Meta's AI Gambit: The Race to Own Your Personal Digital Brain

Meta has launched its new standalone Meta AI app powered by the recently unveiled Llama 4 architecture. The company's official announcement emphasizes that "this release is the first version," and they're "excited to get this in people's hands and gather their feedback." The application marks a significant strategic move as Meta positions itself in the increasingly competitive personal AI assistant market.

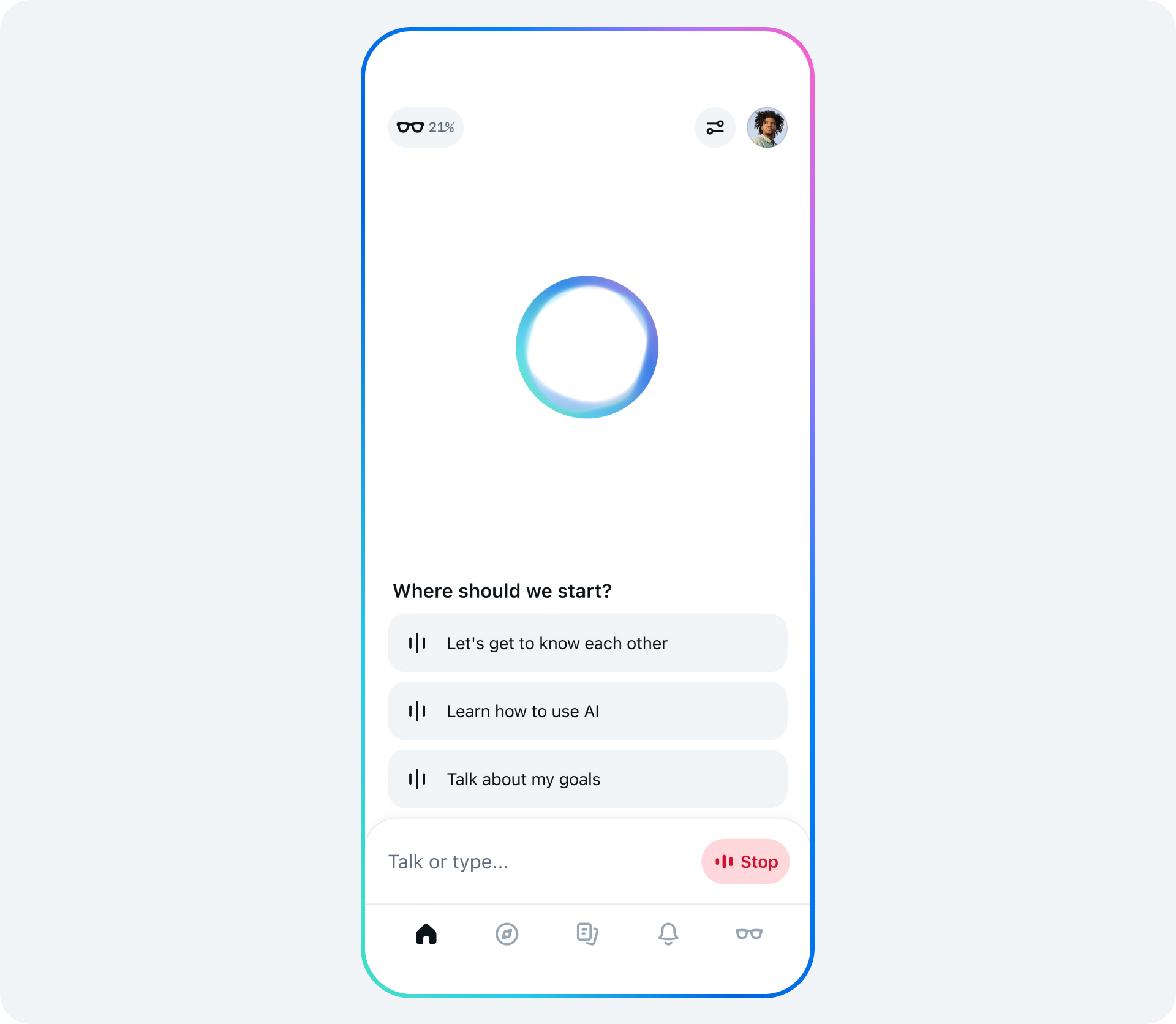

"We're launching a new Meta AI app built with Llama 4, a first step toward building a more personal AI," states Meta in its press release. While the app offers natural voice interactions that aim to feel "more personal and relevant," independent assessments have highlighted issues with hallucinations and what some users describe as intrusive design. This launch represents Meta's bid to establish itself as a frontrunner in AI experiences before competitors like Apple, Google, or OpenAI can capture consumer mindshare.

The Voice-First Future Arrives With Mixed Results

On a busy Tuesday afternoon in San Francisco, marketing executive Alicia Chen demonstrates the app's full-duplex voice technology, speaking to her phone while walking between meetings. "The conversational flow feels remarkably natural," she notes as Meta AI responds to her query about nearby restaurants without awkward pauses. "But ask it about last week's economic data, and it completely fabricates statistics since it can't access the web in voice mode."

This limitation – voice features without real-time information – exemplifies Meta's approach: launch fast with flashy features, even if core functionality remains incomplete. The company is betting that voice interactions, available in the US, Canada, Australia, and New Zealand, will differentiate its offering in an increasingly crowded AI assistant market.

Industry analysts describe this as a calculated strategy. "Meta is racing to establish itself as the default voice-first AI interface," explains a senior technology consultant who requested anonymity due to client relationships with major AI providers. "They're deliberately prioritizing naturalness and multimodal capabilities over factual accuracy, gambling that consumers will tolerate some errors in exchange for convenience and integration with their social graph."

The Architecture Behind the Experience

Meta's Llama 4 model powering the app introduces significant technical innovations, most notably a Mixture-of-Experts architecture that activates only relevant neural pathways for each task. This approach reduces computational costs by approximately 30% compared to competitors, allowing Meta to offer free access at scale while maintaining competitive performance on most benchmarks.

