Tesla's Q1 Results Reveal Steepest Sales Drop in Three Years as Political Backlash and Competition Intensify

Tesla's Q1 Stumble: Political Fallout, Market Share Erosion, and the Energy Division's Redemptive Promise

The gleaming factory floors of Tesla's Austin headquarters seem less bustling these days. Once the undisputed champion of the electric vehicle revolution, Tesla has hit a significant roadblock, reporting its worst quarterly performance in nearly three years. The company's first-quarter results for 2025 reveal not just a temporary setback but potentially deeper structural challenges that could reshape the narrative around America's most valuable automaker.

A Shocking Reversal of Fortune

Tesla's Q1 2025 financial results landed with the subtlety of a sledgehammer on Wall Street. Revenue plunged 9% year-over-year to $19.34 billion, substantially below analyst expectations of $21.3-$21.4 billion. Even more concerning for investors, net income collapsed by 71% compared to the same period last year, dropping to just $409 million.

The numbers paint a stark picture across the board:

- Adjusted earnings per share of $0.27 missed consensus forecasts of $0.41-$0.44

- Automotive revenue—the company's traditional core—fell 20% to $13.97 billion

- Vehicle deliveries declined nearly 13% to 336,681 units, the lowest quarterly figure since mid-2022

Tesla Quarterly Revenue and Net Income (Q1 2022 - Q1 2025)

| Quarter | Revenue (Billions USD) | Net Income (Billions USD) |

|---|---|---|

| Q1 2025 | $19.35 | $0.409 (GAAP) |

| Q4 2024 | $25.71 | $2.314 (GAAP) |

| Q3 2024 | $23.44 | $2.167 (GAAP) |

| Q2 2024 | $24.56 | $1.478 (GAAP) |

| Q1 2024 | $21.30 | $1.171 (GAAP) |

| Q4 2023 | $25.17 | $7.925 (GAAP) |

| Q3 2023 | $23.35 | $1.853 (GAAP) |

| Q2 2023 | $24.93 | $2.703 (GAAP) |

| Q1 2023 | $23.33 | $2.518 (GAAP) |

| Q4 2022 | $24.32 | $3.719 (GAAP) |

| Q3 2022 | $21.45 | $3.292 (GAAP) |

| Q2 2022 | $16.93 | $2.259 (GAAP) |

| Q1 2022 | $18.76 | $3.313 (GAAP) |

"What we're witnessing isn't just a bad quarter, but a genuine inflection point for Tesla," remarked one portfolio manager at a major institutional investment firm. "The company has transitioned from a growth darling to something more complicated—a politically polarized brand with an aging product line facing increasing competition."

In a particularly telling move, Tesla withdrew its growth forecast for 2025, stating it would "reassess 2025 guidance in Q2" due to rapidly shifting market and policy conditions. The decision to delay providing new guidance until next quarter has heightened uncertainty around Tesla's near-term prospects.

The Musk-Trump Alliance: A Double-Edged Sword

Perhaps most surprising in Tesla's own assessment was the acknowledgment that "political sentiment" is actively undermining the brand, particularly in key markets. CEO Elon Musk's increasingly visible alignment with President Trump has sparked what industry observers describe as an unprecedented consumer backlash for an automaker of Tesla's size.

Did you know? CEO activism—when business leaders speak out on social or political issues—can significantly influence how people perceive a brand. In today’s socially conscious world, a CEO’s public stance on topics like climate change, equality, or human rights can strengthen brand loyalty or spark backlash, depending on the audience’s values. This growing trend highlights the powerful link between a company’s leadership voice and its overall brand perception.

"Tesla has become the first major automotive brand where the CEO's ideological positions are demonstrably affecting consumer demand patterns," explained an automotive industry analyst who closely tracks EV adoption trends. "We're seeing evidence of particularly sharp sales declines in traditionally blue states, where Tesla had previously enjoyed some of its strongest market penetration."

The company directly cited "rapidly evolving trade policy" and tariffs associated with the Trump administration as disruptive forces affecting its global supply chains, increasing costs, and complicating demand forecasts. Tesla executives specifically warned that tariffs would impact its energy business even more severely than its automotive segment.

Inside Tesla's sprawling Fremont factory, the political tension is palpable. "There's definitely more anxiety than I've ever seen here," said a Tesla engineer. "People wonder if we're still primarily a car company with a visionary mission or if we've become something else entirely."

