AWS's $4 Billion Chile Investment Reshapes Latin America's Digital Landscape

SANTIAGO, Chile — Against the backdrop of the towering Andes mountains, a different kind of infrastructure is taking shape. Amazon Web Services' announcement of more than $4 billion in investment to establish a full-scale cloud region in Chile by 2026 marks a watershed moment for Latin America's digital economy, promising to redraw the competitive landscape and accelerate the region's technological transformation.

The investment, which will create three availability zones forming AWS's South America Region, represents far more than routine expansion. It's a calculated strategic maneuver that positions Chile as a pivotal digital hub in the Southern Hemisphere while addressing growing demands for data sovereignty and sustainable computing.

AWS Availability Zones (AZs) are distinct, physically separate locations within an AWS Region, each with independent power, cooling, and networking. The primary purpose of utilizing multiple AZs is to build highly available and fault-tolerant applications by distributing resources, thereby protecting against failures in a single data center.

"This is a transformative moment for digital infrastructure in Latin America," said a senior technology analyst at a major regional investment firm. "The scale of AWS's commitment signals confidence not just in Chile's market, but in the broader region's digital future."

Chile's Ascent: From Digital Outpost to Cloud Capital

The announcement builds upon AWS's existing footprint in Chile, which includes a Local Zone in Santiago, a CloudFront edge location, a Ground Station antenna in Punta Arenas, and Direct Connect capabilities at the Sonda Quilicura Q2 data center.

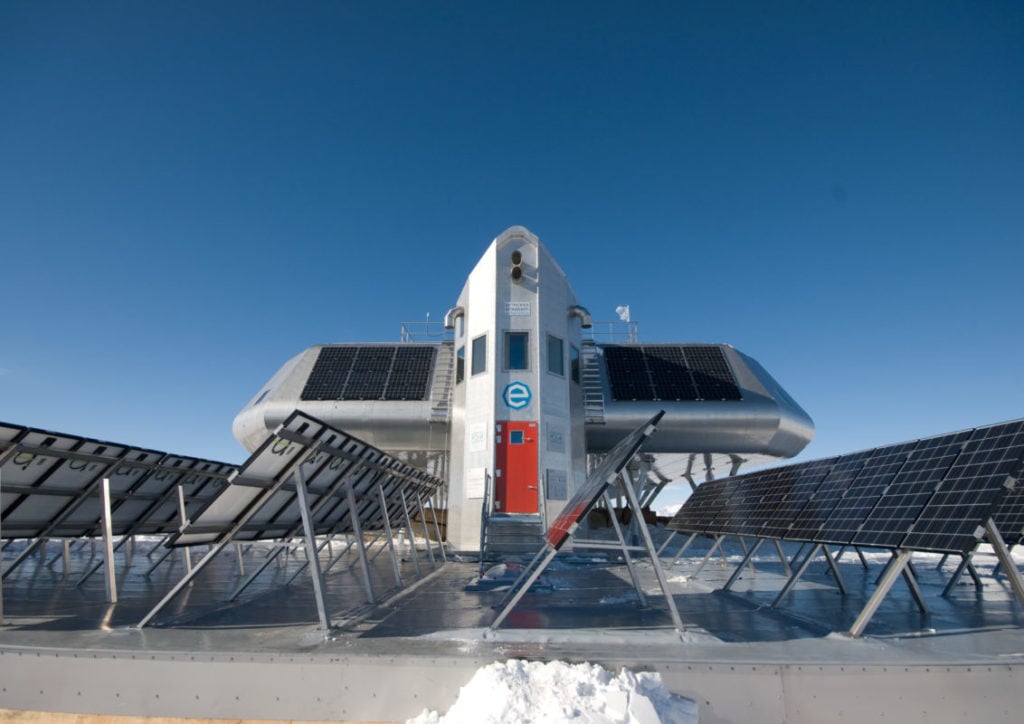

What distinguishes this expansion is its timing and scope. Chile's National Data Center Plan has created an attractive regulatory environment, expediting permits and facilitating renewable energy sourcing for hyperscale operations. More critically, Chile's electrical grid now draws approximately 68 percent of its power from renewable sources—the highest proportion among major Latin American economies—providing AWS with competitively priced, low-carbon electricity that supports its global sustainability commitments.

