The $300 Billion Circle: How AI’s Biggest Players Built a Self-Sustaining Investment Machine

The $300 Billion Circle: How AI’s Biggest Players Built a Self-Sustaining Investment Machine

As NVIDIA pledges $100 billion for OpenAI while selling it billions in chips, critics wonder if Silicon Valley’s AI frenzy looks more like financial gymnastics than genuine progress.

September 23, 2025 — The world’s top AI companies aren’t just competing with each other anymore. They’re also locked into a cycle of eye-watering deals that make Wall Street veterans uneasy. To many, it feels less like building the future and more like spinning the same dollars through a giant loop.

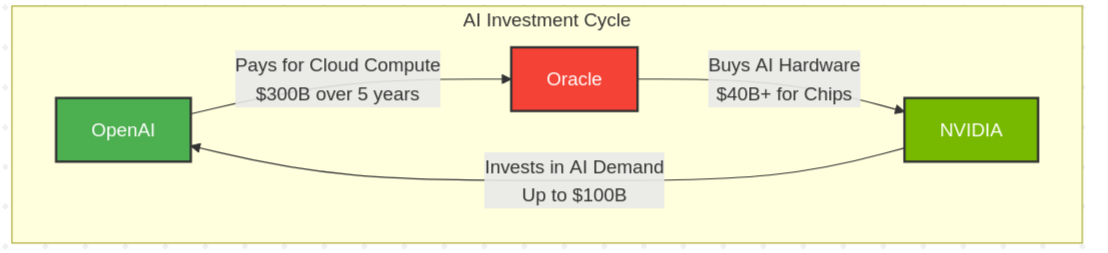

The latest twist came Tuesday morning. OpenAI and NVIDIA unveiled a letter of intent for a partnership that would see the chipmaker gradually invest as much as $100 billion into the AI lab. That announcement follows OpenAI’s earlier $300 billion agreement with Oracle for cloud computing. Oracle, in turn, is spending tens of billions on NVIDIA’s specialized processors. Round and round it goes: OpenAI’s money flows to Oracle, Oracle’s money flows to NVIDIA, and NVIDIA’s money flows back to OpenAI.

The obvious question is whether this loop generates any real value—or just the illusion of it to boost stock prices.

When Deals Outshine Real Growth

Look closely at the numbers and you’ll see a system leaning heavily on promises instead of present-day revenue. OpenAI’s $300 billion, five-year commitment to Oracle is roughly 25 times bigger than its annual sales today. That deal alone gave Oracle’s stock a rocket boost of 43%, briefly making founder Larry Ellison the richest man on the planet.

Behind the headlines, though, OpenAI’s finances tell a different story. The company burned about $8 billion last year, losing $5 billion on just $3.7 billion in revenue. Projections suggest even deeper losses ahead—up to $9 billion this year. From 2023 through 2028, total losses could exceed $44 billion.

Meanwhile, NVIDIA now stands on both sides of the table—its chips power OpenAI’s growth, while its cash bolsters OpenAI’s balance sheet. It’s like being both the landlord and the tenant in the same apartment.

A Market on Concentrated Ground

All of this unfolds against one of the most lopsided markets in history. The so-called “Magnificent Seven”—Apple, Microsoft, NVIDIA, Amazon, Alphabet, Meta, and Tesla—together make up 35% of the S&P 500’s value and nearly three-quarters of the NASDAQ 100. The last time stocks were this concentrated? The dot-com bubble of the late ’90s.

NVIDIA itself now carries a $4.5 trillion market cap, more than the GDP of most nations. Investors are paying more than 30 times future earnings for shares, betting demand for AI computing will rise endlessly. That kind of optimism makes seasoned traders nervous.

When the Cheerleader Waves a Red Flag

Perhaps the biggest warning came from OpenAI’s own CEO. Sam Altman recently admitted the current wave of AI investment looks irrational. His blunt words—“someone’s gonna get burned”—echo like a warning shot. Coming from the man who stitched together many of these mega-deals, the remark carries serious weight.

Industry veterans can’t help but recall past bubbles, when stock prices floated far above reality. Back then, companies raced to announce partnerships and funding rounds rather than prove sustainable business models. Today’s AI market feels eerily similar.

China’s $294,000 Reality Check

If you want a sharp contrast, look east. China’s DeepSeek has trained cutting-edge AI models for a fraction of the U.S. cost—just $294,000 in one case. American firms often spend more than $100 million on similar projects. DeepSeek’s total infrastructure outlay sits around $3 billion, while its U.S. rivals pour tens of billions into theirs.

That efficiency rattled investors. NVIDIA alone lost $600 billion in market value after DeepSeek unveiled its latest model. It was a painful reminder that cheaper alternatives can quickly puncture inflated assumptions.

The Credit Card Behind the Curtain

Equity isn’t the only fuel for this boom. Debt plays a starring role, too. JPMorgan Chase recently led a $22 billion loan facility to bankroll AI infrastructure projects. Lenders are betting tomorrow’s returns will cover today’s risks.

This credit bubble lets companies chase breakneck growth they couldn’t afford otherwise. But if AI projects fall short, the fallout could spread far beyond tech stocks. Credit markets have a way of tightening fast once fear sets in.

What Investors Should Watch

For investors, this loop presents both gold and quicksand. As long as enthusiasm runs high and capital keeps flowing, the cycle could generate handsome returns. But the concentration of wealth in a few intertwined companies means even small setbacks could ripple through the market.

Key questions loom: Can OpenAI ever turn a profit? Will promised infrastructure projects actually deliver results? And can U.S. firms defend their spending habits against lower-cost challengers like DeepSeek?

The answers may decide whether today’s staggering valuations represent a true technological revolution—or just a clever financial carousel where the same money keeps spinning without ever leaving the ride.

This article draws on public information and should not be taken as investment advice. Past performance is no guarantee of future results. Consult a qualified advisor before making financial decisions.