The Great Reversal: When Higher Education Becomes a Path to Unemployment

The 2025 graduate employment crisis marks the first time in 45 years that university degrees correlate with higher joblessness—and the implications stretch far beyond individual career prospects

NEW YORK — In the sterile confines of Manhattan's financial district, a master's degree holder in economics sits in a coffee shop, laptop open to her 47th job application this month. She represents a statistical anomaly that would have been inconceivable just two years ago: the more educated you are in 2025, the more likely you are to be unemployed.

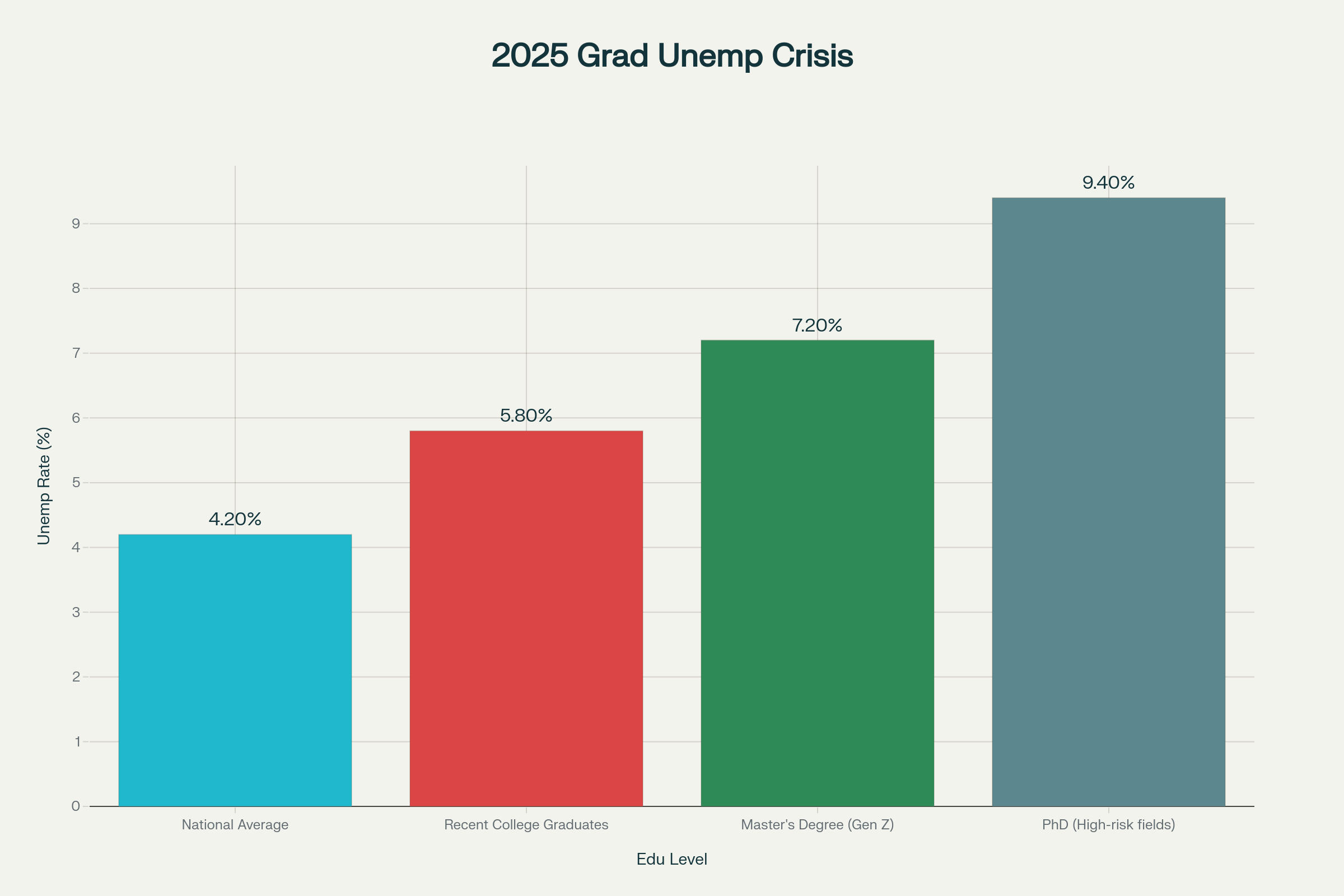

For the first time since data collection began in 1979, Americans with bachelor's degrees or higher face unemployment rates exceeding the national average—a historic inversion that signals the collapse of higher education's fundamental value proposition. The numbers paint a devastating picture: Gen Z graduates with master's degrees confront a 7.2% unemployment rate in the first half of 2025, representing a staggering 140% increase from 3% in the previous year.

