US Government Takes 10% Ownership Stake in Intel Through $10 Billion Deal

America's Strategic Capitalism: The Intel Stake That Signals a New Era

When Washington Becomes Wall Street's Partner in the Semiconductor Wars

WASHINGTON — President Donald Trump announced Friday that the United States government will acquire a 10% equity stake in Intel, marking an unprecedented direct investment by Washington in the struggling semiconductor giant. The arrangement, worth approximately $10 billion at current market prices, emerged from a high-stakes meeting between Trump and Intel CEO Lip-Bu Tan, scheduled for later Friday.

"He walked in wanting to keep his job and he ended up giving us $10 billion for the United States. So we picked up $10 billion," Trump declared, referencing his earlier confrontation with Tan over the CEO's ties to Chinese firms. Commerce Secretary Howard Lutnick confirmed the deal's completion on social media, writing: "The United States of America now owns 10% of Intel."

The equity arrangement represents a fundamental departure from traditional government-industry relationships, converting what were previously $7.9 billion in cash grants approved under the Biden administration's CHIPS Act into direct ownership. Lutnick emphasized that the government's stake would be non-voting, designed to provide financial support without direct operational control.

The CHIPS and Science Act is a U.S. law designed to boost domestic semiconductor manufacturing, research, and development. It provides billions of dollars in funding and tax credits to incentivize businesses to build and expand chip facilities in the United States, aiming to strengthen national security and reduce reliance on foreign supply chains.

The timing proves critical for Intel, which reported an $18.8 billion annual loss in 2024—the company's first annual loss since 1986. Intel's foundry business, central to CEO Tan's turnaround strategy, has struggled with billions in losses while attempting to compete with Taiwan Semiconductor Manufacturing Company's dominant position in advanced chip production. Following Trump's announcement, Intel shares rose 5.5% to close at $24.80, building on momentum from SoftBank's $2 billion investment earlier in the week.

Intel's historical annual net income/loss, highlighting the recent downturn that prompted government intervention.

| Year | Net Income/Loss (USD) |

|---|---|

| 2024 | $-19.233 billion |

| 2023 | $1.675 billion |

| 2022 | $8.017 billion |

The Architecture of State Intervention

The Intel stake represents the latest in a series of unprecedented government interventions that collectively redefine the boundaries between state power and market forces. Within weeks, the administration has negotiated a 15% revenue share on Nvidia's China sales, secured "golden share" veto rights in the Nippon Steel acquisition of U.S. Steel, and positioned the Pentagon as the largest shareholder in rare earth producer MP Materials.

A "Golden Share" is a special class of share that grants its holder specific veto rights over major corporate decisions, regardless of their overall equity stake. Often retained by a government after privatizing a state-owned company, this single share allows it to block actions like takeovers to protect strategic national interests.

Industry veterans recognize this pattern as fundamentally different from traditional defense contracting or even the bank bailouts of 2008. "We're witnessing the institutionalization of state capitalism in strategic sectors," observed one semiconductor industry executive who requested anonymity to discuss sensitive government relationships. "The question isn't whether this continues, but how far it extends."

The approach reflects hard-earned lessons from decades of watching China's state-backed semiconductor champions gain ground while American companies stumbled. Beijing's "Big Fund" has deployed over $50 billion across multiple investment phases, creating national champions like SMIC and enabling Huawei's remarkable resilience under U.S. sanctions.

Comparison of government semiconductor investment funds globally, including the US CHIPS Act, China's Big Fund, and the EU Chips Act.

| Initiative | Country/Region | Total Funding (Public & Private) | Key Objectives | Notable Features |

|---|---|---|---|---|

| CHIPS and Science Act | United States | ~$280 billion authorized for research and manufacturing, with $52.7 billion specifically for semiconductors. | Bolster domestic semiconductor manufacturing and research, reduce reliance on foreign supply chains, and maintain a competitive edge over China. | Includes $39 billion for manufacturing incentives, $13 billion for research and workforce development, and a 25% investment tax credit for manufacturing equipment. |

| National Integrated Circuit Industry Investment Fund (Big Fund) | China | Phase I: ~139 billion yuan (2014), Phase II: 204 billion yuan (2019), Phase III: 344 billion yuan ($47.5 billion) (2024). | Achieve self-sufficiency in the semiconductor industry, build a robust domestic ecosystem, and counter US restrictions. | A series of state-backed investment funds targeting various sectors of the semiconductor supply chain, including funding for major domestic chipmakers like SMIC. |

| EU Chips Act | European Union | Over €43 billion of policy-driven investment, expected to be matched by private investment. | Double the EU's global market share in semiconductors to 20% by 2030, ensure supply chain security, and strengthen technological leadership. | Aims to mobilize public and private investments, with €3.3 billion from the EU budget to support the "Chips for Europe Initiative" for research and capacity building. |

