U.S. Forces Major EDA Companies to Cut Software Access for Chinese Chip Designers, Reshaping Global Tech Competition

EDA Ban: The Silicon Cold War's New Frontier

Washington's Chess Move Sends Shockwaves Through Global Tech Ecosystem

In a calculated maneuver that strikes at the intellectual foundation of semiconductor development, the U.S. government has successfully pressured major Electronic Design Automation software providers to suspend upgrade services for Chinese customers. As of May 29, industry giants Siemens (formerly Mentor Graphics) and Cadence have halted their Chinese operations, while Synopsys remains available only temporarily.

The move represents a strategic evolution in America's technological containment policy—no longer targeting just the finished products or specialized manufacturing equipment, but now cutting off the very design tools that enable innovation at its source.

"This isn't about removing a brick from the wall," explains a senior semiconductor analyst. "It's about pulling out the keystone that holds the entire arch together."

The Digital Architect's Pencil Goes Missing

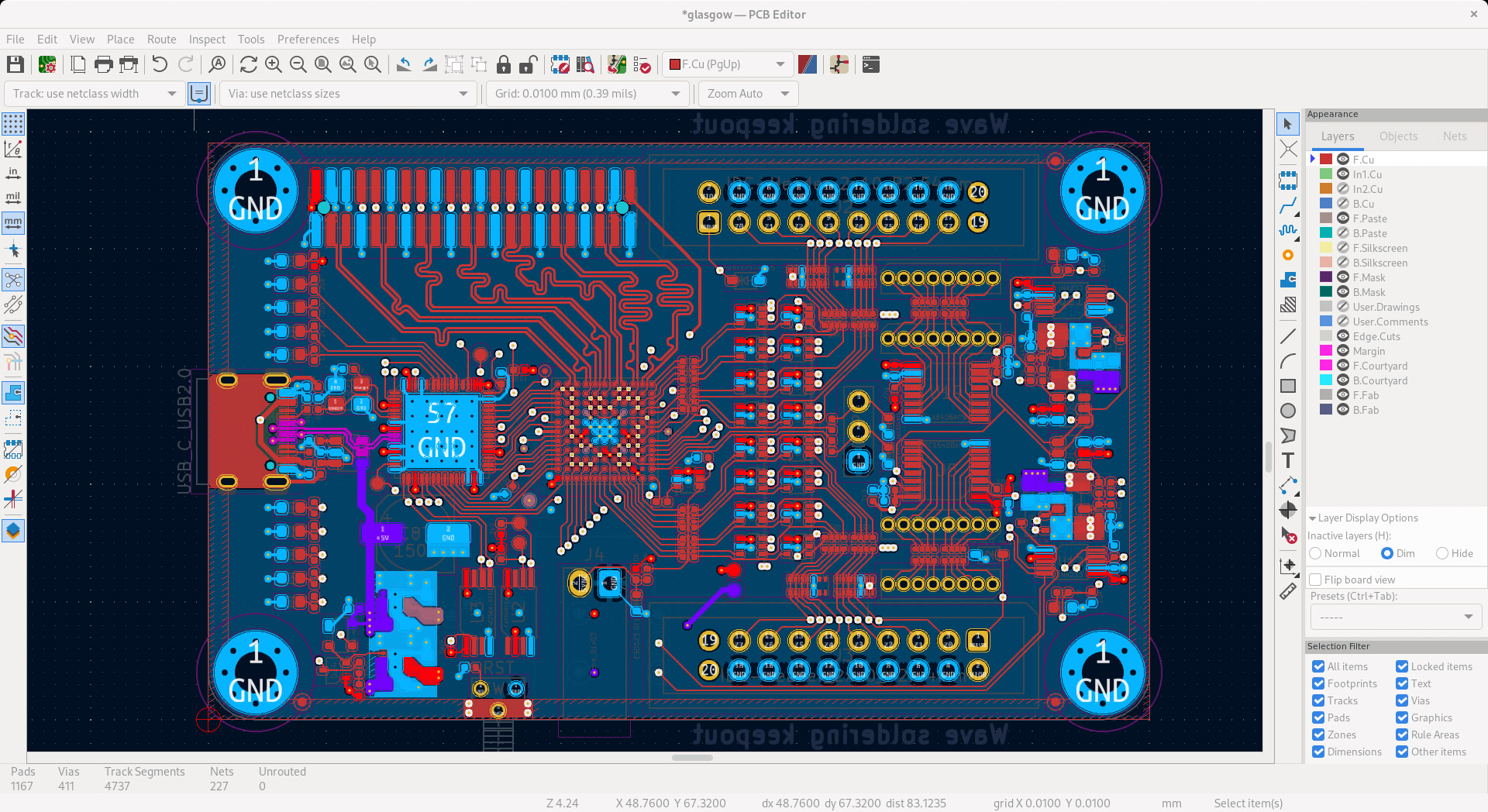

EDA tools function as the sophisticated digital workbenches where modern chips are conceived, tested, and refined before ever reaching a physical form. Without them, creating advanced semiconductors—particularly at cutting-edge nodes like 7nm, 5nm, and below—becomes nearly impossible.

In the quiet corporate offices of Shanghai and Shenzhen, the news landed like a thunderclap.

"We were in the middle of a verification cycle for our next-generation AI accelerator when the software simply stopped working," recounts a project manager at a Chinese chip startup, speaking on condition of anonymity. "The message was clear: license revoked by order of the Bureau of Industry and Security."

