Tesla Board Initiates CEO Search as Musk's Divided Focus Drives Financial Decline and Stock Plunge

Tesla in Crisis: Board Launches CEO Search as Musk's Divided Focus Deepens Financial Woes

The sleek, futuristic headquarters of Tesla in Austin stands in stark contrast to the company's increasingly turbulent reality.

Inside its glass-walled boardroom, a decision that would have seemed unthinkable just months ago has been set in motion: the formal search for Elon Musk's successor as CEO.

Tesla's eight-person board began seriously considering Musk's replacement approximately one month ago, contacting several executive search firms to establish a structured approach for identifying the company's next chief executive. This extraordinary step comes as Tesla faces its most serious crisis in years—a perfect storm of plummeting profits, sliding deliveries, intensifying competition, and a CEO whose attention has been visibly divided between running the world's most valuable automaker and his role in the Trump administration.

"The board has reached a breaking point," said a person familiar with the directors' thinking. "There's a growing recognition that Tesla's challenges require undivided leadership attention that Musk simply hasn't been providing."

The Financial Nosedive

The numbers tell a brutal story. Tesla's first-quarter results for 2025, released last week, revealed a staggering 71% collapse in profits to just $409 million, down from $1.4 billion in the same period last year. Revenue fell 9% overall, with automotive revenue—the company's core business—plummeting by 20%.

Tesla Quarterly Net Income Showing Recent Decline (in $ millions)

| Quarter | Net Income | YoY Change (%) | QoQ Change (%) |

|---|---|---|---|

| Q1 2025 | 409 | -70.58 | -80.78 |

| Q4 2024 | 2,128 | -39.51 | +8.46 |

| Q1 2024 | 1,389 | -55.13 | -48.24 |

| Q4 2023 | 1,963 | -45.86 | -22.76 |

These weren't mere misses against analyst expectations; they were comprehensive failures across every meaningful metric. The company reported earnings of only $0.27 per share against predictions of $0.41, while revenue came in at $19.335 billion, well below the expected $21.345 billion. Perhaps most alarming to investors: Tesla would have posted a quarterly loss without the $595 million in regulatory credit sales—essentially income from selling environmental credits to other automakers rather than from its actual operations.

Automotive regulatory credits are government-issued allowances related to vehicle emissions standards, such as Zero Emission Vehicle (ZEV) mandates. Automakers that exceed these standards, often by producing electric vehicles, can earn credits and sell them to other manufacturers who haven't met their required quotas, creating a compliance market.

The delivery numbers proved equally troubling. Tesla shipped 336,681 vehicles in Q1 2025, representing a 13% year-over-year decline and marking the company's worst quarter for deliveries in nearly three years. Meanwhile, Chinese rival BYD delivered 416,388 battery electric vehicles in the same period—its second consecutive quarter outperforming Tesla on pure electric vehicle sales.

Did you know that Chinese automaker BYD has outpaced Tesla in battery electric vehicle deliveries for two consecutive quarters, solidifying a major shift in the global EV landscape? In Q1 2025, BYD delivered 416,388 passenger BEVs compared to Tesla's 336,681 units-a difference of nearly 80,000 vehicles-representing a remarkable 39% year-over-year increase for BYD while Tesla experienced a 13% decline from the same period last year. Though Tesla narrowly maintained its annual leadership position in 2024 by just 1.35%, industry analysts at Counterpoint Research project 2025 will mark a historic turning point as BYD is expected to capture 15.7% of the global BEV market share, dethroning Tesla as the world's leading electric vehicle manufacturer for the first time since the modern EV era began.

"What we're witnessing isn't a temporary setback—it's a fundamental deterioration in Tesla's competitive position," explained a veteran auto industry analyst. "The company that once enjoyed seemingly unlimited pricing power and growth potential is now struggling to maintain market share in an increasingly crowded field."

The market has responded accordingly. Tesla's stock has plummeted 37% since the beginning of 2025 and now trades more than 41% below its all-time high reached in December 2024. This collapse has erased approximately $310 billion in market capitalization and knocked Tesla out of the S&P 500's top ten weightings.

Did you know that Tesla (TSLA) stock has plummeted approximately 38% year-to-date in 2025, with shares currently trading at $282.16 after reaching yearly highs of $488.54? This dramatic decline represents one of Tesla's most substantial pullbacks in recent years, triggered by a perfect storm of challenges including a 16% year-over-year drop in Q1 production (to 362,000 vehicles), a 13% decline in deliveries (marking Tesla's weakest quarterly delivery performance in three years), intensifying competition in the EV market, and persistent margin pressures despite aggressive cost-cutting measures. The company's struggles in 2025 highlight the growing pains facing even the most prominent electric vehicle manufacturer as the industry matures and competition intensifies.

