Atlassian Buys Arc Browser Maker The Browser Company for $610 Million to Build AI Work Browser

Atlassian's $610M Browser Bet: Redefining Work in the AI Era

SYDNEY — Atlassian Corporation, the Australian software giant behind workplace collaboration tools Jira and Confluence, announced today its agreement to acquire The Browser Company for $610 million in cash, marking one of the largest acquisitions in the emerging AI-powered browser market.

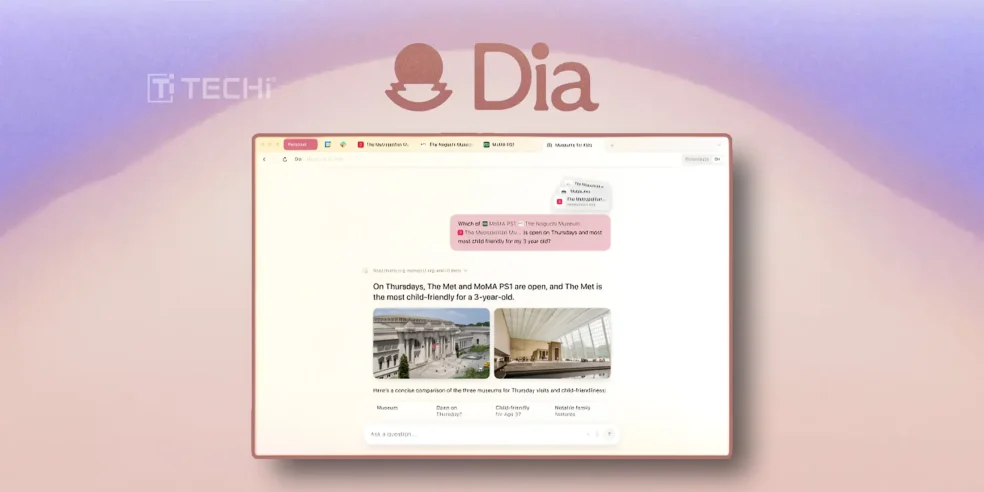

The Browser Company, founded in 2019, creates web browsers designed specifically for professional work environments. The startup's flagship products include Arc, a browser that reimagines tab management and workspace organization, and Dia, a newer AI-native browser that can understand and act upon content across multiple web applications simultaneously.

The acquisition, funded entirely from Atlassian's balance sheet, is expected to close in the second quarter of the company's fiscal year 2026, which runs from October through December 2025. The Browser Company will continue operating independently under Atlassian's ownership, with CEO Josh Miller and his team maintaining control over product development.

The transaction represents a significant bet by Atlassian—whose productivity software serves more than 300,000 customers globally—that the future of workplace efficiency lies not just in individual applications, but in reimagining the browser as an intelligent layer that coordinates work across the entire web-based software ecosystem.

When Browsing Becomes Working

The acquisition centers on Dia, The Browser Company's AI-native browser that promises to transform how professionals navigate their tab-heavy workflows. Unlike traditional browsers built for passive consumption, Dia represents a paradigm shift toward active digital assistance—a browser that doesn't just display web pages, but comprehends the context across multiple applications and can execute complex actions on behalf of users.

"Today's browsers were built for browsing; they were built for work," Mike Cannon-Brookes, Atlassian's CEO and co-founder, stated in announcing the deal. The distinction is crucial: while Chrome commands roughly 69% of global browser market share, its dominance rests on web navigation, not workplace optimization.

Global browser market share, highlighting Google Chrome's dominance compared to competitors like Safari, Edge, and Firefox.

| Browser | Market Share (July 2025) |

|---|---|

| Google Chrome | 63.72% |

| Apple Safari | 22.07% |

| Microsoft Edge | 5.79% |

| Mozilla Firefox | 2.15% |

| Other Browsers | 2.94% |

| Samsung Internet | 3.33% |

The Browser Company's trajectory illuminates this market gap. Founded in 2019, the startup raised $128 million across multiple funding rounds, attracting investment from notable figures including LinkedIn's Jeff Weiner, Medium's Ev Williams, and Figma's Dylan Field. Its most recent $50 million Series B round in March 2024 valued the company at $550 million—making Atlassian's $610 million offer a modest premium that reflects both strategic urgency and market realities.

