U.S. Battery Industry's $100 Billion Investment: A Watershed Moment for Energy Independence

The rolling hills of Sparks, Nevada, once known primarily for their casino-adjacent industrial parks, have in recent years become home to something far more consequential: America's battery manufacturing renaissance. On a clear spring morning, the gleaming expanse of Tesla's gigafactory stretches across the landscape, a physical embodiment of what industry leaders hope will become a nationwide transformation.

It's against this backdrop that the American Clean Power Association made a stunning announcement today: U.S. energy storage manufacturers and developers are committing $100 billion over the next five years to establish a fully domestic battery supply chain, a move that could fundamentally reshape America's energy landscape and manufacturing base.

"The U.S. energy storage industry is committing over $100 billion of investment in the next five years to build and to buy American-made grid batteries," declared Jason Grumet, CEO of ACP, during the announcement. "The energy storage industry is providing essential power when needed most while boosting domestic manufacturing and creating jobs across the country."

A Bold Vision Amid Rising Demand

The $100 billion pledge represents approximately three times the cumulative capital expenditure deployed in U.S. battery manufacturing since the 2010s. It aims to enable American-made batteries to meet 100% of domestic energy storage project demand—a dramatic shift from the current landscape where most batteries used in the United States are imported, primarily from China.

This ambitious initiative comes at a critical juncture. Utility-scale battery deployments are already growing at an astonishing rate of over 60% year-over-year, with 10.3 gigawatts added in 2024 and projections of 18.2 gigawatts for 2025.

Projected growth of US utility-scale battery deployments (in Gigawatts).

| Metric | 2024 (Actual/Est.) | 2025 (Projected) | 2030 (Projected) |

|---|---|---|---|

| Annual Additions (GW) - EIA | 10.3 GW | 18.2 GW | - |

| Cumulative Capacity (GW) - EIA | ~26 GW | ~44.2 GW | - |

| Cumulative Capacity (GW) - S&P | 27 GW | - | >170 GW |

This surge in demand is driven by multiple converging factors: the electrification of appliances, the rise of electric vehicles, and perhaps most significantly, the explosive growth of power-hungry data centers supporting artificial intelligence operations.

"We're looking at AI-powered data centers potentially consuming 13% of U.S. electricity by 2030," noted an industry analyst who specializes in grid infrastructure. "The deployment of large-scale battery storage isn't just a nice-to-have anymore—it's becoming fundamental to our ability to manage load and maintain grid stability."

Grid battery storage systems help manage electricity load by absorbing excess power during periods of low demand or high generation. They then discharge this stored energy back into the grid when demand peaks, thereby balancing supply and demand and enhancing overall grid stability.

The initiative is expected to create approximately 350,000 jobs by 2030, equivalent to roughly 45% of the current U.S. auto-manufacturing workforce. These jobs would span the entire supply chain, from mineral extraction to materials processing and battery assembly.

Projected U.S. Battery Supply Chain Job Creation by 2030 (Compared to Other Sectors)

| Sector | Employment | Timeframe | Notes |

|---|---|---|---|

| Battery Supply Chain (Li-ion, full) | ~310,000 (projected) | 2030 | Based on reaching 1000 GWh domestic production. |

| Battery Supply Chain (Li-Bridge study) | 100,000 (projected) | 2030 | Captures 60% of domestic demand economic value. |

| Manufacturing (Total) | ~12.9 million | 2023 | Total U.S. manufacturing employment. |

| Motor Vehicles & Parts Manufacturing | >1 million | Early 2025 | Includes assembly, parts, bodies/trailers. |

| Construction (Total) | ~8.0 million | 2023 | Total construction sector employment. |

| Professional & Business Services | ~23.3 million | March 2025 | Seasonally adjusted estimate. |

| Private Education & Health Services | ~26.6 million | March 2025 | Seasonally adjusted estimate. |

| Clean Energy Construction Jobs | +28,000 (added) | 2023 | New clean energy factory construction jobs. |

| DOE Battery Manufacturing Projects | >12,000 (projected) | Ongoing | Jobs from $3B DOE investment in 25 projects. |

The Geopolitical Imperative

Behind the ambitious numbers lies a stark reality: America's dangerous dependence on foreign battery supply chains. Currently, 69% of lithium-ion battery imports come from China, creating vulnerabilities that industry leaders and policymakers increasingly view as untenable.

