AI Logistics Startup Nauta Raises $7 Million to Automate Global Import Container Management

The Container Conundrum: How a $7M Bet on AI Could Reshape Global Trade's Hidden Bottlenecks

NEW YORK — Nauta, an AI-powered logistics orchestration platform targeting importers, announced a $7 million seed funding round led by Construct Capital and Predictive. The company, which launched in the first quarter of 2025, has rapidly scaled to serve importers across seven countries and secured partnerships with distributors of major brands including New Balance, Ashley Furniture HomeStore, L'Oréal, Modelo, and Moët & Chandon.

The funding round included participation from notable angel investors Simón Borrero, CEO and co-founder of logistics unicorn Rappi, alongside Waikit Lau of RemoteHQ and Juan Jose Gonzales of Windmar Energy. Early customers and partners, including Soriana, one of the largest retailers across the Americas, also invested in the round.

Co-founded by Valentina Jordan, who previously led product and engineering teams at Rappi, and Rafael Santiago, former leader of a prominent Caribbean importing logistics company, Nauta addresses inefficiencies in global trade management. Despite $5.3 trillion in U.S. goods trade in 2024, with imports from Asia and Latin America alone exceeding $2.3 trillion, importers continue to manage complex, multi-modal shipments through fragmented systems of emails, spreadsheets, and legacy software.

The platform's AI capabilities have delivered measurable results for early adopters: detention costs reduced by up to 80 percent, operator productivity increased by 30 percent, and container processing times improved by 75 percent. These improvements directly address one of international trade's most persistent cost centers.

When Spreadsheets Meet Silicon Valley

The company's emergence reflects a broader reckoning within the logistics industry. Despite decades of digitization elsewhere in commerce, importers continue to rely on email chains, manual spreadsheets, and siloed legacy systems to track container-level shipments worth hundreds of millions of dollars.

"The logistics industry processes trillions in goods annually, yet operates with tools that would feel familiar to someone from the 1990s," observed one supply chain analyst familiar with the sector's dynamics. "The opportunity for AI-native solutions isn't just significant—it's overdue."

Nauta's platform promises to replace this patchwork with what co-founder and CEO Valentina Jordan describes as a "single source of truth and control center." Jordan, who previously led product and engineering teams at logistics unicorn Rappi, co-founded the company with Rafael Santiago, whose background includes leading operations at a prominent Caribbean importing logistics company.

Since launching in Q1 2025, Nauta claims to serve importers across seven countries, working with distributors of globally recognized brands including New Balance, Ashley Furniture HomeStore, L'Oréal, Modelo, and Moët & Chandon. The company reports dramatic efficiency gains: detention costs reduced by up to 80 percent, operator productivity increased by 30 percent, and container processing times improved by 75 percent.

The Detention and Demurrage Goldmine

These metrics point to one of international trade's most persistent and costly problems: detention and demurrage fees. When containers sit idle at ports beyond their allocated free time, costs accumulate rapidly—ranging from $75 to $300 per container per day, with wide variance across terminals and carriers.

Did you know that detention and demurrage (D&D) fees cost U.S. importers over $12.9 billion between 2020 and 2023? These penalties hit when containers aren’t moved within their free-time windows: demurrage is charged when a container sits too long at the port, while detention applies when you hold the container outside the terminal beyond the deadline. Rates typically range from $75 to $300 per container per day, and delays caused by congestion, customs holds, or poor coordination can cause costs to spiral fast. Because importers often lack real-time visibility into container status and last-free-day deadlines, many fees are avoidable—which is why startups like Nauta are betting on AI-powered orchestration to predict risks, automate workflows, and cut D&D costs by up to 80%.

Industry data suggests carriers collected $12.9 billion in detention and demurrage fees, representing a substantial drain on importer margins. For large retailers managing thousands of containers monthly, even modest improvements in processing efficiency translate to millions in annual savings.

"Every container tells its own story, but the systems involved rarely speak the same language," Jordan noted in the funding announcement. "With AI, Nauta helps companies make faster, more proactive decisions about every shipment, reducing risk, improving cash flow, and growing margins."

