Fed Chair Powell Signals Interest Rate Cut Likely in September After Labor Market Warning

Fed's Calculated Pivot: Powell Signals September Cut Amid Labor Market Inflection

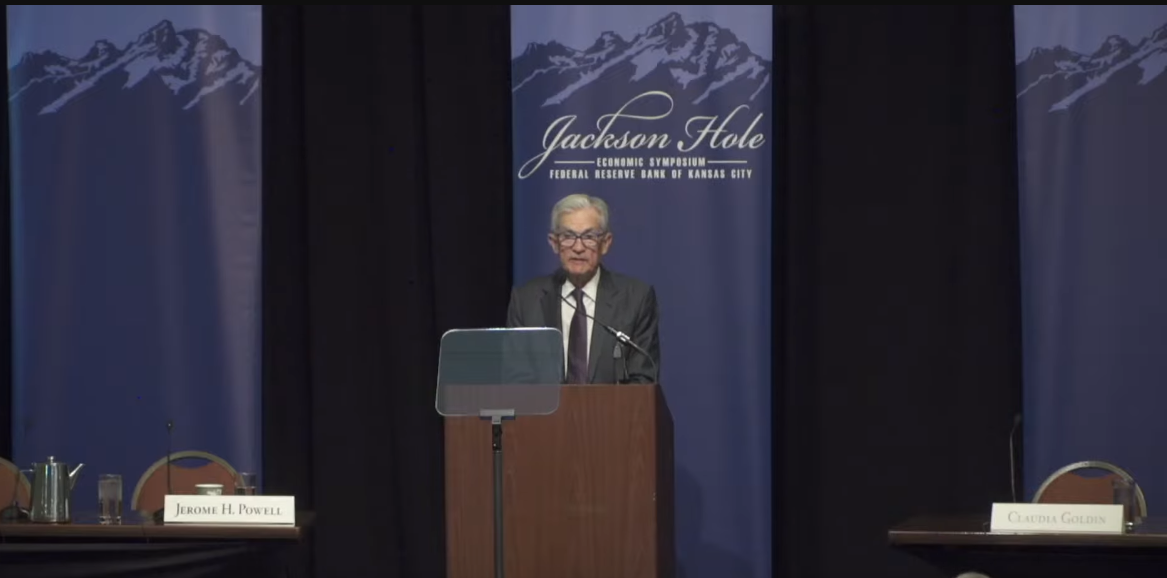

Jackson Hole, Wyoming — Federal Reserve Chair Jerome Powell explicitly opened the door Friday to cutting interest rates as soon as next month, marking a pivotal shift in monetary policy after holding rates steady throughout the year.

Speaking at the Fed's annual Jackson Hole symposium, Powell stated that the "baseline outlook and the shifting balance of risks may warrant adjusting our policy stance," directly signaling potential action at the Federal Open Market Committee's September 16-17 meeting. The central bank has maintained its benchmark rate in the 4.25%-4.50% range since July, citing solid labor market conditions and uncertainty over inflation driven by expanded tariff policies.

Powell's remarks represent the clearest indication yet that the Federal Reserve is prepared to resume rate cuts after pausing its easing cycle. The Fed Chair described the current employment landscape as existing in a "curious kind of balance," while warning that downside risks to employment are rising and noting that tariff-related price pressures have become "clearly visible" in recent economic data.

The announcement comes as the central bank grapples with competing pressures: a labor market showing signs of cooling and trade-related inflation that complicates traditional monetary policy responses.

Labor Market's Precarious Equilibrium

The employment landscape that emerged from Powell's analysis reveals an economy teetering on an inflection point. Three-month payroll growth has decelerated sharply to approximately 35,000 jobs per month following significant downward revisions, while unemployment has climbed to 4.2% with long-term unemployment showing year-over-year increases.

Summary of latest U.S. labor market data (as of Aug 22, 2025): Monthly job growth has slowed significantly, unemployment is edging up, and high-frequency indicators point to continued softness.

| Indicator | Latest Reading | Period | Direction/Context | Notes |

|---|---|---|---|---|

| Nonfarm payrolls (change) | +73,000 | July 2025 | Slowing sharply | Marked downside surprise; signals hiring “stall speed.” |

| Payroll revisions (May & June) | -258,000 (combined) | Revisions released Aug 1, 2025 | Downward | Amplifies slowdown; prior months were weaker than first reported. |

| Unemployment rate (U-3) | 4.2% | July 2025 | Up from 4.1% in June | Near top of 4.0%–4.2% range seen since mid-2024. |

| Underemployment (U-6) | 7.9% | July 2025 | Rising | Indicates easing labor demand; broader slack increasing. |

| Sector dynamics | Health care/social assistance gains; cyclical sectors soft | July 2025 | Mixed | Growth concentrated in fewer sectors; broad softness elsewhere. |

| Jobless claims (initial) | Rose notably mid-August | August 2025 (weekly) | Deteriorating | Biggest rise in ~3 months, pointing to softer conditions. |

| Continuing claims | Highest since 2021 | August 2025 (weekly) | Deteriorating | Suggests harder time finding new jobs. |

| Official release cadence | Next Employment Situation in early September | August report timing | — | July is the latest full BLS month available; schedule indicates early Sept release. |