This isn't merely a temporary market correction. It's a structural realignment that threatens to redefine social mobility, investment patterns, and the entire knowledge economy framework that has dominated developed nations for decades.

When Credentials Become Liabilities

The scale of desperation among America's most educated workforce is unprecedented. Job seekers now submit an average of 45 applications monthly—a 104.5% surge from 22 applications the previous year. Master's degree graduates cast even wider nets, submitting between 32 and 60 applications monthly in what economists describe as the most competitive graduate job market in modern history.

Average Monthly Job Applications per Job Seeker

| Time Period | Job Seeker Activity Level | Key Insights |

|---|---|---|

| Early 2022 | Baseline | Job application volume serves as a benchmark for future comparisons. |

| Late 2023 | High | Job application volume increased by nearly 30% compared to the beginning of 2022. |

| 2024 | Stable but Cautious | While 42% of workers were actively looking for a new job, matching 2025 levels, there was a growing sentiment that the hiring market was becoming less favorable for job seekers. |

| 2025 | High and Competitive | 42% of employed individuals are actively seeking new opportunities, a figure consistent with the previous year. However, job seekers' confidence in easily finding a new job has decreased, and there is a notable increase in older workers applying for entry-level positions. |

The irony cuts deep: those who invested most heavily in their human capital now find themselves most vulnerable to economic displacement. PhD graduates in anthropology face unemployment rates approaching 9.4%, while other doctoral fields hover between 6-8%—figures that would have been relegated to economic recession scenarios just years ago.

Recent college graduates with bachelor's degrees endure a 6.1% unemployment rate as of May 2025, compared to the national average of 4.2%. The inversion represents more than statistical curiosity; it signals the fundamental breakdown of educational signaling in labor markets.

The Silicon Valley Paradox: When Tech Becomes Anti-Graduate

The technology sector, traditionally the promised land for ambitious graduates, has become the epicenter of this employment crisis. Software programming job postings on Indeed have plummeted over 50% since 2022, while junior tech roles declined 36% from 2020 to 2025.

Decline in US Software Programming Job Postings (2022-2025)

| Date/Period | Trend/Statistic | Key Insight |

|---|---|---|

| February 2022 | Software development job postings were 123.28% above the pre-pandemic baseline of February 2020. | This marked the peak of a hiring surge in the tech industry following the initial impact of the COVID-19 pandemic. |

| Mid-2022 to 2023 | A dramatic and sharp decline in job postings occurred. By May 2023, tech-related job postings had fallen below pre-pandemic levels. | The boom of 2021 and early 2022 was followed by a significant downturn due to economic uncertainty and widespread layoffs. |

| February 2024 | Tech-related job postings on Indeed were 25% below the pre-pandemic baseline. For software development specifically, postings were down 33% from February 2020 levels as of early 2025. | The decline in software development roles is more significant than the overall job market, which saw an increase in listings during the same period. |

| Early 2025 | Job listings for software developers are at a five-year low, down more than 33% from 2020 levels. Entry-level and non-senior tech postings were down 34%. | The hiring landscape has become increasingly competitive, especially for junior and entry-level positions. Factors contributing to the decline include the end of zero-percent interest rates and the adoption of AI-powered development tools. |

| February 2025 | Software development job postings on Indeed were down more than 33% from their February 2020 levels. | The decline is attributed to a combination of economic factors, post-pandemic market correction, and a shift in hiring practices by tech companies. |

Artificial intelligence companies are accelerating this displacement with unprecedented transparency about their intentions. Startups explicitly target white-collar automation "as fast as possible," systematically eliminating the entry-level positions that once served as career launching pads. Industry analysts estimate that AI could eliminate half of all entry-level white-collar jobs within one to five years, potentially driving unemployment rates to 10-20%.