The company's agentic AI capabilities automate routine workflows while providing importers with predictive insights about potential delays, customs holds, and port congestion—enabling proactive rather than reactive decision-making.

Racing Against the Enterprise Giants

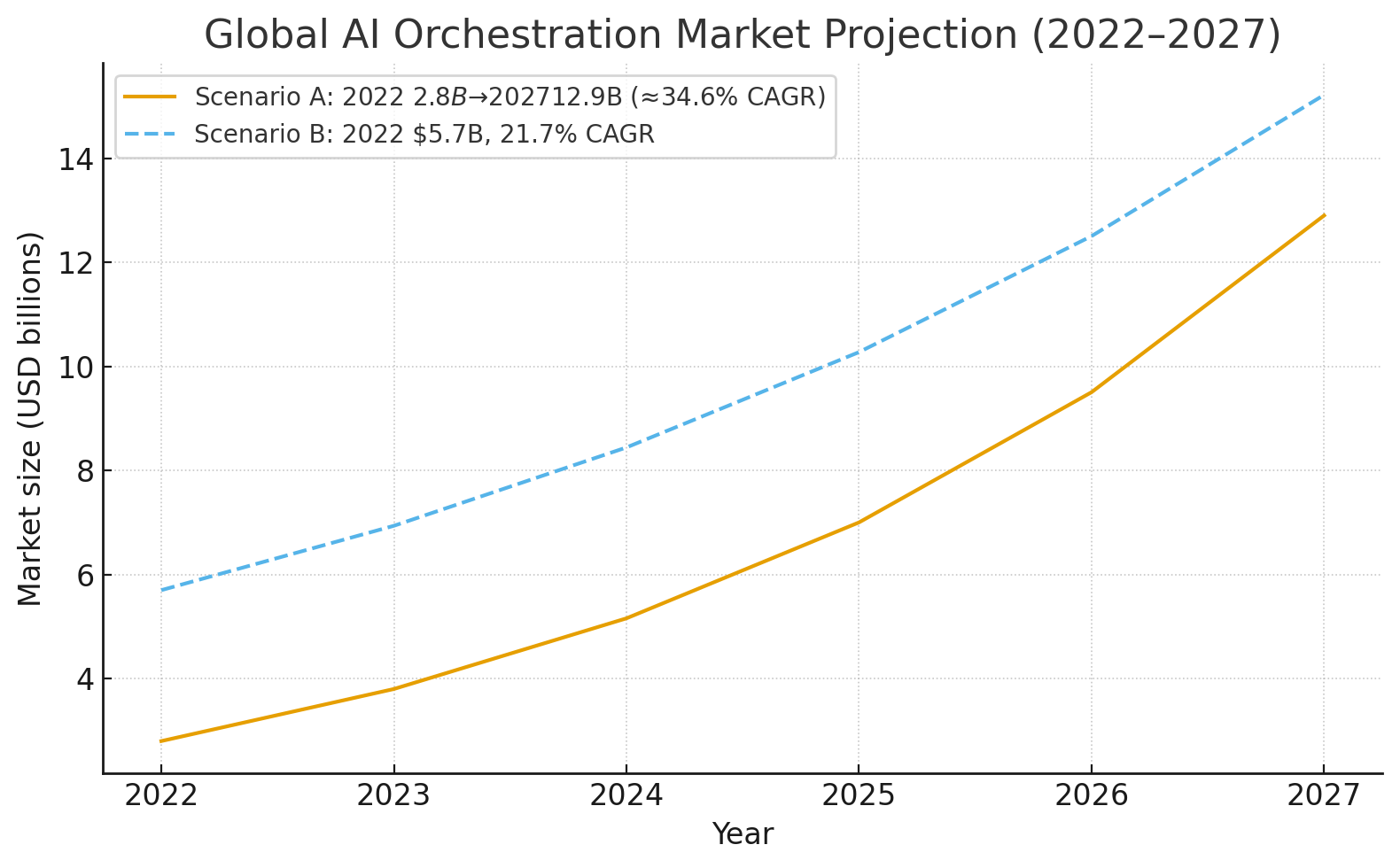

Nauta's emergence occurs within an increasingly competitive landscape where both startups and enterprise incumbents are applying AI across supply chain functions. The broader AI orchestration market is projected to grow from $1.4 billion in 2022 to $13.4 billion by 2027, representing a compound annual growth rate of approximately 44 percent.

