SpaceX Starship Achieves First Satellite Deployment and Engine Relight in Space After Nine Previous Test Failures

SpaceX Starship Flight 10: Breaking Through the Reliability Barrier

STARBASE, Texas — At precisely 7:30 PM Eastern on Tuesday evening, a 403-foot tower of steel and ambition lifted off from the Gulf Coast, carrying with it the weight of humanity's spacefaring future and billions in investor expectations.

SpaceX's tenth Starship test flight achieved what nine previous attempts could not: the seamless execution of two mission-critical capabilities that transform the vehicle from an impressive prototype into a commercially viable asset. For the first time, the spacecraft successfully deployed payload in space and reignited its engines—milestones that signal a fundamental shift from experimental hardware to operational infrastructure.

The flight represents more than technological progress; it marks a strategic inflection point that could reshape the economics of space commerce, accelerate America's return to the Moon, and unlock unprecedented revenue streams for SpaceX's Starlink constellation.

When Engineering Precision Meets Strategic Vision

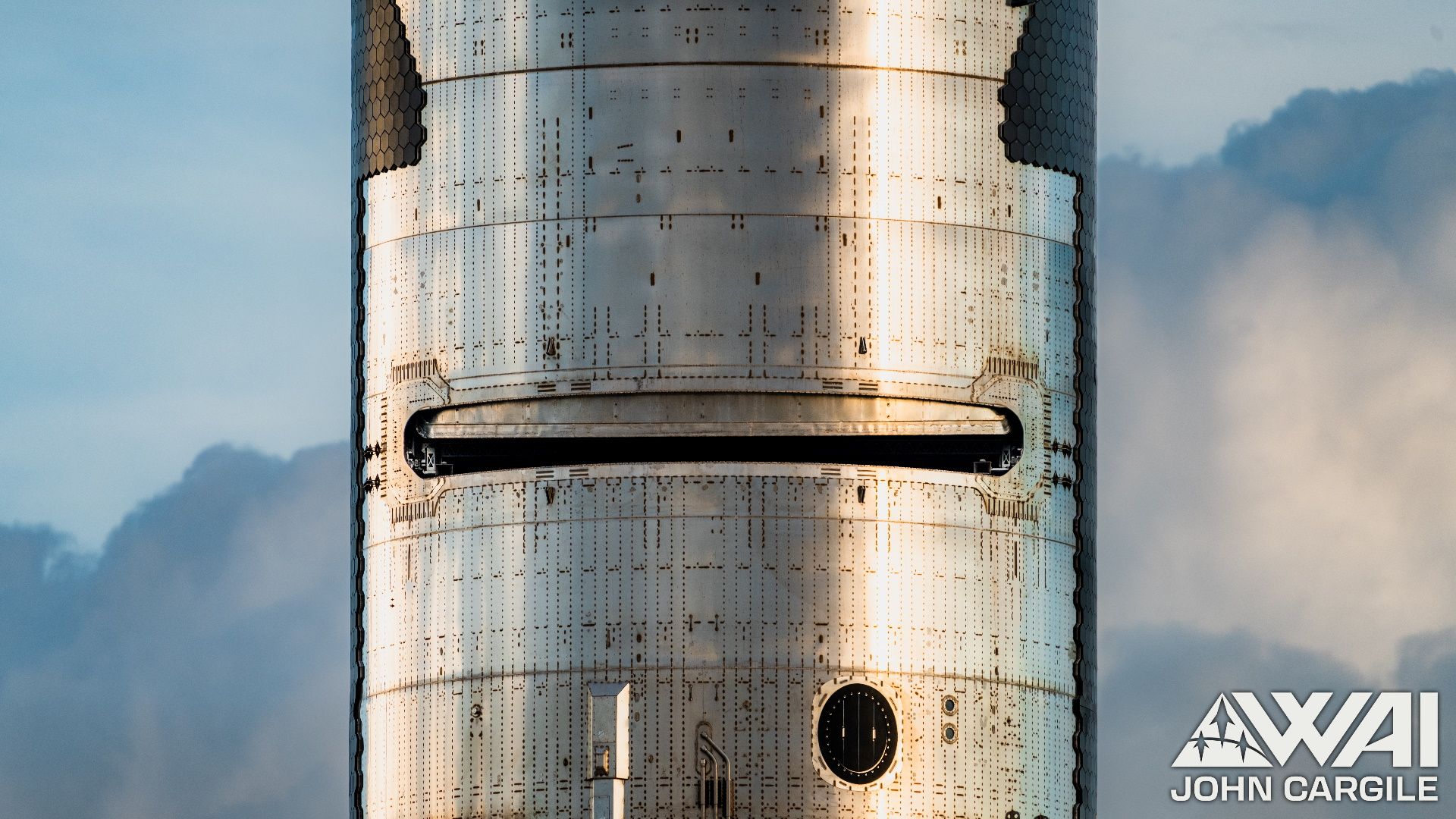

The mission's success emerged from calculated restraint rather than ambitious overreach. Unlike previous flights that attempted complex tower catches and aggressive reentry profiles, Flight 10 focused on two specific objectives: opening the "Pez"-style payload dispenser and demonstrating in-space engine relight capability.

Both achievements address fundamental business requirements. The payload deployment validates Starship's capacity to launch next-generation Starlink satellites—each mission potentially carrying over 40 tons compared to Falcon 9's 17-ton limit. The engine relight capability enables orbital maneuvering essential for deep-space missions and NASA's Artemis program.

"The transition from experimentation to operational readiness requires exactly this kind of milestone-driven approach," observed one aerospace industry analyst familiar with SpaceX's development strategy. "They've moved beyond proving the rocket can fly to demonstrating it can work."

The Super Heavy booster executed an equally significant test, deliberately shutting down primary landing engines and transitioning to backup systems before splashing down in the Gulf of Mexico. This redundancy validation addresses a critical safety requirement for future tower catch attempts at Starbase.

Reading Between the Flight Data