U.S. Lithium-Ion Battery Imports by Country (Q2 2024)

| Country | Percentage of Total U.S. Imports |

|---|---|

| China | 82% |

| South Korea | ~2-3%* |

| Poland | ~2-3%* |

| Hungary | ~2-3%* |

| Japan | ~2-3%* |

| All Others | ~8-10% |

"Batteries aren't just components anymore—they're critical national security assets," explained a former energy policy advisor. "When you consider that everything from our grid stability to our defense systems increasingly relies on energy storage, allowing a foreign competitor to control the supply chain becomes deeply problematic."

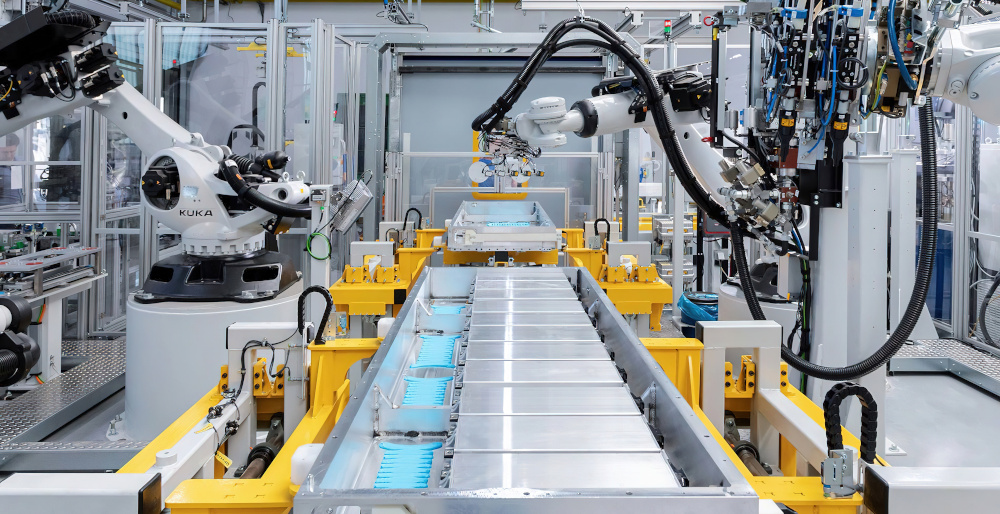

The plan includes building over 170 new or expanded facilities across mining, processing, and pack assembly by 2030. Projects worth between $10-15 billion are already under construction, including expansions like Tesla's battery factory in Nevada, which has received a $3.6 billion investment to add a 100-gigawatt-hour battery cell production capacity.

Yet despite the enthusiastic announcement, industry representatives made it clear that achieving these ambitious goals depends heavily on continued support from Washington.

The Policy Linchpin

The elephant in the room during the ACP announcement was the uncertainty surrounding key federal policies that make domestic battery production economically viable. Section 45X's $35 per kilowatt-hour production credit effectively halves the variable cost of a U.S. cylindrical cell, creating a crucial competitive advantage for domestic manufacturers.