Enterprise players like Blue Yonder, which generated $1.36 billion in revenue in 2024, offer comprehensive AI supply chain suites. Project44's Decision Intelligence platform claims to have saved customers over $150 million through its Detention & Demurrage Optimization tools. Meanwhile, established networks like Infor Nexus and Descartes maintain deep enterprise relationships across compliance and supplier collaboration functions.

Recent startup activity suggests intensifying competition. GoodShip raised $25 million for freight network analytics, Swap secured $40 million for AI-powered e-commerce logistics, and Augment announced $25 million for AI workflow assistants focused on trucking operations.

However, industry observers note that Nauta's specific focus on importer-side container orchestration represents a distinct positioning within this landscape. While enterprise platforms excel at visibility and broad network effects, the deep workflow automation and container-level decision-making that Nauta targets remains underserved.

"Supply chains don't just move goods, they also move data and money," explained Camila Saruhashi, Partner at Construct Capital. "That complexity increases significantly with cross-border shipments, where every touchpoint adds layers of documentation, compliance, and coordination."

The Geopolitical Tailwind

Nauta's timing coincides with broader shifts in global trade patterns. According to McKinsey research, over 70 percent of supply chain leaders report having reconfigured their global footprint within the past 12 months, driven by tariff volatility, climate-related disruptions, and supply chain reorientation efforts.

These macro trends create both opportunity and challenge for AI logistics platforms. Rising complexity increases demand for sophisticated orchestration tools, yet the same volatility that drives this demand also creates operational uncertainty that can complicate AI model performance and customer retention.

The company's early customer base includes Soriana, one of the largest retailers across the Americas, which also participated as an investor in the funding round alongside notable angels including Simón Borrero (CEO and co-founder of Rappi), Waikit Lau (Founder of RemoteHQ), and Juan Jose Gonzales (CEO of Windmar Energy).

Investment Implications and Market Positioning

For institutional investors and trading professionals, Nauta's funding represents a microcosm of broader AI adoption across traditionally analog industries. The logistics sector's gradual embrace of artificial intelligence mirrors patterns observed in manufacturing, agriculture, and other capital-intensive sectors where legacy systems and fragmented data have historically limited technological advancement.

The company's focus on measurable ROI—particularly detention cost reduction and processing time improvements—positions it favorably within the current investment climate, where AI companies face increased scrutiny over tangible value creation versus speculative capabilities.

Market analysts suggest several factors could drive continued investor interest in AI logistics platforms: expanding global trade volumes, increasing supply chain complexity, and the demonstrated cost savings from automation in container management operations.

However, risks include potential market consolidation as enterprise players expand their AI capabilities, the capital intensity required to compete with established networks, and the technical challenges of integrating disparate data sources across global logistics ecosystems.

The Road Ahead

As global trade continues expanding and supply chains grow more complex, Nauta's early traction suggests significant appetite for AI-native logistics solutions among importers seeking operational efficiency and cost reduction.

The company's ability to scale beyond its current seven-country footprint while maintaining the deep workflow integration that differentiates it from broader visibility platforms will likely determine whether this $7 million investment represents the foundation of a major logistics technology transformation or another well-funded attempt to modernize an industry that has proven remarkably resistant to technological disruption.

For importers managing the daily complexity of global trade, the promise remains compelling: transforming the chaos of container logistics into a predictable, optimized system where artificial intelligence anticipates problems before they occur and automates solutions at the speed of modern commerce.

The question is whether Nauta's AI-powered vision can deliver on that promise before larger competitors incorporate similar capabilities into their established platforms—or whether the company's focused approach to importer-side orchestration represents a sustainable competitive advantage in the vast and fragmented world of global logistics.

Investment professionals seeking exposure to AI logistics transformation should consider that past performance indicators do not guarantee future results, and consultation with qualified financial advisors remains essential for personalized portfolio strategies.