Meituan Commits $1 Billion to Brazilian Food Delivery Market as Chinese Tech Giants Target Latin America

Meituan's $1 Billion Brazilian Gambit: China's Food Delivery Giant Challenges Latin America's Status Quo

In a gleaming conference room in Beijing yesterday, two figures representing vastly different worlds shook hands over an agreement that could reshape Latin America's digital economy. Brazilian President Luiz Inácio Lula da Silva, in a rare official visit to China, stood beside Wang Xing, the reclusive billionaire founder of Meituan, as both witnessed the signing of a $1 billion investment agreement that will bring Chinese-style food delivery to South America's largest economy.

During the signing ceremony, the rarely-seen Meituan founder Wang Xing emphasized Brazil's tremendous market potential. He outlined Keeta's three-pronged strategy: enhancing customer experiences, boosting restaurant partner growth, and generating significant local employment opportunities.

The investment marks Meituan's boldest international move yet, and signals a significant shift in China's tech expansion strategy — from cautious exploration to confident, capital-intensive market entry.

The Brazilian Battleground

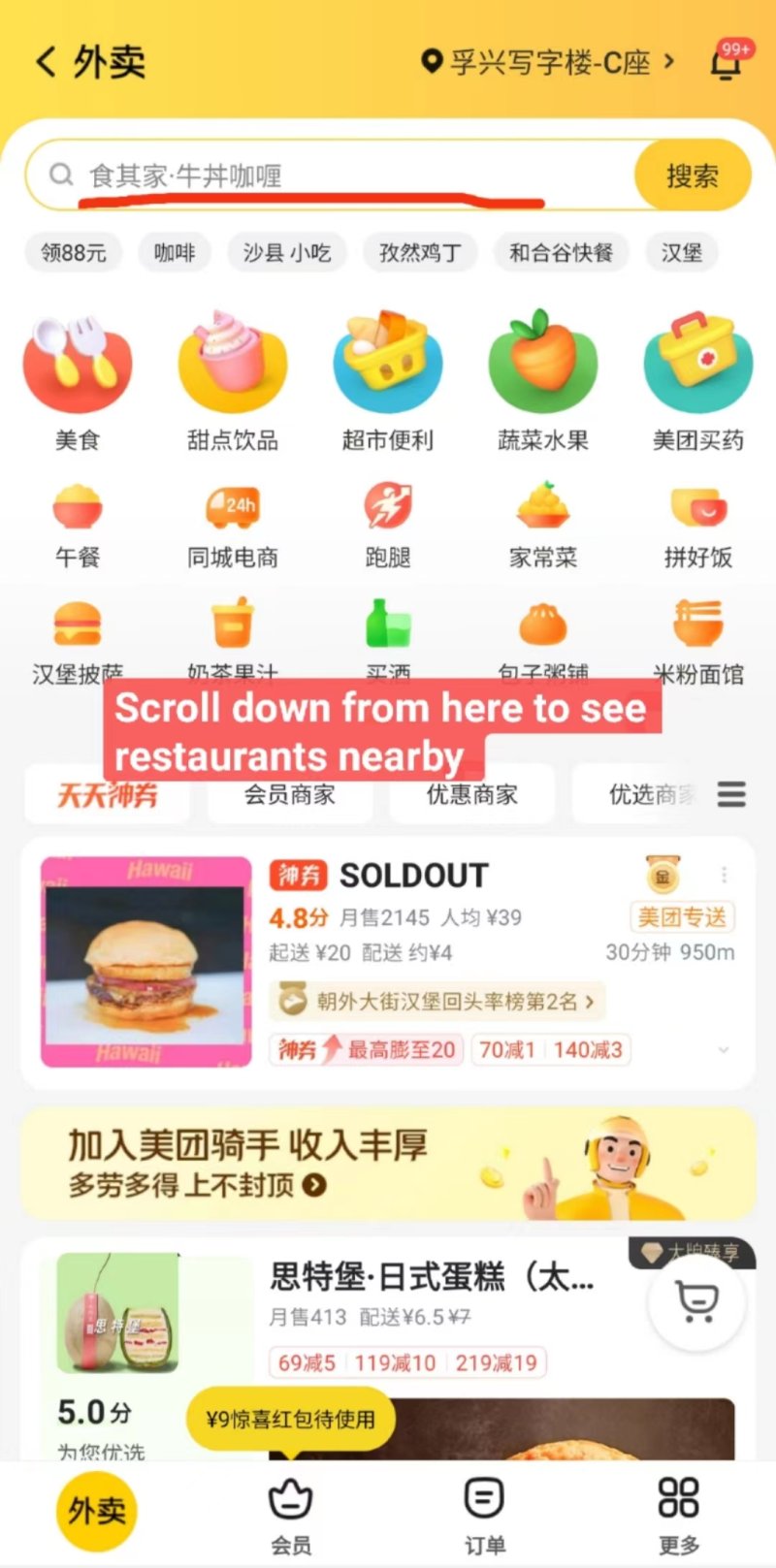

Under its international brand "Keeta," Meituan plans to deploy a nationwide instant delivery network across Brazil's complex urban landscapes — from the dense streets of São Paulo to the hillside neighborhoods of Rio de Janeiro. The move pits the Chinese giant directly against iFood, the Prosus-backed incumbent that currently commands approximately 80% of Brazil's $12 billion food delivery market.

For Meituan, which operates one of the world's largest food delivery platforms in China with over 690 million active users, Brazil represents the perfect testing ground for its global ambitions. Despite the market's significant size — reaching 139 billion reais (approximately $28 billion) in 2023 — only about 30% of Brazilians currently use food delivery services, compared to over 50% in China.

