CBS News Leadership Crisis - McMahon's Exit Signals Corporate Priorities Over Journalistic Independence

CBS News Leadership Crisis: McMahon's Exit Signals Corporate Priorities Over Journalistic Independence

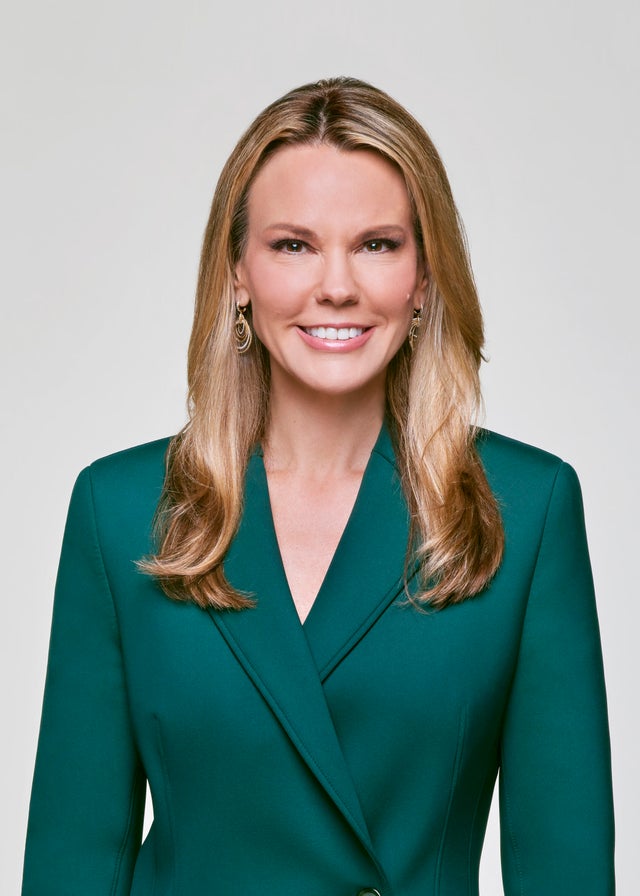

Wendy McMahon has resigned as president and CEO of CBS News and Stations effective immediately, marking the second high-profile departure from the network in less than a month amid escalating tensions between journalistic independence and corporate interests.

McMahon's abrupt exit comes as Paramount Global navigates a precarious $20 billion lawsuit from President Donald Trump over alleged deceptive editing of a "60 Minutes" interview with then-Vice President Kamala Harris during the 2024 presidential campaign. Her departure follows closely behind that of Bill Owens, the veteran executive producer of "60 Minutes," who resigned on April 22 citing his inability to "make independent decisions based on what was right for 60 Minutes."

Boardroom Chess: Editorial Independence vs. Corporate Imperatives

Industry analysts view McMahon's departure as a pivotal moment in the ongoing power struggle between news division leadership and Paramount's board, which is seeking federal regulatory approval for an $8 billion merger with Skydance Media.

"This resignation removes the principal obstacle to a quick settlement with Trump," said a media investment strategist familiar with the matter. "McMahon was the last significant defender of the news division's editorial independence at the executive level, and her exit suggests that business risk mitigation, not journalistic principles, is now driving leadership decisions."

Shari Redstone, Paramount's controlling shareholder, has reportedly been pushing for a swift resolution to Trump's lawsuit to clear regulatory hurdles for the Skydance merger. Sources close to board deliberations indicate that McMahon's steadfast defense of the network's editorial standards had become increasingly untenable as corporate priorities shifted toward legal risk containment.

When Owens resigned in April, McMahon publicly praised his "unwavering integrity, curiosity, and a deep commitment to the truth," positioning herself as a bulwark against corporate interference in news operations. That stance appears to have ultimately cost her the position.

Financial Markets React: Paramount's Precarious Position

Paramount Global's stock traded at $11.66 on Monday, down marginally by $0.04, reflecting investor uncertainty about the company's path forward. The conglomerate faces significant financial challenges beyond its news division turmoil.

In Q1 2025, Paramount reported revenue of $7.19 billion, a 6% year-over-year decline, with its streaming division still bleeding money despite narrowing losses to $497 million. The company's TV media segment has underperformed, with operating income before depreciation and amortization falling 11% year-over-year, compounded by advertising softness.