Renewable Energy Share in Electricity Generation – Selected Latin American Countries

| Country | Renewable Share | Year | Key Sources & Notes |

|---|---|---|---|

| Chile | ~68–70% | 2024 | Solar and wind ~33–35%. December peak: 77%. Hydro, wind, solar dominate. |

| Brazil | ~89% | 2023 | Mostly hydro. Wind ~14%, solar ~10%. 84% of installed capacity renewable. |

| Colombia | ~69% | 2022–24 | Mainly hydro (~72%). Solar/wind growing; ~12% projected by 2025. |

| Argentina | ~18% (non-hydro) | 2023 | 39% low-carbon in 2024. Target: 50% renewables by 2030. Fossil fuels dominate. |

| Mexico | ~24% (clean incl. nuclear) | 2023–24 | Solar ~8%. Goal: 35% clean energy by 2024. Renewables around 25%. |

| LAC Avg. | 62–68% | 2023–24 | Hydro leads (~41–43%). Wind/solar ~17%. OLADE: 68% avg. in past decade. |

Hyperscale data centers are massive facilities designed to support the immense demands of hyperscale computing, enabling companies to efficiently scale IT resources. Their key characteristics include vast size, high density, automation, and the ability to rapidly deploy and manage enormous numbers of servers and storage.

The construction of three availability zones—independent data centers within the same geographic area—will enable businesses to run mission-critical applications with higher resilience than previously possible in the region. For Chilean enterprises currently relying on cloud regions in Brazil or North America, the local infrastructure promises dramatic improvements in application performance.

"Latency matters enormously for modern applications, particularly in financial services and customer-facing systems," explained an enterprise architecture director at one of Chile's largest banks, who requested anonymity due to corporate policies. "Moving from 80-100 milliseconds of latency to single-digit milliseconds transforms what's possible for real-time processing.

Network latency, the delay in data transfer across a network, is a critical factor for cloud applications. High latency negatively impacts application performance and user experience, whereas low latency environments are essential for ensuring responsiveness and overall efficiency.

Market Dynamics and Competitive Reshuffling

The investment comes amid robust growth projections for Latin America's cloud computing sector. The regional market, valued at approximately $13 billion in 2022, is forecast to expand by an additional $26.4 billion between 2025 and 2029, representing a compound annual growth rate of 17.2 percent.

Projected Growth of Latin America's Cloud Computing Market

| Period | 2030+ Market Size (USD) | CAGR | Source |

|---|---|---|---|

| 2025–2030 | 113.2B | 15.5% | Mordor Intelligence |

| 2024–2029 | +26.4B growth | 17.2% | Technavio |

| 2025–2030 | 184.9B | 21.8% | Grand View Research |

| 2025–2033 | 184.0B | 14.7% | IMARC Group |

| 2021–2026 (Storage) | N/A | ~27% | MarkNtel Advisors |

| 2024–2031 (Prof. Services) | 14.9B | 27.8% | Verified Market Research |

Chile's cloud market specifically is expected to grow from $1.5 billion in 2024 to $1.9 billion in 2025, maintaining a 20.3 percent annual growth rate through 2028. Industry observers estimate that AWS's new region could realistically capture 35-40 percent of incremental Chilean infrastructure and platform service spending by 2028, potentially generating $500-600 million in annual revenue—a return that would justify the capital expenditure within a decade.

Chile Cloud Market & AWS Outlook (2023–2028)

| Key Metric | Value / CAGR |

|---|---|

| Cloud Market Size (2023 → 2025) | US$ 1.5B → US$ 1.9B |

| Cloud Market Growth (2023–2028) | 20.3% CAGR |

| Data Center Market Investment | US$ 876M by 2028 |

| AWS Infrastructure Investment | US$ 4B by 2026 |

| ICT Market Size (2023 → 2028) | US$ 16.8B → US$ 25.2B |

The move places immediate pressure on competitors. Google Cloud already operates regions in Santiago and São Paulo, but faces challenges scaling its Chilean operations after encountering regulatory concerns about water usage. Microsoft Azure, which serves Latin America primarily through Brazilian regions, may need to accelerate its previously announced "Transforma Chile" region to avoid losing ground, particularly in artificial intelligence workloads where latency is crucial.

