Amazon Shares Drop Despite Strong Q2 Earnings as Massive AI Spending Raises Investor Concerns

Amazon's Massive AI Bet Masks Retail Renaissance as Q2 Earnings Surge

Tech giant's profits soar above expectations, but investors flinch at unprecedented capital spending spree

In the gleaming halls of Amazon's Seattle headquarters, a financial paradox is unfolding. The e-commerce and cloud computing titan reported stellar second-quarter earnings that shattered Wall Street expectations, with revenue climbing 13% to $167.7 billion and profits surging 35% to $18.2 billion. Yet beneath these impressive headline figures lies a more complex story: a company simultaneously perfecting its retail machine while burning through cash at an extraordinary rate to secure its place in the AI revolution.

The stark contradiction was not lost on investors, who sent Amazon shares sliding massive 6.63% (as of writing) in after-hours trading Thursday despite what would normally be considered a blockbuster report.

The Tale of Two Amazons

At its core, Amazon's latest earnings reveal a company operating on two dramatically different tracks. Its North American and International retail segments have reached new heights of efficiency, with operating income in these divisions increasing by 48% and 448% respectively. The long-struggling International segment finally achieved profitability at scale, marking what one analyst called "a major inflection point" for the company's global operations.

"This is the culmination of years of investment in logistics infrastructure, automation, and regionalization," noted a retail industry expert following the earnings release. "They've transformed what was once seen as a low-margin business into an extraordinarily efficient cash-generating machine."

Meanwhile, Amazon Web Services , traditionally the company's profit engine, showed strong revenue growth of 17% year-over-year to approximately $30.9 billion. But its operating margin compressed significantly, dropping from 35.5% a year ago to 32.9%, as the company pours unprecedented sums into AI infrastructure.

The $100 Billion Moonshot

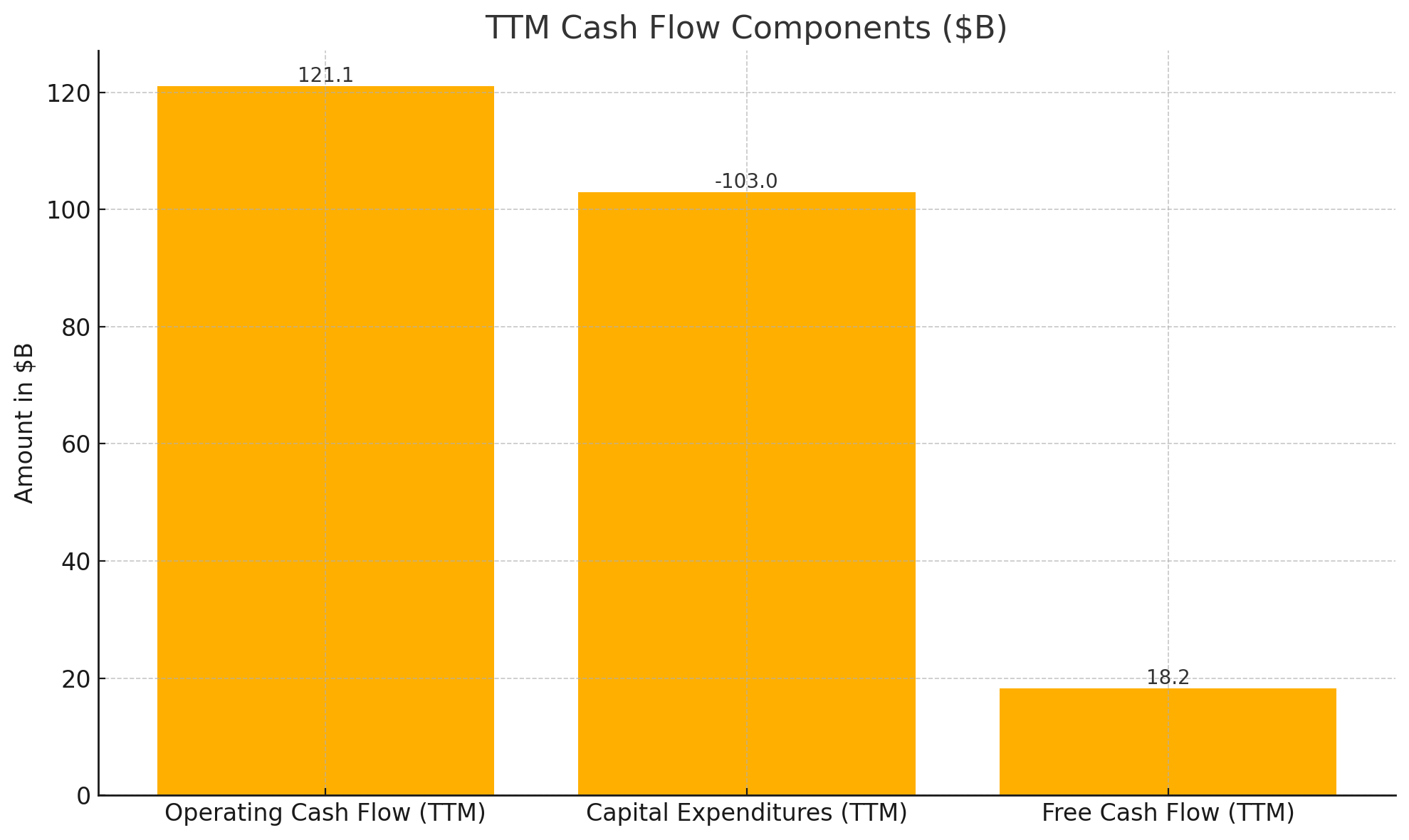

The most striking figure from Amazon's report isn't found in the headline numbers. It's buried in the cash flow statement: trailing twelve-month capital expenditures have nearly doubled to an eye-watering $103 billion, primarily funding data centers, GPU clusters, and AI development. As a result, free cash flow collapsed 66% to $18.2 billion despite strong operational performance.