White-collar automation is the use of artificial intelligence and software to perform administrative and knowledge-based tasks traditionally done by office professionals. This technology is having a significant impact on the modern workplace by automating routine duties, such as data entry, report generation, and scheduling.

The World Economic Forum's Future of Jobs Report 2025 reveals that 40% of employers expect workforce reductions where AI can automate tasks—precisely the analytical and administrative functions that have traditionally absorbed new graduates.

Global Contagion: From Istanbul to Shanghai

This crisis transcends American borders, manifesting across diverse economic systems with striking consistency. Turkey stands as the sole European nation where university education actively correlates with higher unemployment risk, while China's rapid university expansion—from 53 public institutions in 2003 to 204 total universities by 2024—has created severe graduate oversupply.

Switzerland, despite its robust economy, reports graduate unemployment rising from 2.7% in 2021 to 3.2% in 2023. Meanwhile, 58% of fresh graduates worldwide remain unable to secure their first jobs despite expressing complete confidence in their workforce readiness.

The UK presents particularly stark evidence of this confidence gap: 56% of 2025 graduates feel unprepared for the job market despite their qualifications, while only 44% of employers believe college graduates are ready for entry-level positions.

The Automation Acceleration

Behind these statistics lies a technological transformation that has compressed decades of predicted change into mere years. IBM reports automating 94% of routine HR tasks, while UBS deploys AI clones of analysts to handle client queries without human oversight. This isn't gradual technological adoption—it's systematic elimination of human cognitive work.

The skills traditionally developed through higher education—analytical thinking, data processing, research synthesis—are precisely those most vulnerable to AI disruption. Universities find themselves in the impossible position of training students for jobs that may not exist by graduation.

One industry strategist, speaking anonymously, characterized the situation as "technological leapfrogging that has left educational institutions preparing students for an economy that no longer exists."

Investment Implications: Betting Against Human Capital

For professional investors, these trends signal profound sectoral realignments with significant portfolio implications. Traditional education technology companies face structural headwinds as their core value proposition—improving graduate outcomes—becomes increasingly questionable.

Healthcare education represents a notable exception, maintaining 90.3% employment rates nine months post-graduation compared to 64.5% for Arts & Humanities graduates. This suggests defensive positioning toward sectors requiring physical presence and human judgment may prove prescient.

The data indicates potential opportunities in companies developing AI-human collaboration platforms rather than pure automation solutions. Organizations that can successfully integrate human cognitive abilities with AI capabilities may capture disproportionate value as the market searches for sustainable employment models.

Currency markets may experience sustained pressure from countries with severe graduate unemployment, particularly those with substantial education-related debt burdens. The social stability implications of "elite overproduction"—historically associated with political upheaval—warrant careful monitoring across developed economies.

Proposed by historian Peter Turchin, the Elite Overproduction hypothesis suggests that social instability arises when a society produces more credentialed, aspiring elites than it has elite positions for them to fill. This surplus of frustrated aspirants leads to intense intra-elite competition, fueling political polarization and conflict that can ultimately destabilize the state.

The Reckoning Ahead

Financial markets have yet to fully price the implications of this educational value collapse. Student loan portfolios face potential systematic stress as graduates struggle to service debt without commensurate income improvements. The traditional assumption that higher education correlates with higher lifetime earnings—foundational to numerous financial products—requires fundamental reassessment.

Some economists suggest this represents creative destruction necessary for economic evolution. Others warn of a lost generation scenario where over-education becomes a permanent feature of developed economies, creating sustained deflationary pressure on wages across skill levels.

Coined by economist Joseph Schumpeter, creative destruction describes the essential process of innovation where new products or technologies dismantle and replace existing industries. This constant cycle, such as digital streaming supplanting video rental stores, is seen as a primary driver of long-term economic growth in capitalism.

The crisis demands recognition that higher education's role as both human capital investment and social mobility mechanism has fundamentally shifted. Whether this transformation represents temporary disruption or permanent structural change will determine investment returns across multiple asset classes for the remainder of the decade.

For now, the data suggests one certainty: the old equation linking education to employment has been decisively broken, and the new formula remains unwritten.

Market analysis suggests investors should monitor education sector devaluation signals, consider defensive healthcare positioning, and evaluate AI-integration opportunities. Past performance does not guarantee future results; consult financial advisors for personalized guidance.