"The 10-million token context window is genuinely impressive," acknowledges a machine learning expert who has tested the model extensively. "But there's a clear gap between benchmark scores and real-world performance, particularly in coding and complex reasoning tasks."

Independent tests reveal Llama 4 Maverick scoring just 43.83 out of 100 on reasoning tasks – roughly half the performance of top models like Gemini 2.5 Pro. Coding performance is similarly underwhelming at 37.43, despite Meta's claims of parity with specialized coding models.

Even within Meta, there appears to be recognition of these limitations. Several engineers familiar with the project suggested that rushed deployment of the Mixture-of-Experts architecture introduced memory bugs affecting long-context performance, with a patch expected in June that could lift coding scores by as much as 20 percentage points.

The Social AI Revolution

Where Meta truly differentiates its approach is through unprecedented social integration. Unlike standalone chatbots from OpenAI or Anthropic, Meta AI draws on users' Facebook and Instagram activity to personalize responses.

"The app knows I'm planning a trip to Japan because I've been engaging with Tokyo-related content on Instagram," explains early adopter Marcus Williams, demonstrating how Meta AI suggested Japanese phrases he might want to learn. "That level of contextual awareness is both helpful and slightly unsettling."

The app's "Discover" feed takes this social dimension further, showcasing AI interactions from friends across Meta's platforms. Users can see popular prompts from their network and "remix" them – a feature that simultaneously demystifies AI usage while creating a viral loop competitors lack.

Privacy advocates have raised immediate concerns. "Meta is essentially building a social graph of AI interactions without meaningful consent," warns a digital rights researcher at a prominent European university. "The Discover feed transforms a personal tool into a public performance, with your AI usage becoming content for others to consume."

These concerns aren't purely theoretical. On April 24, the Dutch Data Protection Authority issued a warning about Meta AI, signaling potential regulatory battles in the EU over lawful bases for combining social media data with AI interactions.

Financial Markets Take Notice

Wall Street's reaction to the Meta AI launch has been cautiously positive. Meta trades now at $552.40 on Tuesday, up $2.31.

