Quantum Surge: Honeywell’s $600M Bet Accelerates Quantinuum Toward a Fault-Tolerant Future

In the fast-moving world of quantum computing—where fragile qubits hold the potential to transform industries from finance to pharmaceuticals—Honeywell has just made a defining move. On September 4, 2025, the industrial giant announced a $600 million equity raise for its quantum subsidiary, Quantinuum, valuing the company at an extraordinary $10 billion pre-money. The round doubles Quantinuum’s valuation since its last raise and unites a powerhouse group of investors, signaling that quantum is no longer a distant dream but a rapidly approaching reality. As classical computing struggles to handle increasingly complex simulations, this capital infusion underscores a decisive shift: the race to commercial-scale quantum computing is accelerating.

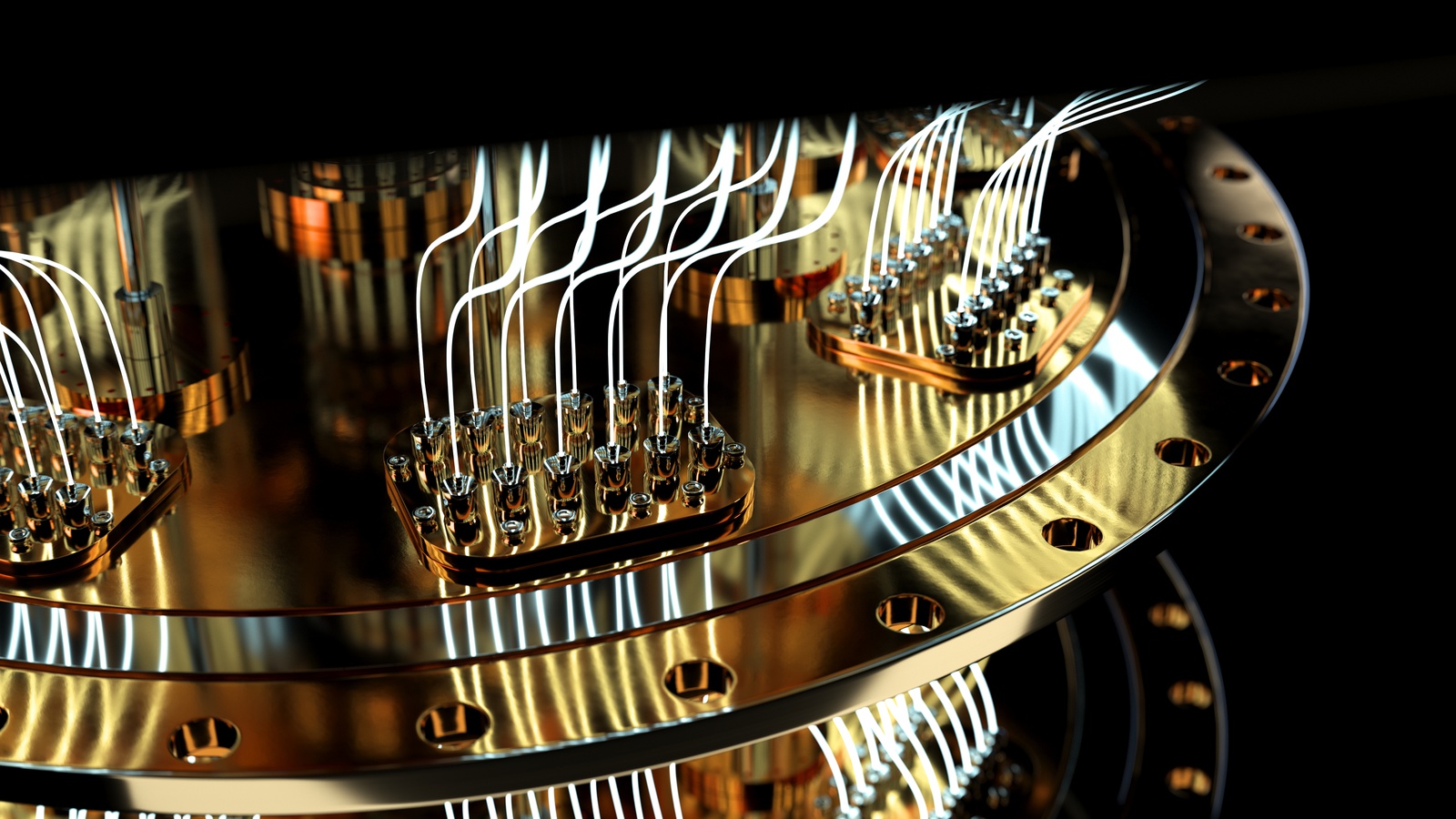

Quantinuum has emerged as one of the most advanced players in the field, offering a full-stack approach built around its leading trapped-ion systems. Spun out of Honeywell and strengthened by its merger with Cambridge Quantum, the company has carefully cultivated a reputation for performance leadership. Its H-series machines currently hold industry records, boasting a Quantum Volume of 8,388,608—a benchmark that measures a system’s ability to process intricate computations. The upcoming launch of Helios, Quantinuum’s next-generation system slated for release later this year, represents the company’s most ambitious leap yet. Helios is designed to push the boundaries of what’s possible, with the goal of achieving universal fault-tolerant computing—the elusive breakthrough that could finally make quantum machines reliable enough for real-world applications.

Quantum Volume is a single-number metric that quantifies the overall performance of a quantum computer. It measures the largest random circuit a quantum device can reliably execute, taking into account both the number of qubits and their quality (error rates, connectivity). This provides a practical benchmark for assessing a quantum computer's real-world problem-solving capability.

Investor enthusiasm has surged alongside these technological advances, and this latest funding round reflects both Quantinuum’s progress and its strategic positioning. The company’s valuation has grown from around $5 billion in early 2024, fueled by milestones such as the Helios program and steady advances toward error-corrected qubits. New participants in the round include NVentures, NVIDIA’s