Intel's Precarious Position in the Global Race

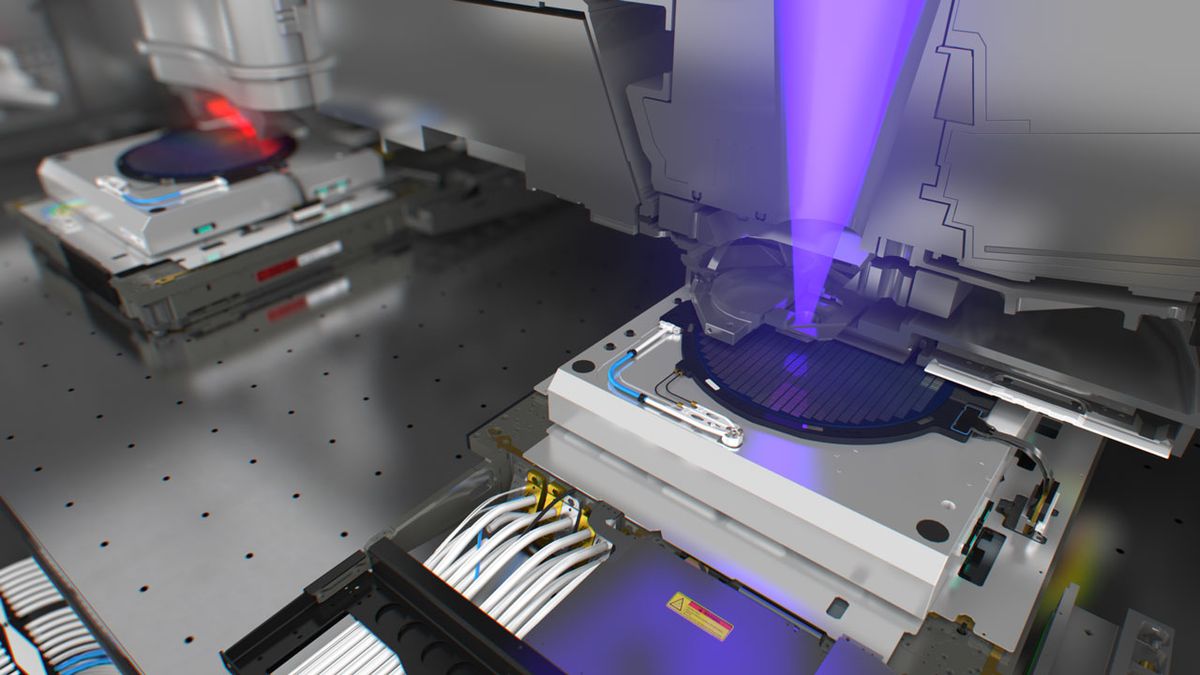

For Intel, the government's embrace comes at a moment of existential vulnerability. The company's foundry services division—critical to CEO Lip-Bu Tan's turnaround strategy—recorded a $7 billion operating loss in 2023 as customers remained skeptical of Intel's ability to match TSMC's manufacturing prowess and reliability.

Global semiconductor foundry market share, showing the dominant position of TSMC compared to competitors like Intel and Samsung.

| Foundry | Q1 2024 Market Share |

|---|---|

| TSMC | 67.6% |

| Samsung Foundry | 7.7% |

| SMIC | 6.0% |

| UMC | 4.7% |

| GlobalFoundries | 4.2% |

The timing of Washington's intervention coincides with SoftBank's $2 billion investment earlier this week, suggesting a coordinated effort to stabilize Intel's capital position. Yet financial support addresses only one dimension of Intel's challenges. The company's "five nodes in four years" manufacturing roadmap remains behind schedule, and attracting major external foundry customers requires proving both technological capability and operational reliability—metrics that cannot be guaranteed through government equity alone.

Tan, who assumed leadership in March with a mandate to reverse Intel's fortunes, now navigates the complex dynamics of managing shareholder expectations while satisfying Washington's strategic imperatives. The administration has emphasized that its stake will be non-voting, but industry observers note that even non-voting shareholders wield considerable influence through informal channels.

The Spillover Effects Across Silicon Valley

The Intel precedent reverberates throughout the technology sector, creating new categories of risk and opportunity. Nvidia and AMD, already subject to the 15% China revenue sharing arrangement, face the prospect of expanded government participation in their business models. The revenue skim, described by one industry analyst as "taxation through export policy," could extend to additional product categories or geographic markets.

