OpenAI's High-Stakes Corporate Makeover: A Partnership Under Pressure

As artificial intelligence superpower OpenAI crafts its path to Wall Street, its multibillion-dollar relationship with Microsoft hangs in a delicate balance that could reshape the AI landscape.

SAN FRANCISCO — In the sleek, glass-walled conference rooms of OpenAI's San Francisco headquarters, a corporate drama is unfolding that could determine the future of one of the world's most valuable AI companies. As OpenAI executives prepare for a momentous corporate restructuring aimed at unlocking vast new capital markets, they find themselves locked in tense negotiations with their most crucial backer: Microsoft.

At stake is OpenAI's ambitious plan to convert its for-profit arm into a Public Benefit Corporation (PBC), a move widely seen as laying groundwork for an eventual initial public offering. But this transformation depends heavily on Microsoft's blessing—and the tech giant is driving a hard bargain.

A Public Benefit Corporation (PBC) is a for-profit entity legally committed to a specific public benefit alongside maximizing shareholder profit. Unlike traditional C corporations that primarily focus on shareholder value, PBCs must also consider their stated social or environmental mission in their decision-making.

"This is one of the most complicated corporate restructurings in tech history," said a venture capitalist familiar with the negotiations who requested anonymity due to the sensitivity of ongoing talks. "It's not just about money—it's about who controls the future of artificial intelligence."

A Partnership Forged in Silicon Valley, Tested by Ambition

The relationship between OpenAI and Microsoft began in 2019, when the Redmond-based tech behemoth invested $1 billion in what was then a relatively modest AI research organization. That initial agreement—covering intellectual property rights, product usage, and revenue sharing through 2030—has since expanded dramatically, with Microsoft pouring more than $13 billion into OpenAI, becoming its largest outside investor.

| Date | Investment / Event | Details |

|---|---|---|

| July 2019 | $1 billion investment | Microsoft made its first $1 billion investment in OpenAI to support Artificial General Intelligence (AGI) development and fund computational resources. |

| January 2023 | $10 billion multiyear investment announced | Part of a total $13 billion commitment, extending the partnership, focusing on AI supercomputing via Azure, and allowing commercialization of AI technologies. |

| March 31, 2025 | Participated in $40 billion Series F funding round | Microsoft joined other investors like SoftBank in a major funding round valuing OpenAI at a reported $300 billion post-money valuation. |

But as OpenAI's ambitions have grown, so have tensions in this partnership. Microsoft is now reportedly willing to dilute some of its equity stake in OpenAI's future PBC structure, but only if it secures unfettered access to OpenAI's technology beyond the 2030 expiration date of their current agreement.

"Microsoft isn't simply writing checks out of generosity," explained a former Microsoft executive who has worked closely with both companies. "They've integrated OpenAI's technology deeply into their product ecosystem, from Azure to Office. Losing privileged access would be strategically devastating."

Without an agreement, OpenAI's restructuring could collapse—potentially forcing the company to return billions to investors like SoftBank, Thrive Capital, and Altimeter Capital, who contributed to the staggering $46.6 billion OpenAI raised in 2023 alone. These backers explicitly expect to receive traditional equity once OpenAI transitions to a PBC structure.

Breaking Free From the Profit Ceiling

The push for corporate metamorphosis stems from the limitations of OpenAI's unusual "capped-profit" model established in 2019, which restricts investor returns to 100 times their original investment. While once revolutionary, by late 2024 this structure was increasingly viewed as a straitjacket constraining OpenAI's ability to fund its voracious appetite for computing infrastructure.

OpenAI's "capped-profit" model is a hybrid structure designed to attract investment while preserving its core mission. Investors in its for-profit arm can earn returns, but these are capped at a pre-determined multiple; any profit beyond this cap is intended to flow back to the original OpenAI non-profit entity to support its goal of benefiting humanity.