venture arm, along with Quanta Computer, QED Investors, MESH, and Korea Investment Partners. They join existing backers like JPMorgan Chase, Mitsui, Amgen, and Honeywell itself, all of whom are deepening their commitments. For many investors, this isn’t just a financial stake—it’s a long-term bet on integrating Quantinuum’s capabilities into broader technology ecosystems. Quantinuum's valuation growth from its 2024 funding round to the latest raise in 2025.

| Date | Event/Funding Round Type | Funding Amount | Valuation |

|---|---|---|---|

| November 2021 | Merger/Acquisition | N/A | $270 Million |

| January 2024 | Equity Fundraise | $300 Million | $5 Billion |

| September 2025 | Series B Funding Round | $600 Million | $10 Billion |

The NVIDIA connection is especially significant, as it positions Quantinuum at the heart of a growing convergence between quantum computing and artificial intelligence. By combining quantum processors with GPU-driven workflows through NVIDIA’s CUDA-Q platform, the two companies are laying the foundation for hybrid systems capable of tackling previously intractable problems. Quantinuum is also expanding globally, establishing a $1 billion joint venture in Qatar to develop advanced quantum infrastructure over the next decade. New facilities in New Mexico and Singapore are focused on computational biology, while collaborations with partners such as RIKEN, SoftBank Corp., Infineon, and the STFC Hartree Center aim to strengthen supply chains, scale manufacturing, and diversify applications ranging from drug discovery to optimization problems.

While Quantinuum’s momentum is undeniable, not everyone sees a smooth path ahead. Some analysts praise the company’s full-stack strategy—integrating hardware, software platforms like InQuanto, and developer tools—as a critical advantage in avoiding fragmentation within the quantum ecosystem. Others, however, caution that the sector’s pre-commercial realities pose serious risks. Trapped-ion systems remain expensive and highly sensitive to noise, creating challenges for scaling. The rapid doubling of Quantinuum’s valuation in under two years has also raised concerns that investor expectations may be running ahead of technological readiness. The market’s reaction reflects this mixed sentiment: competitors like IonQ and Rigetti enjoyed modest stock gains following the announcement, while Honeywell and NVIDIA experienced more muted, uneven shifts, underscoring ongoing uncertainty around timelines and profitability.