This level of spending represents perhaps the largest bet in corporate America on the future of artificial intelligence. Throughout the earnings presentation, CEO Andy Jassy emphasized AI initiatives spanning the company's entire portfolio: from Alexa+ and AI shopping agents for consumers to developer tools like Kiro and Bedrock AgentCore for enterprise customers.

"Amazon isn't just participating in the AI arms race—they're attempting to own the entire battlefield," remarked a technology analyst who follows the company closely. "The question investors are wrestling with is whether this unprecedented capital deployment will deliver commensurate returns, and on what timeline."

Wall Street's Uneasy Response

The market's tepid reaction stems largely from Amazon's guidance for the third quarter. While revenue projections of $174-179.5 billion exceeded analyst expectations, the operating income guidance of $15.5-20.5 billion presented an unusually wide range. The lower end would represent a year-over-year contraction, signaling potential continued pressure from the company's massive investment cycle.

"The guidance bandwidth reveals the uncertainty inherent in Amazon's current strategy," observed a veteran market strategist. "They're essentially asking investors for patience while they build what they believe will be the foundation for the next decade of computing."

The Competitive Landscape Intensifies

Amazon's cloud division continues to face mounting pressure from Microsoft Azure and Google Cloud, both of which reported stronger growth rates in recent quarters. While AWS maintains approximately 31% of global cloud market share, the competition for AI workloads has intensified dramatically, potentially forcing more aggressive pricing and incentives.

Energy constraints present another challenge, with data center power costs rising 11% year-over-year. The company has secured contracts for 3 gigawatts of renewable energy, but potential curtailment penalties in certain power markets remain a concern as AI computing demands escalate.

Retail Renaissance Provides Stability

As AWS navigates this transitional period, Amazon's retail operations have emerged as a surprising source of stability. Online store sales reached $61.5 billion in the quarter, growing 11% year-over-year. The company highlighted its DeepFleet robotics program and inventory management AI as key drivers behind the margin expansion in retail segments.

Advertising services continue to outperform, growing 23% year-over-year to approximately $15.6 billion with margins estimated above 70%. This high-margin revenue stream increasingly serves as a buffer against the capital-intensive investments in cloud and AI infrastructure.

The Investment Outlook: Short-Term Pain, Long-Term Potential

For investors, Amazon presents a complex value proposition. The company trades at approximately 19 times EV/EBITDA, below its 10-year median and only marginally higher than Microsoft despite projections for faster EBITDA growth through 2027.

Financial analysts suggest that if AWS can return to 35% operating margins and capital expenditures normalize to around 15% of sales, free cash flow could exceed $65 billion by fiscal year 2027. Using standard valuation methodologies, this scenario could support a share price approaching $300—representing roughly 28% upside from current levels.

"FY-25 appears to be the peak investment year," noted an investment strategist familiar with the company. "The key catalysts to watch are AWS margin stabilization above 34% by early 2026 and free cash flow inflection in the second half of next year as capital spending plateaus."

Investors should consider that near-term volatility is likely to continue while Amazon's "AI-bill curve" remains elevated. However, the market may be undervaluing the company's long-term potential by focusing on current investment levels as permanent rather than transitional.

Investment Thesis

| Category | Key Points |

|---|---|

| Investment Context | Q2 2025 revenue +13% Y/Y to $167.7B, EPS $1.68 beat consensus. Shares dropped 7% due to AWS margin decline (32.9%, -330bps QoQ) and wide Q3 operating-income guidance. Market overlooks long-term cash-flow potential. |

| Operating Margins | Retail: >800bps Y/Y margin growth (NA & Int'l), Int'l at 4%. AWS: Margin compression (-260bps) from GPU leases/AI investments; 17% growth > Azure (~15%). Ads: $15.6B (+23% Y/Y), >70% incremental margin. |

| CapEx & FCF | TTM FCF fell 66% to $18B due to doubled CapEx (~$103B). Forecast (B): FY23 $59 → FY24 $71 → FY25E $105-110 (peak) → FY26E $95-100 → FY27E $85-90. FCF rebound to $45-50B by 2H26 expected. |

| Strategic AI Focus | Agentic AI: Betting on AWS as workflow layer (Bedrock AgentCore, Kiro IDE). Vertical Integration: Proprietary chips (Graviton5/Trainium3) to boost margins. Retail AI: Shopping Agent & Review Summaries drive ad yield. |

| Competition & Risks | Cloud Share: AWS ~31% (vs. Azure, GCP). Energy Costs: +11% Y/Y. Regulatory: EU/FTC risks (15% probability of structural impact, 60bps margin drag). Bear Risks: AWS price war (30%), CapEx overrun (25%). |

| Valuation (vs. Peers) | AMZN: 19x EV/EBITDA (below 10-yr median), 3.9x EV/Rev vs. Azure (6.1x), GCP (4.7x). Intrinsic value ~$300/share (28% upside). Stock Prices (8/1/25): AMZN $234.11, MSFT $533.50, GOOGL $191.90. |

| Investment Stance | Overweight (3Y): Accumulate below $230. Catalysts: AWS margin >34% by Q1 2026, FCF rebound in H2 2026, agentic AI driving ad growth. Risks: Near-term volatility, regulatory/CapEx overruns. |

Disclaimer: This analysis is based on current market data and historical patterns. Past performance does not guarantee future results. Investors should conduct their own research and consult financial advisors before making investment decisions.