The mission's technical achievements obscure several strategic signals that merit closer examination. SpaceX's decision to test alternative thermal protection materials—including metallic and actively cooled tiles—suggests development priorities extending beyond near-term lunar missions toward Mars-class atmospheric entry requirements.

The company removed sections of heat-shield tiles to stress-test the underlying structure, generating data that would be prohibitively expensive to obtain through ground testing. This approach reflects confidence in the vehicle's fundamental design while acknowledging that full reusability remains elusive.

More significantly, the successful maintenance of communications throughout the flight addresses a persistent concern for NASA oversight. Previous missions lost telemetry during critical phases, creating uncertainty about vehicle health and mission status—unacceptable conditions for crewed operations.

The Artemis Timeline Calculus

While Flight 10 reduces technical risk for NASA's moon landing program, the critical path remains unchanged. Artemis III depends on capabilities not yet demonstrated: orbital refueling operations requiring multiple Starship launches, cryogenic propellant transfer in space, and lunar descent engine certification.

Did you know? Orbital refueling is a groundbreaking technology that allows spacecraft and satellites to refuel while in space, extending their lifetimes and enabling deep-space missions. By transferring propellant from a tanker spacecraft to another vehicle in orbit, agencies like NASA and companies like SpaceX aim to make missions to the Moon, Mars, and beyond more efficient and cost-effective. This technology not only reduces the need to launch massive amounts of fuel from Earth but also paves the way for long-term space infrastructure — though it faces challenges like zero-gravity fluid dynamics, cryogenic fuel storage, and precision docking.

Industry sources suggest these requirements could extend the timeline beyond NASA's mid-2027 target, particularly given the complexity of validating life-support systems and crew safety protocols. However, the reliability demonstrated in Flight 10 strengthens confidence in the underlying vehicle architecture.

The mission's success comes at a crucial political moment. Congressional appropriators have expressed growing skepticism about Artemis timelines and costs. Visible progress in Starship development provides NASA with tangible evidence of program advancement, potentially securing continued funding through fiscal year 2026.

Starlink's Economic Transformation

The payload deployment success carries profound implications for SpaceX's revenue model. Current Starlink operations generate an estimated $6.5 billion annually, but constellation expansion requires launch capabilities beyond Falcon 9's capacity.