Trapped-ion quantum computers utilize individual ions as qubits, holding them in place within a vacuum using electromagnetic fields known as ion traps. Lasers then precisely manipulate the quantum states of these trapped ions, enabling the performance of quantum operations and entanglement necessary for computation. This allows for highly controlled processing of quantum information.

Still, Quantinuum’s technical leadership remains a compelling draw. Its hardware advantages, including all-to-all qubit connectivity and exceptionally high-fidelity gates, position it for early progress in achieving fault tolerance. Partnerships such as the NVIDIA Accelerated Quantum Research Center are further amplifying this momentum by driving breakthroughs in hybrid computing, which could significantly enhance the performance of classical AI models. This funding round, one of the largest private raises in the history of the quantum sector, signals growing investor confidence in the company’s potential and reflects a broader recognition that quantum technologies are inching closer to commercial relevance.

Fault-Tolerant Quantum Computing (FTQC) is an approach to building reliable quantum computers by protecting fragile quantum information from errors. It achieves this through quantum error correction (QEC), which redundantly encodes qubits to ensure accurate computations despite noise and imperfections.

Yet the challenges remain formidable. Error correction—the key to making quantum systems robust—continues to be one of the field’s most difficult technical hurdles. Benchmark results, while impressive, are often vendor-reported and lack uniform cross-platform validation, leaving room for skepticism. If the rollout of Helios faces delays or if fault-tolerance milestones slip beyond 2030, the pressure on valuations could intensify. The competitive landscape is also heating up, with IBM, Google, and emerging startups in neutral-atom and photonic quantum computing pursuing their own aggressive roadmaps, increasing the risk of disruption for any single approach. A comparison of the leading quantum computing modalities, including Trapped Ion, Superconducting, Photonic, and Neutral Atom, based on key characteristics like qubit fidelity, connectivity, and scalability.

| Modality | Qubit Fidelity (Single-Qubit) | Qubit Fidelity (Two-Qubit) | Connectivity | Scalability | Key Characteristics |

|---|---|---|---|---|---|

| Trapped Ion | Very high | High | Fixed (linear), but shuttling enables flexible interactions | Challenging due to individual laser control and increasing difficulty with more ions | Ions confined by electromagnetic fields, precise control with lasers. Long coherence times. Slower gate operations compared to superconducting qubits. Do not require dilution refrigeration, relying on laser-based cooling. |

| Superconducting | High | High | Fixed wiring | Significant progress in qubit count, but challenges with connectivity and coherence. Roadmap to over 4,000 qubits by 2025. | Exploits properties of superconductors at low temperatures. Easy control through microwave pulses. Fast computational speed. Highly sensitive to environmental noise, leading to decoherence. Relies on established semiconductor manufacturing techniques. |

| Photonic | N/A | Probabilistic (e.g., ~50%) | Limited (requires induced interaction for two-qubit gates) | Challenges in achieving efficient photon-photon interactions and on-demand single-photon sources | Uses photons as qubits. Weakly interacting and well-isolated from thermal noise, leading to manageable decoherence. Can operate near room temperature (detectors often cryogenic). Photon loss hinders performance. Two-qubit logic gates are challenging. |

| Neutral Atom | > 99.9% reported | Improving (around 97%) | Flexible, reconfigurable (all-to-all connectivity with shuttling) | Arguably the best physical scalability, hundreds of qubits in 2D with full control demonstrated, potential for thousands or millions of qubits | Uses uncharged atoms trapped by light. Qubits encoded in atomic states, typically hyperfine ground states. Long coherence times (seconds). Slower gate speeds (microseconds) compared to superconducting qubits. Operates at room temperature. |

The structure of the raise itself sheds light on Quantinuum’s strategy. At a $10.6 billion post-money valuation, existing shareholders face around 5.7% dilution if they choose not to participate pro rata, though Honeywell is expected to maintain its majority stake—historically between 52% and 54%—valuing its position at roughly $5.5 billion. The fresh capital will function as a war chest to harden Helios for production readiness, advance unified software platforms like Nexus and Guppy, and drive global demand creation. With J.P. Morgan Securities acting as placement agent and Freshfields advising on legal matters, the professionalism of the deal hints at more ambitious goals ahead, including a possible public offering as early as 2027.

