The Approaching U.S. Fiscal Precipice - A Comprehensive Analysis of America's $36 Trillion Debt Crisis

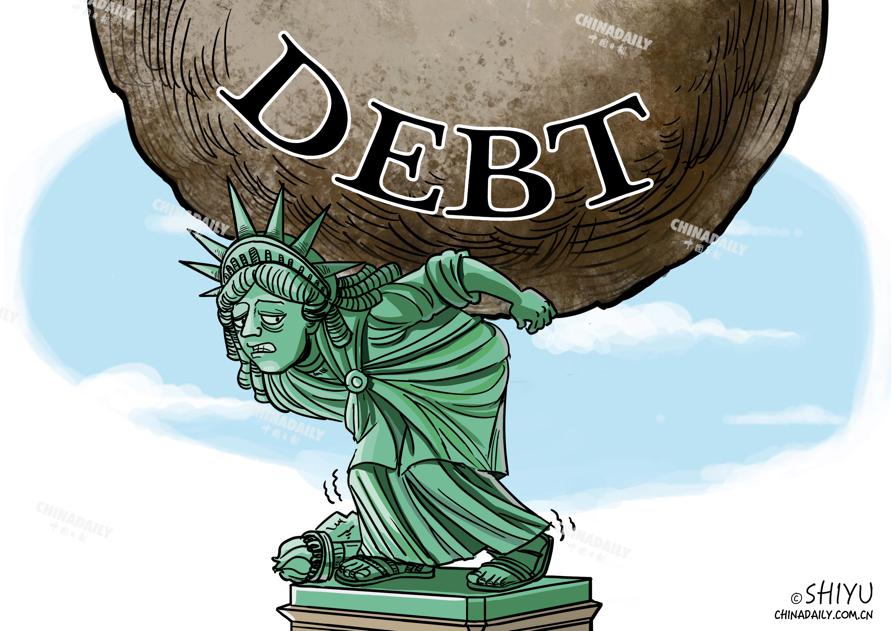

The Approaching U.S. Fiscal Precipice: A Comprehensive Analysis of America's $36 Trillion Debt Crisis

The United States finds itself at a critical juncture in its fiscal history, with national debt surpassing $36.2 trillion and representing 122% of GDP—levels not witnessed since the immediate aftermath of World War II. This comprehensive analysis reveals a confluence of structural factors, market dynamics, and policy decisions that have created what leading financial experts describe as an inevitable reckoning. The recent bond market turbulence, characterized by 30-year Treasury yields breaching 5% and rising term premiums, signals diminishing investor confidence in America's fiscal trajectory. Congressional Budget Office projections paint an alarming picture: without significant policy intervention, federal debt will reach 118% of GDP by 2035, with annual deficits approaching $2.7 trillion. The convergence of elevated interest rates, structural spending pressures, and political gridlock has created a perfect storm that threatens the foundation of U.S. economic leadership and global financial stability.

Current Fiscal Landscape and Debt Dynamics

The Scale and Trajectory of U.S. Debt

The magnitude of America's fiscal challenge becomes apparent when examining both absolute figures and relative metrics. As of January 2025, the U.S. national debt stands at $36.2 trillion, representing approximately $107,000 per person or $247,000 per household. This debt burden has grown at an unprecedented pace, increasing by roughly $1 trillion every three months. The Congressional Budget Office's latest projections indicate that under current law, debt held by the public will surge from $29 trillion today to $52 trillion by 2035, escalating from 100% of GDP to 118% of GDP over this period.

The debt-to-GDP ratio trajectory reveals the severity of the situation. The current 122% ratio already exceeds the previous post-World War II peak, and CBO projections suggest it will reach 156% by 2055 under current law. More alarmingly, if proposed tax cuts are extended without corresponding spending reductions, this ratio could balloon to 129% by 2035, potentially reaching 200% by 2055 according to some estimates. These projections assume relatively optimistic economic growth rates of 4.2% annually, meaning any economic slowdown could accelerate the deterioration.