Starlink’s explosive growth positions it as the primary driver of SpaceX’s valuation and future profitability.

| Metric | 2024 | 2025 (Projected) | Key Notes |

|---|---|---|---|

| Revenue | ~$7.7B | ~$11.8B–$12.3B | ~50% YoY growth, driven by subscriber expansion & government contracts |

| Subscribers | ~4M | ~7.8M | ~76% growth; revenue lags subs due to lower ARPU in emerging markets |

| Revenue Mix | — | ~$7.5B consumer, ~$1.3B hardware, ~$3B gov/enterprise | Non-residential demand rising sharply |

| Free Cash Flow | — | ~+$2B | Positive FCF despite heavy capex, supported by vertical integration |

| SpaceX Valuation | ~$350B EV | Starlink ≈ 60% rev, 75% EBITDA | Starlink seen as 65%+ of SpaceX’s total value |

| Scenarios | ~$7.7B actual | Upside to ~$12B+; downside from capacity & pricing risks | Growth tied to subs, ARPU, and gov contracts |

Next-generation Starlink satellites demand larger orbital slots and enhanced capabilities, necessitating Starship's volume and mass advantages. Industry analysts project that successful Starlink scaling could generate over $20 billion in annual revenue by 2028, transforming SpaceX from a launch provider into a telecommunications infrastructure company.

This revenue potential explains SpaceX's recent $350 billion valuation in private markets. The company's financial trajectory increasingly depends on Starlink's growth rather than traditional launch services, making Starship's payload capabilities essential to future profitability.

Competitive Landscape Shifts

Flight 10's success amplifies pressure on competing heavy-lift providers. Blue Origin's New Glenn, still awaiting its inaugural flight, faces an increasingly challenging value proposition if Starship achieves operational status first. Similarly, United Launch Alliance's Vulcan rocket, despite recent certification success, operates in a fundamentally different economic category.

LEO Payload Capacity Comparison of Major Heavy-Lift and Super-Heavy Launch Vehicles (Design Targets vs. Operational Capability)

| Launcher | Vendor Status | LEO Payload

(Config) | Notes |

| ------------------ | -------------------------- | ----------------------------------------------------------------------------------- | --------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| Starship | In flight test / iterative | Target: 100–150 t (fully reusable)

Current (2024): ~40–50 t | SpaceX advertises 100–150 t fully reusable; public remarks in 2024 cited ~40–50 t for early flights, indicating optimization ongoing relative to design goals. |

| Falcon Heavy | Operational | 63.8 t (fully expendable) | SpaceX lists 63,800 kg; payload drops significantly with booster recovery; remains a heavy/super-heavy lift option. |

| SLS Block 1 | Operational (Artemis I) | ~70 t class; some analyses discuss up to 90–95 t under certain assumptions | NASA materials emphasize TLI figures; LEO payload depends on configuration and assumptions. |

| New Glenn | Near-term | ~45 t | Published capability ~45 t to 51.6° LEO; ~13 t to GTO in reusable mode; first flight pending. |

| Ariane 6 A64 | Operational | ~21.5–21.6 t | ESA/industry sources cite ~21.5 t to LEO for A64; smaller A62 variant supports ~10.3 t. |

| Vulcan Centaur | Operational | ~10–11 t (core-only); scales to teens+ t with 2–6 GEM 63XL boosters | Performance highly configuration-dependent; strong direct GEO capability implies higher scaled LEO lift when more boosters are used. |

International competitors face starker challenges. China's Long March 10 program, targeting crewed lunar missions around 2030, must now accelerate development to remain relevant. European Space Agency initiatives appear increasingly inadequate for next-generation requirements.

The broader launch industry confronts a potential paradigm shift toward fully reusable systems. Small and medium-lift providers must differentiate through specialized mission profiles, rapid deployment capabilities, or niche technical requirements rather than competing on cost per kilogram.

Investment Implications and Market Dynamics

For institutional investors, Flight 10 validates the technical feasibility underlying SpaceX's premium valuation while highlighting remaining execution risks. The company's path to public markets likely depends on Starlink's operational cash flow rather than launch service revenue alone.

Potential beneficiaries include aerospace suppliers specializing in thermal protection systems, cryogenic handling equipment, and satellite manufacturing. Companies positioned in ground infrastructure for satellite constellations may also benefit from expanded constellation deployment.

Traditional telecommunications providers face intensifying competitive pressure from low-Earth orbit broadband services. Rural and mobility markets appear particularly vulnerable to disruption as satellite coverage improves and costs decline.

The Path Forward

SpaceX's next development priorities appear clear: achieving orbital insertion and recovery, demonstrating inter-vehicle propellant transfer, and validating rapid reusability. Each milestone addresses specific commercial or programmatic requirements rather than technological demonstrations.

The company's incorporation of Starbase as an independent city reflects confidence in long-term operations while potentially streamlining regulatory approvals. This vertical integration strategy extends SpaceX's control over critical infrastructure and development timelines.