The Washington Distraction

At the heart of Tesla's leadership crisis lies Musk's controversial role in the Trump administration, where he has served as head of the Department of Government Efficiency (DOGE) since January. Though he reportedly scaled back his physical presence in Washington in April, Musk has continued attending Cabinet meetings and dedicating significant time to government affairs.

"Elon has been spending most of his time with the Trump administration rather than running Tesla," claimed Ross Gerber, a prominent Tesla investor whose firm holds substantial positions in the company. "I think Tesla needs a new CEO. The business has been neglected for too long."

Sources close to the White House indicate that President Trump has informed his inner circle that Musk will be reducing his government responsibilities in the coming weeks, with both men apparently concluding that Musk should refocus on his businesses. However, one source cautioned that anyone believing Musk would completely exit Trump's sphere is "deluding themselves," suggesting he's likely to maintain an informal advisory role.

The timing of Musk's potential step back from Washington appears troublingly late for many Tesla stakeholders. As one portfolio manager who oversees investments in the company noted, "Every week of execution that's lost matters enormously right now. The competition isn't standing still."

The Mounting Pressure Campaign

The board's search for a successor comes amid unprecedented pressure from multiple directions. In a remarkable development, eight state treasurers sent a formal letter to Tesla's board chair Robyn Denholm, expressing "increasing concern that Tesla's recent performance signals deeper governance and leadership challenges" and questioning whether the company's leadership is "fully engaged in addressing the company's core challenges."

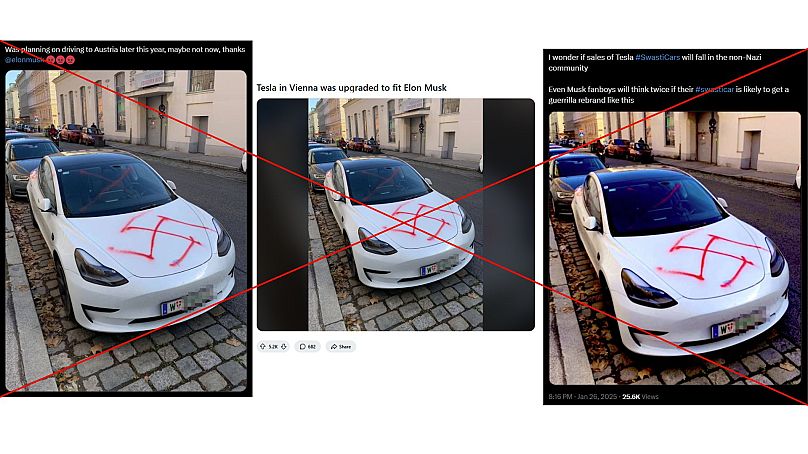

Individual investors have grown increasingly vocal as well. The CEO of a significant investment firm with over 250,000 Tesla shares told Newsweek that the board should remove Musk, characterizing their inaction regarding his behavior as "grossly negligent" and questioning why they remained passive while the brand's value diminished to the extent that "cars are being set ablaze"—a reference to reports of vandalism targeting Tesla vehicles, allegedly related to backlash against Musk's political activities.

Even longtime supporters have begun shifting their stance. JB Straubel, Tesla co-founder and board member, has reportedly been meeting with major investors to reassure them that the company remains in capable hands despite the current turmoil—a move that speaks volumes about the level of concern among institutional shareholders.

The Succession Stakes

The street will judge Tesla's CEO search process on three critical axes: speed, candidate profile, and governance reset.

Timing could prove crucial. If Tesla announces a CEO-elect before its third-quarter earnings call, markets might respond positively. However, if the search drags into 2026, pessimism could deepen substantially.

The successor's background will face intense scrutiny. An operator with large-scale manufacturing expertise (such as Tom Zhu, Tesla's current head of global production) could reassure investors focused on execution.

Alternatively, a technological visionary with autonomous driving credentials might reinvigorate the company's innovation narrative.

Perhaps most critically, the board must address Tesla's governance structure. A scenario where Musk transitions to a non-executive chairman role with a rebased compensation plan could restore confidence. Conversely, if Musk maintains a dual role or retains effective veto power over major decisions, skepticism will likely persist.

"Failure on any two of these dimensions could push the stock into the $90-110 range," predicted a senior equity analyst at a major investment bank. "That would represent a dramatic reset to 18-20 times a rebased 2026 earnings per share of roughly $5. However, a credible operator plus meaningful governance fixes could rebuild a $200+ share price narrative."