"What we're seeing is the export of China's mature food delivery model to markets with similar urbanization patterns but significantly lower digital penetration," explained Maria, a Latin American technology analyst. "The untapped potential here is enormous."

Meituan has been quietly preparing for this move for years. Company records show it registered its Brazilian trademark as early as March 2020, but intensified its approach this year with negotiations with local logistics partners and work on tax compliance frameworks.

A Two-Pronged Chinese Advance

Meituan isn't venturing into Brazil alone. Just weeks earlier, Chinese ride-hailing giant Didi announced the revival of its food delivery service in Brazil under the "99 Food" brand, integrating it with local ride-hailing and payment infrastructure. The nearly simultaneous entry of two Chinese tech powerhouses suggests a coordinated push into Latin America's digital economy.

"Chinese platforms have effectively saturated their domestic markets and are facing intense regulatory scrutiny at home," said Paulo, an economics professor. "Brazil offers them both regulatory breathing room and a demographic dividend that's increasingly rare in aging Asian economies."

For Meituan, Brazil represents just the latest step in a carefully orchestrated global expansion. Keeta has already been operating in Hong Kong for two years, where it claims to have doubled partner restaurants' sales. Since September 2024, it has also established operations across major cities in Saudi Arabia, reporting steady growth in both users and orders.

The Competitive Edge

To challenge iFood's dominance, Meituan is bringing its technological prowess and deep pockets. Sources close to the company reveal that Keeta plans to differentiate itself through significantly lower commission rates for restaurants — between 10-20% compared to iFood's average 25% — while also subsidizing delivery fees for consumers.

Ricardo, who owns three restaurants in São Paulo's upscale Jardins district, is cautiously optimistic. "If they can truly deliver on these commission rates while maintaining service quality, many restaurant owners will be eager to diversify beyond iFood," he said.

Meituan has already established headquarters in São Paulo's Vila Olímpia district, a tech hub home to numerous startups and multinational tech companies. The company is also finalizing partnerships with digital banks to streamline integration with PIX, Brazil's instant payment system that has revolutionized electronic transactions across the country.

Keeta plans to recruit 50,000 delivery riders within its first year of operation — a move that could significantly impact Brazil's gig economy, which has swelled during post-pandemic economic restructuring.

"We've studied the logistical complexities of Brazilian cities extensively," a Meituan executive said. "Our AI-driven dispatch system has been specifically adapted to account for factors like São Paulo's traffic patterns and Rio's unique topography."

Beyond Delivery: The Strategic Stakes

For professional investors watching this development, Meituan's move represents more than just another food delivery option for Brazilian consumers. It signals China's strategic pivot toward service-sector expansion in regions where American tech influence has historically dominated.

"What we're seeing is the export of China's digital infrastructure — not just apps, but entire ecosystems of payments, logistics, and merchant services," explained Carlos, a senior partner at a leading VC, a fund specializing in Latin American technology investments. "The real value creation will happen at these intersection points."

The timing is particularly notable. Brazil's "New Industry" plan offers tax incentives for companies investing in modern logistics infrastructure, while President Lula has openly courted Chinese investment as part of his economic revitalization strategy.

For China, Brazil serves as an ideal gateway to wider Latin American expansion. Success there could provide a blueprint for entry into neighboring markets like Argentina, Colombia, and Chile.

"If Meituan can make this work in Brazil — with its complex tax system, challenging logistics, and entrenched competition — they can make it work almost anywhere in Latin America," said Carlos.

Risks and Challenges

Despite its financial firepower and technological advantages, Meituan faces significant hurdles. Brazil's complex regulatory environment, inflation-prone currency, and distinct consumer preferences all present operational challenges.

Labor regulations could prove particularly thorny. While China's gig economy operates with relatively few restrictions, Brazil has seen growing pressure to formalize delivery workers' employment status, potentially undermining the flexible, low-cost model that powers food delivery platforms.

"The Brazilian labor courts have been increasingly sympathetic to delivery workers' claims for employment recognition," noted Júlia, a labor law specialist in Rio de Janeiro. "Any company entering this space needs to factor potential regulatory changes into their business model."

Customer acquisition costs also run approximately 40% higher in Brazil than in China, according to industry estimates, while cash still accounts for roughly 25% of payments in some regions — a stark difference from China's nearly cashless urban centers.

Furthermore, iFood won't surrender market share without a fight. The company has deep pockets thanks to its Prosus backing and has already begun enhancing its restaurant support services and rider incentives in anticipation of increased competition.

The Broader Picture: China's Digital Silk Road

Meituan's Brazilian venture is just one piece of a larger pattern of Chinese tech expansion across developing markets. In recent months, Tencent Cloud opened its first Brazilian data center, ByteDance (TikTok's parent company) is considering a massive wind-powered data center project at Brazil's Pecém port, and Alibaba Cloud launched operations in Mexico.

This digital expansion complements China's established physical infrastructure investments across Latin America, creating what some analysts call a "full-spectrum" approach to economic influence.

"We're witnessing the digital dimension of China's global Belt and Road Initiative," explained Jennifer, a geopolitical risk analyst. "While traditional infrastructure projects like ports and railways continue, these digital platforms represent a more subtle but potentially more transformative form of economic integration."

For Wang Xing and Meituan, Brazil represents not just a new market but a crucial test of their global ambitions. As he told attendees at the signing ceremony: "Internationalization is one of Meituan's long-term strategies. We will continue working hard to expand into overseas markets and create new growth opportunities."

With $1 billion on the line and a competitive battle looming, the stakes couldn't be higher. For Brazil's consumers, restaurants, and delivery workers, the entry of another deep-pocketed competitor promises both opportunities and disruption. For investors and market watchers, it offers a front-row seat to one of the most consequential expansions of Chinese technological influence in the Western Hemisphere.