The Enterprise Trust Equation

For The Browser Company, the acquisition solves a fundamental scaling challenge that has plagued consumer-focused browser alternatives for decades: distribution and enterprise trust. Josh Miller, The Browser Company's CEO, acknowledged that the deal would enable faster hiring, feature development, and multi-platform support while maintaining operational independence.

The arithmetic is compelling. Atlassian brings more than 300,000 customers and 2.3 million monthly active AI users to the equation—a distribution channel that The Browser Company could never have accessed independently. More critically, Atlassian offers the enterprise trust infrastructure that modern IT departments demand: single sign-on capabilities, security certifications, compliance frameworks, and administrative controls.

Atlassian's customer growth over the past several years, illustrating its large enterprise footprint.

| Fiscal Year | Total Customers |

|---|---|

| 2021 | ~200,000 |

| 2022 | 242,600 |

| 2023 | 262,337 |

| 2024 | >300,000 |

| 2025 | >300,000 |

"The real bottleneck wasn't technology—it was distribution and trust," notes one analyst familiar with enterprise software adoption patterns. "Browser alternatives succeed in consumer markets through viral adoption, but enterprise deployment requires systematic rollouts through IT departments that already trust existing vendors."

Racing Against Platform Giants

The timing of Atlassian's move gains additional significance against the backdrop of recent regulatory developments. A federal judge's decision this week to spare Google from being forced to sell Chrome preserves the search giant's browser dominance while limiting remedies to data-sharing requirements and restrictions on exclusionary practices.

This regulatory outcome effectively validates Atlassian's distribution-focused strategy. Rather than waiting for antitrust actions to level the playing field, the company is building alternative pathways to browser adoption through its existing enterprise relationships.

The competitive landscape reveals the strategic imperative. Microsoft has steadily enhanced Edge with Copilot integration, creating tight coupling between browser functionality and enterprise AI capabilities. Google continues expanding Gemini's presence within Chrome, while maintaining its default position across billions of devices. Meanwhile, security-focused browsers like Island have carved out niches by prioritizing data loss prevention and zero-trust architectures.

The Orchestration Layer Strategy

Atlassian's acquisition thesis extends beyond browser market share to a more fundamental question: what becomes the primary interface for knowledge work in an AI-driven world? The company's existing portfolio—Jira, Confluence, Trello, and Loom—represents discrete applications within broader workflows. A work-optimized browser potentially becomes the surface that connects and orchestrates across all these tools.

A Digital Orchestration Layer is a software component that manages and automates complex digital workflows. It coordinates tasks across disparate systems and applications, ensuring seamless, end-to-end execution of business processes.

Dia's architecture embodies this vision. The browser's AI capabilities can summarize information across multiple tabs, execute actions within different applications, and maintain context about ongoing projects and priorities. Rather than treating each web application as an isolated silo, Dia attempts to create a coherent work environment that spans the user's entire digital toolkit.

The technical challenges are substantial. AI-powered browsers require significant computational resources for local processing and cloud-based inference. The Browser Company had begun charging $20 monthly for Dia Pro to address these costs, but Atlassian's resources enable a different economic model—bundling browser capabilities into existing enterprise subscriptions where AI costs can be amortized across larger customer contracts.

Security as the Ultimate Battleground

Enterprise adoption of AI-powered browsers will ultimately hinge on security implementations that can withstand sophisticated attacks. Recent security incidents involving AI browsers have demonstrated the risks: prompt injection attacks that manipulate AI responses, unauthorized data access across application boundaries, and session hijacking through compromised browser extensions.

A prompt injection attack is a method where malicious instructions are embedded within user inputs to manipulate an AI model. This aims to override the AI's intended directives or safety guidelines, forcing it to generate unintended or harmful outputs.

The Browser Company's independent operation under Atlassian provides both opportunity and challenge. Maintaining autonomous development enables continued innovation, but enterprise customers will demand security standards and compliance certifications that align with Atlassian's broader platform commitments.