The suspension hits particularly hard because it applies not just to new purchases but to existing licenses, suggesting a policy of blanket denial rather than selective restriction. Even more telling: no civilian exemptions have been carved out, signaling Washington's intent to impose maximum pressure.

Markets React, Companies Recalibrate

Wall Street's response has been swift but measured. Synopsys suspended its fiscal year 2025 guidance within 24 hours of receiving the Bureau of Industry and Security's letter, while Cadence filed an 8-K acknowledging that all exports to China now require case-by-case licensing.

Both companies have seen their stock prices fluctuate dramatically. Synopsys is currently trading at $463.98, up $8.92 from previous close, while Cadence sits at $287.07, a modest $2.39 increase. The intraday volatility tells the real story—Synopsys swinging between $447.46 and $465.47 on heavy volume of over 3.3 million shares.

"The market is still processing what this means," observes a technology investment strategist at a major Wall Street firm. "China represents approximately 16% of Synopsys' revenue and 12% of Cadence's. The initial sell-off barely covers the hole if zero China sales persist, but doesn't account for potential silver linings like reshoring demand or premium pricing on 'secure' software seats."

The Substitution Question: Can China Build Its Own Tools?

Within hours of the announcement, Chinese social media platforms were ablaze with contrasting reactions—from nationalistic calls for self-reliance to sober assessments of the challenge ahead.

"Let the U.S. ban Linux next! Then we can reinvent the wheel—nothing more exciting!" one commenter mockingly wrote, embodying a strain of defiant optimism that sees forced independence as a blessing in disguise.

Reality paints a more complex picture. While China has made significant progress in developing domestic alternatives, the technology gap remains substantial. Current Chinese tools cover approximately 70% of the design-flow breadth but only 30% of the depth needed for advanced nodes—particularly in critical areas like sign-off verification, formal methods, and 3D integrated circuit design.

The domestic landscape features several promising players:

- Empyrean: Strong in analog design, with production-ready tools for 28nm and pilot programs at 14nm

- Primarius: Competitive in modeling and simulation for older process nodes

- X-Epic: Offering point tools for digital verification, though recently facing layoffs

- HiSilicon: Huawei's internal toolchain, proven on 7nm designs but not commercially available

Yet industry experts estimate China may need 5-10 years to close the EDA gap—if ever. The challenge isn't merely technical but systemic, requiring ecosystem cohesion, third-party intellectual property integration, and validation at scale.

"Anyone claiming we already have working alternatives is selling a political narrative, not engineering reality," says a veteran chip designer who has worked with both Western and Chinese tools. "The companies presenting themselves as EDA providers are mostly just creating interfaces to foreign tools, not replacing their core functionality."

Beyond the Headline: Second-Order Effects

The ripple effects extend far beyond the EDA companies themselves. The entire semiconductor supply chain faces recalibration:

- Foundries will likely see delays in next-generation tape-outs, shifting capacity toward mature nodes

- AI accelerator startups face verification freezes on advanced designs, potentially forcing them to move intellectual property offshore

- IP vendors like ARM and Imagination Technologies must contend with compliance challenges and the risk of unpaid usage

- Open-source EDA projects will see surging interest, though the quality gap remains substantial

Perhaps most concerning for global innovation: the specter of fragmented standards looms large. A Chinese EDA ecosystem would likely develop incompatible file formats and design methodologies, creating painful interoperability issues for multinational companies and reducing cross-border collaboration.

"We're witnessing the beginning of a technological bifurcation that may be impossible to reverse," warns an industry consultant specializing in semiconductor supply chains. "The short-term pain is obvious, but the long-term costs to global innovation could be incalculable."

The Investment Calculus: Where Capital Flows Next

For investors navigating this seismic shift, the strategic implications are multifaceted.

The most likely scenario—a continued stringent application of export controls with rare license approvals—suggests contrarian opportunities in U.S. and European semiconductor ecosystem companies. Defense electronics firms that require secure EDA seats may see particular benefit.

A potential pair trade emerges: shorting Cadence against going long on Altair, an engineering software company with minimal China exposure that stands to benefit from reshoring of AI chip simulation workloads.

Equipment manufacturers like KLA Corporation and ASML could see demand pulled forward as capacity reallocates to Western fabrication facilities, regardless of which process node dominates.

For those considering exposure to China's domestic champions, caution prevails. Shanghai-listed Empyrean (SHA: 688033) warrants watching, particularly after its acquisition of Xpeedic, but should be approached as a momentum trade rather than a fundamental investment until technological parity approaches.

"Technology bifurcation is now path-dependent," says a semiconductor portfolio manager. "Near-term volatility in EDA stocks represents entry opportunity, not exit signals. The beneficiaries will be regional fabs and mid-node equipment providers, not necessarily cutting-edge players."

A Silicon Iron Curtain Descends

As the dust settles, it becomes clear that the EDA ban represents more than just another trade restriction—it signals a fundamental shift in how technology competition between superpowers will unfold.

By targeting the design phase itself, the U.S. has weaponized the idea-fabric of chips. China can and will close some gaps through massive state investment and talent cultivation, but time itself has become the scarcest resource.

For the global technology ecosystem, this moment marks the crystallization of a new reality: the creation of parallel, potentially incompatible innovation spheres that may define the next decade of advancement.

In the words of one industry veteran: "We've spent forty years building a global semiconductor ecosystem. We may spend the next twenty watching it split in two."

Disclaimer: This article contains market analysis and investment perspectives. Past performance does not guarantee future results. Readers should consult financial advisors before making investment decisions based on information presented here.