The Perfect Storm: Pricing Pressure, Competition, and an Aging Lineup

Tesla's challenges extend far beyond the political sphere. The company's core models, particularly the Model Y—once its growth engine—are showing signs of sales fatigue amid intensifying competition. Tesla has responded with increased promotions and discounts, pressuring both revenue and margins.

"The EV market has fundamentally changed," noted an automotive industry consultant who advises several major manufacturers. "Tesla's early-mover advantage has eroded as traditional automakers and new entrants have caught up in technology while offering fresher designs. Meanwhile, Chinese competitors like BYD are demonstrating remarkable growth with their 416,000 battery electric vehicle sales in Q1—up 39% year-over-year."

Table: Global BEV Market Share by Manufacturer – Q1 2025 vs Q1 2024.

| Manufacturer | Q1 2024 Market Share | Q1 2025 Market Share | Change/Trend |

|---|---|---|---|

| Tesla | ~20% | ~14% | ↓ Lost global lead, declining |

| BYD | ~15% | ~16% | ↑ New global leader, strong growth |

| Geely Holdings | ~8% | ~9% | ↑ Rapid growth |

| Volkswagen Group | <5%* | ↑ | ↑ Surged in Europe |

| Others | ~57% | ~61% | ↑ Market more fragmented |

This competitive pressure comes at a particularly vulnerable moment for Tesla, whose product lineup has remained largely static. While the company emphasized that new, more affordable vehicles remain on track for production in the first half of 2025, and its robotaxi service is still planned for 2026, the market appears increasingly skeptical about these timelines given Tesla's history of delayed product launches.

On the factory floor in Shanghai, Tesla's once-dominant position in the Chinese market appears increasingly tenuous. Local manufacturers have rapidly closed the technology gap while maintaining significantly lower price points. "The competition here is brutal now," remarked an automotive supply chain executive based in Shanghai. "Tesla's brand still carries premium cachet, but that only goes so far when local options offer comparable features at better prices."