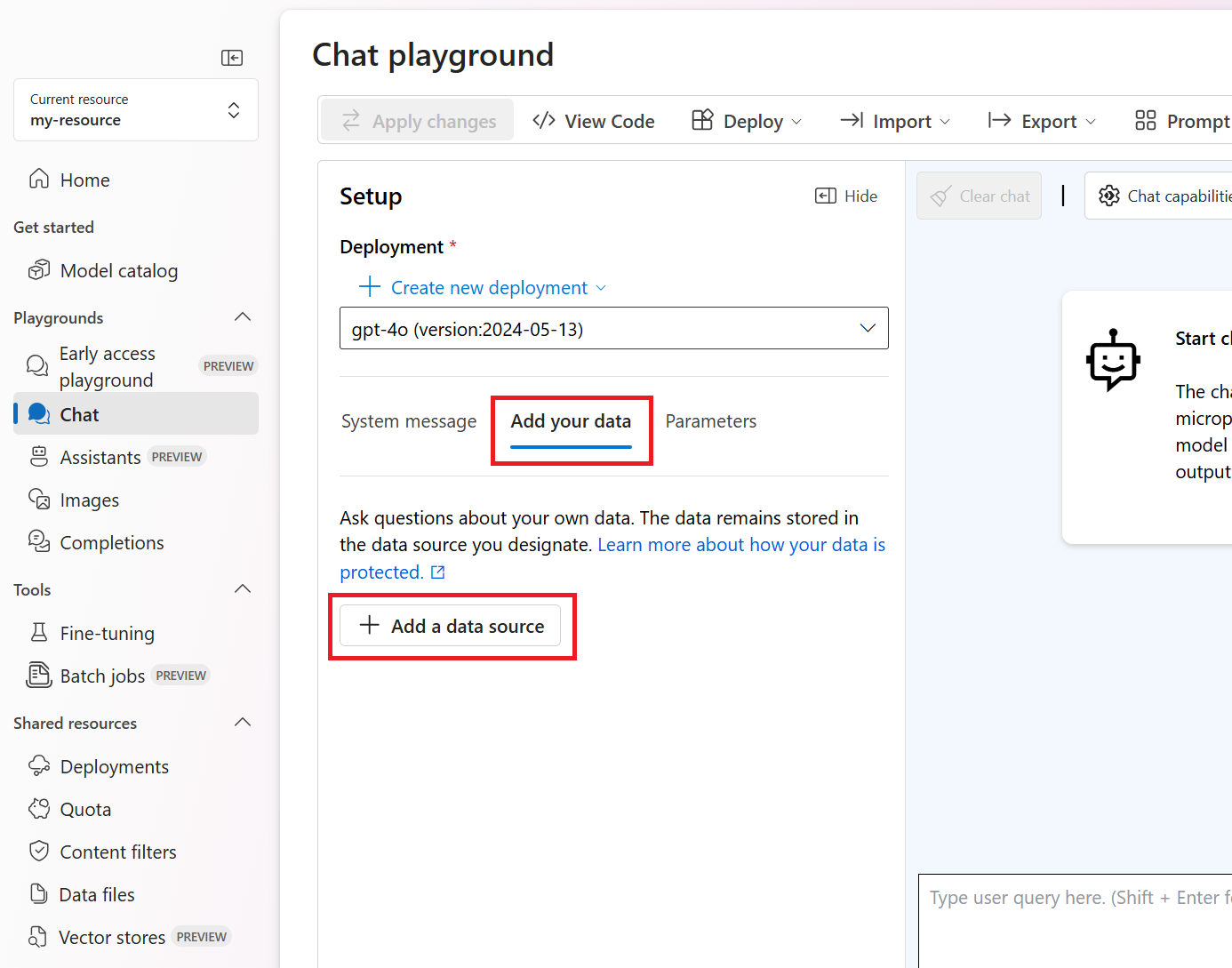

"The economics of AI have fundamentally changed," said a technology analyst at a major investment bank. "Training frontier AI models now requires capital outlays comparable to building nuclear power plants or space programs. The capped-profit model simply wasn't designed for this scale." Chart illustrating the exponential growth in computing power (and cost) required to train state-of-the-art AI models over time.

| Year of Release | Model Name | Creator(s) / Contributor(s) | Estimated Training Cost (Inflation-Adjusted USD) | Training Compute (petaFLOPs/day or total petaFLOPs) |

|---|---|---|---|---|

| 2017 | Transformer | $930 | Low (relative to later models) | |

| 2018 | BERT-Large | $3,288 | Low (relative to later models) | |

| 2019 | RoBERTa Large | Meta | $160,018 | Moderate |

| 2020 | GPT-3 175B (davinci) | OpenAI | $4,324,883 | ~3,600 petaFLOPs-days |

| 2021 | Megatron-Turing NLG 530B | Microsoft/NVIDIA | $6,405,653 | - |

| 2022 | PaLM (540B) | $12,389,056 | - | |

| 2023 | GPT-4 | OpenAI | $78,352,034 - $100,000,000+ | >10 billion petaFLOPs (total) |

| 2023 | Llama 2 70B | Meta | $3,931,897 | - |

| 2023 | Gemini 1.0 Ultra | $191,400,000 - $192,000,000 | - | |

| 2024 | Llama 3.1-405B | Meta | $170,000,000 | - |

| 2024 | Grok-2 | xAI | $107,000,000 | - |

| 2024 | Mistral Large | Mistral | $41,000,000 | - |

In May 2025, OpenAI unveiled specifics of its transformation: The new PBC would remain under the oversight of the original non-profit foundation but would abandon profit limitations in favor of a traditional share structure. This reimagined OpenAI aims to eventually raise what company documents describe as "hundreds of billions to trillions" of dollars—primarily to construct vast new data centers required for next-generation AI systems.