The ripple effects extend well beyond Quantinuum. Rivals may accelerate their own timelines, pursue new alliances, or even consolidate to keep pace. Hybrid quantum-AI models are gaining traction across the industry, and governments are likely to increase funding for quantum security initiatives such as post-quantum cryptography, reflecting the growing economic and geopolitical stakes. From an investment perspective, Honeywell stands to benefit as Quantinuum’s success enhances its overall valuation, potentially inviting activist interest by 2026 or 2027. Public quantum proxies like IonQ, Rigetti, and D-Wave may ride a wave of sector optimism, though Quantinuum’s progress could simultaneously sharpen competitive differentiation. For NVIDIA, the stake is strategically vital even if financially modest, ensuring its CUDA-Q platform remains central as hybrid architectures evolve.

Post-Quantum Cryptography (PQC) refers to cryptographic algorithms designed to secure our digital information against the threat of future quantum computers. These PQC systems are developed to run on classical computers but be resistant to attacks from powerful quantum machines, ensuring long-term data security as quantum computing advances.

Looking ahead, the next few years could prove transformative. The debut of Helios in 2025 or 2026, combined with deepening strategic partnerships, could set the stage for a 2027 IPO, potentially making Quantinuum the first public pure-play quantum company. Between 2028 and 2030, early demonstrations of fault-tolerant systems could unlock breakthroughs in areas like drug discovery and materials science, while consolidation among full-stack leaders could reshape the competitive landscape entirely. For investors, opportunities abound, but the risks are equally significant. Honeywell’s stock could see upside if IPO timelines hold, IonQ may benefit from renewed confidence in trapped-ion technologies, and broader exposure to quantum ETFs or NVIDIA’s hybrid computing strategy could serve as a hedge against volatility. Still, the sector’s milestone-driven nature makes it prone to sharp swings in sentiment, more akin to biotech than traditional enterprise technology. A projected timeline of Quantinuum's key milestones from 2025 to 2030, including the Helios launch, potential IPO, and demonstrations of fault tolerance.

| Year | Milestone | Description |

|---|---|---|

| 2025 | Helios Launch & Logical Qubit Demonstration | Quantinuum plans to launch its Helios quantum computer, capable of delivering approximately 50 logical qubits with an error rate below 10^-4. This year may also see a demonstration of a single logical qubit benchmark. Helios will debut with a new full-stack software platform designed to lower programming barriers and advance fault-tolerant quantum computing. |

| 2027 | Second System Release & Potential IPO | Quantinuum aims to release a second quantum computing system, two years after Helios, which is expected to double the logical qubit count to around 100 and reduce error rates by an order of magnitude. The company is also preparing for a potential IPO by 2027 to capitalize on its pre-IPO growth phase. This period is also targeted for demonstrating a small error-corrected circuit. |

| 2029-2030 | Apollo System & Fully Fault-Tolerant Quantum Computing | Quantinuum's roadmap targets the Apollo system for release by 2029, with the goal of achieving a universal, fully fault-tolerant quantum computer by 2030. The Apollo system is projected to have hundreds of logical qubits, capable of executing circuits with millions of gates to enable scientific and commercial advantage. This milestone represents the delivery of a full fault-tolerant subsystem. |

Ultimately, Honeywell’s $600 million raise doesn’t just fund Quantinuum’s ambitions—it cements its position at the forefront of quantum computing. The combination of cutting-edge technology, deep-pocketed investors, and global alliances positions the company to lead the race toward fault-tolerant systems. But the journey from laboratory breakthrough to commercial adoption remains fraught with technical and market challenges. If Quantinuum delivers on its promises, this moment may mark the point where quantum computing begins its transition from experimental novelty to industrial necessity.