With a debt-to-EBITDA ratio of approximately 4.5x and negative free cash flow projected at $1.1 billion for fiscal year 2025, Paramount desperately needs the Skydance merger's promised $2 billion equity infusion while simultaneously risking a $1.5 billion break fee should the deal collapse.

"The news division accounts for roughly 10% of revenue, but it's disproportionately important for regulatory leverage through broadcast licenses, brand equity, and now legal liability," explained a media analyst at a major investment bank. "McMahon's departure fundamentally alters several near-term valuation factors for Paramount investors."

McMahon's Mixed Legacy: Local Strength, National Challenges

During her tenure, McMahon achieved notable successes in local and streaming operations, areas that had been her primary focus before ascending to the top news division role. Local streaming viewership grew by an impressive 61% year-over-year, and 11 of 13 owned-and-operated stations ranked first or second in late local news.

Her operational innovations included launching a Local News and Innovation Lab in Fort Worth, Texas, which fostered joint local-to-national investigative series and contributed to a 14% year-over-year increase in digital starts according to internal metrics from November 2024.

However, these achievements were overshadowed by struggles with the network's flagship programming. "CBS Evening News" consistently trailed competitors, running third in nightly ratings behind NBC and ABC, with particularly concerning demographic erosion. A costly $40 million Times Square studio build-out for "CBS Mornings" was abandoned after ratings plummeted within seven weeks.

McMahon also faced internal criticism over editorial decisions, including a controversial reprimand of morning show anchor Tony Dokoupil over questioning during an Israel-Hamas conflict segment, which triggered a newsroom petition alleging "selective censorship."

Succession Speculation: Cibrowski Positioned as Frontrunner

While CBS has not officially named a successor, industry observers point to Tom Cibrowski as the likely candidate. Appointed as President and Executive Editor in February 2025, Cibrowski joined CBS after 25 years at ABC News, where he notably led "Good Morning America" to overtake NBC's "Today" after 16 years at number one.

"Cibrowski brings operational experience and a track record of ratings success without the baggage of being associated with recent editorial controversies," noted a veteran network executive speaking on condition of anonymity. "His appointment would signal to both regulators and potential settlement partners that CBS is making a clean break."

However, some industry veterans question whether Cibrowski has the necessary experience to lead a politically exposed news division at the national level, particularly given that he was passed over multiple times for the top position at ABC News.

Critical Inflection Point for Media Investors

For investment professionals monitoring Paramount Global, several key dates loom large. A first mediation conference in the Trump lawsuit is scheduled for May 31 in the Southern District of Texas. By June 15, CBS will provide an upfront ad-sales pacing update, which will indicate whether advertisers have forgiven the network's recent controversies.

The Trump lawsuit settlement value has become a critical swing factor for Paramount's valuation. While street analysts had projected a $15-20 million cash drag from settlement, some legal experts now suggest the figure could balloon to $50-75 million if CBS loses a "truth-in-editing" motion—significantly higher now that McMahon's departure suggests corporate willingness to settle quickly.

Similarly, the Skydance merger timeline appears increasingly precarious. Previously expected to close in the first half of 2025, industry analysts now project a slip to late Q3 at best, as FCC staff continue probing allegations of news distortion.

What's Next: Three Scenarios for Paramount

Investment analysts outline three potential scenarios for Paramount Global following McMahon's departure:

In the base case (50% probability), a quick Trump settlement of approximately $60 million clears the way for the merger to close in Q3 2025, with Cibrowski confirmed as McMahon's permanent replacement. This scenario could drive Paramount's share price to $14-15.

The bull case (25% probability) hinges on the lawsuit being dismissed on First Amendment grounds, with the merger generating $500 million in cost savings and streaming operations turning cash flow positive by Q4. Under this scenario, shares could exceed $20.

The bear case (25% probability) envisions the lawsuit proceeding to discovery, with FCC delays ultimately causing the merger to fail, potentially driving shares down to $7-8.

The Bottom Line: Regulatory Appeasement Over Editorial Independence

McMahon's departure represents more than just another executive shake-up—it signifies Paramount Global's strategic pivot toward prioritizing regulatory appeasement and liability containment over journalistic independence.

With multiple federal agencies scrutinizing both the pending merger and CBS's broadcast licenses, and a sitting president's litigation threatening to derail the company's financial lifeline, Paramount appears to have concluded that editorial bravado is a luxury it can no longer afford.

Whether this calculated gamble will unlock merger upside for investors or merely paper over structural declines in traditional television remains the central question for Paramount stakeholders through the remainder of 2025.