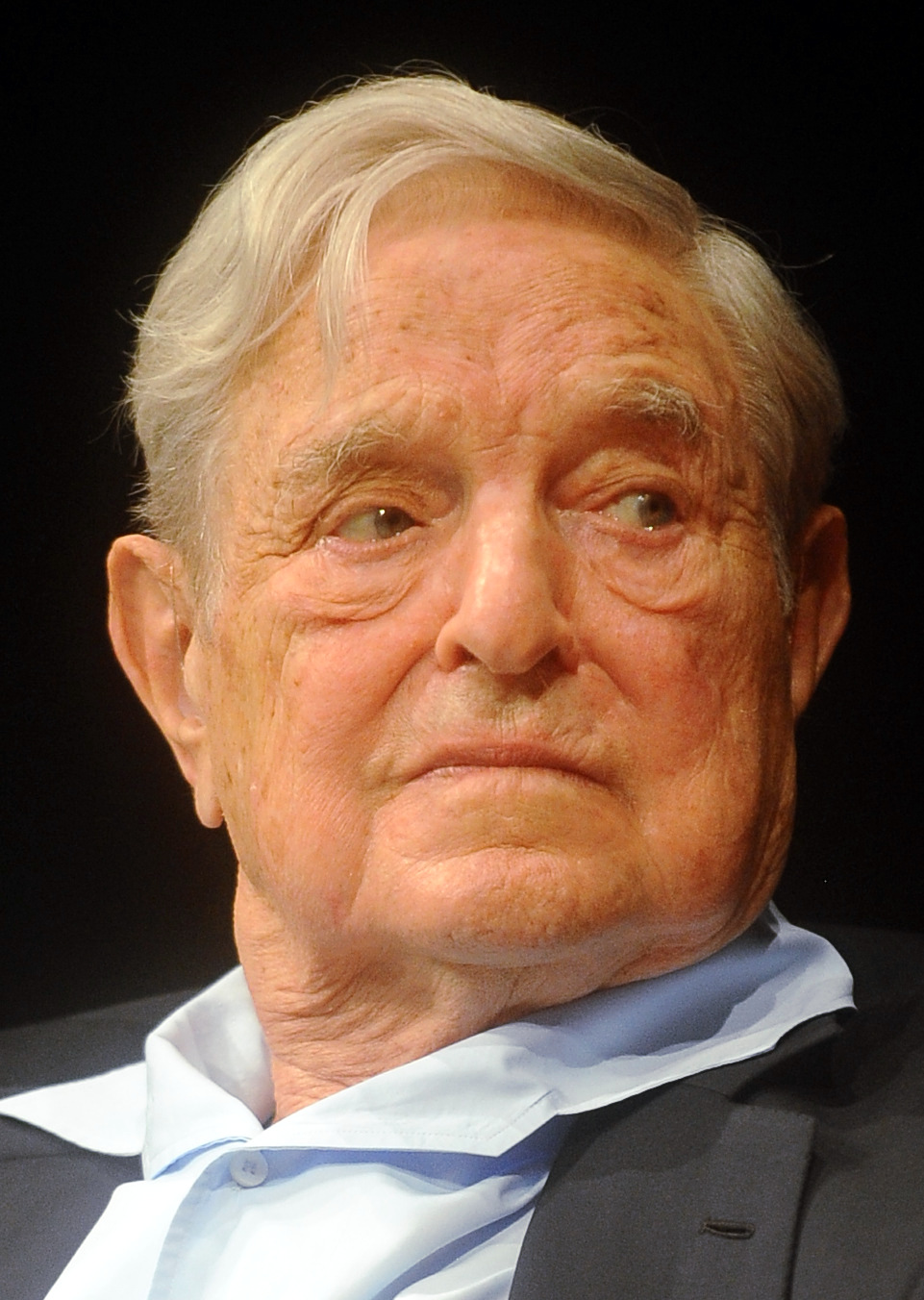

Trump Demands Federal Racketeering Charges Against George Soros for Protest Funding

Legal Weaponization or Political Theater: Trump's RICO Gambit Against Soros Signals New Phase of Institutional Warfare

WASHINGTON — The criminal justice system has become the latest battleground in America's political warfare, as President Trump's Wednesday Truth Social post calling for federal racketeering charges against billionaire George Soros marks a significant escalation in the administration's use of prosecutorial tools against perceived adversaries.

