforming what Moscow characterizes as routine military exercises into a live test of NATO's collective response mechanisms.

NATO's Article 4 is a provision for member countries to consult together whenever they perceive a threat to their territorial integrity, political independence, or security. Unlike Article 5, which mandates collective defense in response to an armed attack, Article 4 is invoked for discussions and diplomatic action before a direct military confrontation, allowing for a collective response to various security concerns.

Prime Minister Donald Tusk's government framed the border closure as essential national security measures tied to the Zapad-2025 exercises, which simulate operations near the strategically vital Suwałki Corridor—the narrow land bridge connecting Poland and Lithuania that represents NATO's most vulnerable geographic chokepoint to the Baltic states.

France's deployment of three Rafale fighter jets, announced by President Emmanuel Macron, signals a shift from symbolic solidarity to operational deterrence. While the numerical contribution appears modest, defense analysts suggest the deployment fundamentally alters Moscow's escalation calculus by introducing direct French military assets into potential conflict scenarios.

Germany's commitment to expand air policing operations over Poland, coupled with signals of support for a new EU sanctions package, indicates Berlin's recognition that the security environment has shifted beyond diplomatic management toward active defense requirements.

The Economics of Escalation

The immediate economic impact centers on supply chain disruption rather than strategic commodity flows. EU-Belarus trade volumes had already contracted significantly following earlier sanctions, but the complete border closure affects remaining freight corridors and forces costly rerouting through Lithuania and Latvia.

Transport industry sources indicate immediate spikes in trucking rates and insurance premiums for eastern European routes, with some logistics operators pausing Belarus-linked operations pending security reassessment. Airspace restrictions extending to 9,500 feet altitude through December create additional operational complexity for regional aviation, though major commercial routes remain largely unaffected.

More significantly, the coordinated response accelerates existing trends in European defense procurement and infrastructure investment. Poland's access to €43.7 billion from the EU SAFE fund, combined with the European Sky Shield Initiative's multi-layered air defense requirements, creates substantial medium-term procurement momentum for defense contractors.

The European Sky Shield Initiative (ESSI) is a multi-layered air defense system designed to strengthen European air and missile defense capabilities. It aims to close critical protection gaps by enabling participating nations to jointly procure and deploy a range of air defense assets.

Strategic Recalibration in Progress

The timing and scope of allied responses suggest a deliberate recalibration of NATO's eastern posture beyond reactive measures. Unlike previous crisis responses that emphasized diplomatic de-escalation, the current approach prioritizes visible deterrence and operational preparedness.

Security experts note that temporary deployments historically evolve into semi-permanent rotations once operational infrastructure is established. France's Rafale deployment, while initially limited, creates precedent for sustained allied air presence over Poland that extends beyond immediate crisis management.

The integration challenges are substantial. Coordinating French, German, and Polish air assets requires significant command and control infrastructure development, creating both operational opportunities and potential friction points as alliance members balance national sovereignty with collective defense requirements.

Investment Implications: Defense Wins, Transport Adjusts

The defense sector emerges as the clear beneficiary of sustained eastern flank tensions. European air defense manufacturers—particularly those specializing in counter-unmanned aerial systems and integrated air and missile defense—face accelerated demand cycles driven by both immediate operational requirements and longer-term capability gaps exposed by drone warfare tactics.

Key beneficiaries include Rheinmetall's ground-based air defense systems, Hensoldt's radar technologies, and Thales's command and control infrastructure. The shift toward comprehensive airspace monitoring creates opportunities for sensor fusion technologies and artificial intelligence-enhanced threat detection systems.

Transport and logistics sectors face mixed prospects. While border closures create near-term operational challenges and cost increases, they also accelerate infrastructure investment in alternative routing and enhanced border security technologies. Companies with established presence in Baltic states may benefit from traffic redistribution, though volumes remain limited by broader geopolitical constraints.

Market Positioning for Persistent Tension

Financial markets should prepare for sustained rather than cyclical security tensions in Eastern Europe. The pattern of drone incursions, military exercises, and allied responses suggests a new operational baseline rather than temporary crisis management.

Currency markets may experience periodic volatility around security incidents, with the Polish złoty particularly sensitive to escalation signals. However, Poland's strong economic fundamentals and EU integration limit sustained downward pressure absent major kinetic events.

Defense equity valuations appear positioned for multi-year expansion cycles, supported by both immediate procurement acceleration and fundamental shifts in European security doctrine. Investors should focus on companies with established NATO supply relationships and scalable production capabilities rather than speculative pure-play opportunities.