Market observers should monitor several key indicators: FAA licensing cadence for subsequent flights, NASA's on-orbit refueling demonstration schedule, and Starlink subscriber growth rates. These metrics will signal whether Flight 10's success translates into sustained operational capability.

Beyond the Technical Achievement

Flight 10 represents more than engineering progress; it demonstrates SpaceX's evolution from disruptive innovator to infrastructure provider. The mission's measured approach and focus on specific objectives suggest organizational maturity aligned with commercial and programmatic requirements.

The broader implications extend beyond SpaceX itself. Success in developing fully reusable heavy-lift capability could accelerate space-based manufacturing, orbital construction projects, and deep-space exploration initiatives. The economic multiplier effects of reduced launch costs remain largely theoretical but potentially transformative.

As the aerospace industry transitions from government-driven exploration to commercial-scale operations, Flight 10 may be remembered as the moment when next-generation space transportation moved from possibility to reality. The technical achievements matter less than their validation of economic models that could reshape humanity's relationship with space itself.

House Investment Thesis

| Category | Details & Analysis |

|---|---|

| Mission Summary | Successful soft splashdown of Booster in Gulf of Mexico. Ship deployed 8 Starlink simulators via PEZ dispenser, executed a single Raptor relight in space, and had a soft splashdown (with tip-over/explosion) in the Indian Ocean. All primary objectives met. |

| Key Achievements | • Payload Deployment: Validated PEZ dispenser, unlocking Starlink v3 launches. • In-Space Relight: Essential for orbital maneuvers and future refueling. • Engine-Out Redundancy: Booster successfully landed with one of three center engines disabled. • TPS Data Gathering: High-value heat-load data collected via deliberate tile tests. |

| Root Causes of Success | 1. Narrowed Test Scope: Focused on key milestones (deployment, relight). 2. Hardened Controls/Comms: Addressed previous attitude and communication issues. 3. Iterated Landing Logic: Confidence to test engine-out redundancy. 4. Data-Over-Hardware: Deliberate TPS experiments for accelerated learning. |

| Remaining Challenges | • Not Orbital/Recovered: Profile remains sub-orbital with hardware disposal. • TPS Unresolved: Post-splashdown explosion indicates re-entry heating issues persist. • Critical Path Unchanged: On-orbit refueling (for Artemis) remains a separate, unproven challenge. |

| Starlink Implications | Moves Starlink v3 at scale from "speculative" to "plausible" by 2026. Critical for economics given Starlink's growth (>6M customers, $15.5B 2025 revenue guide). Supports potential Starlink carve-out/IPO in 2026-2027. |

| Artemis Implications | No change to critical path. Artemis III mid-2027 probability remains <50% without a successful cryogenic propellant transfer demo by 2026. |

| Competitive Implications | • Negative for Amazon Kuiper: Widens unit-economics gap. • Pressure on GEO: Adds pressure on legacy satellite providers (price/latency). • Pressure on Launch: Risks heavy-lift pricing power for Vulcan/New Glenn. |

| Regulatory/Geo-political | • Starbase City: Local control may accelerate cadence but amplifies scrutiny/litigation risk. • Starlink Governance: Ukraine service controls remain a procurement risk with allied governments. |

| Probabilistic Roadmap | • Orbital Insertion: 70% by H1 '26 • Booster Tower Catch: 55% by H2 '26 • Cryo Transfer in LEO: 45% by 2026 • Starlink v3 on Starship: 50% by 2026; 75% by 2027 • Artemis III Landing: <50% by mid-2027 |

| Valuation Thoughts | Base Case (supported): SpaceX ~$400B valuation prices in optionality. SFT-10 supports this but adds no near-term EBITDA. Path to Starlink revenue dominance improves odds of no near-term IPO need. |

| Leading Indicators | 1. SpaceX's next test plan (orbital insertion/catch language). 2. FAA licensing/Starbase litigation. 3. Cryo transfer hardware rollout. 4. Starlink KPIs (subs, ARPU, v3 readiness). 5. Competitor signals (Kuiper, New Glenn). |

| Overall Take | Technical: Lowers program risk, transitioning from "prototype" to "systems integration that works." Commercial: Specifically de-risks the Starlink v3 cash engine. Strategic: Engine-out test is a key inflection point for fault-tolerant, factory-scale reuse. Net: Risk down, timeline still tight. |

Investors should note that space industry investments carry significant technical and regulatory risks. Past performance of test flights does not guarantee operational success or commercial viability.