Structural Drivers of Debt Accumulation

The rapid debt accumulation stems from persistent structural imbalances between federal spending and revenue. Federal outlays have expanded from 20.7% of GDP in fiscal year 2016 to 23.3% in 2025, with projections indicating further growth to 24.4% by 2035 and 26.6% by 2055. Meanwhile, assuming expiration of the 2017 Tax Cuts and Jobs Act, revenues are projected to rise more modestly from 17.1% of GDP in 2025 to 19.3% by 2055. This widening gap between spending and revenue creates a structural deficit that compounds over time.

The composition of federal spending reveals the challenges policymakers face in addressing the debt crisis. Mandatory spending on Social Security, Medicare, and Medicaid continues to grow as a share of the economy due to demographic trends and healthcare cost inflation. Interest payments on the debt itself have become a major budget category, rising from 1.6% of GDP in 2020 to a projected 3.2% in 2025. Under current projections, interest costs will reach 4.1% of GDP by 2035 and 5.4% by 2055, potentially consuming 28% of total federal revenue.

Technical Bond Market Analysis and Investor Sentiment

Understanding Term Premiums and Yield Decomposition

The recent bond market volatility can be understood through the lens of term premium analysis, which decomposes Treasury yields into expectations for future short-term rates and compensation for risk. The Federal Reserve Bank of San Francisco's yield decomposition model shows that the 10-year term premium has risen to 1.29% as of May 2025, compared to 0.92% a year earlier. This 37 basis point increase reflects investors' demand for higher compensation to hold longer-term debt amid growing fiscal uncertainty.

Historical context reveals the significance of this development. During the stagflation period of the 1970s, term premiums peaked at 5%, while they reached approximately 4% following the Volcker shock recessions of the early 1980s. The current level, while elevated relative to recent years, remains well below these historical peaks, suggesting potential for further increases. Emanuel Moench, co-developer of the New York Fed's ACM term premium model, warns that "some investors may be concerned about a self-perpetuating debt crisis—where a high debt-to-GDP ratio drives interest rates up, consequently increasing the government's interest burden".

Bond Market Stress Indicators and Liquidity Concerns

The April 2025 Treasury sell-off demonstrated emerging stress in what is traditionally considered the world's most liquid and stable bond market. Alliance Bernstein identified four key factors contributing to the sell-off: equity market volatility leading to forced Treasury sales, tariff-induced inflation concerns, intensifying fiscal worries, and potential foreign investor divestment. The firm noted that while Treasury Secretary Bessent confirmed no evidence of foreign selling in April, this remains a critical risk factor to monitor.

Market structure vulnerabilities have become apparent during periods of stress. Repo rates have increased as dealers struggle to absorb Treasury sales, and bid-ask spreads have widened during volatility periods, though systemic problems have not yet emerged. Jamie Dimon's warning about market-making capacity reflects concerns about the financial system's ability to handle large-scale Treasury liquidations, particularly given the massive expansion of the Treasury market over the past decade.

International Bond Market Contagion

The U.S. Treasury sell-off has triggered a broader global bond market rout, indicating that fiscal concerns are no longer confined to American markets. Unlike previous episodes where investors fled to German bunds or Japanese government bonds during Treasury stress, this time investors are exiting long-duration bonds across multiple markets simultaneously. This contagion effect suggests that global investors are reassessing sovereign debt risk more broadly, with implications for international capital flows and monetary policy coordination.

Expert Warnings and Market Predictions

Wall Street Leadership Perspectives

The convergence of warnings from major financial institutions and market leaders represents an unprecedented level of concern about U.S. fiscal sustainability. Jamie Dimon, CEO of JPMorgan Chase, has been particularly vocal, stating that "a crack in the bond market is going to happen" due to what he characterizes as massive policy errors following the COVID-19 pandemic. Dimon specifically cited $10 trillion in fiscal stimulus since 2020 and $8 trillion in Federal Reserve asset purchases as creating unsustainable asset price inflation and financial system fragility.

