Silicon Reshoring: Trump's Chip Tariff Redraws Global Tech Map

WASHINGTON — President Donald Trump has fundamentally altered the global semiconductor landscape with his August 6 announcement of a plan of sweeping 100% tariff on imported computer chips, sending ripples through technology supply chains worldwide while creating strategic exemptions that favor domestic production.

The announcement, made during a White House event with Apple CEO Tim Cook present, represents perhaps the most aggressive trade policy intervention yet in the critical semiconductor sector that powers everything from smartphones to national defense systems.

What distinguishes this tariff from previous trade measures is its carefully structured exemption mechanism: companies that either already manufacture semiconductors in the United States or have committed to building facilities on American soil will be spared from the import penalties—a provision that immediately changes the calculus for global chipmakers.

Industry experts note this policy goes beyond typical protectionism, representing a sophisticated approach to technological sovereignty that will reshape manufacturing decisions for years to come.

Carrots, Sticks, and Silicon Wafers

The tariff's architecture reveals a nuanced understanding of leverage points in the semiconductor supply chain. By threatening retroactive penalties for companies that fail to fulfill their U.S. manufacturing commitments, the administration has created both immediate compliance pressure and long-term accountability mechanisms.

The stakes are substantial. Last year alone, the U.S. imported over $60 billion in semiconductors, primarily from East Asian manufacturing hubs including Taiwan, Malaysia, Vietnam, South Korea, and Japan. Each percentage point of this tariff represents approximately $600 million in potential economic impact—making the full 100% rate a profound disruption to current supply patterns.

The announcement coincided with Apple's pledge to invest an additional $100 billion in domestic manufacturing, building upon earlier commitments from major tech companies including Taiwan Semiconductor Manufacturing Company and Nvidia, which have also promised substantial investments in U.S. chip production.