Performance of a European Aerospace & Defense stock index compared to a broad European market index like the STOXX 600 over the past three years.

| Time Period | European Aerospace & Defense Index Performance | STOXX 600 Performance |

|---|---|---|

| Last three years (approx. Mar 2022 - Mar 2025) | +165% | +25% |

| Year-to-Date 2025 (as of Mar 28, 2025) | +35% | +8% |

| Year-to-Date 2025 (most recent available data) | +55.776% (as of Sep 11, 2025) | +9.83% (average for 2025 YTD, likely up to July 2025) |

Looking Forward: The New Normal Takes Shape

The confluence of Zarad-2025 exercises, drone harassment tactics, and coordinated NATO responses establishes patterns likely to persist beyond immediate crisis resolution. Poland's decision to extend airspace restrictions through December signals expectations of continued pressure rather than rapid normalization.

Future developments will likely center on the sustainability of enhanced air policing operations and the speed of defensive infrastructure development. The European Sky Shield Initiative's implementation timeline becomes critical for maintaining credible deterrence without unsustainable operational tempo.

Investment strategies should account for this transition toward persistent tension management rather than crisis resolution. Defense spending normalization at elevated levels appears probable, while transport and energy sectors adapt to enhanced security requirements as standard operating conditions.

The eastern flank's transformation from symbolic trip-wire to actively defended frontier represents fundamental change in European security architecture. Market participants ignoring this shift risk missing both immediate opportunities and longer-term structural adjustments in regional economic relationships.

For professional investors, the key insight remains tactical agility within strategic patience—positioning for sustained defense spending expansion while maintaining flexibility for periodic security-driven volatility across affected sectors and currencies.

House Investment Thesis

| Category | Summary |

|---|---|

| Event & Catalyst | Poland fully closes all Belarus border crossings (Sep 11-12). NATO (France/Germany) reinforces air policing over Poland following 19+ Russian drone incursions into Polish airspace. Catalyst window is Russia's Zapad-2025 military drills (Sep 12-16) near the Suwałki Corridor. |

| Base Case (70% Probability) | No manned-aircraft or missile violations. Continued drone harassment during Zapad. Poland's airspace restrictions (to FL095) remain until Dec 9. Border closure phases out in 2-3 weeks for tighter screening. EU advances sanctions package #19 and air-defense funding. |

| Upside / Escalatory Tail Risk | A drone causes casualties/critical infrastructure damage inside Poland. Outcome: NATO surges more air assets (Patriots, UK/US); EU sanctions harden (shadow fleet, banks, China). Market Impact: CEE equities wobble, PLN weakens, Polish government bond spreads widen. |

| Downside / De-escalatory Tail Risk | Zapad-2025 ends quietly. Poland reopens crossings sooner and narrows air restrictions. Outcome: Short-term give-back in defense stock momentum, but structural bull case remains intact. |

| Recommended Trades & Positioning | 1. Core Long: European Defense & C-UAS (Rheinmetall, Hensoldt, Thales, Dassault, Airbus, Leonardo, Saab). Accumulate on dips. 2. Pair Trade: Long defense basket vs. Short European airlines (Lufthansa, Wizz Air, Ryanair). 3. FX/Vol: Buy EUR/PLN topside (calls) for Zapad window; fade on de-escalation. 4. Logistics: Negotiate procurement/insurance for companies exposed to Poland-Belarus lanes; transient trucking rate increases. |

| Sector Read-Through | Defense: Multi-year tailwind; orders accelerate. Airlines/Insurers: Operational/war-risk premiums rise; equities are twitchy. Energy: Minimal near-term flow risk; muted price action. CEE FX/Sovs: PLN softens on spikes; POLGB spreads drift wider. EU Policy: Momentum favors sanctions #19 targeting Chinese enablers & shadow fleet. |

| Sharp Convictions | 1. Defense stocks outperform into year-end; buy any dip. 2. Airlines under-hedge geopolitics; keep defense-airlines pair trade on. 3. PLN volatility is mispriced; own gamma for Zapad window. 4. Sanctions #19 will bite at the margin; bigger winner is EU defense primes. |

| View Breakers | Manned aircraft violation or mis-identification shootdown. Polish domestic politics forcing a prolonged border closure (>2 months). US/EU political wobble delaying sanctions #19. |

| Key Metrics to Watch | NATO air tasking (AWACS/UK Typhoon surges). Polish NOTAM/airspace restriction updates. UNSC outcomes & language post-Zapad. Drone debris forensics for new sanctions targets. |

NOT INVESTMENT ADVICE