Trump's demand that Soros and his son face charges under the Racketeer Influenced and Corrupt Organizations Act represents more than political rhetoric—it signals a systematic approach to criminalizing opposition that could reshape how civil society operates in America. The post, which accused the philanthropist family of supporting "violent protests" through their Open Society Foundations, immediately sparked constitutional questions while revealing the administration's broader strategy of weaponizing white-collar enforcement mechanisms.

"George Soros, and his wonderful Radical Left son, should be charged with RICO because of their support of Violent Protests, and much more, all throughout the United States of America," Trump wrote, adding ominously, "Be careful, we're watching you!"

The Open Society Foundations swiftly rejected the accusations as "outrageous and false," clarifying that the organization does not support or fund violent protests and stands for constitutional rights including free speech and peaceful demonstration.

When Legal Framework Meets Political Warfare

The choice of RICO as the preferred weapon reveals sophisticated strategic thinking. Originally designed to dismantle organized crime syndicates, the 1970 statute requires prosecutors to prove an enterprise engaged in a pattern of racketeering activity through at least two predicate crimes within a decade. Its power lies not just in enhanced penalties, but in its ability to connect seemingly disparate actors under a single criminal umbrella.

The RICO Act, or Racketeer Influenced and Corrupt Organizations Act, is a powerful U.S. federal law designed to combat organized crime. It targets individuals who engage in a pattern of specific "predicate" criminal acts as part of an ongoing criminal enterprise, rather than just isolated offenses.

Yet applying RICO to philanthropic activity supporting civil rights advocacy faces formidable legal obstacles. Constitutional protections for political association, established in landmark cases like NAACP v. Claiborne Hardware, shield broad advocacy movements from liability absent clear evidence of specific unlawful conduct. The Supreme Court's Brandenburg v. Ohio standard requires proof of incitement to imminent lawless action—a threshold that funding civil rights organizations typically cannot meet.

Legal experts suggest the administration faces a fundamental evidentiary problem: transforming legitimate philanthropic grants into predicate criminal acts. Without concrete evidence of specific crimes attributable to the Soros network, federal prosecutors would struggle to survive First Amendment challenges that have historically protected political advocacy from RICO prosecution.

The precedent concern extends beyond this case. The Supreme Court's rejection of protest-targeting RICO theories in cases like Scheidler v. NOW suggests judicial skepticism toward expanding racketeering law into political organizing. State-level experiments, including Georgia's controversial "Cop City" RICO prosecutions, have highlighted how such applications generate significant constitutional resistance.

The Architecture of Opposition Suppression

This RICO threat represents one component of a broader administrative strategy to criminalize political opposition through technical violations and procedural weaponization. Since returning to office, Trump has launched multiple investigations into perceived adversaries, notably employing mortgage fraud referrals as tools for criminal targeting—a pattern that transforms routine regulatory compliance into potential felony exposure.

The Soros targeting serves multiple strategic functions simultaneously. Domestically, it simplifies complex social movements into a single-villain narrative that mobilizes the political base while deflecting attention from governance challenges. The billionaire philanthropist has served as a longstanding conservative foil, making him an efficient target for political messaging.

More concerning for market participants and civil society actors, the rhetoric creates immediate chilling effects on legitimate political participation. Large institutional donors may reassess grants to advocacy organizations, while smaller nonprofits face increased banking and compliance friction as financial institutions become risk-averse around politically sensitive transactions.

The approach also carries international implications. Global investors and diplomatic partners observe America's internal use of prosecutorial power against political opponents as a signal about institutional reliability and rule-of-law consistency. Such dynamics could influence everything from sovereign bond markets to foreign direct investment decisions.

Market Implications and Capital Flow Disruption

For sophisticated investors, the RICO threat against Soros reveals broader systemic risks that extend well beyond a single philanthropist. The weaponization of financial enforcement mechanisms creates new categories of regulatory and reputational risk for any entity engaging in politically sensitive activities.