The Economics of Disruption

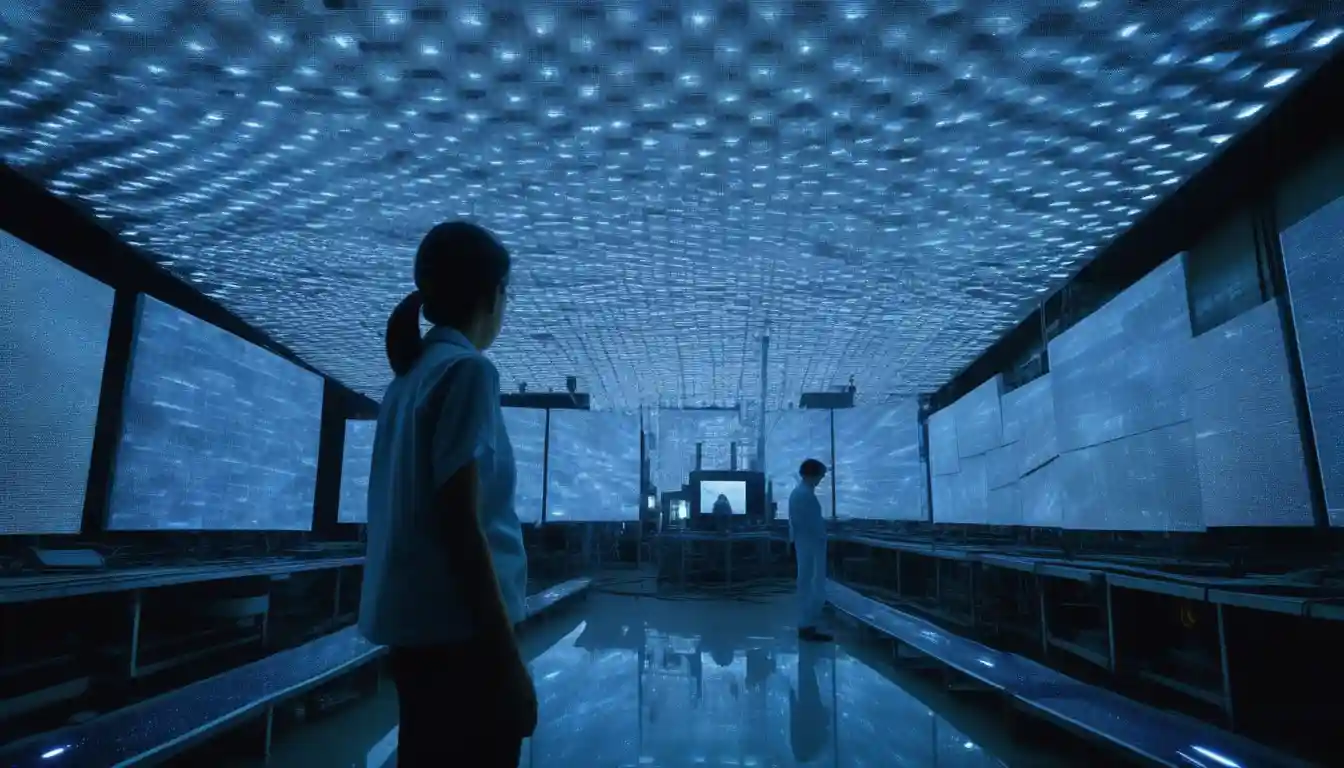

In Arizona's Sonoran Desert, TSMC's massive fabrication facility offers a physical manifestation of the economic challenges this policy aims to address. The facility—already representing a significant investment—has reportedly struggled financially, losing over 89 billion New Taiwan dollars over four years, while the company's Nanjing plant in China generated profits of nearly 180 billion NTD during the same period.

This stark disparity illustrates why government intervention of this magnitude may have been deemed necessary to shift production patterns against powerful economic gravity.

The financial mathematics underpinning the global semiconductor industry now face comprehensive recalculation. According to industry data, the raw production cost of an Arizona wafer runs 25-30% higher than its Taiwanese counterpart before shipping. With a 100% tariff added, the economics suddenly favor domestic production—transforming what were challenging ventures into potentially viable enterprises.

International Responses and Negotiations

The international response has revealed the complex geopolitical dimensions of semiconductor trade policy. Within 24 hours of Trump's announcement, South Korea reportedly secured exemptions for Samsung and SK Hynix, demonstrating that certain allies may be able to negotiate more favorable terms.

For Taiwan—whose economy is intrinsically linked to semiconductor manufacturing—the implications are particularly significant. While TSMC's stock has shown volatility following the announcement, dropping 1.15% to $231.37 by Thursday afternoon, longer-term questions about Taiwan's strategic position have intensified.

Industry analysts suggest this policy could accelerate TSMC's existing plans to expand its Arizona operations, potentially shifting the center of gravity for advanced chip manufacturing.

The Reshuffled Industry Landscape

For investors and industry players, the tariff announcement has triggered a fundamental reordering of relative positions. Intel shares climbed 1.14% to $20.41 on Thursday, as the company potentially stands to benefit from its domestic manufacturing footprint. With an enterprise value-to-sales ratio still below 1.3x compared to peers above 4x, some analysts see significant upside potential as the company potentially absorbs demand from competitors affected by the tariff structure.

Equipment manufacturers and infrastructure providers represent another potential beneficiary. Companies like Applied Materials, Lam Research, and Eaton may benefit from accelerated capital expenditure as chipmakers race to establish U.S. manufacturing capabilities.

The ripple effects extend beyond the semiconductor industry itself. Every 10% increase in semiconductor input costs potentially adds approximately 0.1 percentage point to core PCE inflation, according to analyst estimates. If the full 100% tariff materializes, this could add significant inflationary pressure in 2026—potentially affecting Federal Reserve policy considerations.

The Future of Fragmented Silicon

As markets absorb these seismic shifts, investors are positioning for a fundamentally altered landscape. Equipment manufacturers (AMAT, LRCX, ACLS) appear particularly well-positioned, potentially benefiting from accelerated orders and pricing power.

Domestic foundries like Intel and GlobalFoundries may gain from increased demand for U.S.-based manufacturing, while infrastructure companies addressing power and construction bottlenecks face potential years of accelerated demand.

For consumers, the implications may include price increases of 5-10% on consumer electronics in the short term, with potential compression of manufacturer margins in the medium term as companies absorb costs to maintain market share.

As global technology companies navigate this new landscape, one thing appears certain: the era of frictionless globalization in semiconductor production is facing unprecedented challenges. In its place emerges a more fragmented system where national security considerations increasingly influence economic decisions.

The next significant development in this unfolding story is expected in September-October 2025, when the U.S. Trade Representative is expected to publish detailed draft rules defining exactly which products fall under the tariff regime.

Disclaimer: This analysis represents the current market situation and established economic indicators. Past performance does not guarantee future results. Readers should consult financial advisors for personalized investment guidance.