Table: Key Elements of the Section 45X Advanced Manufacturing Production Credit

| Aspect | Details |

|---|---|

| Eligible Components | - Solar energy components- Wind energy components (including offshore wind vessels)- Inverters- Qualifying battery components- Electrode active materials- Applicable critical minerals (50 specific minerals) |

| Eligibility Requirements | - Production must occur in the U.S. or its possessions- Manufacturer must substantially transform materials into complete components- Components must be sold to unrelated parties or related parties with specific conditions- Components must be produced and sold after December 31, 2022 |

| Credit Structure | - Credit rates vary by component type- Begins to phase out after December 31, 2029- Cannot be combined with Section 48C Advanced Energy Project Credit |

| Claiming Process | - File Form 7207 (Advanced Manufacturing Production Credit)- Claim through Form 3800 (General Business Credit)- Separate Form 7207 required for each production facility |

| Recent Developments | - Final regulations (TD 10010) released October 2024- Direct and indirect material costs qualify- Extraction costs for critical minerals included- Recycled materials can be used for eligible components- Credit can be monetized or transferred to another taxpayer |

"Without mincing words, this entire initiative hinges on the continuation of the production tax credits established under the Inflation Reduction Act," admitted a battery industry executive who participated in formulating the investment pledge. "We're being transparent about this because these are massive capital investments with decade-long horizons. Policy stability isn't just helpful—it's existential."

The timing of the announcement appears carefully calibrated to align with the current administration's priorities. The ACP specifically highlighted how this investment supports actions taken by the Trump Administration to "unleash American energy and develop critical minerals in the United States."

Industry observers note this is likely an attempt to create political costs around any potential repeal of clean energy tax credits established under the Inflation Reduction Act of 2022.

Economic Opportunities and Challenges

The domestic battery market is projected to reach $55 billion annually by 2030, but currently, U.S. companies capture less than 30% of this value. The planned investments aim to dramatically shift this equation, creating what some economists call a "manufacturing renaissance" in regions hit hard by previous waves of industrial outsourcing.

At Tesla's Gigafactory in Nevada, the company has invested a total of $6.2 billion since 2014, creating facilities that have produced 1.5 million battery packs and 7.3 billion battery cells. This model of domestic production is what industry leaders hope to replicate across the country.

However, significant challenges remain. U.S.-produced battery materials typically cost 10-20% more than Asian imports, making it difficult to compete on price without policy support. American manufacturers also face much longer wait times for equipment and tooling—12 to 18 months compared to just 3-4 months for their Chinese counterparts.

Estimated Cost Comparison for Battery Materials and Components: US Domestic vs. Asian Imports (Pre-IRA Credits)

| Component/Material | Role in Battery Cost | Cost Comparison (US vs. Asia) | Notes |

|---|---|---|---|

| Battery Cells | Core component; major cost driver | ~8–20% higher in US | Higher energy, labor, and land costs; automation narrows gap; IRA credits aim to offset difference. US pack prices 11–31% higher than China. |

| Cathode Materials | Largest material cost (~50–75% of cell cost) | Higher in US | Asia produces ~96% of cathodes; US faces competitive disadvantages pre-IRA. |

| Anode Materials | Significant material cost | Higher in US | Asia produces ~95% of anodes; silicon anodes could lower US costs in the future. |

| Separators & Electrolytes | Essential for safety/performance | Higher in US | Asia dominates production (~90–95%); US domestic manufacturing less mature. |

| Raw Materials | Primary driver (~70–80% of total costs) | Slightly higher in US | Global commodity markets, but US supply chains are less integrated than Asia’s. |

"The economics are straightforward but challenging," explained an energy storage financial analyst. "Battery projects struggle to meet the 15%-plus return on capital often required by U.S. investors. When you factor in high initial investment costs followed by lengthy qualification and production scale-up periods, the numbers only work with some form of policy support."

Adding further complexity is the ongoing trade war. The effective duty on Chinese LFP (lithium iron phosphate) battery packs currently stands at 82%, with the potential to reach 155% if pending Section 301 actions are implemented. While these tariffs protect nascent domestic production, they also create a short-term irony: they push spot U.S. battery prices 10-20% above Asian benchmarks, widening the very cost gap that localization hopes to close.

LFP (Lithium Iron Phosphate) batteries are a type of lithium-ion battery known for using iron phosphate as the cathode material. They offer key advantages like lower cost, enhanced safety, and longer lifespan compared to other chemistries like NMC, though often with lower energy density.