"This creates a competitive forcing function," noted a cloud infrastructure consultant who works with major providers across Latin America. "Azure and Google can't afford to cede this market to AWS for the next two years. Expect acceleration in their investment timelines, possibly with revised cooling architectures that minimize water consumption."

Water Conservation in a Drought-Conscious Nation

In a country that has endured severe drought conditions, AWS's emphasis on sustainable design resonates deeply with local concerns. The company states that the new region will primarily utilize air cooling systems, resorting to water-based cooling for only about 4 percent of the year—equivalent to the annual water consumption of just eight Chilean households over 15 years.

Data centers consume significant amounts of water, largely for cooling purposes, prompting investigation into their environmental impact. Air cooling methods offer a notable benefit by substantially reducing this water dependency compared to water-based cooling systems.

This approach addresses one of the most significant regulatory hurdles facing data center developments in the region. Google Cloud previously encountered legal challenges related to water usage at its Chilean facilities, highlighting the sensitivity surrounding water resources in the country's digital infrastructure planning.

"The air-cooled design isn't just environmentally responsible; it's a prerequisite for operating at scale in Chile's regulatory environment," said an environmental policy specialist familiar with the country's data center regulations. "AWS clearly learned from competitors' experiences and designed their infrastructure with these constraints in mind from inception."

Sovereign Cloud Considerations and Regional Impact

AWS's characterization of the Chilean region as "sovereign-by-design" speaks to growing data localization requirements across Latin America. Chile's pending privacy law 21.719 includes provisions for critical data localization, which will require certain categories of information to remain within national borders.

A sovereign cloud is a cloud infrastructure residing entirely within a specific nation's borders, subject to its laws and governance. This is crucial for data localization, the practice of keeping data within defined geographic boundaries, enabling organizations to meet regulatory compliance and enhance data control.

For Chilean financial institutions, healthcare providers, and government agencies, the local AWS region removes a significant barrier to cloud adoption. Banking sector analysts project a potential migration of core banking workloads to the new region once operational, representing an industry-wide operational expenditure shift of approximately $100 million.

The investment's impact extends beyond Chile's borders. The region will become AWS's southernmost major cloud infrastructure outside Australia, providing improved performance for organizations throughout the Southern Cone, including Argentina, Uruguay, and southern Brazil.

"This isn't just about serving Chilean customers," explained a regional technology director at a multinational corporation with operations across Latin America. "It creates a performance footprint that improves cloud economics for the entire southern region, potentially influencing where companies locate their digital operations."

Connectivity Ecosystem and Infrastructure Convergence

The AWS region announcement coincides with significant developments in Chile's connectivity infrastructure. The Humboldt submarine cable project will link the country directly to Asia-Pacific and Oceania, reinforcing Chile's position as a digital gateway connecting Latin America to Pacific markets.

Local telecommunications operators including Entel, GTD, and Movistar stand to benefit from increased wholesale traffic and Direct Connect reselling opportunities. Financial analysts project these carriers could see margin improvements of 200-300 basis points by 2027 as a result of the AWS ecosystem expansion.

AWS Direct Connect establishes a private, dedicated network link between an organization's premises and AWS, bypassing the public internet. This provides businesses with benefits such as improved security, consistent network performance, and potentially reduced data transfer costs.

The convergence of cloud infrastructure with 5G networks and edge computing capabilities is also accelerating. With Equinix's ST5 data center scheduled to come online, latency from Santiago's central business district to AWS availability zones could drop below 5 milliseconds, enabling new categories of applications requiring near-instantaneous processing.

Edge computing processes data locally, near its source, to reduce latency and bandwidth usage, unlike traditional cloud computing which relies on centralized data centers. While distinct, edge often complements cloud services by handling immediate processing tasks for specific use cases like IoT or autonomous systems, with the cloud managing larger-scale data storage and analysis.

"We're approaching a connectivity inflection point," said a network architecture specialist at a major Chilean telecommunications provider. "The combination of hyperscale cloud, advanced fiber networks, submarine connectivity, and 5G creates a foundation for applications we couldn't reasonably deploy five years ago."