BlackRock, the world's largest asset manager, has taken the unusual step of maintaining an underweight position on long-term U.S. Treasuries despite their traditional safe-haven status. The firm's Investment Institute, led by Jean Boivin, projects that the U.S. deficit-to-GDP ratio could reach 5-7%, particularly if current spending proposals advance. BlackRock's analysis emphasizes concerns about foreign investor appetite and the potential for further increases in term premiums.

Economic Research and Academic Perspectives

Ray Dalio, founder of Bridgewater Associates, has provided detailed analysis of what he terms "unsustainable debt levels" across the global economy. Dalio's framework emphasizes the mechanics of debt sustainability, noting that the U.S. faces a "very severe supply and demand problem" as traditional buyers like China and Japan reduce their Treasury holdings. His projection of a 7.5% U.S. deficit by 2025 without fiscal reform underscores the urgency of the situation.

David Stockman, former Reagan administration budget director, offers perhaps the most dire assessment, characterizing the current fiscal trajectory as a "five-alarm dumpster fire". Stockman's analysis of the proposed "One Big Beautiful Bill" suggests it could add $3.8 trillion to the deficit over ten years, pushing annual deficits toward $3 trillion by 2035. His critique emphasizes the political economy challenges, noting that both parties have abandoned fiscal discipline in favor of tax cuts without corresponding spending reductions.

Structural Economic Implications and Policy Constraints

Interest Rate Dynamics and Debt Service Burden

The intersection of elevated debt levels and higher interest rates creates a particularly challenging dynamic for fiscal policy. Interest costs on the national debt totaled $881 billion in 2024 and are projected to reach $952 billion in 2025, representing an 8% increase. Over the next decade, total interest payments are projected to reach $13.8 trillion, nearly double the inflation-adjusted total spent over the past two decades.

The debt service burden now exceeds spending on most other government programs. Interest costs currently surpass defense spending and are projected to exceed Medicare spending throughout the upcoming decade. By 2035, interest payments will consume 22.2% of federal revenues, compared to 18.4% currently. This creates a vicious cycle where higher debt leads to higher interest costs, which in turn require additional borrowing.

Monetary Policy Constraints and Financial Stability

The Federal Reserve faces increasingly constrained policy options as fiscal and monetary policies become more intertwined. Academic research on the COVID-19 inflation period suggests that "long-term inflation risks remain due to sustained high debt levels" and that "central banks in this environment may face constraints on their policy choices, potentially leading to an inflationary trend if fiscal pressures mandate continuous monetary accommodation".

The concept of fiscal dominance—where monetary policy becomes subordinated to fiscal financing needs—represents a fundamental threat to central bank independence. If Treasury markets experience sustained stress, the Federal Reserve may face pressure to intervene through quantitative easing or yield curve control, potentially compromising its inflation-fighting credibility. This dynamic is particularly concerning given that inflation expectations for both short- and long-term periods are at their highest levels in decades.

Economic Growth and Productivity Implications

High debt levels pose significant risks to long-term economic growth through several channels. The Congressional Budget Office projects that when the average interest rate exceeds economic growth , debt dynamics become particularly challenging. CBO expects this condition to persist after 2045, creating a scenario where debt grows faster than the economy's ability to service it.

The crowding-out effect of government borrowing on private investment represents another critical concern. As the government absorbs an increasing share of available savings, less capital remains available for productivity-enhancing private sector investments. This dynamic becomes particularly problematic when interest payments consume such a large share of federal revenues that funding for infrastructure, education, and research—investments crucial for long-term growth—becomes constrained.

