Australian Court Rules Apple and Google Abused App Store Market Power

The Digital Reckoning: How an Australian Courtroom Cracked Silicon Valley's Most Lucrative Empire

SYDNEY, Australia — The morning light filtered through the tall windows of Sydney's Federal Court as Justice Jonathan Beach prepared to deliver a judgment that would send shockwaves through the glass towers of Cupertino and Mountain View. His voice, measured and deliberate, began reading from what would become the most consequential 2,000 pages ever written about the screens in our pockets.

For the countless app developers who have watched their innovations struggle under Apple's 30% commission structure, the moment felt surreal. After years of legal battles, corporate stonewalling, and mounting financial pressure, an Australian judge was about to validate what millions of developers worldwide had long suspected: the digital marketplace wasn't really a marketplace at all.

Justice Beach's exhaustive analysis systematically dismantled the legal architecture that has enabled Apple and Google to extract unprecedented profits from what amounts to digital highway tolls. His ruling found both tech giants guilty of systematically abusing their market dominance, transforming essential digital infrastructure into private taxation systems that have cost Australian consumers and developers hundreds of millions while stifling innovation across entire economic sectors.

The decision opens compensation pathways for approximately 15 million Australian consumers and 150,000 developers, but its implications stretch far beyond financial restitution. In courtrooms from Brussels to Tokyo, similar challenges are mounting—part of a global reckoning with digital power that threatens to reshape the technological landscape that has defined the 21st century.

Inside the Machine: How Digital Gatekeeping Really Works

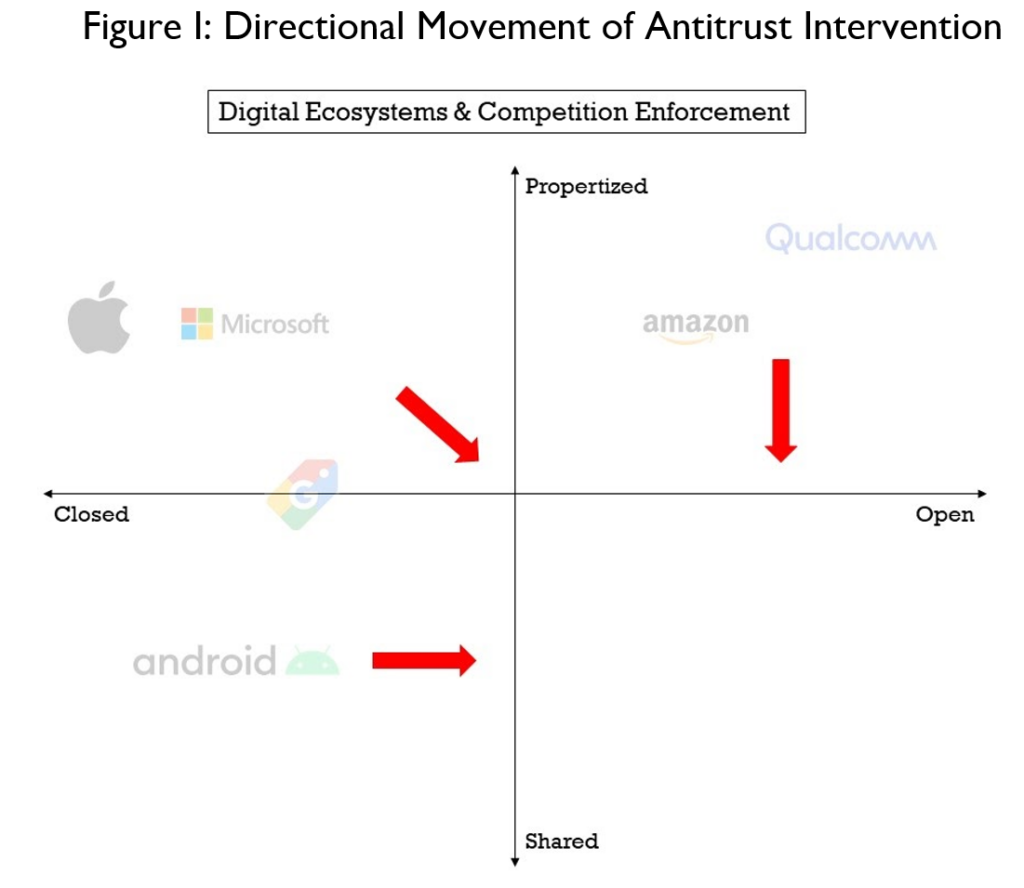

The court's findings revealed the sophisticated mechanics of what competition experts call "two-sided gatekeeping"—a system where platforms control both the roads and the toll booths, creating unprecedented leverage over everyone forced to travel them. This architectural control enables systematic exclusion of competitive alternatives while extracting monopolistic rents from captive markets.