This deterioration in labor market momentum represents a fundamental shift from the robust employment conditions that justified the Fed's prolonged pause. Market strategists note that Powell's emphasis on the speed with which labor conditions can deteriorate suggests policymakers are increasingly focused on preemptive action rather than reactive measures.

The unemployment rate's trajectory has become particularly concerning for Fed officials, as historical patterns suggest that once joblessness begins climbing, it tends to accelerate rapidly. Current levels approaching the upper bound of what economists consider full employment leave little cushion for further deterioration without triggering broader economic instability.

Tariff Turbulence Reshapes Inflation Calculus

Powell's acknowledgment that tariff-related price effects are accumulating represents a significant evolution in the Fed's assessment of trade policy impacts. Unlike previous trade tensions that were viewed as temporary disruptions, current tariff implementations across steel, aluminum, and other industrial sectors appear to be generating sustained price pressures.

The complexity of this challenge cannot be overstated. While traditional monetary policy tools remain effective at managing demand-driven inflation, supply-side price increases from trade restrictions create a more nuanced policy environment. Powell's suggestion that sharper labor market deterioration could offset tariff-driven inflation concerns reveals the Fed's sophisticated risk management approach.

"The potential for a sharper labor slowdown could reduce concerns that tariff-driven cost increases will keep inflation elevated," Powell explained, highlighting the institution's willingness to accept near-term inflation risks if employment conditions deteriorate significantly.

This framework suggests the Fed is prepared to cut rates even if headline inflation measures remain elevated, provided labor market weakness justifies such action. The approach represents a calculated bet that demand destruction from higher unemployment would ultimately prove more disinflationary than supply-side price pressures from trade policy.

Market Mechanics and Immediate Implications

Financial markets responded predictably to Powell's dovish pivot, with major equity indices surging over 1.2% as investors rapidly repriced September rate cut probabilities to approximately 70-75%. The reaction was particularly pronounced in cyclical sectors, with steelmakers and base metals proxies leading gains as investors anticipated benefits from lower discount rates and potential demand support.

The market's interpretation of Powell's remarks as a clear signal for September easing reflects sophisticated institutional positioning ahead of the speech. Options flows and futures positioning had already begun reflecting increased cut probabilities, suggesting professional investors were anticipating a dovish tilt based on recent economic data.

Currency markets showed more measured responses, with the dollar experiencing modest weakness against commodity-linked currencies while maintaining strength against safe-haven assets. This nuanced reaction reflects market recognition that any Fed easing cycle will likely be measured rather than aggressive, given persistent inflation risks.

Bond markets demonstrated particular sensitivity to Powell's two-sided risk framing, with the yield curve steepening as front-end rates declined while longer-term yields remained anchored by inflation concerns. This dynamic suggests investors are pricing a limited easing cycle rather than a return to ultra-accommodative policy.

Did you know? A “bull steepener” in the U.S. Treasury yield curve—when short-term yields drop faster than long-term ones—often signals markets are pricing in near-term Fed rate cuts, since the front end is most sensitive to policy; recent late-August commentary ties the ongoing steepening to expected easing while noting long-maturity yields can stay elevated due to inflation expectations and heavy Treasury issuance, so the curve can steepen both because cuts pull down short rates and because term premium keeps long rates sticky.

Strategic Investment Positioning

The evolving monetary policy landscape creates distinct opportunities across asset classes for sophisticated investors. Fixed income strategies favoring front-end duration appear increasingly attractive, with particular appeal in the 1-year to 3-year maturity range where rate cut expectations are most directly reflected.

Credit markets present a more nuanced picture, with investment-grade spreads likely to benefit from lower risk-free rates while maintaining selectivity around sectors vulnerable to tariff disruptions. The industrial and manufacturing segments face particular complexity as lower financing costs compete with elevated input costs from trade restrictions.

Equity positioning strategies should emphasize quality factors while maintaining tactical exposure to domestic cyclicals that benefit from lower rates without significant tariff exposure. Small-cap equities present compelling risk-adjusted opportunities if the Fed successfully engineers a soft landing, though downside protection remains essential given labor market uncertainties.

Currency strategies favoring commodity-linked and growth-sensitive currencies against traditional safe havens appear well-positioned, though positions should incorporate tight risk management given trade policy uncertainties. The Australian and New Zealand dollars present particular appeal given their sensitivity to global growth expectations and commodity demand.