International Perspectives and Global Financial Implications

Foreign Investor Sentiment and De-dollarization Trends

The International Monetary Fund has issued warnings about the U.S. borrowing trajectory, noting that the United States is "borrowing at a higher rate than the global average". This development coincides with broader trends toward de-dollarization, as foreign central banks and sovereign wealth funds reassess their Treasury holdings. While Treasury Secretary Bessent has denied evidence of foreign selling in recent months, the structural trend remains concerning.

Traditional large holders of U.S. debt, including China and Japan, have been reducing their Treasury positions over the past several years. This shift forces the U.S. to rely more heavily on domestic investors and private markets, potentially leading to higher borrowing costs and increased volatility. The loss of foreign official demand removes a stabilizing influence on Treasury markets and reduces the U.S. government's financing flexibility.

Global Financial System Stability

The potential for a U.S. debt crisis carries profound implications for global financial stability, given the dollar's role as the world's primary reserve currency and Treasuries' function as the foundation of global collateral chains. A crisis of confidence in U.S. debt markets could trigger widespread financial instability, affecting everything from bank funding markets to sovereign debt valuations globally.

The contagion effects observed in the recent global bond sell-off provide a preview of how U.S. fiscal stress could spread internationally. European and Asian bond markets have experienced sympathetic selling as investors reassess sovereign debt risk more broadly. This interdependence means that U.S. fiscal policy decisions have global ramifications that extend far beyond American borders.

Future Scenarios and Crisis Potential

Alternative Fiscal Trajectories

The Congressional Budget Office's baseline projections assume current law remains unchanged, but political reality suggests significant policy changes are likely. The extension of the 2017 Tax Cuts and Jobs Act without offsetting spending cuts could accelerate debt accumulation dramatically. Under such scenarios, debt could reach 129% of GDP by 2035 rather than the baseline 118%, with potentially catastrophic implications for debt dynamics.

Conservative estimates suggest that permanent extension of current tax policies without spending offsets could drive debt to nearly 200% of GDP by 2055. At such levels, the United States would approach debt-to-GDP ratios seen only in countries experiencing severe fiscal crises or wartime economies. The sustainability of such levels remains highly questionable, particularly in peacetime conditions.

Crisis Scenarios and Market Breaking Points

Financial market experts have identified several potential triggers for a full-scale debt crisis. Jamie Dimon's warning about inevitable "cracks" in the bond market reflects concerns about specific stress points where market functioning could break down. These could include failed Treasury auctions, rapid increases in borrowing costs, or sudden foreign investor withdrawal.

The concept of a "bond market strike"—where investors refuse to purchase government debt at prevailing yields—represents perhaps the most severe potential outcome. Historical precedents include the UK gilt crisis of 2022, where rapid increases in borrowing costs forced immediate policy reversals. Given the much larger scale of the U.S. Treasury market, a similar event could have far more severe global consequences.

The Path Forward

The convergence of unsustainable fiscal trajectories, rising market stress indicators, and unprecedented warnings from financial leaders suggests that the United States faces its most serious fiscal challenge since World War II. The national debt's trajectory toward 118% of GDP by 2035, combined with structural spending pressures and political gridlock, creates conditions for potential financial crisis that could fundamentally alter America's economic position globally.

The technical indicators—rising term premiums, global bond market contagion, and emerging liquidity stress—signal that markets are beginning to price in meaningful default risk or significant policy changes. With interest costs projected to consume over 22% of federal revenues by 2035 and continue growing thereafter, the mathematics of debt sustainability become increasingly challenging.

The path forward requires difficult political choices between spending reductions, tax increases, or accepting the risks of continued fiscal expansion. The unprecedented consensus among financial experts—from Jamie Dimon to Ray Dalio to institutional investors like BlackRock—suggests that market forces may ultimately compel the policy changes that political processes have been unable to deliver. Without significant fiscal reforms, the United States risks experiencing the type of debt crisis previously associated with developing economies, with potentially profound implications for global financial stability and American economic leadership.