"Even a modest $1 per month upsell to just 15% of WhatsApp's 2 billion monthly active users represents a $3.6 billion annual recurring revenue opportunity," calculates a senior technology analyst at a leading investment bank. "More significantly, the behavioral data from AI interactions could substantially enhance Meta's advertising targeting, potentially doubling the return on ad spend for brands using its Advantage+ platform."

At 26 times trailing earnings, Meta's valuation suggests the market is not yet fully pricing in the potential upside from becoming the dominant consumer AI platform. By comparison, companies with weaker data advantages command significantly higher multiples despite more limited growth prospects.

The Hardware Connection

Meta's AI strategy extends beyond software to include hardware integration, most notably with Ray-Ban Meta glasses. The company is merging its Meta View companion app for these glasses with the new Meta AI app, creating what it describes as "the most exciting new hardware category of the AI era."

This tight integration creates what some industry observers call a "hardware-software feedback loop" that competitors like Microsoft and OpenAI currently lack. Users can start conversations with their glasses, then continue them in the app or on the web, creating a seamless cross-device experience.

"The glasses are becoming the iPod for AI wearables, with Meta controlling the entire stack," observes a veteran hardware analyst who has tracked wearable computing for over a decade. "If voice-first AI becomes the dominant paradigm, having a head start in glasses gives Meta a significant advantage over companies constrained to phones and laptops."

Strategic Implications for the AI Landscape

Meta's aggressive push into consumer AI represents an existential challenge for competitors. By embedding its AI assistant across Facebook, Instagram, WhatsApp, and now a dedicated app, Meta is creating one-tap access that rivals confined to browser tabs or requiring separate downloads can't match.

This distribution advantage, combined with the cost efficiency of Llama 4's architecture, allows Meta to offer free tiers that competitors struggle to match economically. The social layer adds a viral dimension that pure AI companies can't replicate without similar user graphs.

However, serious gaps remain. Without real-time web access in voice mode, Meta AI can't compete with OpenAI and Google on current information. Its mixed performance on coding benchmarks leaves an opening for developer-focused alternatives. And the intrusive design choices – users report aggressive AI prompts hijacking conversations – risk alienating early adopters.

Looking Forward: Three Scenarios

As Meta refines its AI strategy over the next 18 months, investors and industry watchers are contemplating several potential outcomes.

In the bull scenario, Meta AI could reach 600 million monthly active users, with increased ad targeting precision delivering a 3 percentage point lift in lifetime value. This would likely drive Meta's share price up by approximately 25% from current levels, provided regulators allow "legitimate-interest" data usage across the company's platforms.

A base case sees steady adoption with modest subscription revenues, though EU limitations on personalization would be offset by stronger US growth. This scenario would add 5-8% to Meta's current valuation.

The bear case involves persistent quality complaints, privacy fines exceeding €3 billion, and competitive pressure from potential Apple-OpenAI partnerships stealing mindshare from Meta's offering. Such outcomes could drive shares down by 15% or more.

The Strategic Calculation

For Meta CEO Mark Zuckerberg, the standalone AI app represents a calculated risk. By launching early with acknowledged limitations, Meta is prioritizing capturing the "personal AI OS" layer before competitors can establish themselves.

"Meta is turning every feed, chat, and Ray-Ban lens into an on-ramp for its Llama 4 brain," summarizes a prominent venture capitalist with investments across the AI sector. "If regulators don't clip its wings, Meta captures the 'personal AI OS' layer before anyone else has a chance to deploy at scale."

For consumers, the calculus is different. They must weigh the convenience of an AI assistant deeply integrated with their social graph against concerns about privacy, accuracy, and the increasingly blurred line between their personal data and Meta's commercial interests.

As one early user put it after a week with the app: "I'm constantly toggling between being impressed by how much it knows about me and wondering if I should be worried about exactly that."

In this new frontier of personal AI, Meta's aggressive approach ensures it won't be left behind – but whether it's leading in the right direction remains an open question that users, developers, and regulators will be answering in the months ahead.