Trends in U.S. philanthropic giving, showing allocation to different sectors like civil rights, social justice, and advocacy over the last decade.

| Year | Sector Focus (e.g., Racial Equity, Public-Society Benefit) | Amount/Percentage of Giving | Key Trend/Notes |

|---|---|---|---|

| 22020 | Racial Equity | $16.5 billion | Philanthropic interest in social justice surged, particularly for racial equity, following events in 2020. Nearly a quarter (24.9%) of affluent households gave to social justice causes. Major foundations like Ford and Open Society Foundations significantly increased their commitments to racial justice and advocacy. |

| 2021 | Racial Equity | Just under $8 billion | Funding levels for racial equity experienced a significant decline from the peak in 2020. |

| 2023 | Public-Society Benefit Charities | $29.59 billion (7% of all donations) | This sector, which often includes civil rights, social justice, and advocacy organizations, saw an increase of 7.8% in donations. Total contributions to the top 100 charities, including some in civil liberties and advocacy, exceeded $61 billion in private donations, marking a 4% increase for their fiscal year. |

Philanthropy markets, already experiencing post-pandemic reorganization, face additional complexity as major donors evaluate whether advocacy-adjacent giving exposes them to federal investigation. This chilling effect could redirect billions in charitable capital away from civil rights, voting access, and social justice organizations—fundamentally altering America's philanthropic landscape.

Financial services firms must now calculate compliance costs and reputational risks associated with serving politically active clients. The mortgage fraud referral pipeline, combined with RICO threats, suggests that routine banking relationships with opposition figures could generate regulatory scrutiny. Such dynamics typically drive risk-averse institutions to preemptively terminate relationships, creating de facto financial exclusion without formal government action.

Market analysts suggest monitoring several key indicators: philanthropic foundation asset flows, particularly those focused on civil rights advocacy; banking relationship changes affecting politically active organizations; and compliance cost increases across financial services firms serving nonprofit sectors.

Investment Positioning for Institutional Uncertainty

The current environment suggests several strategic considerations for institutional investors navigating heightened political-legal risks. Defense contractors and private security firms may benefit from increased domestic surveillance and enforcement spending, while civil liberties organizations face operational and funding challenges.

Legal services firms specializing in First Amendment defense and nonprofit compliance could see sustained demand growth as organizations lawyer-up against potential prosecution. Conversely, traditional advocacy-focused nonprofits may experience donor flight and operational constraints that limit their effectiveness and sustainability.

Technology platforms face particular complexity as government pressure to monitor and potentially restrict politically sensitive content intensifies. Companies with significant government contracts must balance constitutional obligations against regulatory relationships, creating ongoing operational uncertainty.

Analysts suggest that investors consider defensive positioning around sectors exposed to political prosecution risk while identifying opportunities in legal services, compliance technology, and security-focused industries that benefit from heightened enforcement activity.

The Expanding Battlefield

The Soros RICO gambit represents a significant escalation in America's institutional warfare, transforming political opposition into potential criminal liability. Whether federal prosecutors ultimately pursue charges matters less than the precedent established: political adversaries now face credible threats of criminal investigation for activities traditionally protected by First Amendment guarantees.

Congressional Republicans have proposed expanding RICO to explicitly cover rioting and financial backing of civil unrest, suggesting this rhetoric could acquire legislative momentum. State-level prosecutors, particularly in Republican-controlled jurisdictions, may adopt similar approaches against protest networks and their financial supporters.

The administration's broader pattern—mortgage fraud referrals, RICO threats, military deployment discussions against "radical left lunatics"—indicates a systematic approach to criminalizing political opposition that extends far beyond traditional partisan competition.

For business leaders and investors, the implications transcend political preferences. An environment where regulatory and prosecutorial tools systematically target political adversaries creates unpredictable risk profiles for any entity engaging in politically sensitive activities. The rule of law becomes subordinate to political loyalty, fundamentally altering America's investment climate and institutional reliability.

The question facing markets and civil society is not whether George Soros ultimately faces RICO charges, but whether America's prosecutorial apparatus can maintain independence from political pressure. The answer will shape everything from philanthropic capital allocation to foreign investment decisions, as global actors assess whether American institutions remain governed by consistent legal standards or political favoritism.

Investment Disclaimer: This analysis reflects current market conditions and regulatory trends. Past performance does not guarantee future results. Readers should consult qualified financial advisors for personalized investment guidance appropriate to their specific circumstances and risk tolerance.