House Investment Thesis

| Category | Details & Analysis |

|---|---|

| Deal Fundamentals | • Round: Pre-IPO "war chest" round. • Amount: ~$600M primary. • Valuation: $10B pre-money, ~$10.6B post-money. • Lead: JPMorgan Securities (placement), Freshfields (counsel). |

| Key Investors | • New: NVentures (NVIDIA), Quanta Computer, QED Investors, MESH, Korea Investment Partners. • Existing: JPMorgan, Mitsui, Amgen, Honeywell. |

| Ownership (Pro-Forma) | • Overall Dilution: ~5.7% for non-participating holders. • Honeywell Stake: Historically 52-54%. If they took pro-rata, stake is maintained; if not, it drifts to high-40s/low-50s%. |

| Strategic Rationale | 1. Fund Helios Launch (2025): Next-gen Hardware-as-a-Service (HaaS) & new unified software stack (Nexus, Selene, Guppy). 2. Hybrid Quantum-AI with NVIDIA: CUDA-Q distribution and Accelerated Quantum Research Center co-location. 3. Global Demand Creation: Qatar JV ("up to $1B" pipeline) and Singapore MoU for computational biology. |

| Technology Position | • Hardware: Trapped-ion H-series. Leader in benchmarks (reported QV 8,388,608), all-to-all connectivity, high fidelities. • Error Correction: Published progress on logical operations surpassing physical. A "two-horse race" with IBM for fault-tolerance (FTQC) before 2030. • Software/Ecosystem: InQuanto (chemistry), Nexus, plus integration with Azure Quantum and CUDA-Q. |

| Author's Bull Case | The $10B valuation is a bet on execution. If Helios delivers in 2025 and QEC milestones are hit, enabling useful logical qubits by 2027-2030, the valuation will look cheap. The moat is systems-level (hardware + software + QEC). |

| Author's Bear Case | The valuation is "top-tick" and risks becoming "mark-to-myth" if: Helios slips, QEC progress stalls, or benchmark leadership is lost to competitors (IBM, Google, neutral-atom, photonic). |

| Pros / Validation | • Rare deeptech valuation double ($5B → $10B). • Blue-chip strategic investors. • NVIDIA partnership validates hybrid quantum-AI model. • Geographic diversification via government JVs. |

| Cons / Risks | • Pre-commercial: Investors underwriting milestones, not cash flow. • Benchmark Opacity: Vendor-reported metrics need independent verification. • Competition: IBM/Google roadmaps are aggressive; risk of leapfrog by other modalities. |

| Implications: Honeywell (HON) | Stake is mark-to-model at ~$5.5B. Activist-driven break-up creates a natural timeline to monetize the stake by 2026-27, adding SOTP optionality. |

| Implications: Sector | • Bullish for hybrid-stack software and CUDA-Q ecosystem. • Bearish for "me-too" trapped-ion players. • NVDA: Strategic, not financial; a hedge to keep CUDA-Q central. |

| Key Catalysts | 1. Helios GA with specs & cost/performance benchmarks. 2. Hybrid workload wins with CUDA-Q. 3. JV milestones converting to contracted revenue. 4. IPO preparation breadcrumbs. |

| Key Red Flags | 1. Helios or software stack slippage. 2. Benchmark progress plateaus while competitors advance. 3. JV work dilutes platform focus. |

| Due Diligence Asks | 1. Helios technical data room (raw error logs, stability). 2. Reproducible QEC evidence (logical error rates). 3. Unit economics & HaaS margins. 4. JV/MoU contract quality (minimums, take-or-pay). 5. Confirmed platform openness (Azure, CUDA-Q roadmap). |

| Bottom Line | Quantinuum is a top-two player with the best near-term path to useful error-corrected computing among private companies. The round prices the IPO and sets the bar for execution. |

NOT INVESTMENT ADVICE