The Wild Card Scenarios

Several unexpected developments could reshape Tesla's trajectory in the coming months. Industry insiders point to several plausible scenarios:

SpaceX COO Gwynne Shotwell could emerge as a dark-horse CEO candidate. She possesses operational expertise, understands Musk's corporate culture, and would likely reassure Washington skeptics concerned about Tesla's direction.

To shore up its cash position, Tesla might consider selling a strategic minority stake (20-25%) in its energy storage division to a sovereign wealth fund, potentially at a $30 billion valuation. Such a move could crystallize hidden asset value while funding development of the long-promised $25,000 Tesla model.

The company's autonomous driving timeline could see significant revisions. If full autonomy launch slips to 2027, as some industry experts predict, management might pivot to reignite margins through an accelerated "Model 2" program built on a simplified 48-volt electrical architecture.

The Six Levels of Driving Automation as Defined by the Society of Automotive Engineers (SAE)

| Level | Name | Description | Driver Responsibility | Examples |

|---|---|---|---|---|

| 0 | No Automation | No automated driving features. All driving tasks performed by human. | Complete control of all driving tasks at all times. | Traditional vehicles without driving assistance features |

| 1 | Driver Assistance | Vehicle can assist with EITHER steering OR acceleration/deceleration, but not both simultaneously. | Monitor driving environment and maintain control of most driving functions. | Adaptive cruise control, basic lane keeping |

| 2 | Partial Automation | Vehicle can control BOTH steering AND acceleration/deceleration under specific conditions. | Must remain engaged and monitor systems constantly. Ready to take over at any time. | Tesla Autopilot, GM Super Cruise, Nissan ProPILOT |

| 3 | Conditional Automation | Vehicle can take over all driving tasks under specific conditions. System requests intervention when needed. | Not required to monitor environment constantly but must be prepared to intervene upon request. | Mercedes-Benz Drive Pilot (approved in some regions) |

| 4 | High Automation | Full autonomy in specific conditions without requiring driver intervention. Vehicle can handle emergencies independently. | No need to monitor or intervene when system is operating within its domain. May be limited to specific areas or conditions. | Waymo's autonomous taxis in designated areas |

| 5 | Full Automation | Complete autonomy in all driving scenarios that a human could handle. | No driver needed. Vehicle can operate anywhere under all conditions. | Not yet commercially available |

In a more contentious scenario, if governance reform talks break down, Musk could move to spin off xAI (his artificial intelligence company) into a separate listed entity, potentially taking Tesla's Dojo supercomputer intellectual property with it and leaving Tesla paying licensing fees for technology it helped develop.

Tesla's Dojo is a powerful supercomputer custom-built by Tesla primarily to train the AI models for its self-driving vehicles. xAI, on the other hand, is a separate AI research company founded by Elon Musk with the broader goal of understanding the universe, distinct from Tesla's direct automotive applications.

The Competitive Landscape Shifts

While Tesla navigates its internal crisis, competitors are seizing the opportunity to accelerate their electric vehicle ambitions. BYD's overseas sales have doubled as it aggressively expands beyond China, with satellite photos revealing rapid progress on its massive European factory.

General Motors has shown surprising momentum, with its Ultium joint venture swinging to $241 million in equity earnings while its U.S. electric vehicle market share nearly doubled year-over-year. Other established automakers are similarly accelerating their electric vehicle launch timelines to capitalize on Tesla's moment of weakness.

"The window for competitors to cement gains against Tesla is now," observed an automotive industry consultant who works with several major manufacturers. "They're all moving faster because they sense vulnerability."

The Way Forward

For a company once defined by its seemingly limitless potential, Tesla now stands at a pivotal crossroads. The board's ability to execute a clean, confidence-inspiring succession plan within the next 6-12 months could determine whether the world's most celebrated electric vehicle pioneer becomes an underperforming value trap or reclaims its position as an innovative market leader.

"Tesla is no longer priced for perfection; it's priced for confusion," concluded a senior portfolio manager at a global asset management firm. "The board now controls the single catalyst—CEO succession—that can unlock a re-rating. Investors should position for continued downside volatility but stay nimble for a fast-moving governance 'fix' that could restore the growth narrative almost overnight."

As the search for Musk's successor unfolds, the greatest irony might be that the very qualities that made him an irreplaceable visionary—his boundless ambition and refusal to focus on a single venture—have now become Tesla's greatest liability. Whether the company can successfully transition to new leadership while preserving its innovative culture remains perhaps the most consequential question in today's automotive landscape.