Energy Division: The Silver Lining

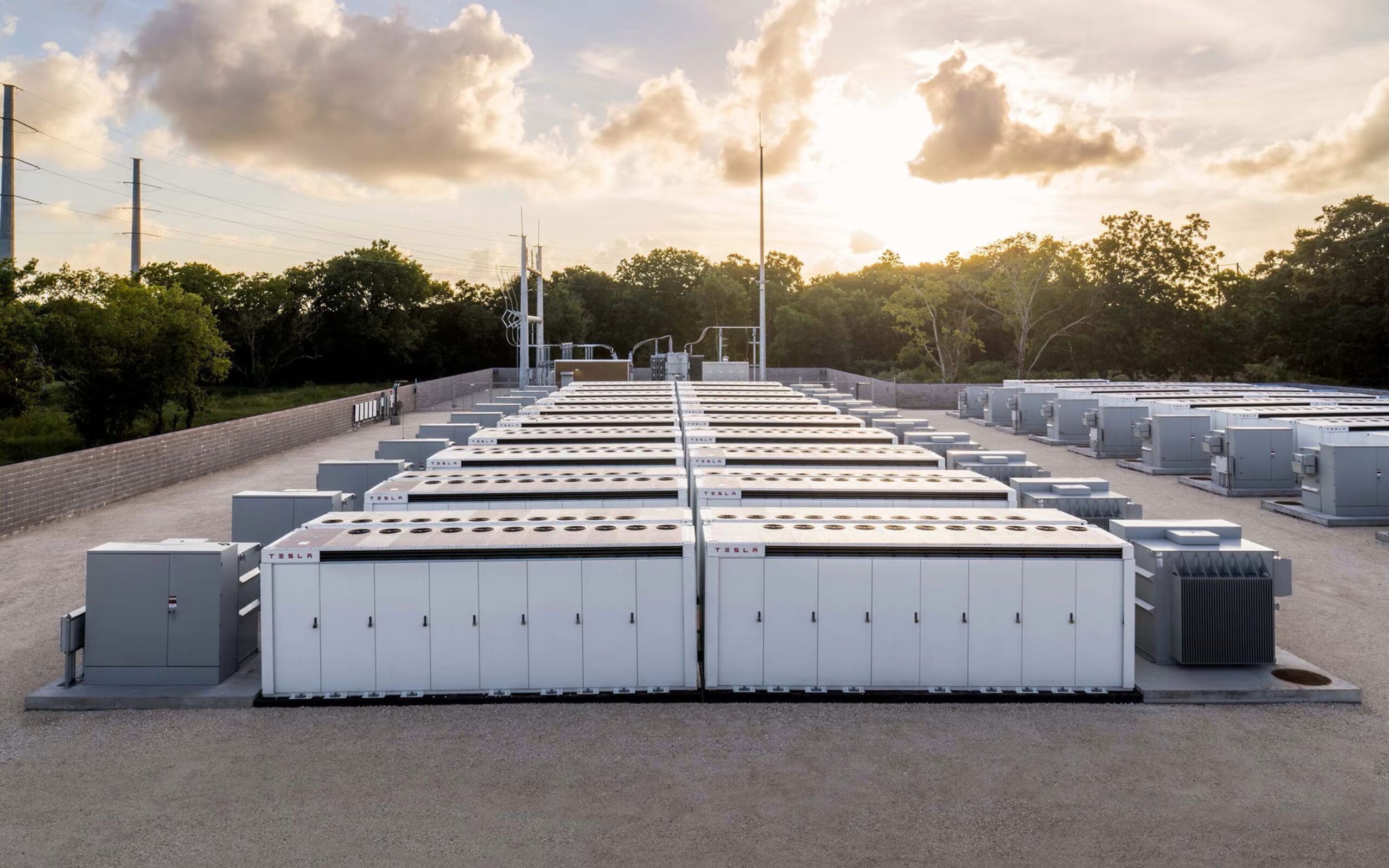

Amid the troubling automotive figures, Tesla's energy generation and storage segment emerged as a rare bright spot, growing 67% year-over-year to $2.7 billion. The company's services business also showed resilience with 15% growth.

Did you know? In Q1 2025, Tesla’s Energy Generation and Storage segment achieved a remarkable 67% year-over-year revenue growth, reaching $2.73 billion—driven by record energy storage deployments and improved profit margins—even as the company’s automotive business faced challenges. This rapid growth highlights Tesla’s expanding role in the renewable energy sector and its increasing reliance on energy solutions as a key part of its business.

"The energy storage unit is rapidly becoming Tesla's potential savior," explained an energy sector analyst who tracks battery technology developments. "With Megapack deployments accelerating globally and utility-scale storage becoming increasingly critical to grid stability, this division could eventually rival or even surpass automotive in terms of profitability."

Walking through Tesla's massive Gigafactory in Nevada, the contrast between the automotive and energy divisions becomes evident. While vehicle production lines show signs of slowing, the battery production areas remain in a state of constant expansion.

"If the energy segment can maintain its current 25% margins and continues its 60% year-over-year growth trajectory, it could justify around $60 billion of Tesla's $400 billion market capitalization on its own," calculated a quantitative analyst at a major investment bank. "That provides a potential valuation floor even if automotive continues to struggle."

Market Reaction and Investor Sentiment

Despite the disappointing results, Tesla's stock rose slightly in after-hours trading following the earnings release. This seemingly counterintuitive reaction reflects the complex calculus investors are performing around the company's future.

"The initial 9% pre-announcement dip followed by a 2% recovery after the earnings call represents classic short-covering rather than conviction buying," explained a veteran equity derivatives trader. "The options market is pricing in significant volatility, with one-month put options reaching 42% implied volatility—the highest since the Cybertruck launch disappointment."

Perhaps most concerning for long-term investors is the company's operational profitability. When excluding regulatory credit sales and net interest income, Tesla actually recorded a pre-tax operational loss of approximately $200 million for the quarter.

EV regulatory credits, including ZEV credits, are instruments used in government regulations to incentivize the production and sale of electric vehicles. Automakers earn these credits by selling EVs and can then sell surplus credits to other manufacturers who haven't met their own EV sales quotas, providing a notable income stream for companies like Tesla.

"Tesla's core automotive business risks becoming structurally unprofitable without the cushion of regulatory credits," warned a senior credit analyst. "If we see another quarter of negative automotive EBIT, that could push net leverage above critical thresholds and potentially trigger credit rating actions."

The Road Ahead: Three Competing Narratives

As Tesla navigates these turbulent waters, three competing narratives have emerged about the company's future, creating what one analyst described as an "identity crisis" for a brand that once had singular clarity of purpose.

"Tesla's Q1 miss isn't just about numbers—it's a stress test of three grand narratives," observed a prominent technology investor. "Can a celebrity-led brand maintain cohesion in an age of political tribalism? Are there limits to price-led volume strategies in EVs? And perhaps most importantly, can Tesla's energy arm become the new core profit engine?"

The company's strategic options appear increasingly constrained. Tesla could double down on price cuts to drive volume, but at the risk of further margin erosion. Alternatively, it could accelerate its pivot toward energy and AI initiatives, but potentially at the cost of its automotive leadership position.