"Security will be the make-or-break factor," observes one cybersecurity executive who has evaluated AI browser deployments. "CISOs need verifiable controls around data boundaries, model behavior, and agent actions before they'll approve enterprise rollouts."

Investment Implications and Market Dynamics

From an investment perspective, Atlassian's acquisition reflects broader market dynamics around AI infrastructure and enterprise software consolidation. The deal's $610 million price tag, funded from existing cash reserves, suggests confidence in near-term revenue synergies rather than speculative technology bets.

Analysts may focus on several key metrics as the integration unfolds: enterprise browser adoption rates within Atlassian's customer base, incremental revenue from browser-related upsells, and competitive responses from Microsoft and Google. The company's existing AI user growth—2.3 million monthly active users with over 50% quarter-over-quarter expansion—provides a foundation for modeling browser-based AI adoption.

Atlassian's rapid growth in monthly active AI users, highlighting the foundation for adopting the new AI browser.

| Metric | Latest Data | Additional Context |

|---|---|---|

| Monthly Active AI Users | 2.3 million (Q4 FY2025) | Up 50% quarter-over-quarter. |

| R&D Spending (Most Recent Reported Quarter) | $685 million (last quarter as of May 2025) | Represents 50.5% of revenue and an increase of nearly 19% year-over-year. |

| Non-GAAP R&D Expenses (Q3 FY2025) | $444.38 million | Increased 15% year-over-year and accounted for 32.8% of total revenue. |

Market observers should monitor whether Atlassian maintains Dia's neutrality across competing software platforms. The company's statements emphasize vendor-agnostic AI assistance, but practical implementation could favor Atlassian's own applications in subtle ways that influence customer purchasing decisions.

The broader implications extend to enterprise software strategy. If browsers become primary orchestration layers for digital work, software vendors face pressure to optimize their applications for AI-driven automation rather than human navigation. This shift could accelerate consolidation as companies seek to control larger portions of the workflow stack.

The Future of Digital Work

Atlassian's browser acquisition represents a calculated bet that the future of enterprise software lies not in individual applications, but in the intelligent fabric that connects them. Success will depend on execution across multiple dimensions: technical integration, security implementation, enterprise sales, and competitive positioning against well-funded platform incumbents.

The deal's expected completion in late 2025 provides a timeline for measuring early outcomes. Key indicators include Windows platform parity for Dia, mobile device management integration, and enterprise security certifications that enable broad IT department adoption.

For Atlassian shareholders, the acquisition offers exposure to a potentially transformative shift in how professionals interact with digital tools. The risks center on execution challenges, competitive responses, and the fundamental question of whether browsers can evolve beyond their traditional roles to become primary work interfaces.

The broader technology industry will watch closely as this experiment unfolds, recognizing that control over the browser layer could determine competitive positioning across enterprise software markets for years to come.

House Investment Thesis

| Aspect | Summary |

|---|---|

| Deal Thesis | Atlassian acquires The Browser Company (TBC) for ~$610M cash in a distribution & trust arbitrage play. It moves the AI work browser (Dia) from consumer novelty to an enterprise attach surface across 300k+ customers, aiming to own the "pane of work" above SaaS. Success hinges on enterprise security, credible neutrality beyond Jira/Confluence, and Windows/MDM parity. |

| Deal Context | • Terms: ~$610M cash, closes Q2 FY26 (Oct-Dec 2025). TBC operates independently. • TBC Funding: $128M raised; last round was $50M Series B at $550M valuation (Mar 2024). • Market: Google was not forced to divest Chrome; it retains default advantage. • Share: Chrome has ~69% global share; new browsers need enterprise deployment, not consumer defaults. |

| Root Causes | 1. Distribution & Trust: TBC lacked enterprise essentials (SSO/SCIM, SOC2, MDM, sales motion); Atlassian provides them plus an installed base. 2. Cost Efficiency: Bundling amortizes Dia's compute-heavy AI costs over Atlassian's seat ARPU. 3. Strategic Control: Shift from apps to owning the work surface for cross-SaaS agents and telemetry. 4. Regulatory Timing: Chrome's intact dominance forces challengers to partner with incumbents. 5. Scale Required: Building & maintaining a browser (Chromium, multi-OS, extensions, security) is a scale game. |