Did you know that in many digital platforms, a concept called Two-Sided Gatekeeping shapes how people and businesses interact? In a two-sided market—like ride-sharing apps connecting drivers and passengers or online marketplaces linking buyers and sellers—the platform acts as a gatekeeper controlling access, pricing, and rules for both sides. These platforms thrive on cross-network effects, where the value for one group grows as the other group expands, and they often subsidize one side while charging the other more to keep the ecosystem balanced. By managing these interactions, gatekeepers can wield significant market power, influencing who participates, how value flows, and ultimately how the entire network operates.

Apple's iOS ecosystem emerged as perhaps the most elegant example of this control architecture. The company's prohibition of "sideloading"—installing apps from any source outside the official App Store—combines with mandatory payment processing requirements to create what economists term "leveraging." Users seeking access to essential applications must simultaneously accept Apple's financial terms, bundling utility with profit maximization in ways that would have made railroad barons envious.

The human cost becomes visible in data points that represent real struggles: iOS commands approximately 56% of Australia's mobile operating system share, while Android holds 43%. This duopoly has enabled rent extraction that some industry analysts estimate generates margins exceeding 75% for Apple's App Store operations—profits built on preventing the very competition that might benefit consumers.

Did you know that in Australia, almost every smartphone runs on either Apple’s iOS or Google’s Android, forming a near-total duopoly? As of mid-2025, iOS holds the lead with about 56.13% market share, while Android follows closely at 43.21%. All other operating systems combined make up less than 1%, showing how strongly Australians favor these two platforms. iOS’s dominance is driven by brand loyalty, seamless ecosystem integration, and its premium positioning, while Android remains competitive thanks to its vast range of devices and affordability.

Google's approach, while superficially more open through Android's sideloading capabilities, employed what the court identified as "Project Hug"—strategic financial incentives designed to prevent major developers from exploring alternative distribution channels. Internal documents revealed systematic efforts to maintain market position through exclusionary payments disguised as standard business development.

The Invisible Victims of Digital Monopolization

Behind every percentage point of market share lie countless individual stories of constrained opportunity and thwarted innovation. The Australian ruling validates experiences that span continents—small developers crushed by platform fees they cannot negotiate, consumers paying inflated prices for digital goods, and entire economic sectors shaped by the strategic preferences of two California companies.

The compensation framework encompasses both direct overcharges and broader competitive harms stemming from reduced innovation and choice. For affected developers, the decision promises potential relief from what many describe as extractive relationships that have fundamentally altered the economics of digital creativity.

The scale of affected parties—15 million consumers and 150,000 developers in Australia alone—illustrates how thoroughly app store policies have penetrated ordinary economic life. These numbers represent teachers downloading educational apps, small business owners processing payments, teenagers buying digital content, and countless other transactions shaped by monopolistic infrastructure.

Global Rebellion Against Digital Feudalism

The Australian judgment arrives amid coordinated international pressure that suggests fundamental transformation in how democratic societies govern digital markets. The timing appears deliberate—regulators worldwide are sharing analytical frameworks and remedy approaches in what amounts to organized resistance against digital platform overreach.

In Brussels, the European Union's Digital Markets Act has already compelled Apple to permit alternative app marketplaces and web distribution, while ongoing enforcement actions scrutinize whether compliance measures genuinely address competitive concerns or merely create new barriers wrapped in regulatory language. European regulators have shown particular skepticism toward Apple's Core Technology Fee structure, viewing it as potential circumvention of structural reform requirements.