Technological Disruption on the Horizon

Even as the industry rallies around lithium-ion technology, potential technological disruptions loom. Iron-air batteries, being developed by companies like Form Energy, target costs below $20 per kilowatt-hour for long-duration storage—a potential game-changer for grid applications. Form Energy's West Virginia factory is scaling to 500 MW by 2026.

Sodium-ion cells from China present another wildcard. If classified outside lithium-ion Harmonized System codes, they could potentially reach U.S. shores tariff-free, becoming a price undercutter by 2027.

Iron-Air and Sodium-Ion represent emerging battery chemistries being explored as next-generation alternatives to current technologies. Understanding how these systems function and comparing their potential, particularly for applications like grid storage, is central to this research.

"We're making these investments knowing full well that battery chemistry is evolving rapidly," acknowledged a project developer involved in several of the announced initiatives. "The key is building manufacturing capacity and expertise that can adapt as technology changes. The fundamental need for storage isn't going away, even if the optimal chemistry changes."

Grid Transformation at Stake

Beyond the manufacturing implications, the battery industry's commitment could fundamentally transform America's electrical grid. Large-scale batteries enable the storage of renewable energy for use during peak demand periods, enhancing grid resilience against disruptions from extreme weather events.

For utilities and grid operators, batteries offer a way to unlock congestion relief more cheaply than building new transmission lines—potentially deferring $50-60 billion in transmission capital expenditures by 2030.

"The grid we've operated for the last century was built around the principle that electricity must be used the moment it's generated," explained a veteran utility executive. "Battery storage at scale fundamentally changes that equation. It gives us flexibility we've never had before, allowing us to time-shift both generation and consumption in ways that make the entire system more efficient."

For tech giants and data center operators, co-locating behind-the-meter battery energy storage systems cuts peak demand charges and signals green power credentials to investors. However, if capacity payments lag, these large electricity consumers may remain captive buyers of natural gas peaking plants, undermining broader decarbonization goals.

Scenarios for Success or Failure

Industry analysts outline several possible futures for America's battery manufacturing ambitions. In one scenario, if IRA production credits are repealed in 2026 (estimated 30% probability), the domestic capacity build-out could pause abruptly, allowing Asian incumbents to retake market share and potentially causing U.S. battery storage stocks to plummet by 40% overnight.

Alternatively, if China launches a price war by dumping sodium-ion packs at less than $50 per kilowatt-hour CIF (cost, insurance, and freight) into the U.S. market (estimated 40% probability), it could trigger another round of tariff escalation. This would likely delay U.S. grid projects, harm mining operations, but potentially benefit recycling companies as the focus shifts to recovering materials domestically.

A third scenario considers what happens if AI electricity demand flattens post-2027 as inference moves to edge devices (estimated 25% probability). Storage growth would likely undershoot forecasts, causing long-duration players to find themselves with excess capacity and triggering a wave of strategic mergers and acquisitions.

The Bottom Line

As industry leaders and policymakers digest the implications of today's announcement, one thing becomes clear: the $100 billion pledge represents neither guaranteed success nor empty hype. If Washington maintains the 45X production credit, and if tariff walls remain high enough to shelter infant industries yet low enough to avoid cost paralysis, the United States could emerge by 2030 as a top-three global battery exporter while fundamentally rewiring its grid economics.

If policy falters, however, America risks being left with a costly, half-built supply chain and another lost industrial decade. The stakes extend far beyond the battery industry itself—touching energy security, grid reliability, manufacturing employment, and America's technological leadership in a carbon-constrained future.

"This is one of those rare industrial inflection points," concluded a veteran energy investor. "When we look back a decade from now, we'll either see today's announcement as the moment America seized its energy storage future, or as a missed opportunity of historic proportions. The technology is ready. The market demand is there. The question now is whether we have the policy consistency to see it through."

For the workers in places like Sparks, Nevada, already building America's battery future piece by piece, the hope is that today's bold vision becomes tomorrow's manufacturing reality—creating not just cells and modules, but a revitalized industrial ecosystem that spans from mine to grid.