Equipment manufacturers like Applied Materials and Lam Research benefit from sustained capital expenditure as government backing provides Intel with extended runway for fab construction. However, the same companies face increasing scrutiny over their China operations as Washington tightens export controls while simultaneously demanding domestic manufacturing scale.

Investment Implications in the New Paradigm

For institutional investors, the emergence of strategic capitalism introduces complex new variables into sector analysis. Companies that align with Washington's priorities may access lower-cost capital and guaranteed demand through government offtake agreements. Conversely, firms perceived as misaligned with national security objectives face potential regulatory intervention or revenue sharing requirements.

Market analysts expect the government's direct equity participation to create both floor effects—limiting downside through state backing—and ceiling effects through potential exit overhangs as Treasury eventually seeks liquidity. The non-voting structure may provide some insulation from political interference, but the precedent of government equity participation fundamentally alters the risk-return calculus for semiconductor investments.

Portfolio managers are beginning to price in a "policy beta" across strategic technology sectors, recognizing that government intervention may become the norm rather than the exception. This dynamic particularly affects cross-border mergers and acquisitions, where golden share arrangements may become standard CFIUS remedies.

The Committee on Foreign Investment in the United States (CFIUS) is an inter-agency U.S. government body that reviews certain foreign investments in American businesses. Its review process is designed to determine the effect of these transactions on U.S. national security and to address any potential risks.

The Path Forward: Managed Competition or Market Distortion?

The Intel stake test case will likely determine whether America's strategic capitalism experiment enhances competitive positioning or introduces problematic market distortions. Success requires Intel to demonstrate meaningful progress on its 18-angstrom manufacturing process, secure major external foundry customers, and prove that government partnership accelerates rather than substitutes for operational excellence.

In chip manufacturing, a "node" is a naming convention for a generation of technology, where a smaller number signifies more advanced, denser chips. As features shrink beyond the nanometer scale, the "angstrom"—a unit of measurement one-tenth of a nanometer—is now used in node names like Intel's 18A to mark the next era of miniaturization.

China's response to American state capitalism measures remains uncertain but significant. Beijing may accelerate its own domestic semiconductor investments while implementing procurement preferences that effectively shrink the addressable Chinese market for U.S. companies. Such retaliation could justify further American intervention, creating a potentially self-reinforcing cycle of state involvement.

European and Japanese allies watch these developments with concern, recognizing that the era of purely market-driven technology competition may be ending. The European Union's €43 billion Chips Act and Japan's investment in Rapidus represent defensive responses to both Chinese and American state intervention.

Measuring Success in Strategic Terms

The ultimate measure of the Intel experiment extends beyond traditional financial metrics to encompass strategic autonomy in semiconductor manufacturing. If the government stake enables Intel to achieve manufacturing parity with TSMC while maintaining innovative capacity, it validates the strategic capitalism model for other critical technology sectors.

However, if the intervention merely delays necessary restructuring while failing to address Intel's fundamental competitive challenges, it may discredit the approach and highlight the limitations of state-directed industrial policy in dynamic technology markets.

As Washington assumes its new role as Silicon Valley stakeholder, the global technology landscape enters uncharted territory where traditional market dynamics intersect with geopolitical imperatives. The Intel stake marks not just a corporate transaction, but the beginning of a new chapter in the competition for technological supremacy between the world's superpowers.

House Investment Thesis

| Aspect | Key Details & Implications |

|---|---|

| Core Shift | U.S. is moving from "market-led with subsidies" to strategic capitalism, using equity stakes, revenue skims, and golden-share vetoes. It is not China's SOE model but represents a higher policy beta and a lower cost of capital for aligned firms. Net effect: can crowd in private capital but raises regulatory overhang and exit risks. |

| Key Precedents (New Facts) |

|

| China Comparison |

|

| Sector Positioning |

|

| Underpriced Risks | 1. Policy-beta creep (>50% odds of another equity/royalty deal in 6-12mos). 2. Exit overhang from eventual government stake sell-downs. 3. Cross-border chill from normalized CFIUS veto rights. 4. China retaliation shrinking accessible TAM. 5. Execution trap where subsidies cushion underperformers. |

| Scenarios (12-24mo) |

|

| Key Triggers to Watch |

|

| Bottom Line | The U.S. is locking in a repeatable playbook. The investment edge shifts to policy-microstructure. Tilt toward semicap/packaging, run event-driven Intel exposure, haircut China AI margins, and keep dry powder for policy-panic dips in names like MP. |

NOT INVESTMENT THESIS