Japan's Mobile Software Competition Act, entering enforcement December 18, 2025, mandates even more comprehensive changes: third-party app stores, alternative billing systems, browser engine choice, and elimination of anti-steering provisions. The law represents Asia's most ambitious attempt to democratize digital platform governance.

This regulatory convergence creates strategic challenges that transcend individual market economics. Companies that once negotiated with isolated national authorities now face coordinated pressure that makes jurisdictional arbitrage increasingly difficult.

Market Psychology and Strategic Positioning

Financial markets absorbed Tuesday's news with characteristic complexity, reflecting both immediate relief and longer-term uncertainty about regulatory trajectory. Apple shares advanced $2.52 to close at $229.70, while Alphabet gained $1.54 to finish at $202.54—movements suggesting investors view Australia's direct economic impact as manageable while potentially underestimating broader momentum.

Sophisticated traders recognize that Australia represents less than 5% of global app store revenue for either company. However, template effects could prove exponentially more significant if similar regulatory frameworks proliferate across larger markets or if remedy designs prove impossible to contain through creative compliance strategies.

The investment thesis now requires fundamental recalibration to incorporate previously negligible variables: regulatory compliance costs, fee structure volatility, and competitive pressure from alternative distribution channels. Traditional platform metrics focusing on user growth and engagement need updating for markets where monopolistic assumptions no longer hold.

Corporate Countermoves and Compliance Theater

Both companies' measured public responses reveal strategic vulnerabilities while previewing likely defensive strategies. Google's emphasis on the court's rejection of Epic's demand for "app stores within the Google Play store" highlights relief at avoiding the most structurally threatening remedies while disputing findings around billing practices and developer relationship management.

Apple's characterization of its App Store as providing "the safest way for users to get apps" maintains security-focused messaging that resonates with consumers but faces increasing skepticism from regulators applying sophisticated economic analysis to competitive effects. The company's European compliance model—permitting alternatives while introducing new fees and eligibility criteria—suggests likely approaches for Australian implementation.

However, the effectiveness of such strategies depends critically on regulatory acceptance of revised fee structures. Recent European Commission statements expressing continued concern about Apple's compliance measures indicate that creative interpretation of regulatory requirements may face increasingly sophisticated regulatory response.

Investment Calculus for a Regulated Future

Professional market participants should prepare for investment landscapes where platform economics face systematic constraint rather than isolated challenges. The European Commission's ongoing review of Apple's revised EU terms will largely determine whether fee redesigns can preserve essential platform economics under regulatory pressure.

Japan's enforcement guidelines publication ahead of December implementation will clarify how extensively structural changes may spread, while Australian class-action damages proceedings could establish methodological precedents for calculating platform overcharges across multiple jurisdictions.

Strategic analysts suggest modeling scenarios where blended take-rates decline 50-150 basis points over 2-3 years if similar regulatory frameworks spread across major developed markets. While such changes represent manageable near-term adjustments, they signal fundamental shifts in competitive dynamics that could accelerate significantly.

Companies demonstrating proactive adaptation to emerging regulatory frameworks while maintaining innovation incentives may discover competitive advantages in markets where monopolistic positioning becomes legally untenable. Conversely, those pursuing resistance through creative compliance face escalating regulatory pressure and reputational risks that could compound over time.

Tomorrow's Digital Marketplace Takes Shape

Justice Beach's decision represents more than antitrust enforcement—it articulates an emerging vision of digital markets governed by principles that prioritize human flourishing over corporate extraction. The ruling suggests that technological sophistication cannot indefinitely shield business models that fundamentally distort competitive processes and democratic governance.

The remedy phase proceedings, expected to unfold over coming months amid inevitable appeals, will determine whether this landmark ruling translates into meaningful structural transformation or becomes another negotiating position in the ongoing global dialogue between digital platforms and democratic accountability.

For the millions affected by app store policies worldwide, the Australian decision offers something more valuable than immediate compensation: evidence that even the most powerful digital empires remain accountable to democratic institutions willing to examine their practices with appropriate rigor. Whether that promise becomes enduring reality depends on implementation details that courts, regulators, and market participants will watch with intense scrutiny.

The screens in our pockets may look the same tomorrow, but the invisible economic relationships that govern their operation have begun an irreversible transformation—one that could redefine digital commerce for generations to come.