| Tech & Product | • Dia's Edge: AI that sees tab context/history/cookies to act across SaaS (summarize, fill forms). • Key Risk: Security, specifically resilience against indirect prompt-injection and unsafe agent actions. • Competition: Enterprise browsers are a funded category (e.g., Island at $4.8B valuation); Dia leads with productivity/agents vs. their security wedge. • Platform Headwinds: iOS WebKit rules and Manifest V3 extensions limit mobile parity and automation capabilities. |

| Go-to-Market | Dia becomes an enterprise product first, attached to Jira/Confluence footprints. Expected packaging: included in higher tiers with admin policies, plus Pro upsell for heavy AI use. Key to Win: Windows/MDM support on day zero, clear security/compliance posture, and strict neutrality (no favoring Atlassian apps over competitors). |

| Competitive Map | • Microsoft Edge + Copilot: Deep Windows/Entra integration, formidable enterprise default. • Google Chrome + Gemini: Distribution king, moving carefully on enterprise agents. • Brave + Leo: Consumer privacy focus, not enterprise-first. • Perplexity Comet: Ambitious but security flubs created a cautionary tale. • Security Browsers (Island, etc.): Lead with DLP/zero-trust; adjacent to Dia's battleground. |

| Unit Economics | • COGS: AI is token-heavy; requires seat bundling, rate-limits, and a mix of on-device/cloud LLMs to protect margins. • Expected Model: 1) Baseline included in Premium/Enterprise tiers, 2) Pro upsell, 3) Admin packs for DLP/audit/policy. |

| Risks (by Severity) | 1. Agentic Security Incident: A breach could stall adoption in regulated industries. 2. Windows/IT Friction: Lagging on Windows/MDM will cause procurement to default to Edge. 3. Neutrality Optics: Privileging Atlassian apps will lose deals in M365/ServiceNow-dominated shops. 4. Mobile Limitations: iOS constraints create messy sales cycles. 5. Extension Shifts: Breaking automations require re-design. |

| Predictions | 1. Dia becomes an enterprise SKU (bundled) in 6-12 months (80% confidence). 2. Windows GA + core MDM within 2026 (70%). 3. TBC's Arc browser moves to maintenance; innovation focuses on Dia (85%). 4. Competitors broaden agent guardrails and AI features (60%). 5. A security event in the AI-browser category slows adoption in a regulated vertical (70%). |

| Founder Playbook | • Pick a Wedge: Security-first browser, vertical agentic workflows, or agent policy/observability. • Design for Safety: Least-privilege agents, signed "skills," DOM isolation against prompt-injection. • Exploit Enterprise Mechanics: MDM-friendly packaging, SCIM/SSO, SOC2 evidence, clear DPIA language. • Mobile Realism: Prioritize desktop; degrade gracefully on iOS. • Key Metrics: Time-to-value, policy coverage, blocked exfil events, % tasks automated, net AI COGS/seat. |

| Investor Lens | • Thesis: The browser is the operational bus for SaaS; value goes to the safe orchestrator of cross-app actions. • Exit Map: Strategic acquirers (Microsoft, Google, security platforms, Atlassian) or IPO for security-led browsers. • Diligence Questions: Windows/mobile roadmap, data boundaries/LLMs, neutrality parity, agent safety model, COGS control. |

| Contrarian Takes | • This is an agent policy war, not a browser war; differentiation is on verifiable safety, not model IQ. • Monetizing Neutrality: Shipping first-class skills for competitor stacks (MSFT/Google) is the fastest way to win trust and upsell. • Convergence: Productivity browsers (Dia) and security browsers (Island) will converge via partnership or M&A. |

| What to Watch | • Public Dia Windows GA date + MDM profiles. • Packaging: Does Dia appear on Atlassian Premium/Enterprise pricing pages? • Security Papers: Dia's published prompt-injection posture and audit/logging docs. • Mobile: Any loosening of iOS engine rules beyond the EU. |

The transaction is subject to customary closing conditions and regulatory approvals, with completion targeted for the second quarter of Atlassian's fiscal 2026. NOT INVESTMENT ADVICE!