Behind Closed Doors: The Negotiation Battlefield

Sources with direct knowledge of the talks reveal that Microsoft CEO Satya Nadella personally intervened in negotiations after initial proposals from OpenAI were deemed unacceptable. A particular sticking point concerns OpenAI's increasing efforts to reduce its technical dependence on Microsoft.

"Every time OpenAI announces a new computing partnership, the temperature in Redmond drops a few degrees," said a technology consultant advising both companies on AI infrastructure. "Microsoft executives view these moves as direct challenges to what was supposed to be an exclusive relationship."

Most controversial is OpenAI's "Stargate" project—a massive $500 billion initiative developed in partnership with SoftBank, Oracle, and MGX to build proprietary computing infrastructure. While OpenAI CEO Sam Altman publicly maintains that the Microsoft Azure partnership remains central to OpenAI's strategy, insiders confirm that Stargate's resources will be exclusive to OpenAI, bypassing Microsoft entirely.

"There's a fundamental strategic divergence happening," noted a board member at a competing AI lab. "Microsoft wants to embed AI everywhere across its product suite, while OpenAI increasingly sees itself as the next Google or Meta—a platform company in its own right."

The Regulatory Minefield

As if negotiating with Microsoft weren't complex enough, OpenAI's restructuring faces intense regulatory scrutiny. The attorneys general of both California and Delaware are reviewing whether the proposed PBC conversion adequately preserves OpenAI's original mission of ensuring artificial general intelligence benefits humanity broadly.

Artificial General Intelligence (AGI) refers to a theoretical form of AI possessing the ability to understand, learn, and apply knowledge across a wide range of tasks, much like a human being. Unlike current narrow AI systems designed for specific functions, AGI would exhibit general cognitive capabilities and adaptability.

"The shift from a non-profit-controlled entity with strict profit caps to a more conventional corporate structure raises legitimate questions about mission drift," said a former regulatory official specializing in corporate governance. "Regulators want assurances that public benefit won't be sacrificed at the altar of shareholder returns."

Additionally, the U.S. Federal Trade Commission has launched inquiries into the AI partnership landscape, with particular focus on the Microsoft-OpenAI relationship and its competitive implications. In parallel, international bodies like the UK's Competition and Markets Authority are developing frameworks that could impose additional constraints.

Market Implications: Billions in Motion

Financial markets are watching these negotiations with rapt attention. Microsoft's stock rose 1.1% to $443.47 on May 12, 2025, as investors processed reports of progress in restructuring talks. The broader implications ripple through the technology sector, with competing firms reassessing their AI strategies in response. Chart showing recent stock performance of Microsoft (MSFT).

| Date | Open | High | Low | Close/Last | Volume |

|---|---|---|---|---|---|

| 05/09/2025 | $440.00 | $440.74 | $435.88 | $438.73 | 15,324,230 |

| 05/08/2025 | $437.93 | $443.67 | $435.66 | $438.17 | 23,491,330 |

| 05/07/2025 | $433.84 | $438.12 | $431.1103 | $433.35 | 23,307,240 |

| 05/06/2025 | $432.20 | $437.73 | $431.17 | $433.31 | 15,104,200 |

"This is a pivotal moment for AI as an investment category," explained a portfolio manager overseeing over $50 billion in technology investments. "How OpenAI resolves these governance and partnership questions will set precedents for the entire industry."

Google has already responded by investing another $1 billion in rival AI lab Anthropic, while Amazon doubled down on its own $4 billion commitment to the same competitor. These moves highlight how the AI arms race is accelerating, with companies spending unprecedented sums to secure technological advantages.

Meanwhile, Anthropic—which already operates as a Public Benefit Corporation—has launched a new $200 monthly "Max" subscription plan directly challenging OpenAI's premium offerings. This rapidly intensifying competitive landscape adds urgency to OpenAI's restructuring efforts.

The Path Forward: Innovation Versus Control

As negotiations continue, fundamental questions loom over the future of artificial intelligence development. Will the industry consolidate around a few dominant players, or will a more diverse ecosystem emerge? Will corporate priorities ultimately align with or diverge from broader societal interests?

"The tension we're seeing between OpenAI and Microsoft reflects deeper unresolved questions about who should control AI and how that control should be structured," observed a professor specializing in technology ethics at a leading university. "These aren't just business decisions—they're decisions that could shape the future of humanity."

For traders and investors watching from the sidelines, the outcome of these negotiations represents both opportunity and risk. While an eventual OpenAI IPO could become one of the most significant public offerings in history, success hinges on successfully navigating the complex terrain of corporate governance, regulatory approval, and competitive positioning.

"What we're witnessing is nothing less than the birth of a new type of corporate entity," concluded a veteran Silicon Valley investor. "One that attempts to balance profit motives with societal benefit at unprecedented scale. Whether it works or fails will tell us a lot about the future of technology and capitalism itself."