Inside Tesla's design studio in Hawthorne, California, the pressure to deliver transformative new products has never been higher. Engineers and designers work frantically to finalize the company's next generation of more affordable vehicles, aware that the timeline for these launches has become increasingly critical to the company's trajectory.

"The next 12 months will determine whether Tesla becomes a value trap or maintains its position as a technological visionary," concluded a senior portfolio manager at a major asset management firm. "For investors, the question is which narrative gains traction first—eroding automotive fundamentals or the triple option value of energy, autonomy, and AI."

What This Means for the Industry

Tesla's struggles have paradoxically provided breathing room for traditional automakers. Ford and General Motors executives are reportedly relieved that Tesla's weakened position tempers the ongoing EV price war, giving them political cover to moderate their own capital expenditures without appearing to fall behind.

"The legacy automakers are quietly celebrating," revealed an automotive industry consultant who works with multiple major manufacturers. "Tesla's stumble gives them more flexibility to pace their EV transitions without the market punishing them for appearing sluggish relative to Tesla."

For suppliers, the picture is more complex. The tariff environment has created significant uncertainty around production volumes, while simultaneously accelerating the push toward localized supply chains. "We're seeing a fundamental reshaping of automotive supply networks," noted a senior executive at a major automotive components manufacturer. "Companies with diversified customer bases and regional production flexibility will be the winners."

As the dust settles on Tesla's disappointing quarter, the implications extend far beyond a single company's financial results. The EV pioneer's challenges reflect broader tensions in the automotive industry's transition toward electrification, the complexities of operating global businesses in an era of rising trade barriers, and the unprecedented phenomenon of consumer purchasing decisions being influenced by corporate leadership's political affiliations.

For Tesla, the path forward remains uncertain but critically important. Whether the company can recapture its growth momentum or is entering a period of sustained turbulence will have profound implications not just for investors, but for the entire electric vehicle industry it helped create.

Investment Perspectives: Navigating Tesla's Inflection Point

For professional investors, Tesla's current situation presents both significant risks and potentially overlooked opportunities. Analysts broadly outline three potential scenarios for the company over the coming year:

Base Case (45% probability)

- Automotive average selling prices decline another 6% as Tesla matches BYD's pricing strategy

- Energy division reaches a $10 billion annual run-rate, doubling 2024's performance

- Full-year EPS reaches approximately $1.60, well below current street consensus of $2.10

- Stock trades within a range of $120-$160

Bull Case (25% probability)

- Musk reduces his public political activity, helping to stabilize demand in politically progressive markets

- The company's affordable model begins pilot production in Austin by Q4 2025

- Production capacity expands to accommodate approximately 400,000 additional units by 2026

- Valuation multiple expands to 50× forward earnings, pushing the stock toward $250

Bear Case (30% probability)

- Trade tensions escalate further, with energy Megapack exports facing a 10% tariff surcharge

- Political backlash intensifies, with California fleet sales dropping 25%

- Automotive EBIT remains negative throughout 2025

- Credit rating agencies take negative actions, further pressuring the stock

"For nimble investors, the optimal approach may be to own the volatility rather than taking a binary directional bet," suggested a hedge fund manager specializing in the technology sector. "The extreme price swings we're likely to see create opportunities for sophisticated options strategies that can profit regardless of which narrative ultimately prevails."

Table: Summary of Options Strategies Based on Volatility Outlook and Market Expectations

| Volatility Outlook | Directional Bias | Strategy Examples | Primary Profit Driver |

|---|---|---|---|

| High (Rising) | None | Long Straddle, Long Strangle | Large moves in either direction |

| High (Rising) | Up or Down | Long Call, Long Put | Large move in one direction |

| Low (Falling) | None | Short Straddle, Short Strangle | Stability, falling volatility, time decay |

| Low (Falling) | Up or Down | Covered Call, Cash-Secured Put | Small moves, time decay |

| Moderate/Range-Bound | None | Iron Condor, Iron Butterfly | Stability within a defined range |

As Tesla continues its evolution from pure-play EV manufacturer to a more complex, politically exposed conglomerate with significant energy and AI ambitions, investors will need to recalibrate their expectations and valuation frameworks accordingly. Whether the company represents a tremendous buying opportunity at current levels or the beginning of a prolonged decline depends largely on factors that extend well beyond traditional automotive industry metrics—a fitting challenge for a company that has always defied conventional categorization.