AI Leadership and Future Possibilities

Chile's position at the forefront of Latin America's artificial intelligence development—the country scored highest on the 2024 Latin American AI Index—makes the AWS region particularly significant for machine learning and generative AI workloads.

Latin American AI Index 2024 – Top Countries

| Country | Score | Rank | Notes |

|---|---|---|---|

| Chile | 73.1 | 1st | Leader in AI governance, talent, and adoption. |

| Brazil | 69.3 | 2nd | Strong in infrastructure and innovation. |

| Uruguay | 65.0 | 3rd | Solid in talent and scientific output. |

| Argentina | 55.8 | — | In “Adopter” category. |

| Colombia | 52.6 | — | In “Adopter” category. |

| Mexico | 51.4 | — | In “Adopter” category. |

The presence of local compute infrastructure capable of supporting AWS's specialized AI processors, including Inferentia and Trainium chips, could establish Santiago as the default zone for parameter-intensive language model fine-tuning across Latin America. This capability aligns with growing demand for Spanish and Portuguese language AI models tailored to regional contexts.

AWS offers specialized AI hardware with its Inferentia and Trainium chips, designed as machine learning accelerators. Inferentia chips are explained as being optimized for efficient inference (making predictions), while Trainium's purpose is to provide high-performance and cost-effective training for machine learning models.

Some industry observers suggest even more ambitious possibilities. AWS's existing Ground Station in Punta Arenas, combined with the new region, could position the company to develop specialized services for Antarctic research data markets. The region's proximity to Chile's emerging green hydrogen production hubs—with 67 projects currently in development—also creates potential synergies for sustainable energy sourcing.

"We should interpret this investment through multiple lenses," advised an energy infrastructure analyst specializing in data center power systems. "It's simultaneously about market share, sovereignty compliance, sustainability credentials, and positioning for emerging technology trends. Few infrastructure investments satisfy so many strategic objectives simultaneously."

Economic Reverberations Beyond Technology

The economic impact extends into adjacent markets. Data-center-ready land in Santiago's Pudahuel district has already experienced approximately 40 percent year-over-year price increases in anticipation of supporting infrastructure development. Chilean utilities are exploring time-of-day tariff structures to accommodate the additional electrical load from hyperscale operations.

Time-of-day electricity tariffs involve varying electricity prices based on demand throughout the day, often as part of smart grid tariff structures. For large energy users, such as data centers, understanding and adapting to these tariffs is crucial for managing energy costs by shifting consumption to off-peak, less expensive periods.

For Chile's workforce, the region represents a significant skills development opportunity. AWS has already trained over 100,000 people in Chile since 2017 through programs including AWS Academy, AWS Educate, and AWS Skill Builder. The company has committed to hiring local talent to support the new region's operations.

Chilean pension funds are reportedly exploring infrastructure bond opportunities tied to the region's development, potentially creating a new asset class for local investors seeking exposure to digital infrastructure growth.

Infrastructure bonds are debt securities issued by governments or corporations to raise capital specifically for large-scale projects like transportation, energy, or digital networks. They function by allowing investors to lend money for these developments, receiving interest payments and principal repayment over time, thus enabling the financing of essential public and private works.

"The ripple effects extend well beyond technology companies," noted an economist specializing in Chile's digital economy. "We're witnessing the creation of an entire economic ecosystem spanning real estate, energy, education, and financial markets."

A Regional Catalyst

As construction begins on AWS's Chilean infrastructure, the investment appears poised to catalyze broader regional development. Industry analysts suggest Peru and Colombia may implement similar fast-track permitting processes to attract hyperscale cloud providers, potentially creating a "latency triangle" of west coast regions by the end of the decade.

For now, AWS's $4 billion commitment represents a definitive bet on sovereign cloud demand and sustainable power economics in the Southern Cone. It forces competitors to accelerate their plans, offers Chile a platform for AI-led digital exports, and positions Amazon to capture a disproportionate share of Latin America's next wave of cloud growth while advancing its environmental objectives.

In the shadow of the Andes, a new kind of infrastructure rises—one measured not in physical height, but in transformative potential for an entire region's digital future.