Forward-Looking Risk Assessment

The path forward for monetary policy remains contingent on incoming economic data, with particular emphasis on labor market indicators and inflation measures. September's employment report will prove especially critical, as will August inflation data that could either support or undermine the case for immediate easing.

Analysts suggest the bar for skipping a September cut has risen significantly following Powell's explicit guidance, though unexpectedly strong economic data could still prompt delay. The Fed's commitment to data-dependent decision-making means investors should remain prepared for rapid policy adjustments based on evolving conditions.

The broader economic environment suggests the Fed faces a narrow path between supporting labor markets and managing inflation expectations. Success in this endeavor could extend the current economic expansion, while missteps risk either renewed inflation pressures or more severe labor market deterioration.

Market participants should monitor credit conditions closely, as any signs of financing stress could accelerate the Fed's easing timeline. Similarly, developments in trade policy that either escalate or de-escalate tariff pressures will significantly influence the central bank's policy calculus.

Strategic Implications for Professional Investors

Powell's Jackson Hole address fundamentally alters the investment landscape for the remainder of 2024 and beyond. The explicit acknowledgment of shifting risk balances provides clearer guidance for portfolio positioning while maintaining appropriate hedges against potential policy errors.

Professional investors should consider this environment favorable for strategies that benefit from declining short-term interest rates while maintaining protection against supply-side inflation pressures. The Fed's sophisticated approach to balancing dual-mandate concerns suggests a measured easing cycle that supports risk assets without compromising long-term price stability.

House Investment Thesis

| Category | Summary of Key Points |

|---|---|

| Powell's Signal | Opened the door to a September rate cut, emphasizing two-sided risk management (downside labor risks vs. upside inflation risks from tariffs). Markets reacted dovishly (equities up, yields down, Sept cut odds ~70-75%). |

| Current Policy | Rate: 4.25%-4.50% (effective 4.33%). A 25bp cut would make it 4.00%-4.25%. Macro Backdrop: Unemployment 4.2% but payroll growth decelerating sharply (~35k/mo). Headline CPI 2.7%, Core CPI 3.1%. Tariff pass-through is active and uncertain. |

| Base Case Call | 25 bp cut in September (not 50bp) with a soft easing bias. The bar for skipping is higher now. A hot CPI (>0.3% m/m core) or strong payrolls (>175k) could lead to a hold. |

| Why 25, Not 50? | A 50bp cut would contradict "proceed carefully" with core inflation at ~3% and tariffs lifting prices. Policy is already "modestly restrictive," not requiring a large cut without an acute labor shock. |

| Cycle Path (Probabilities) | Most Likely: Sept -25bp → Dec -25bp → pause into 2026 (if unemployment <4.6% and core disinflation continues). Alternatives: Hold in Sept (on strong data) or -50bp in Sept (only on an acute labor shock). |

| Market Implications (Rates) | Front-end: Receive 1y1y/EDZ6. Curve: Prefer 2s10s bull steepeners. Breakevens: Neutral-to-slight long 5y BE (supported by tariffs/shelter). |

| Market Implications (Credit & Equities) | Credit: Favor up-in-quality IG carry; avoid deep cyclicals/CCC. Equities: Tactical tilt to domestic cyclicals/small caps but be selective on tariff-sensitive names. Quality factor should keep leadership. |

| Market Implications (FX & Comm) | FX: Modest USD downside; prefer long AUD/NZD vs. JPY (with tight stops). Commodities: Lower rates supportive, but don't extrapolate instant reflation; gold's pop may be constrained by tariff inflation. |

| Consensus Blind Spots | 1. Underpricing tariff stickiness: Effects will accumulate, capping the easing pace. 2. Misreading labor risk: It's about the speed of a potential downturn, arguing for an insurance cut now. 3. Ignoring framework changes: New Fed communications shift away from a "low-for-long" 2010s paradigm, implying a shallower terminal rate. |

| What Changes My Mind | Hawkish Hold: Aug payrolls >175k + low unemployment + core CPI >0.3% m/m. Larger/Faster Cuts: Jobless claims >280k, unemployment jumps, or a credit accident. Curve Risk: Tariff escalation could flatten a steepener via higher term premium. |

| Key Calendar Dates | Beige Book: Sept 3. FOMC Meeting: Sept 16-17 (press conference on the 17th). |

| Bottom Line | Trade the Fed's reaction function, not the point forecast. Position for a 25 bp "insurance" cut with a mild easing glidepath via front-end duration, 2s10s steepeners, neutral BEs, up-in-quality credit, and selective cyclicals with tight data risk controls. |

This analysis is based on current market conditions and established economic indicators. Past performance does not guarantee future results. Investors should consult qualified financial advisors for personalized investment guidance.